Current Situation

Home Depot Inc has grown tremendously since its inception back in the 1970’s when it was formed by three business executives who had left Handy Dan Stores. Then the company had only one store and annual earnings of $ 23M; however now the company has grown and is one of the largest retailer and installer of home improvement appliances serving individuals and professional customers.

The company’s founder retired back in the year 2000 after opening the 1000th store and Bob Nardelli was appointed C.E.O. This move has proved highly decisive because since then the company has even performed better. The new C.E.O has overseen the opening of over 900 stores and is prospective to open the 2000th store soon.

The retailer is now among the top 3 retailers in the world behind Wal-Mart, though it is the Americas’ largest Home Improvement selling company (Wheelen & Hunger 2010). The company has experienced profit growth every year since 2000-05; the profits have grown from $45.7B in 2000 to over $81B. Additionally, despite the value of its shares falling the company has increased the earnings per share from $1.10 to $2.75; the company currently has paid out close to $ 13B in cumulative earnings back to its shareholders.

Besides this, the company’s operating margin has also grown from 9.2 % to 11.5% thereby all indication indicates that the company is quite healthy and is performing well. Above all the company has over 345,000 employees on its payroll to ensure that the company is able to cater to their customers (Wheelen & Hunger 2010). The efforts of C.E.O Bob Nardelli have to be appreciated.

He has used all his experience and skills in his position to ensure that the company continues to operate on a path which allows it to grow in both size and revenue by catering for the needs of their customer base and offering a lot of competition to rivals such as Wal-Mart, by building stores and Home depot centers that are specious and well designed. The decision to open the Home depot online business has also played a big role in ensuring dominance of the retailer.

Strategic Posture

Home Depot Inc is a well established company that hopes to aims its customers with the highest quality home improvement products and services.. The slogan improve everything we touch is a clear indication of the customer experience strategy that Home Depot wants its consumers and its entire customers to experience as soon as they purchase products from their retail centers.

The company takes its customers seriously and hopes to offer solutions to their daily needs by providing services that will improve the homes and lives of their customers. This mission has been relevant to the current performance and vision of the company to become one of the best retail companies of this millennium (Wheelen & Hunger 2010)

Objectives

Home depot desires to be one of the biggest participants in the retail industry in this millennium and also aims to realize a rise in its market share by acquiring other companies using an aggressive business culture. The company has ambitions to maintain an annual growth in sales of 9-12% by the year 2010. Additionally, the company aims to increase its EPS for its equity owners to between 10-14% by the year 2010 (Wheelen & Hunger 2010).

The company believes that its survival is not the only objective but it is important for the company to grow and acquire other new companies such as Hughes supplies to increase its dominance in the retail industry. Furthermore, the company intends to pen close to 400-500 stores by 2012 despite the indication that the market is saturating.

Other objectives of the company include increasing cumulative operating cash flow to $50b, cumulative capital expenditure to $17-20b and grow their supply sales to $23-27b.The stores believe that their targets can be met if employees spend approximately 70% of their working hours on the selling floor and expanding their markets (Wheelen & Hunger 2010).

Strategy

Home Depot uses an aggressive strategy which will allow the company basically to grow. The strategy is known as the 3E’s strategy which involves extending business, expanding the market and enhancing the core. This strategy is effective as besides guaranteeing its growth it also ensures that the quality of service and value delivered to customer’s increases as the company expands (Charles, 2002).

Policies

The company’s policy evolve around its customers, the need to enhance the customer experience is vital to success and therefore the company intends to encourage associates to spend close to 70% of total work time on the selling floor this way the needs of the current consumers and targeted consumers can be catered for ( Wheelen & Hunger 2010).

Strategic Managers

The Home Depot Center had previously been accused of using unsuitable management techniques that were highly decentralized and unsuitable to combat the competition from other participants such as Lowe. However, upon the entry of Robert Nardelli the firm faced radical changes in both the board by bringing in a group of skilled directors who had a lot of experience about the American consumer market (Wheelen & Hunger 2010).

The board was divided into five committees as required by corporate governance laws, that is, the executive committee, audit committee, the nominating committee, the leadership committee and the information technology committee and the chairmanship was handed to a couple of directors.

Bob Nardelli served as both chairman and C.E.O of the company and the directors were compensated using both cash and stock options. The 24 directors and officers were paid $ 130000 annually $ 50,000 in the form of stock and the rest in deferred shares additionally the directors were paid $200 for each board meeting attended and $ 1500 for every non board meeting they attended.

Apart from this the directors were compensated for all their expenses ( travel and accommodation) an extra $10,000-15,000 was paid to the chairmen of the committees Nardelli, Clendenin, Langone, Hill and Hart respectively ( Wheelen & Hunger 2010).

Under Bob Nardelli tenure the board executives were highly experienced individuals with experience in various companies like general electric and this proofed important since his visionary leadership was to assist Home Depot realize its desire to grow and therefore he needed a good board behind (Jones, 2010).

Although Nardelli was criticized for manipulating the board and serving both as chairman and C.E.O his leadership style was still able to deliver despite numerous shareholder protests after the board was absent in the AGM (Wheelen & Hunger 2010).

Top management

The top management of Home Depot consisted of highly skilled 13 executive officers who had a wide set of skills and experience that they had gathered from the American consumer industry (Wheelen & Hunger 2010). The top management consisted both of inbred and exported talent, some of them having earlier left the company to work in other companies but due to their experience were called back to help the organization realize its strategic goals.

Although it was notable that some of the business executives had previously worked at general electric and the current C.E.O was accused of hiring individuals from General electric, he insisted that they were performers due to the high level of experience and talent that they possessed.

External environment

Home Depot Inc is a company that operates mainly in the Americas and the political environment especially in Canada and United States is generally suitable due to the capitalistic nature of the economy and the free market economy (Koontz & Weihrich 2009). The American home improvement industry is valued at $700b with $500b going directly into purchase of products while the rest going into service delivery and installation.

Social-Economic environment

Irrespective of the economy has been moving slowly, the industry is usually seasonal in nature depending on the availability of money to the customers of the company. The sales records of the company suggest that sales are strong mainly during the summer i.e. Q2 and sales are low during Q4 i.e. winter (Wheelen and Hunger 2010). This is mainly due to the weather and also availability of money in the economy.

The main market of the company especially when the economic situation is terrible include do it yourself customers and do-it-for-me customers who only intend to repair or renovate their housing. During the recession of the economy the number of professional customers usually goes down because few houses are constructed during this time due to cash tightness.

Technological environment

The technological environment, especially in North America, is very advanced and Home Depot Inc. needs to be commended for moving with the times. Due to the nature of products that Home Depot Inc deals with it is very important that the company uses appropriate technologies to keep accurate records about all transactions within the organization (Campbell, Stonehouse & Huston 2002).

The company therefore has installed the latest bar-coding technologies and UNIX servers that play a big role in ensuring that inventory management is up to date and accurate ( Wheelen & Hunger 2010). Poor inventory management techniques will most likely increase company costs and stock redundancy and furthermore since the company has an aggressive growth structure it is vital that organization transactions and records are maintained by highly competent and efficient technology.

The company has also put in place an extra I.T centre in Texas to ensure that the company runs at efficiency and avoid extra costs that may arise out of poor practices (Trott 2008). The centre ensures that the company maintains accurate customer records, labor, financial and inventory management records. Additionally the company has installed back end scanning technology, upgraded call centre technology in order to support various processes within the organization.

Task Environment

Home Depot Inc serves millions of customers across North America and the Americas, serving the do-it-yourself market, do-it-for-me market and the professional customers (Campbell, Stonehouse & Huston 2002). The do-it-yourself customers are customers who wish to purchase home improvement products and install them themselves unlike do-it-for-me and most professional customers who demand extra services.

Most of D.I.Y customers are usually married males who are between the ages of 25-34 who earn an average income of between $ 20,000-40,000, as compared to D.I.F.M customers who earn above average and may most of the time be more learned individuals who are baby boomers compared to D.I.Y customers (Wheelen & Hunger 2010).

The professional customers are the type of customers who spend a lot of money and have extended credit lines, who consist of general contactors, repair people and merchandisers who purchase in large volumes (Jones 2010).

Competition

Home Depot Inc doesn’t only face competition from home improvement stores such as Lowe, Menards, Eagle hardware & Garden of Seattle but also faces competition from other hardware, category niche companies’ construction companies and contractors within the construction industry. Lowe is Home Depot’s largest competitor with close to 1300 stores and 185,000 employees.

The company has over 144,000 square feet space under their control and sales of over $ 30B.The company has also a very aggressive growth culture that is almost similar to Home Depot’s. Other competitors include Menards who operate over 205 stores and have sales of $5.45 billion as at 2005 and over 45,000 employees (Wheelen & Hunger 2010).

Lumber is also another strong competitor, which operates in over 35 states and is steadily operating. Construction companies like Building Material Holding Company (BMHC) which deals with high volume sales and enjoys sales of over $ 3b, Lanoga with over 300 stores and revenues of $1.2b, Stock building supply with over 314 stores in 33 states are some of Home Depot competitors within the home improvement industry.

Additionally there exist category niche companies such as Ace hardware and True Value who enjoy revenues of over $3.4b and $2.0b making Hardware stores serious participants who make competition more intense within the industry (Wheelen & Hunger 2010).

Supliers, Potential entrants and Substitute products

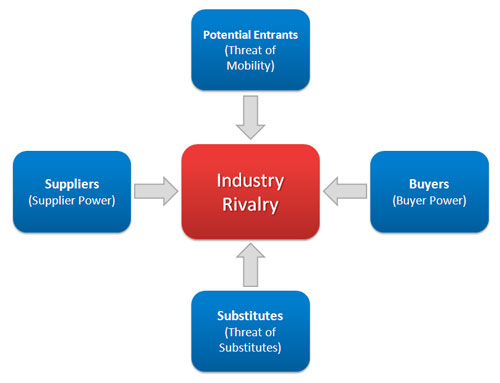

The ability of home depot to use multiple sourcing techniques has given the company a lot of bargaining power and the company can thus pursue a low cost strategy that enables the company sell high quality products at a very low price. The industry is a capital intensive industry and the Home depot has been in business for a long time and thus it is relatively hard for new entrants to enter the industry to its capital intensive nation.

Home improvement products have relatively low number of substitutes and consumers are required to purchase specific items to improve their homes and Home Depot stocks over 35,000 products some of which are substitutes making it had for substitutes to threaten the business of Home Depot.

Internal environment

The corporate structure of Home Depot was reportedly chaotic before the arrival of Bob Nardelli when the founders of Home Depot Inc decided to retire. The current structure is managed according to regions whereby each every region south, south east, south east, west, east, north and Midwest, whereby each store has its own manager and this managers thereby have a line of managers below them but it remains the responsibility of this managers to communicate strategic developments with the company’s executive vice-president of stores Carl Libert (Wheelen & Hunger 2010).

Unlike previously where leadership was fragmented and decentralized, the current management system allows its managers to communicate directly with the top management team so that strategic developments can be closely reviewed (Koontz & Weihrich 2009, 77).

Corporate Culture

Home Depot Inc. has dedicated enormous efforts towards ensuring that its customers are always satisfied. The company’s desire is to provide high quality home materials and to cater to the needs of their customers. The C.E.O, Bob Nardelli, expects that every manager will achieve the optimal output and deliver results furthermore all employees are required to spend some time on the selling floor in order to ensure that the needs of customers are catered for in order to ensure that customer satisfaction ratings go up (Sinkovics & Ghauri 2009).

The company has put in place enough mechanisms in order to ensure that managers and employees are able to dedicate more times to the needs of consumers through interaction. It is the corporate desire of the company not only to sell goods but also to deliver value to all consumers in America, Canada and Americas.

Corporate resources

From a humble beginning of making $ 23m back in the 1970’s, Home Depot is currently the largest retailer of home improvement supplies with a large customer base reporting to over 1900 hundred stores they own ( Wheelen & Hunger 2010).

The company has a lot of resources financially and a good profitability track record of $ 64b, $73b, and $81.5billion from 2003-05.With such high sales the company is able to enjoy high net sales of over $5 billion thereby enabling the company’s asset base expand as the company continues investing and making capital expenditures advertise vigorously and sponsor evens (Wheelen & Hunger 2010).

The company did spend close to $3 billion in 2005-06 mainly in expanding its business portfolio this is an indication that the company is financially strong to support its growth. The company has assets totaling to over $ 44billion and retained earnings of $9billion as at the end of 2005 thereby indicating that the company has enough funds for it to fund its business activities and also grow thereby giving it a better competitive advantage ( Wheelen & Hunger 2010).

Moreover the company is financially stable and as over the years been buying back stock and increasing its earnings per share despite the company’s share value plummeting.

Human Resources

The company boasts of having a radical and progressive human resource strategy that comes in handy and assisting the company makes the choices when recruiting, retraining or promoting employees. The company operates with the aim of minimizing costs and increasing output among its workforce therefore the company depending on consumers traffic may decide to employ season employees.

Additionally the company also has only 69% of its total workforce of 345,000 employees as permanent employees (Wheelen & Hunger 2010). The larger the store the more the number of employees that the corporate headquarters assigns a Home Depot store. The company has a radical and customized training system whereby the company avails training programs customized for every employee depending on the duties and needs of the employee.

The company is working on increasing the employee retention and reducing turn over to less that 20% annually (Wheelen & Hunger 2010). The integration of automated proprietary systems makes it more possible for the company to select the best employees. The company also rewards and compensates employees based on competitive market rates by handing them cash bonuses, commissions, base salaries, stock options, and badges.

Information Systems

The company has gone a step further and acquired bar coding technologies together with a UNIX operating system that assists the company to achieve a high level of efficiency in every functional department of the company ( Wheelen & Hunger 2010). The I.T and information management department are responsible of assisting the company get rid of redundant processes and reduce costs.

The department ensures that all records are entered into a central server so that management and analysts from different departments can use the data to make important business decisions. The company as a part of its technological advancements have introduces back end technologies and upgraded multiple systems so that business functions in the organization can be improved.

Operations/marketing

Home Depot owes a lot of its commercial success to the marketing ability of employees who spend their time on the selling floor. The marketing ability of their employees is a resource that has enabled the company develops excellent customer service despite many hurdles and poor rating compared to other companies. The company has successfully used various merchandising techniques to make sure that it maintains a low price model and stock their massive stores with the widest variety of merchandise (Wheelen & Hunger 2010).

The company’s approach to use location and direct marketing has seen it close down inactive stores and reopen more strategically placed stores and avoid self cannibalization of their own businesses. The company’s operations are able to run smoothly because the company owns 85% of all the malls it operates in.

SWOT Analysis

It is important that organizations conduct a SWOT occasionally so that the managers can find out whether the same parameters and assumptions that were used to formulate the strategy still apply or the premises which were used should be changed.

Strengths

Home Depot boasts of having the necessary resources to pursue its growth strategy. The financial records suggest that the company has enough assets over $91b, revenue of over $81b and enough retained earnings that the company can use to make sure that the company pursues its 3E’s strategy and therefore grow to diversify or consolidate its business portfolio (Wheelen & Hunger 2010).

Home Depot’s strength does not only depend on financial strength but also on its strong and large workforce of over 345,000 employees who can be quite effective in selling and initiating the process of customer satisfaction and customer care (Wheelen & Hunger 2010).

The leadership structure, style and team created of Bob Nardelli is unique and suitable for an organization which wishes to expand and grow because it consists of highly talented individuals who have a lot of experience and Bob Nardelli as the C.E.O uses a centralized approach that demands for managers to perform or loose their jobs.

The current organization culture in Home Depot ensures that customer satisfaction is maximized within the organization, furthermore the vision of the company is of excellence and this is what the top management intends to cultivate through out the organization and individuals who haven’t agreed with this culture have left the organization thus leaving a workforce that is working towards to the same direction (Sinkovics & Ghauri 2009).

Weakness

The company’s current business operations are concentrated in North America therefore making the company lack a global image. The world’s most respected companies operate with a global approach this way if local markets saturate then these companies can move to other geographical regions and increase their chance of commercial success.

The company’s executive compensational policies are very expensive and therefore unsuitable and unfair for the shareholders of the company. Shareholders reserve the right to maximize their investment and therefore the top management should therefore practice more friendly compensation practices which are not abusive and unjustifiable because they can lead to greediness and injure the vision of the company.

Opportunity

Home Depot has the opportunity to expand its business outside America and fully venture into other markets such as the European market. Home Depot being a company of good reputation and a good image and having enough resources can purchase companies within the home improvement industry.

Often business executives fear that entering new markets may be met with resistance but when companies form mergers or acquire already existing business establishments the chance of business ventures succeeding increase tremendously. If Home Depot does this then it will be able to further its vision by focusing more efforts in newer markets that offer more opportunity as compared to the northern American market where the company has been for many years.

The company can alternatively try to absorb its smaller competitors in America and Canada by acquiring these businesses in order to maintain its position as the industry leader in America. The drop in customer satisfaction ratings should not be taken as a problem but as and opportunities by which the company can show its customers that it care and improve the company’s image and increase organization sales.

Threats

Stiff competition from close competitors like LOWE who are said to imitate strategies of Home Depot and other competitors pose a threat to the commercial success of Home Depot and thus the company should be radical and innovative inn order to remain a step ahead of competitors (Charles et al 2002).

Although being aggressive in terms of growth the Home Depot should be aware being overly aggressive and ambitious can be dangerous for the organization and can exhaust resources for the company and lead it in a financial mess thus the company should precede with caution to avoid overstretching its resources.

This SWOT analysis suggests that the current strategic path of Home Depot is justified and that the company should continue with its aggressive business model

Strategic Alternatives

Due to the turbulent and unpredictable nature of the business environment companies are often expected not only to operate with a single strategy but also develop alternative strategies that organization will use to pursue its mission and vision (Jones 2010).

Growth through concentric diversification

Home Depot intends to remain in the same industry of selling home improvement products this way the company will be able to acquire new businesses more easily and meet its growth projections more easily. The advantage of this plan is that if a company has a good image and reputation it then becomes easier to expand because parent companies that take over other companies operate with experience having been in that industry.

Experience and resources together with brand equity gives synergy to the company which is growing. In some instances growth can end up being paralyzing if the management does not approach this matter with the care it deserves many companies end up overstretching their financial capabilities and injure their strategic goals.

Home Depot despite having vast resources should be highly careful while merging and acquiring or opening new stores in new markets (Wheelen & Hunger).

Pause and proceed with caution strategy

Most managers like this strategy because it is a strategic move that allows the company to operate with caution and avoid making rush decisions that may threaten the position of the company (Blyth 2009). Home Depot is the current market leader and may argue that it has enough resources to follow a growth strategy by expanding its business portfolio but it will be more fruitful if the company decides to use a pause and proceed with caution strategy because that way the company can reduce the amount of risks that are attached to their business industry (Kourdi 2009).

The advantage of this strategy is that it can assist Home Depot reduce the amount of risks that it faces by making more informed and rational decisions while venturing into other markets by acquiring companies like Hughes supplies and increasing its number of stores in line with the decades targets.

Divesture and retrenchment

It is clear that not all stores that are opened or businesses which will be acquired will be quite profitable and worthwhile thus making it necessary that top management have the will to let go by retrenching resources or selling out for a profit those stores which are not profitable (Trott 2008).

It makes no sense to own stores which make no profit and thus if interested business individuals who are not in the same industry wish to purchase them then they should purchase such assets as real estate warehouses belonging to Home Depot so that the company can invest this resources somewhere else that they are crucially needed. The strategy will allow the company to get rid of a redundant portion of the workforce and stores in order to save on costs.

Recommended Strategy

Considering that the home improvement industry is subject to seasonal fluctuations, Home Depot Inc. should consider using a strategy mix that will allow the company to operate with a high degree of flexibility that is directly related to the volatile industry environment (Koontz & Weihrich 2009). This way the company will be able to pursue a steady growth strategy but at the same time practice some caution and also divest or retrench resources when need rises.

Since there is opportunity in certain areas of the American Market the company should continue expanding but also where the market seems saturated the company should proceed with caution before increasing the level of investment. The company ambitions to maintain an annual growth in sales of 9-12% by the year 2010, can only be achieved through growth and careful planning which can be achieved by using growth, pause and proceed with caution and retrenchment strategies depending on the economic situation on the market (Trott 2008).

Implementation

Home Depot’s vision is to be one of the millenniums most respected retailers companies by providing day to day services to consumers who desire to get the highest quality of home improvement materials at lower prices. With strategy being created it is important that the company dedicates all the necessary resources for the strategic goals of this company to be realized.

Financial resources but it is also important to have the necessary human resources who have the same ambitions with the top management in order for the business desires of the Home Improvement retailer to be realized (Trott 2008). It is also necessary that the top management and the board are continuously evaluated so that the company’s overall leadership can be deemed talented and efficient to lead the organization towards its goals and targets.

If the leadership lacks the passion and ambition to lead the company then the employees will most likely also follow suit (Bennet 2006). Resources should thereby be well coordinated and moved within the organization to where they are mostly needed, because the process of implementing strategy usually requires resources.

The I.T department should be vigorous and work together with operation managers to ensure that project planning techniques are used to track and monitor the implementation of strategy across regions whereby presidents of Home Depot centers in the south, south east, south east, west, east, north and Midwest, can continuously hand in brief reports of the strategic progress (Kourdi 2009).

The research and development, and marketing departments need to be continuously remodeled so that the company can be in tandem with what goes on in the market. Since competition from Lowe, Menards and competitors within the real estate business posses a big threat to the operation of Home Depot.

The company can form a competitive Intelligence division within the marketing Department which will coordinate efforts together with an implementation committee in order to ensure that a more continuous approach is used to monitor how strategic developments within Home Depot Inc.

Since every member of the team is valued then the company should open an employee communication portal whereby the employees can also air their opinions on operations of Home Depot Inc. with the sole aim of strengthening strategy (Blyth 2009).

Furthermore, the company should also remodel its entire Customer service/care function and invite marketing research companies/audit firms to assist the company in creating a customer care function that is up to date with the current market (Trott 2008). If the company doesn’t achieve its decade targets of beating competition and increasing sales then evaluation and control will identify problematic areas.

Evaluation and control

It is important for Home Depot Inc. to continuously evaluate their strategy in the long run. It is important that the managers of Home Depot evaluate strategy using a wholesome approach which gathers data from key performance indicators using a balanced score card approach is an approach which managers and strategists often use to evaluate monitor and justify any corrections in strategy within organizations (Trott 2008).

If the company decides to grow by acquisition then the newly acquired companies must operate in tandem with the strategic vision of Home Depot evaluation of strategy may assist Home Depot to find out whether the strategic focus of the company has achieved results which are within the acceptable targets and if not then changes in strategy may be initiated.

The advantage of a balanced scorecard approach is that it uses both a financial and non financial approach to measure strategic success of an organization, by comparing input of various process inputs and output (Kourdi 2009). BSC is a highly effective strategic performance evaluation technique that enables managers takes a critical look on how appropriate corporate, business and functional strategy was to the organizations.

The BSC approach allows manager to review strategy by taking an in-depth look at how the organization performed especially when it comes to financial parameters, customer parameters; internal business processes parameters and learning and growth parameters of the organization (Charles et al 2002).

This way the company will not only dwell on financial success but also take a critical look at how strategy has achieved non financial targets such as customer satisfaction. Home Depot hopes to have its business sales and revenues to grow at a compounded rate of 9-12% annually and add close to 55m square feet in new store openings as well as an increase in cumulative operating cash flow (Wheelen & Hunger 2010; Kourdi 2009).

The company will thus need a radical evaluation strategy that will enable it keep the company strategy on course and ensure that the company’s mission, vision and goals are realized in both the short run and long run.

Conclusion

It is thus important that Home Depot Inc uses good strategic practices in order for its business to succeed the failure to audit strategy and also carry out strategic changes may often endanger a commercial organization and it is thus very important that top managers and directors communicate their strategic intentions more frequently so that the entire organization can be on the same page when it comes to strategy, this move will ensure that the employees are able to be part of a time because knowledge and information empowers them, hence have an idea of the direction the organization takes.

Appendices

Figure 1.Industry Forces that are included in the porter’s model used in analyzing task environment.

A list the number of Home Depot Stores as at the end of 2005 in United States

Alabama 24, Nebraska 8, Alaska 6, Nevada 17, Arizona 48 New Hampshire 19

Arkansas 14 New Jersey 64, California 199, New Mexico 13, Colorado 42, New York 93

Connecticut 25, North Carolina 40,Delaware 7, North Dakota 2,District of Columbia 1, Ohio 68, Florida 133, Oklahoma 16, Georgia 74, Oregon 21,Hawaii 7, Pennsylvania 64

Idaho 11, Puerto Rico 8, Illinois 68, Rhode Island 8, Indiana 25, South Carolina 23, Iowa 8 South, Dakota 1, Kansas 16, Tennessee 32, Kentucky 15, Texas 165, Louisiana 24 Utah 19, Maine 11, Vermont 4, Maryland 38, Virgin Islands 1, Massachusetts 40 Virginia 44, Michigan 68, Washington 40, Minnesota 30, West Virginia 4, Mississippi 14 Wisconsin 29, Missouri 32, Wyoming 4, Montana 6 Total U.S. 1,793. Canada had a total of 137 stores and Mexico 54.

References

Bennet, P. (2006). Marketing Management and Strategy, 4th edn. New York, NY: Prentice Hall.

Blyth, M. (2009). Business Continuity Management: Building an Effective Incident Management Plan. New Jersey: John Wiley and Sons.

Campbell, D., Stonehouse, G. & Huston, B. (2002). Business Strategy an Introduction, 2 edn. Linacre House, Banbury Rd: Butterworth-Heinemann.

Charles, W. et al. (2002). Essentials of Marketing. Natorp Boulevard: South Western Cengage Learning.

Jones, G. (2010). Organizational theory, design, and change. Upper Saddle River, NJ: Prentice Hall.

Koontz, H. & Weihrich, H. (2009). Essence of Management an International Perspective. New Delhi: Tata McGraw Hill.

Kourdi, J. (2009). Business Strategy: A Guide to Effective Decision Making 2nd edn. New York, NY: Economist books.

Sinkovics, R. & Ghauri, N.P. (2009). New Challenges to International Marketing. London: Emerald Group Publishing.

Trott. P. (2008). Innovation Management and New Product Development 4th edn. London: Pearson.

Wheelen, T. & Hunger, D. (2010). Strategic Management & Business Policy: Achieving Sustainability, 12th International Edn. New York: Pearson Prentice Hall.