Introduction

Music is a one of the most popular leisure activities worldwide. It is so popular that the music industry is a dynamic industry that keeps growing and advancing in the way it delivers music to the fans worldwide. Fans get to listen to their favourite musicians over the Internet through applications like YouTube.

Listening or watching music online can sometimes be very frustrating, especially when the Internet is not fast enough and buffering takes ages. The advance in technology has assisted in solving this problem. One of these solutions was created by the Spotify Company under Daniel EK, who is the founder of this popular technological innovation.

The service provided by this company also bears the name Spotify like the company itself. Spotify engages in the provision of a service that allows the streaming of music. This platform allows Internet users to listen to music on demand from their favourite artists without having to buy or own the albums (Gilmour, 2011).

Spotify is the most recent online music service that was launched in London by the Spotify company in 2006 (Miller, 2012). The service is designed to avail streaming music from internationally recognized labels like Warner Music Group, Sony, EMI, among others.

Therefore, the service gained popularity very fast across Europe and also internationally and by 2010, Spotify had about 10 million users, and the number was increasing by the day. This was an indication of how technological advancements can lead to the rapid development of an industry.

Spotify has been able to reach out to many customers through the technological advancement experienced in the global Internet connectivity. This paper provides a critical analysis of the Spotify Company in the way it has been carrying out its business.

The Spotify Company and its Resources

The music industry thrives in the presence of the Internet. Spotify is a company that is entirely depended on the Internet. For the company to survive, it needs to appeal to the users and give them services that will keep them hooked. This means that Spotify always has to anticipate the needs of its users and meet them.

Every business depends on its consumers to survive in the competitive market. For Spotify, it goes more than that. Its users are its own lifeline. This company literary cannot exist or grow without new account creations or new subscriptions from users.

This means that consumers are the biggest source of resources for Spotify. The company has shifted the notion of ownership from having the physical product to virtually possessing it. This also includes having accessibility to it irrespective of time and place (Jones & Dewing, 2010).

Spotify also depends on the content producers for its survival. The international recording label companies, which Spotify helps advertise and play their music directly to consumers, pay for promotion (Aigrain, 2012). The content also benefits at the end of the day. They get to have their music promoted and advertised without having to sign contracts with recording labels for advertisement (Zager, 2012).

Spotify is a major investor attraction due to its fast grasp of the market share. Shrewd investors, both local and international, have a canny ability to smell lucrative venture from far. Spotify has proven its high potential by capturing interested clients in such a short time.

According to Myers (2011), recording label companies like Merlin, Sony BGM, Warner Music, and EMI among others own about 18% of the Spotify company (Heimer, 2011). By June 2011, other investors of Spotify included Sean Parker, Li Ka-Shing, Northzone Ventures and Wellington Partners.

The Spotify Company’s Performance

For individuals who love music, Spotify is like a dream come true. This is because they get to listen to whichever track they want anytime and anywhere as long as the Internet is present. Although this is a good thing, it cannot be the only determining factor for success.

This is because there are other aspects that have to be considered. These factors include: is the company able to sustain itself? How efficient is it? Are the profits as high as they appear to be? Does it give back to investors who channel cash into it?

Efficiency

Efficiency of a company has to do with the quality of services it provides to its clients, speed of service and how well it meets the consumer needs of its clients. Spotify has gained such a high rating in growth of market share due to its ability to respond to the needs of consumers.

Spotify has in its collection music from different recording labels, which means that whichever song a consumer might want to hear Spotify will play.

Buskirk (2012) observes that Spotify is like one big database where a consumer can find all the play lists, ratings and artistes they want. It is like owning a modern, top notch technology radio that plays all the songs an individual may want.

Sustainability of the Spotify Company

Spotify is a company that has made such huge milestones in the market share and within such a short time. In as much as this is good or business, it may be its major down side. This is because the company might be growing in so fast a rate that it will not be able to sustain itself. Therefore, the company may be a victim of the great success it has made (Hepworth-Sawyer & Golding, 2011).

Spotify and Profits

Every business venture has the aim of making maximum profits and cutting down on its losses. Spotify has been under maximum scrutiny since its inception as critics try to analyse its operations and economic status. The company started off in a high note, which is still the current case.

This is a good sign of a business destined for great success in the future. Spotify may have undergone major rocking times in 2010, like the fact that it lost approximately $45 million, but it certainly headed for greatness (Peoples, 2011).

Therefore, Spotify is on the right track in regards to business. It started off on a high note, which is good for business since many followers ensures good marketing and promotion. The losses it has seemingly made are just a price it has to pay.

Spotify and Investors

Every investment is always a risk. In the music industry, and especially virtual industries, the risk is way higher. This is because such business ventures are totally depended on shifting focal points of resources like consumers.

Once consumer needs change; and the company is not flexible enough to meet these needs, it means that the company is sure to take a nose dive in its ultimate profits. At such a time, the company may not give back very much to its investors.

However, since the company has potential of growing even more and producing bigger profits in the future, it will be wise to invest. Some investors are shying away from investing in Spotify nevertheless. It is normally asserted that when the risks are high, the returns are also attractive.

Strategic Analysis of the External Environment

PESTEL Analysis

PESTEL analysis is a model that will be used to evaluate the risks that the Spotify company and also the external environment that have influence on the company with the emphasis on the social, economic, legal, technological, environmental and political aspects.

Opportunities

Social

This aspect has to do with the feelings and opinions of the community. The opinions can be reflected by how individuals react to the product. With the number of users going up on a daily basis, it is clear that the community thinks highly of the Spotify music streaming service.

This can be viewed as a great opportunity for the company since it is online based and its success depends on the number of users it has. The advantage of Spotify over other online music services is that the required music can be accessed instantly and played anywhere as long as the Internet was available.

Another advantage is that Spotify allows the user to store assorted music in libraries for future listening. Spotify is also available in different shapes and sizes, and it comes in models that are compatible with PCs, mobile phones, home audio systems and Macs (Spotify Ltd, 2012).

Threats

Economic

Spotify, like all other businesses, is not immune to the effects of the changes in the economic environment. Fluctuations in the economy will affect the stakeholders of Spotify which will in turn affect the company and threaten its very existence.

Environmental constraints will affect the company’s operations and advertising. Aigrain (2012) observes that, for some companies like Spotify, their business models are based on subscriptions by the users and advertising.

Technological

Technological factors in the external environment of the company affect the company in that the trends of technology keep changing by the day. Innovations in technology may pose a challenge to Spotify.

This is because these changes may happen at a frequency that any company might have difficulties in adapting to the changes. There is the threat of other companies introducing new products in the market that will compete with Spotify.

Legal

The controversies that have arisen with the advent of free music streaming could lead to copyright restrictions for Spotify by the music owners. If this should happen, Spotify would be left flat on its back.

Environmental

The environmental aspect has to do with issues such as global warming. Even though Spotify is an online company, it does not exist in a vacuum. Therefore, changes in the environment trigger a domino effect that gets to Spotify and influences its operations.

Political

The political aspect of the environment will affect Spotify in terms of change in the tax policy that will affect the company in a negative way.

Specific Environmental Analysis

Porter’s Five Model

The Porter Five model draws on a company’s economics to come up with five forces determining the intensity of the company and hence its attractiveness in the market.

Three of these forces have to do with the external environment and competition. They are; the threat of substitute products, the threat of new entrants, and the threat of established rivals. The remaining two forces that constitute the internal competition include the suppliers’ and consumers’ bargaining power.

The threat of substitute products

The music industry is large and diversified. This means that new products are coming up every other time. This is a threat that Spotify faces since the introduction of another music dispensing product means that some of its clients will move over to the other side. Such loss will cost Spotify a big deal.

The threat of new entrants

Spotify also faces threat of other music streaming companies that might come up in the future. These companies will take up part of the market share that is already owned by Spotify.

The threat of established rivals

There are also established rivals for Spotify. A very good example of such would be Pandora. This is the pioneer business in the online, streaming industry.

Pandora, which was founded in 2000, has been the lone music streaming business before Spotify. With the advent of Spotify, as the new kid in the block, there is no question about the competition for market share between the two (Taylor, 2011).

Bargaining Power of Suppliers

The suppliers of Spotify’s music are record labels. The fact that Spotify needs this music to survive can make the suppliers increase the prices of the product they provide to Spotify Company. This will cost Spotify more.

Bargaining Power of Customers

The users of Spotify service are the lifeline of the company. They are the main determinants as to whether the company will survive or not. Apart from that fact, they also determine the prices of the services provided by Spotify. Spotify has to determine their target group before they can set the prices for the upgraded service.

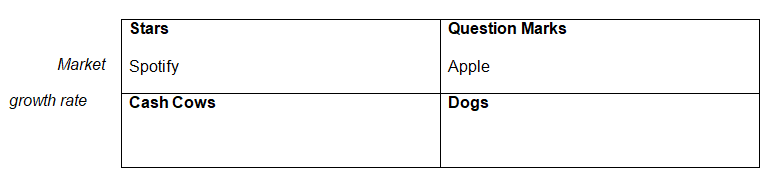

Boston Consulting Group Matrix (BCG)

BCG is a model based on categorizing a company’s components into four classes. This is made possible by merging the market growth and market share in relation to the major rival. In this case, Spotify’s market share and market growth is merged in comparison to its current biggest rival in the market.

Consequently, Spotify can increase its annual earnings and its continuous growth and development (Chitale & Gupta 2011). The BCG model takes into considerations two main variables. These include “the potential for attractive earning or relative market share and the potential for growth given by product sales growth” (Chitale & Gupta 2011, p. 56).

Spotify is viewed as a star actor since it has so far demonstrated a huge market share and steady growth in the music streaming industry. Despite the entry of more competitors in the market, Spotify has managed to maintain a large number of customers.

The growth rate of the company has been fast, and this makes the company to be described as a star. However, there are other companies which had a large market share even before Spotify entered into the market.

Apple Inc. has dominated the market, has a large market share and high growth rate. The iTune product of Apple dominated the market, and this makes Apple to be located at the question marks quadrant of the BCG Matrix.

SWOT Analysis

This analysis stands for strengths, weaknesses, opportunities and threats. The strengths and weaknesses represent the internal environment while the opportunities and threats represent the external environment.

Strengths

Spotify has ventured into a partially exploited market and managed to scoop a large chunk of the market share within such a short time.

Spotify Company can provide any track to its users anytime, anywhere. However, this is for as long as the users have an internet connection. Also, the company can take care of the consumer needs and provide these services for free. In addition, the company has low overheads, which gives it the chance to provide real good service to its users.

Weaknesses

The company underwent major losses in its initial stages in 2010. For a company that is still trying to find its way around the market, that was a major blow. Investors were hesitant to put their money in Spotify Company due to these loses. This is also not good for business as Spotify relies on a big part on investors to be able to operate.

Opportunities

The Spotify business has a very large room for expansion, bearing in mind that it is online, and its services can be accessed globally. The company also has the potential to make big profits. Therefore, there is room for great investment, and big names in the industry will take great interest in the business.

Threats

Many companies might take notice of the lucrative nature of the music streaming business and start their own music streaming services.

This will bring about great competition for Spotify in the future. There is also the copyright threat that is hovering over Spotify. Content owners may put restrictions on the music that Spotify can and cannot play. These limitations will reflect on the services provided.

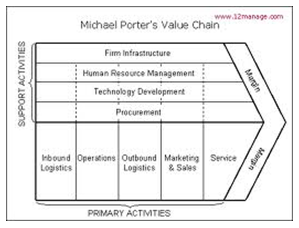

Value Chain Analysis

The value chain is a company’s chain of activities in its operations within a certain industry. The business unit of the company is the most suitable for the construction of a value chain. Spotify has applied technology to acquire a large market size.

The company has acquired online retail stores to market its products to the international market. In addition, the company has sufficient infrastructure to support the development and sale of music products. Spotify has also employed professionals to produce quality products.

Marketing and sales of the company are conducted by a professional team. The company sells its products to local and international markets. The diagram below shows the value chain of the company.

Source: Neilson & Pritchard (2009).

Operations

Spotify uses various applications that ensure the value of the music, which their clients listen to, is of a top notch quality. Top quality sound and videos are some of the reasons that the company has gained so much popularity worldwide.

Key Success factors of Spotify

The key success aspects endorsed by the company include simplicity, comprehensive catalogue, and smart marketing. In simplicity, there is the lack of sophistication and complexity. This has proved to be an asset to the Spotify Company. This has also contributed to its popularity.

In comprehensive catalogue, the ad-supported tire of the Spotify Company provides free access to a free, comprehensive catalogue. In smart marketing, Spotify makes use of shrewd marketing techniques which launches an invite-only mode. This creates scarcity, which makes the demand shoot.

Spotify’s Strategic position

Spotify understands the enthusiasm of individuals about the internet all over the world. Therefore, company understands its business will bloom. The company has also created a very user friendly interface in the web and has also made its services downloadable.

There is also the option for its users to save their favourite songs using the same application. The simplicity factor of the company has assisted push the company further up the competition ladder and also promoted the company’s services to potential market (Allen & Wray, 2009).

Implementation of the Policies and Strategies

It is also imperative that policies have to be established to make sure that the music streamed by Spotify improves the music industry rather than destroy it.

The presence of free streamed music over the Internet is two sides of the same coin, and if no policies are enforced to ensure its controlled exploitation, it will be more of harm than good to the industry. Laws governing and restricting the music streaming business should be enacted.

Biagi (2011) asserts that technology without some control is usually very destructive. It may seem all glossy at first, but the long term effects will be negative. Also, by the time this is acknowledged, it would be quite late to salvage the situation. The music industry could be totally killed by the overestimation or under estimation of the effects of technology.

It is important for the company to have a strong and firm management system that strategically plans the business of the company. This forms another platform that can enhance the performance of the Spotify Company. Technology is dynamic, in that it changes on a daily basis.

Spotify needs a team that ensures the company is flexible enough to make the necessary modifications in order to fit in the modern world (Aaker & McLoughlin, 2010). These changes are also critical in keeping up with market dynamics in respect to the consumer needs and desires.

Summary of the Threats to the Spotify Company and future strategies to counter the threats

This is the biggest threat since other companies are coming up to compete with Spotify for the market share. The online music streaming industry sure is lucrative, and other companies are getting interested. Spotify has to ensure that it delivers quality service to its consumers in order to stay on top of the game.

The advent of free, streaming music also raises very valid concerns in the music industry worldwide. In as much as it serves the consumer’s music needs, will it profit the other stakeholders in the music industry too in the long run? There emerges a pertinent question on whether its business model is sustainable, whether or not it will survive the harsh test of time and economy (Allen & Wray, 2009).

Fear of investment is also another issue. People tend to shy away from ventures that have such an easy way of rising to the top in their areas of expertise (Aaker & McLoughlin, 2010). Investors hesitate to invest in Spotify du to the past losses it has made. The company should work to improve its profits so as to attract a significant number of investors.

Viable Future Strategy for Spotify

Spotify Company should build the audience they receive sufficiently in order to attract established companies in the advertising industry. This strategy will work towards generating increased income for the company.

The company should also move its services to mobile phone in order to maximise its market share. This is because the mobile phones provide more portability than a PC. Spotify should also try to improve its relationship with its stakeholders as much as possible.

Conclusion

In summary, Spotify has the potential to grow and expand to unimaginable heights. The company has to take into account the internal and external environment that surrounds it.

It should take advantage of the strengths it has like its simplicity, which makes it very user friendly, in order for it to expand and try to minimise the threats it faces. Threats like competition from existent and potential rivals. The fact that Spotify is a star actor according to the BCG matrix proves that the company has the potential of expanding and growing to an international music streaming company.

Spotify also has to consider the way it deals with its stake holders as a strategy of survival in the future. In addition, the company should meet all the needs of the consumers, the investors, and the record labels too. This strategy will ensure that the internal environment, which is also crucial, is conducive for the company.

The external environment of Spotify will also have to remain balanced for it to survive. The management should form policies that guarantee survival in the environment. Balancing the internal and external environment will keep the stakeholders satisfied. This will also keep Spotify in business.

Reference List

Aaker, DA & McLoughlin, D 2010, Strategic market management global perspectives, Wiley, Chichester.

Aigrain, P 2012, Sharing: culture and the economy in the Internet age, Amsterdam University Press, Amsterdam.

Allen, K & Wray, R 2009. Can Spotify’s Free Music Pay Off?. Web.

Biagi, S 2012, Media/impact: an introduction to mass media, Wadsworth Cengage Learning, Australia.

Buskirk, EV 2012, One Big Database Could Save the Music Business with Billions of Tiny Rivulets. Web.

Chitale, AK & Gupta, R 2011, Product policy and brand management: Text and cases, PHI Learning, New Delhi.

Gilmour, K 2011, Spotify for Dummies, John Wiley & sons, Washington DC.

Heimer, M 2011, The theory of access replacing ownership on the example of spotify. Web.

Hepworth-Sawyer, R & Golding, C 2011, What is music production? A producer’s guide: the role, the people, the process, Focal Press, Burlington, MA.

Jones, T & Dewing, C 2010, Future agenda the world in 2020, Infinite Ideas, Oxford.

Miller, M 2012, Sams Teach Yourself Spotify in 10 Minutes, Pearson Education, Inc., USA.

Myers, CB 2011, Spotify Closes $100 Million from High Profile Investors at $1 Billion Valuation. Web.

Neilson, J., & Pritchard, B. (2009). Value chain struggles: Institutions and governance in the plantation districts of South India. Chichester, U.K: Wiley-Blackwell.

Peoples, G 2011, Business Matters: Why Spotify Shouldn’t Worry About Turning A profit Right Now. Web.

Spotify Ltd 2012, What is Spotify?.

Taylor, C 2011, Pandora: Spotify is Our Friend, Not a Competitor. Web.

Zager, M 2012, Music production: for producers, composers, arrangers, and students, Scarecrow Press, Lanham, Md.