Discuss the strengths and weaknesses of the cost and value management process of the Boeing 767 programme in the context of the following topics;

Project uncertainty and risk management

The Boeing Aircraft Company, in the late 1970’s planned to introduce new two -person cockpit model in the Boeing 767 series. Airline companies are much interested in the two person cockpit model of Boeing and they wanted to make changes in their already ordered crafts with two person cockpits. But it requires further time and cost and it is against the contract with the customers. By anticipating the interests of airline companies on new two-person cockpit model, Boeing had had conducted preliminary studies years earlier for finding an effective way of converting the three person cockpit model to two person cockpit model.

To overcome the time and cost constraints in new 767 model, Boeing published notification regarding the expecting additional cost and delivery delay resulting from the changes in the thirty planes. All of their customers except one are ready to bear the extra cost and delay time for their two person cockpit model aircraft. There were two ways in front of the production team for the conversion process. First one is to complete the ongoing production process with their original design of three person cockpit models and then make changes in the crafts after they had left the production floor. Second one is to conversion process has to be applied in the stage of production process by modification in production plans.

After getting the permission for two person cockpit model, Boeing had conducted further studies immediately to identify the required cost and time components for these changes. They identified that thirty aircrafts was in advanced production stages with three person cockpit design. Some of them were almost finish in the production stage. The goodwill of Boeing on keeping the delivery dates promise required to be fulfilled in case of new 767 models also. Thus the quick decision on the crucial step has to be adopted by the management. In case of cockpit design changes, it will lead to substantial delays in product delivery. The change process consumed a small percentage of cost and an almost finished cost-effectiveness average of one month delay time.

Boeing undertook internal as well as external analysis for finding out the strengths and weaknesses of the company and the cost effectiveness and risks of new changes. After that Boeing undertook the modification of cockpits of 30 planes during the inline production stage instead of after that retrofitting of cockpits. Boeing 767 is sold out profitably by the company (The Boeing 767: From Concept to Production (A) & (B) Harvard Case Study, 2008).

Quality management

The quality management process at Boeing is a very difficult process for the company. A plane like the 767 has about 3 million parts and almost everything other than the wings and the superstructure are sourced from outside. For example, customers are given a choice of Pratt & Whitney or Rolls Royce engines and the aircraft is fitted accordingly. There are nearly 1300 original equipment manufacturers working with the company. In the case of the major suppliers, Boeing sends their engineers to their manufacturing base to ensure that quality is maintained. The case of wing control surfaces and tail supplier Aeritalia is an example of this practice. Testing of parts was done in sequence. Once each part became operational, the company would test it and certify it as okay. Once manufacturing is complete, the plane would be tested first on the ground (firing engines, testing flaps, etc) and would finally be flown by test pilots. They would report on the handling of the plane and any other problems that needed correction. In the airline industry quality of the aircraft is of utmost importance because an accident may mean the collapse of the entire company due to bad publicity.

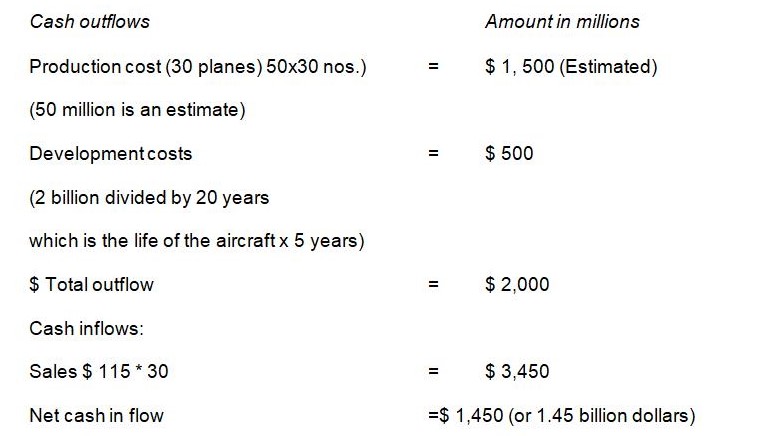

Forecasting cost and budget estimating and cash flow

The estimated cost of Boeing 767 is 3.1 million for individual parts, development costs $ 2 billion. The selling price of the Boeing 767 is $ 48, 08,960.

Financial appraisal of projects

Aircraft manufacturing is one of the riskiest processes in the world in terms of finance and profits. Billions of dollars and many years are required in the design of a new plane. It may take up to ten years from concept to production. Many things may change during the process. The expected orders may not come or the technology used may become obsolete. Boeing had a plan to see that the 767 would succeed. The board was permitted to go ahead with the development and manufacture of the aircraft only if order from two domestic and one foreign airline was confirmed. At its preproduction stage (after research and development were over) at least 100 orders should be there.

The other side of risk is that once an aircraft was successful and accepted by airline companies, the profits would begin to pour in making the risky investment enormously profitable for the company. In other words, an initial spend of 2 billion for the development of a new aircraft would bring nearly 25 billion in 20 years. Boeing expects a return of 19 billion for the 767 which is quite a healthy return on investment. The board decision paid off because the company got an order of thirty 767s from United Airlines along with worth one billion. By the preproduction stage, Boeing had a total of nearly eighty orders assuring that the 767 will be a commercial success (if they could fulfill the promises of quality, performance, and economy of the aircraft.

Earned value analysis

Earned Value Analysis (EVA) is an efficient tool for measuring the progress of a given project at a specific time. It helps make a prediction on the completion date of the project, and its related cost requirements. It is the forecasting of project completion based on the current level of the project progress. Earned Value is the value of the actual completed work. (Cullen, Faithful & Gould. (2005).

From the earned value analysis of the Boeing 767 project, it derived that implementing changes in the existing 767 model; requires additional time and cost factors for completing the project. The EVA analysis declared that an average one-month delay in project completion should be expected. Thus adequate information was passed to the ordered customers regarding the additional cost and time requirements through notification. Thus the company got support from most of their customers for bearing the additional cost and time for the new model 767 Boeing.

Value management

Value management is based on the performance improvement of the organization through the development of human resource skills through motivation and synergy promotion. It is intended to improve the value by reducing unnecessary costs. Continuous checking of the cost factors, object-based activities, functional improvement, etc are steps of value management. Achievement of organizational goals with minimum resource requirements is ensured through value management. (What is value management, 2006).

Value management is effectively employed in the manufacturing of the new 767 models of Boeing. The production stage of Boeing 767 involved thousands of scientists and engineers and they always improve their production strategy by developing new production technology and carefully overcome the design changing problems. Extensive vertical integration is employed in the organization and it supports better coordination between different production units. An efficient design and development process was adopted by the manufacturers for developing products at a minimal cost.

Change and configuration management

Multifaceted products like automobiles and aircraft consist of thousand of configuration parts. Thus changes in any nature to a particular product at the production stage should be very complex. Thus accurate analysis about the cost and time constraints of the project change together with its effectiveness in meeting the functional requirements of the specific product has to be carried out. (Crow, 2002).

Better configuration of different departments involved in the production and marketing of products played an important role in the successful launching of the new model of Boeing 767. The result from market analysis is effectively combined with the production process for realizing cost-effectiveness. For the production of Boeing 767, required engine parts were purchased from General Electric and Pratt & Whitney manufacturing groups. The experience of the company revealed the quality and efficiency of their suppliers. Due to the competition between different manufacturers, the company benefits from moderate cost.

In the developmental stages of Boeing 767, the better configuration between the forecasting group and design group was ensured through vertical integration. From the market research, it derived that the demand for advanced planes was increasing among the aircraft companies. The two-engine model occupies more fuel efficiency and lower weight. For ensuring adequate lead time for project completion, Boeing Company prepares its project schedule with the time lag between different stages.

In Boeing, the views derived from market analysis are reviewed by the production department. They undertake the capability of the new project in terms of internal features such as cruising speed, range, and related operating costs. Their review report is sent to the designing department for taking customer satisfaction-based final decision. Thus better coordination between the marketing and production departments helps the company to adopt a cost-effective and customer-based production strategy for their projects. Change management is done through the coordination of forecasting and marketing departments.

Comparative analysis of Quality management with Airbus Industries

The only major competitor to Being is the consortium of companies which is called the Airbus Industries. The plane is assembled in France and its different parts are manufactured in varied places like the UK and Germany (including France). Quality is the most crucial aspect in the airline industry since it is closely linked to safety. Air safety is crucial since one single accident (due to quality defects) can ruin the reputation of a company. If repeated, the company may even be ruined financially and ultimately be forced to close down.

Airbus naturally takes the issue of quality very seriously. It has a team of engineers in its plant during the whole production process to find problems on the go. “To achieve the very highest standards in these and other aspects of an aircraft’s facets and performance the question of quality is addressed by Airbus at every stage from design to final assembly and beyond.” (Striving for the highest standards, 2008). This team of problem finders is expected to identify and note any defects or malfunctioning and report the problem to the company so that it can be rectified immediately. The company has a spare parts division called the Airbus Spares Support and Services. The company has been awarded the quality certification standard called EN9100:2000. This certification requires higher quality maintenance than what is required for ISO 9001.

Concerning its many outside suppliers (like Boeing and every other manufacturer of large aircraft) Airbus too has many outside suppliers. The company has the following processes to see that the quality of the products supplied by the OEMs is maintained to the highest standards. The company has in place Quality Management Systems for monitoring the quality of supplier components. There is also a system of verification called Special Processes. This is because quality verification has to be done during the manufacture of the product. This means that Airbus cannot verify the quality since manufacturing is already over. One of the systems in place is the IAQG Industry Controlled Other Party / Other Party Scheme (IAQG ICOP / OPS).

This is a quality control system initiated by the IAQG or International Aerospace Quality Group which is an organization comprising of the major aircraft manufacturers of the world. IAQG recognizes the quality certification of supplier products if they are certified by accredited bodies. “Airbus recognizes certificates granted by accredited CB’s and registered in corresponding database “OASIS”, mandates its supply base to gain and maintain 9100 series certification and is actively involved in ICOP /OPS Management and Oversight activities to ensure the efficiency of the process.” (Global quality standardization deployment in the airbus supply chain: IAQG industry controlled other parties/party scheme, 2008).

A second quality control process is the Nadcap which is again a cooperative effort of the major players in the industry. Nadcap is used for the quality certification of the Special Processes mentioned above.

Conclusion

The manufacture and launch of a new model of aircraft is a risky process. The Boeing Company was able to convince a large majority of customers (99%) of the small delay and additional cost that would incur for changing the three-person cockpit model to the two-person one. This was in the case of thirty planes that were in advanced stages of production. The change was done before the plane left the assembly line. For all other models, the change was done as in the previous case since production levels were not so advanced. The company had managed the project uncertainty and risk management very well.

Quality management in such a high risk, high investment, and high technology structure are very important and the company has a well-established quality control system in place. Boeing also ensured that enough orders would be in place before the actual production of the new model thereby ensuring the financial success of the new model. The company also has a well-established value management process in place that checks the production process at every stage. With regard to competition, the market is oligopolistic in nature and the only major competitor for this type of commercial aircraft is the Airbus Industries. Airbus is a consortium of several government companies from France, the UK, Germany, etc. Each part of the plane is made in one country and finally assembled in France. Like Boeing, Airbus is also highly capable in terms of quality, technology, and the variety of models available.

Recommendations

Both Boeing and Airbus are highly reputed manufacturers operating in an oligopolistic market. But Airbus has more government backing whereas Boeing is a private corporation with no such subsidies. “The EU, on the other hand, has made a concerted effort to fund research and development for its commercial aerospace industry, producing significant results in civil aviation, rotorcraft, space launch, satellite manufacturing, modern wind tunnels, and satellite navigation systems.” (Douglass, 2004).

This is an unfair advantage for Airbus and it has already brought criticism from the US Government. Boeing should see that this unfair advantage should not continue and should join hands with the other US and outside manufacturers in seeing that this practice is stopped. The two-person cockpit that is now prevalent has to be incorporated into the manufacturing process. Options for both two and three-person cockpits should be made available to customers. The quality management process in Boeing is well established, but the company should not lose focus on this aspect in the future. About financial appraisal, the company did the correct thing in waiting for an initial order before commencing the production of the new plane. The Boeing 767 will indeed be a commercial success for the company.

Even though the market is an oligopoly, high competition exists between the two companies. Boeing could do well to have some strong joint venture operations with other companies to increase its financial strength. This is because aircraft manufacture is a high investment industry. Designing a new model is also extremely risky since the huge resources and time spent on development may not pay off. The market may not accept the model and some new technology may have developed making the craft obsolete. A joint venture will help to bring down this financial risk to a large extent. The change in the cockpit configuration seems to have caught the company by surprise and had to change the earned value due to this. It would be better if the company can anticipate those changes even before the commencement of production. Then this problem of delays and additional costs would not have occurred. With regard to quality management Boeing has a good system in place. It can also adopt the strategies employed by Airbus like the IAQG Industry Controlled Other Party / Other Party Scheme (IAQG ICOP / OPS).

Configuration management is also an area of strength for the company. The whole industry follows the practice of giving the customer the choice of engines. But, the company could do more research into the area and offer more choices to the customers. For example, Boeing could have introduced the idea of the two-person cockpit themselves instead of waiting for the idea to come from others. The two-person cockpit is beneficial to airline companies because it entails a lower cost of the aircraft. In this case, the cost increased because the planes were already in an advanced stage of production. But if incorporated in the process from the beginning, the cost will be reduced. Moreover, airline companies can also reduce one crew member since only two persons will occupy the cockpit instead of the usual three. In a highly competitive industry product differentiation plays an important part. Boeing can differentiate their aircraft to some extent by bringing in more change and configuration management. Boeing is certainly a well-managed, professionally run organization. But they have a strong competitor in Airbus and hence should not take the fact lightly.

References

- Crow, Kenneth. (2002). Configuration management and engineering change control. DRM Associates. Web.

- Cullen, Scott., Faithful, Handscomb., & Gould. (2005). Earned value analysis: Introduction. WDGB: Whole building design guide. Web.

- Global quality standardization deployment in airbus supply chain: IAQG industry controlled other party/party scheme. (2008). Airbus: Airbus services/working with airbus procurement.

- Striving for the highest standards. (2008). Airbus: Corporate Information/Ethics and Commitment Quality.

- The Boeing 767: From concept to production (a) & (b) Harvard case study. (2008). Academic Term Papers Catalogue.

- What is value management. (2006). IVM: The Institute of Value Management.

- Douglass, John. W. (2004). Airbus vs. boeing: Big government subsidies don’t fly. International Herald Tribune.