Executive Summary

The purpose of the report is studying of how the economic theories work in the real-life setting, and how they can be applied in decision making. The focus of study is the essence and effectiveness of anti-tobacco policy of the Federal Government from the perspective of economic theories.

The methodology of study includes the review of the articles devoted to the anti-smoking measures of the Federal Government and application of economic theories to them. Such measures as the increase of the tobacco excise tax, restrictions in advertising and packaging of cigarettes, and anti-smoking programs are considered. Increase of the tax is expected to reduce the demand by 6 per cent and make 2-3 per cent of smokers give up their habit.

Plain packaging is aimed at making distinguishing cigarettes brands more difficult. The amount collected as a result of the measures will be provided to the hospitals. Despite it is assumed that the measures will have significant effect, the preliminary survey demonstrated that the reaction of tobacco consumers may deviate from that expected.

Thus, the elasticity of the demand for cigarettes may be lower than it is assumed. The recommendation to the Government is fulfillment of a research devoted to the psychological factor, tobacco consumption in different social groups, and the mechanisms of effectiveness of tobacco advertising. The Government should also pay attention to alternative measures aimed at smoking rate reduction.

Introduction

Anti-smoking actions are today taken by governments of the majority countries of the World. Reduction of a numbers of smokers is an important task which will help to save citizens from tobacco-caused diseases and deaths. At the same time, to make the anti-tobacco policy effective, it is necessary to build it based on the economic background and consider a range of factors, including those psychological. In this work, the anti-tobacco policy of the Federal Government is discussed.

The observed articles describe the actions that are planned to be introduced, as well as the responses that these actions have got. The discussion is devoted to the measures planned by the Government from the perspective of the economic theories; the report includes the recommendations on making these measures more effective.

Definition of the Topic

The excise tax is a tax on a unit of a product sold within a country; it is calculated per unit and is introduced on certain groups of products. Tobacco and cigarettes are the products that are included into the list of excisable products.

Cigarette Tax to Increase 25 pc from Midnight

The increase of the tobacco tax will decrease the quantity of cigarettes consumption; however, the decrease will depend on the elasticity of demand for cigarettes. The article describes the anti-tobacco decision of the Federal Government that implies increase of the cigarette tax by 25 per cent, which actually means that the cost of a pack of 30 cigarettes will increase by $2.16 (Rodgers).

The increase is a part of the Government’s anti-smoking plan which also implies introduction of plain and standartized packaging of cigarettes, restrictions in advertising and a range of anti-smoking programs.

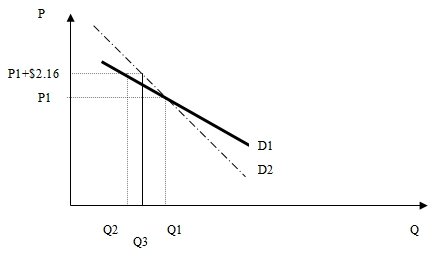

The Government expects the law of demand to work: the higher the price of a good is, the smaller quantity is demanded (Investopedia). Thus, from 2 to 3 per cent of smokers are expected to give up their habit. The Figure 1 demonstrates the hypothetical demand curves that refer to this case:

In the Figure 1, D1 is a demand curve for cigarettes; the point (P1, Q1) is the condition before the tax increase; when the tax of $ 2.16 is introduced, the government expects the demand to come to the point (P1+$2.16, Q2). Despite the estimated number of smokers that will give up their habit is 2-3 per cent, it is reasonable to assume that Q1-Q2 will exceed 2-3 per cent (in fact, it is expected to be about 6 per cent), as there are smokers who may begin to buy fewer cigarettes because of the price increase.

However, another possible outcome is the point (P1+$2.16, Q3) in case the elasticity of demand for cigarettes is not as big as expected (the demand curve D2): Q3 will be smaller than Q1, but bigger than the expected Q2. To reach the desired decrease of demand for cigarettes, the Government should: 1) do a research on elasticity of demand for cigarettes; 2) provide intense anti-smoking programs.

Cigarette Tax Hike Sparks Panic Buying

The news about the tax increase will impact the demand: the expectation of a higher price will, backwards, make people buy more cigarettes; besides, the poorer consumers may react on the tax increase not as strongly as expected.

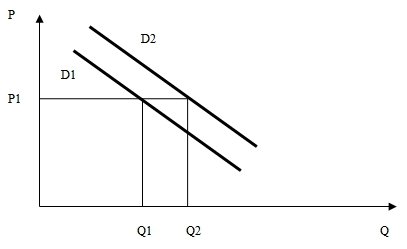

The article provides an illustration of how the news about the future price increase may influence the demand for a product (Hall). A survey shows that while some people will give up smoking because of the price increase, others will not stop. The Figure 2 illustrates the “buying panic” caused by the Government’s decision:

D1 demonstrates the demand for cigarettes before the news about the price increase. The news makes consumers buy cigarettes in large quantities; thus, without of changes in P, Q increases (P1,Q2); besides, Q2-Q1 will be quite big, as “Shoppers who would normally buy just one packet are buying three or four” (Hall).

Thus, the demand curve will go up, as the consumers are afraid of the news about the price increase, and will buy more. It is also expected that the retailers will buy cigarettes in bulk, as they have opportunity to “invest” much money immediately unlike many individuals. Later, selling the cigarettes at a new price, they will have a good profit.

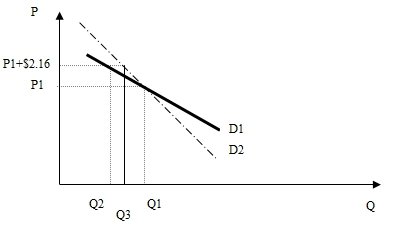

Another interesting issue discussed in the article is the elasticity of demand for cigarettes (Figure 3):

It is expected that the demand is more elastic in case of poorer consumers (D1), as it will be challenging for them to pay more ((P1,Q1) versus (P1+$2.16, Q2)).

At the same time, due to the psychological factor, the demand may be less elastic (D2) than expected, as smoking is poor citizens’ way to have pleasure and get relaxed; in this case, quantity demanded will be Q3, which is bigger than the expected Q2. The government should analogically do a survey to learn the elasticity of the demand for cigarettes in groups with different level of income in order to know to what extent the measures will be effective.

Cigarettes Up, and Plain Packaging Compulsory to Help Stub Out Smoking

Restrictions on design of cigarettes packaging will make it more difficult for tobacco producers to distinguish their products. Besides the tax increase, the article focuses on the introduction of the new requirements to packaging of cigarettes: now, packs will be plain and of the same colour; the names of brands and logos will be small, and their position will be uniform (Coorey).

“The laws will ban the use of any colours, logos, brand imagery or promotional text that would in any way distinguish one brand of cigarettes from the other”, says the article (ibid.).

Packaging is one of the components of the 4P marketing mix; it refers to the fourth “P”, which is “promotion” (Learning Marketing). It helps producers make a product recognizable, fulfill positioning of a product and thus increase the quantity sold; in case of cigarettes, packaging is “a subtle form of advertising that significantly influences smoking rates and habits” (Coorey.).

It is necessary for the Government to prepare to the “struggle” against the tobacco industry. Firstly, tobacco companies may file suits to protect their rights for the design of cigarette packaging; the Government should have a neat position on this issue.

Besides, advertising designers tend to find effective solutions in any difficult situation: for example, in (Lebedev), the mechanism of turning the “frightening” image of Don Miguel (a smoker with a “hole” in his throat) into a “neutral” one is described. Thus, if a pack should be neutral, designers are always ready to offer an additional pack holder or any other attribute that will distinguish the pack of a certain brand from other ones. The Government should be ready to fight against designers’ tricks.

Cigarette Tax to Rise by 25 per cent

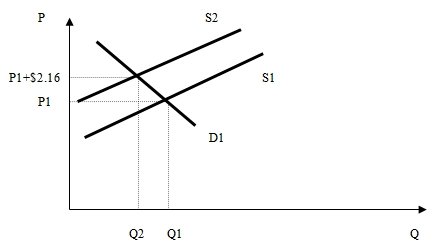

The tax increase will shift the supply curve and create the new market equilibrium. The article (World News Australia) describes the measures planned by the Government in numbers. Particularly, the increase of the tobacco excise tax by about $2.16 will provide additional $5 billion during 4 years. The Figure 4 reflects the effect of the tax increase:

If the excise tax is increased, the supply curve shifts up, and the new market equilibrium takes place. Instead of the point (P1, Q1), the tobacco market will come to the equilibrium of (P1+$2.16, Q2).

Rudd’s Tobacco Tax Increase Yields $5bn Windfall for Hospitals

The Government plans to reach the effect of decrease of cigarettes consumption by combining different anti-smoking measures and to support hospitals by the money collected. The article (Kelly) is also devoted to the recent anti-smoking decisions by the Government; it focuses on the medical aspects of the issue. Particularly, according to (Kelly), about 15,000 people are dying from tobacco-related diseases; at the same time, the Government expects that the recent decisions will reduce a number of smokers by 87,000.

The amount raised within the program, which is $5bn, will “be automatically dedicated to the National Health and Hospitals Fund”, says Prime-Minister (ibid.). Besides, about $27.8 million will be provided for introduction of anti-smoking campaigns. The Government’s task is to make the use of the provided effective. In the previous articles, it was discussed that smokers’ reaction on the measures is quite difficult to predict; thus, substantial survey is necessary.

Alternatives

When developing anti-smoking policy, the Government should set the concrete aims and find the most effective ways to reach them. In the previous chapters, the Government’s measures and their effectiveness have been discussed. At the same time, there are some other measures that can be applied within the borders of an anti-tobacco campaign.

The overall goal of the Government’s policy is reduction of smoking rate. This includes several sub-goals, which are:

- decreasing the total number of smokers;

- decrease of consumption of cigarettes by smokers;

- decrease the number of people who become smokers.

To make the policy effective, it is important to remember about each of these sub-goals. Some actions should be aimed at reaching one of these sub-goals; however, taking complex measures is also important.

To reach the first sub-goal, the Government should develop quit programs and provide the necessary subsidies. There are different approaches to helping smokers quit, particularly:

- aversion therapy (implies using electric shock);

- anti-depressants;

- nicotine replacement therapy (includes nicotine patch, nicotine inhaler, nicotine gum);

- alternative therapies (hypnosis, acupuncture, herbs) (Tobacco Free).

Government may provide financial support for such programs in order to decrease the smoking rate. However, in this case, the question arises: should tax payers provide funds for quit programs?

To reduce the number of new smokers, the Government should introduce educational programs. They should inform “potential smokers” about the negative consequences of smoking. At the same time, these programs may help to reduce tobacco consumption among current smokers, as they will understand the harm and the risk connected with smoking.

Among other approaches to struggling against smoking, it is necessary to recollect anti-smoking campaigns (Gifford). Some of them are very creative, moving, or shocking – that is why they attract smokers’ attention and are thus effective. However, like in case of any social advertising, it should be done professionally, with regards to the peculiarities of smokers’ attitudes and world-view. It is also necessary to develop live support centers that will instruct and support smokers who are willing to quit.

Conclusion

The planned measures of the Government include a range of measures:

- increase of the tobacco excise tax by 25 per cent;

- restrictions in the field of tobacco packaging and advertising;

- anti-smoking programs.

The expected effect of the measures is the decrease of cigarettes consumption by 6 per cent and decrease of a number of smokers by 2-3 per cent. The measures planned by the Government fit into the existing economic theories, such as the law of demand and supply, the notion of elasticity, and laws of marketing.

Recommendation

It is now evident that it is quite difficult to estimate the effect of the taken measures. Though the certain numbers are announced, the real effect may turn out to deviate from that expected.

Thus, the Government should fulfill the study of demand for cigarettes paying attention to such aspects as the psychological factor, tobacco consumption in different social groups, the mechanisms of effectiveness of tobacco advertising; this will help fulfill a really effective anti-tobacco policy. The Government should also pay attention to numerous alternative anti-smoking measures that may help reduce the smoking rate.

References

Coorey, P. 2010, ‘Cigarettes Up, and Plain Packaging Compulsory to Help Stub Out Smoking’, SMH. Web.

Gifford, A., ‘Top 10 Most Creative Anti-Smoking Ad Campaigns’. Web.

Hall, A. 2010, ‘Cigarette Tax Hike Sparks Panic Buying’, ABC.Net.Au. Web.

Investopedia., ‘The Law of Demand’. Web.

Kelly, J. 2010, ‘Rudd’s Tobacco Tax Increase Yields $5bn Windfall for Hospitals’, The Australian. Web.

Learning Marketing., ‘Marketing Mix’. Web.

Lebedev, A. 2008, ‘Design is War’, Artlebedev. Web.

Rodgers, E. 2010, ‘Cigarette Tax to Increase 25 pc from Midnight’. Web.

Tobacco Free, ‘Selected Quitting Resources’, Tobacco Free. Web.

World News Australia. 2010, ‘Cigarette Tax to Rise by 25 per cent’, World News Australia. Web.