Background and History

Sturm, Ruger & Company is a firearm manufacturing company founded under the partnership of William B. Ruger and Alexander McCormick Sturm in 1949. Its initial establishments were Southport, Connecticut in which the pair rented a small machine shop. Bill Ruger was lucky to have previous knowledge on firearms after he duplicated some pistons from the original that was taken from Nambu as the second world war was about to end. Ruger was excited by his first encounter with the Nambu pistols and he went ahead to design the first automatic pistol. He later decided to come up with a firearm that incorporated the features of the German 9mm Ruger and the American Colt Woodsman. This investment was very successful and they managed to commercially produce and sell 22-caliber pistol toward the launch of the company.

Since then, the company has taken the larger market share in United States’ riffle market especially on Ruger 10/22 semiautomatic rifle. It is popular among the users because it is cheap but of quality whereas after-market accessories are readily available. The company enjoys market dominance to target shooters among other users. This has led to opening of new Ruger Casting plants in Newport, New Hampshire, and Arizona among others. The plants deal with ferrous, ductile iron, and commercial castings. Sturm, Ruger became a public company in 1969 and in 1990, it joined the New York Stock Exchange. William B. Ruger was involved much in the management of the company from 1951 when Alex Sturn died until 2002 when he met his demise. The company has manufactured over 20 million firearms of different models to various users.

Organization of Management

The company had a partnership form of business initially between the two member founders. However, this later changed, as the company became a public company and a member of NYSE Company in 1969, and 1990 respectively. This meant that the company had to involve different kind of organization in management. William B. Ruger was the longest serving and iconic manager in the company until his death in 2002.

Since the company became public, there have been some changes in the management and organization in the company. Currently, Michael Fifer is the President, Chief Executive Officer, Director of the company, a role he took from 2006. Other directors include Michael Jacobi (Independent Non-Executive Chairman of the Board since 2010), Thomas Sullivan, Thomas Dineen, and James service. The above professional have been earlier involved in other leadership and currently they are working tirelessly to maintain the progress achieved in the company.

Products

The company has grown since its establishment in 1949 in which the sales have been increasing annually. Between the times of establishment up to 2004, the company had manufactured more that 20 million firearms. The products are of different models and designed to serve the purpose of various consumers. The consumer base consists of hunters, target shooters, self-defence personnel, and law enforcers. Their products fall under five broad categories named rifles, Submachine guns, shotguns, semi-automatic pistols, and revolvers.

Each of the above categories has some models still used whereas the company discontinued others. For instance, there are various riffles such as Ruger M77, and Ruger Mini-14. On the other hand, the company had Ruger 96, Ruger model 44, and Ruger 10/17 among others that have been discontinue. The company has only one model of submachine gun named Ruger MP9. Several sub-automatic pistols include P85, P89, P95, Ruger MK II, Ruger MK III, and LC9 among others. Revolvers fall under two subcategories named single and double action. Single action revolvers include Vaquero, Single six, and Bearcat whereas the double action features GP-100, LCR, and Speed 6 among others. Lastly, there are two types of short guns namely Red Label and Gold Label although the company discontinued the latter.

Market and Distribution Channels

As a grown company, Ruger is involved in most of retail and the wholesale trading. However, the company has emphasized on improving their retailing and wholesaling channels to eliminate the intermediaries. The company is investing much on how to improve the retail marketing through advertisement. The company is even supplying most of the consumers in various regions as well as importing some related accessories to facilitate their business. They have markets all over the world.

Competition

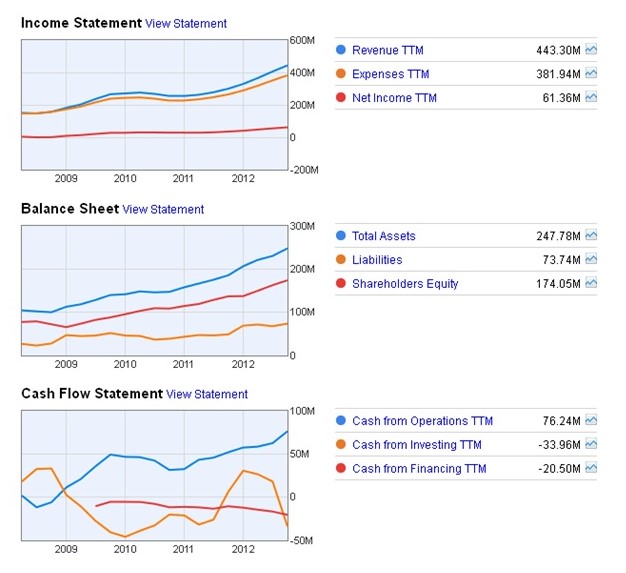

The major competitors of the company include Mace Security International Inc., Smith & Wesson Holding Corp (SWHC), Browning Arms Company, and Remington Arms Company, Inc. However, it is very clear that Ruger is the major competitors in the stock market over the SWHC because the market capital is 1.03 billion compared to 624.12 million for this competitor. On the other hand, the last two competitors are privately help hence not listed in the NYSE. On the same note, Ruger has higher net income of 61.36 million and 58.48 million for SWHC. Nevertheless, the SWHC have higher revenue than Ruger of 500.52 million and 43.30 for Ruger as at February 15, 2013.

Both Browning Arms Company and Remington Arms Company are private companies. The SWHC is a subsidiary of Smith & Wesson Corp, it has been successful in shooting business, and it has a wide market for pistols, revolvers, tactical rifles, and police accessories. The company was established earlier than Ruger in 1852 and it also have businesses in handcuffs, and hunting rifles. Among other businesses are boats, watches, sunglasses, boats and home alarms systems as imported to U.S. by Smith & Wesson.

Just like Smith and Wesson, Browning Arms Company has been in business for approximately 125 years since its establishment by John Moses Browning. He established a firearm factory at Utah after successful; designs for various companies. The company has invested in various businesses such as making rifles, shotguns, pistols, and accessories. In addition, they have invested on consumer goods that include flashlights, footwear, archery, and fishing equipment, knives, and security safes.

The two companies are revealed as the major competitor to Ruger and diversity in their activities and the existence in business for more time give them advantage. However, Ruger has tried all the best to sustain their manufacturing, promotion, and marketing strategy to improve their activities. That is why it has remained one of the leading firearms manufacturers.

Production Facilities

After the listing of the company as both public and in the NYSE, Ruger has established various facilities to meet their production. For instance, there was the opening of new Ruger Casting plants in Newport, New Hampshire, and Arizona among others. The plants deal with ferrous, ductile iron, and commercial castings. The company has established defined divisions for its manufacturing and consumer goods. The various divisions are present across United States.

Among the most significant production facilities is the corporate headquarters in Southport, Ruger Firearms/LE Firearm sales, in Southport, Newport Manufacturing facility, Ruger Export Firearms sales and Pine Tree casting in Newport. The Ruger Record Department and Ruger Sportswear products are in Newport also (Sturm, Ruger & Co., Inc 1).

Promotional Activities

Ruger has fully funded and equipped its sales and marketing department top facilitate the promotion of their products. That is why they have come up with a Retail Co–op Advertising Program to enhance their retail level advertisements. Promotion is a key factor and the company has strategized how to promote their products both locally and internationally. They have both the visual, audio, and audio visual adverts.

They are very keen on the adverts content and formulation to deliver the required information. This is targeting to comply with the legal terms and keeping the minds of their consumers to avert discriminatory adverts. The company is using various advertisement media that include, local and international newspapers/magazines, direct mails, sign/bill boards, radio, television, and online banners advertisements. The adverts have designs that can meet the targeted consumers in the language they can understand through the preferred media (Ayoob 53).

Acquisitions

Ruger has not been much focusing on any acquisition and previous literatures review very few on this issue. However, the management team is determined to get one acceptable acquisition that can boost the company. This seems a dilemma to the company because the company has been constant in making profits as the sales grow. Most companies prefer some acquisitions to strengthen their company (Denicolo 54). That is why Ruger have less interest on acquisition. However, plans are underway to make some acquisition as revealed by Michael O. Fifer, Chief Executive Officer of Sturm, Ruger & Co.

The financial Times website clearly reveals, “There are no recent mergers or acquisitions for Sturm Ruger & Company Inc.” the company is busy paying dividends to the shareholder a sign that the business is doing fine. However, Mr. Fifer had the following to ay as the company announced special dividend of $4.50 per share in November 2012. He emphasized that the achievement of the special dividend came with assurance to the company on how they can pursue business opportunities in future. The company’s new product development strategy takes the first priority whereas plans are underway for an accretive acquisition opportunity that can enhance the business through expansion of the manufacturing ability of the company (Ruger 1).

Historical Financial Statements

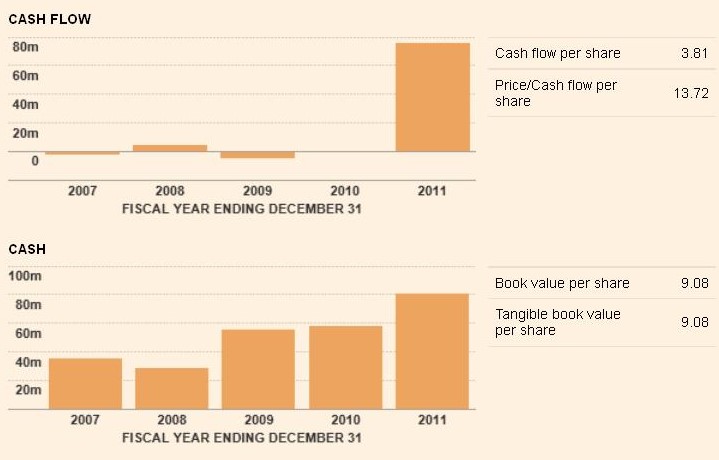

From the attached file in financial statements, it was clear that the company is progressing positively in most parts. The company has been increasing since 2007. For instance, the revenue has been increasing from 2007 to 2011 apart from 2010 when the company’s revenue dropped only to regain in 2011. Net income has been fluctuating especially in 2008 but it rapidly increased in 2009. Since then, the company’s net income has been increasing. Similarly, the dividend per share and earnings per share has recorded increase since 2007. It has been a disappointing moment for the company on cash flows since 2007 but 2011 turned to be a good year as the company registered a 75.92 million cash reserve (Wilson 23).

Notes to Consolidated Financial Statements

Evidently, their balance sheet revealed that the company’s assets have been gradually increasing from 2007 to 2011 an increase of approximately 100 million to 2000 million respectively. The current ratio as at 31 December 2011 was 3.10 whereas the quick ratio was 2.94. This reveled the liquidity of the company was very high. On the other hand, the company suffered the highest total debt in 2008 but the other year the debt was insignificant.

Trends in Growth and Variability

Income statement in USD

Growth rates in USD

Cash flow in USD

Balance sheet

Ratio Analysis

From the financial analysis, various ratios can be calculated to determine the performance and the state of the company. Some of these ratios include liquidity, solvency, and efficiency and probability ratios.

Liquidity ratios

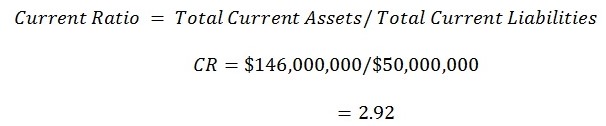

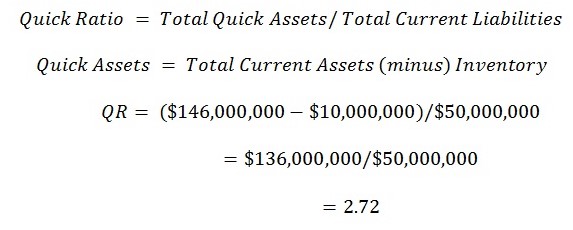

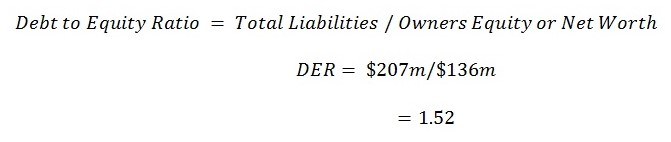

To start with, the liquidity ratios are derived from the balance sheets to determine whether a company can meet both the long term and short-term obligations. They include current ratio, quick ratio, and debt to equity ratio. These ratios are calculated as shown below using the balance sheet as at December 31, 2011.

It is used For testing liquidity of the company. The company can easily use the current assets to pay their short-term liabilities during liquidation.

It is the acid test for the liquidity of the company

Reveals the leverage between the debts and the capital invested in the company

Probability ratios

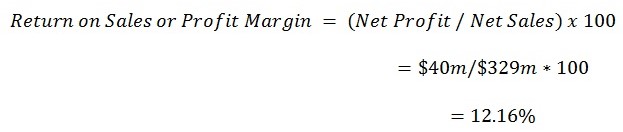

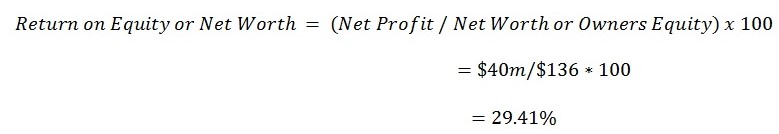

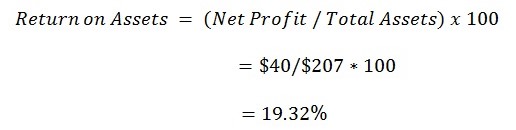

On the other hand, the probability ratios are significant in showing how a company is capable of getting returns and profits from various investments. They include, profit margin, return on assets, and net worth (Sanzo 23). They are calculated as from the income statement and balance sheet as at 31 December as shown below:

It shows how a company can compete better despite the challenges in fuel, reductions in sales, and other market issues.

It is a measurement of how the capital invested in the company can generate good returns.

Shows how companies use their assets to earn good returns for the company.

Works cited

Ayoob, Massad. Combat Shooting with Massad Ayoob. Ohio: F+W Media, 2011. Print.

Denicolo, Marie. Acquisitions. St. Catherines, Guildford: CLP, 2005. Print.

Sanzo, Richard. Ratio analysis for small business. 4th ed. Washington, D.C.: Small Business Administration, Office of Management Information and Training, 1977. Print.

Sturm, Ruger & Co., Inc. corporate news. Ruger, 2012. Web.

Wilson, L. Richards. Ruger & His Guns; A History of the Man, the Company, and Their Firearms. New York: McGraw-Hill, 1996. Print.