The article under consideration dwells upon the mechanism design theory, its development, implications and significance. The author notes that the developers of the theory, Leonid Hurwitz, Eric Maskin and Roger Myerson, were awarded the 2007 Nobel Prize in Economics, which can be seen as recognition of the importance of the mechanism design theory (Čihák 82).

Admittedly, the theory can be applied to the most disputable spheres such as auction regulations, environmental regulations and global economy. The author focuses on the use of the theory for the development of international economic policies.

The article starts with the definition of the theory. Hence, the mechanism design theory is the branch of economic theory which studies the mechanism design problem. In its turn, the mechanism design problem encompasses analysis of strategies the information can be extracted and the way the information revelation problem undermines the development of collective decisions which respond to individual aspirations.

The author also stresses that this theory addresses one of the most important issues of the modernity, i.e. how to develop economic collaboration so that even though the agents behave “in a self-interested manner” they could make decision which could be beneficial for all (Čihák 82). Nonetheless, the mechanism design theory is still under-developed as quite little attention has been paid to it for decades. Lots of people do not understand its relevance, even though it has been applied in many areas.

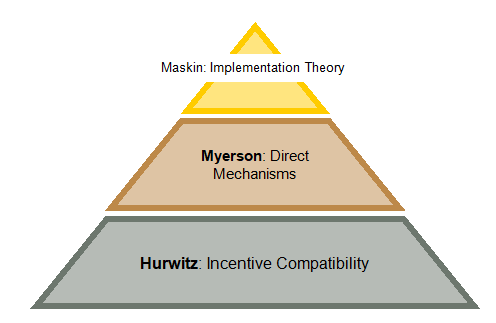

The author also reveals contribution of each Nobel Prize Laureate. This contribution can be presented in the form of the graph (see fig. 1). Thus, Hurwitz agreed with other researchers who noted that information dispersion was the reason why central planning fails, but he also claimed that market mechanism were also negatively affected by this dispersion.

According to Hurwitz, even though agents may act to achieve the most effective economic outcomes (and have compatible incentives); the very existence of private information tends to lead to Pareto efficiency, i.e. some benefit at the expense of others. Notably, the researcher also emphasizes that if the agents have incompatible incentives, Pareto efficiency is more probable. Therefore, the concept of the incentive compatibility is the basis of the theory of the mechanism design theory.

Fig. 1. The Developers of Mechanism Design Theory

Čihák illustrates Myerson’s contribution as well (83). Thus, Myerson came up with a specific pattern to analyze incentive compatibility. The researcher developed direct mechanisms which could help develop more specific mechanisms, i.e. the researcher introduce mathematical patterns which could be applied to a variety of settings.

Finally, Maskin developed the implementation theory. According to this theory incentive-efficient equilibriums were necessary for the development of mechanisms. Čihák notes that this theory is especially efficient in auction regulations development.

When the theory is explained, Čihák provides the range of applications of the theory (84). The theory can be applied in development of trading mechanisms. The author also gives a specific example of information dispersion.

The author stresses that agents in regulated industries tend to hide private information due to their desire to get more profit. The mechanism design theory has also been extensively used in auction regulations design. The author also mentions that theory has also been exploited in development of environmental policies and regulations.

Čihák goes into detail when considering the use of the mechanism design theory in coordination of international economic policies (85). The author notes that researchers have analyzed this coordination in terms of the game theory. The so-called prisoner’s dilemma is associated with such analysis. Thus, when developing economic policies across national borders policy makers tend to take into account specific national needs.

This often undermines their attempts to create efficient economic policies which could be beneficial for all countries involved, i.e. it led to Pareto efficiency. Čihák points out that the recent global economic crisis of 2008 (which originated from the US mortgage market) can be an example of the prisoner’s dilemma as the USA was reluctant to reveal certain information.

The author also stresses that the development of proper international policies is particularly important for the EU countries due to their “commitment to financial market integration… and the emergence of pan-European financial institutions” (Čihák 85). This makes the policy makers interested in the creation of specific mechanisms which could ensure that the agents working in self-interested way can develop effective solutions to achieve the good of all.

According to the mechanism design theory, countries cooperating across borders are unable to develop mechanisms which ensure that all agents ignore national interests and are ready to have losses even if this will lead to the common good. In other words, policy makers will still try to minimize their nation’s risks even thou they understand it can also harm the common good.

Čihák provides a formal representation of the process (86-87). This representation can be illustrated by a graph (see Fig. 2). Agents tend to hide certain information due to a variety of reasons. For instance, agents may be afraid of certain sanctions or lack of financial support. Admittedly, all agents tend to behave in a self-interested manner.

Thus, though each agent has all the necessary data, they share only certain amount of information. At the same time, each agent tries to calculate risks on the basis of the information they get from other agents (which is also limited). Each agent anticipates certain risks, which turn out to be higher as the agents did not take into account the information hidden.

Fig. 2. Agent’s Self-Interested Behavior: Correlation between the Information Dispersion and Risks

In other words, each agent tries to maximize the profits and minimize risks, even though each agent may declare some readiness to share risks for the sake of the common good. According to the mechanism design theory, even though it is possible to develop mechanisms effective for internal markets, these mechanisms are impossible when it comes to cross-border economic cooperation of countries due to the agent’s desire to pursue national goals.

Remarkably, the author also points out that there is a need in collective responsibility. In other words, countries should be ready to share risks to minimize collective crisis cost.

Countries can develop effective crisis management policies by limiting their self-interested behaviors. Thus, the countries should be preoccupied with preserving balance within the system as it benefits all countries involved, while pursuing certain political and national goals may pose threats to the system and be harmful for the country in the long run.

According to the author, first steps in this direction have already been made. Thus, ECOFIN agreement of 2007 is an illustration of countries readiness to act responsibly. This agreement poses certain regulations which can be beneficial for cross-border economic cooperation.

This agreement also ensures that countries are eager to protect stability of the system by imposing collective responsibility, i.e. crisis costs should be shared between all the agents “on the basis of equitable and balanced criteria” (Čihák 87). This can be illustrated by the graph below (see fig.3). The recent financial crisis in the EU countries has evoked certain turmoil. Thus, some nations asked for help, while others stressed that every nation was to address issues on their own.

Admittedly, the dialogue would have been more effective if the countries had followed the principles of collective responsibility. Thus, more well-off countries could have invested more, while countries enduring severe crisis could have invested less (see fig. 3). This would help the countries restore balance in the system.

Fig. 3. Sharing Crisis Costs between Some EU Countries as Regards the Recent Financial Constraints

Thus, countries should be ready to accept crisis costs imposed even though some countries will have more losses. The countries should understand that this will be beneficial for the entire system. They should also understand that each country will have to endure severe financial constraints if the system fails. Čihák also stresses that this is possible if the countries cooperate more closely with each other (87).

In conclusion, it is possible to note that the article in question considers efficiency of the mechanism design theory. The author claims that the theory has proved to be effective as it has already been applied in a variety of areas. However, the author concentrates on the use of the theory in developing international economic regulations.

The author stresses that it is impossible to create mechanisms aimed at achieving the common good in terms of self-interested behavior in terms of cross-border financial cooperation of countries. However, the researcher also notes that the development of these mechanisms becomes possible if the countries limit their self-interest behavior and cooperate more closely.

The author also mentions the specific agreement based on the principles of collective responsibility. The author also expresses his hope that the countries will continue moving in that direction and will be able to develop proper economic regulations.

Works Cited

Čihák, Martin. “The 2007 Nobel Prize in Economics: Mechanism Design Theory.” Czech Journal of Economics and Finance 58.1-2 (2008): 82-89. Print.