Introduction

The issues related to the global market of corn stay one of the most essential among the global economic matters, as the corn market is closely related to the issues of global welfare, ethanol production, and lots of agricultural issues.

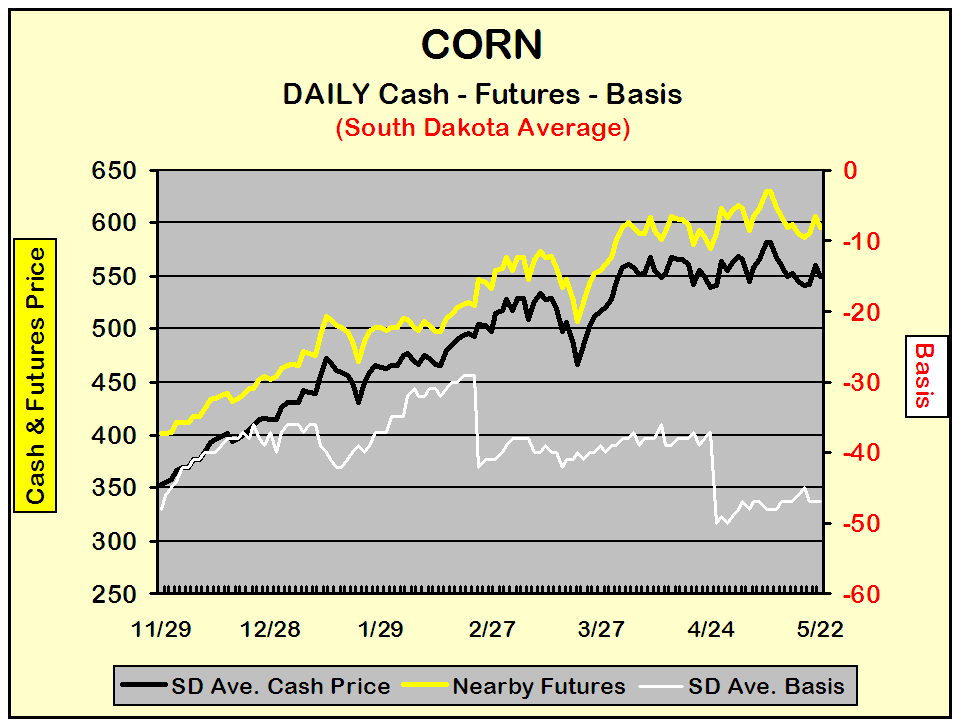

To begin with, it is necessary to define the matters of prices. The existing price of corn is $3.23 per bushel, more than half yet again what it was a year ago, and starting bringing to mind the record $5.545 a bushel set a decade ago.

There are lots of motives for this price gush. The ethanol boom has provided a jagged new requirement for corn. The Department of Agriculture amended its estimation of the 2006 corn crop downhill by some 200 million bushels due to weather and other features. There is also slighter corn storage on hand than always – the smallest in a decade – which equates to lacks around the world.

Yet all this has occurred against the background of three record yields in a row, a sure signification of how solid the ethanol requirement for corn production is appearing to be. It’s coaxing to suppose that the impact of piercingly superior charges is detained principally to the farming sphere. But where corn is alarmed, we are all part of the farming sector. The traditional cheapness of corn has turned it into almost every component of the financial system, in the shape, most intimately, of corn syrup. The squat charge of corn over the previous half-century is located at the very basement of America’s traditionally (and romantically) low food consequences.

Indulging the two key requirements – cheap food and cheap fuel – applied to occur easily as both corn and oil were copious. Cheap oil assisted in keeping corn charges low as it cost growers less to run the agricultural machinery and equipment.

But humanity is entering an innovative dynamic now. While there has been a conversation recently about refining ethanol from resources other than corn that could take a jiffy. So at the instance what is now tried to do is indulge those requirements from the same source: farming territory. No matter how high costs go, what will be required to change is not the quantity of corn house attainable or even the dimension of the massive yields being already gathered.

Concepts

Demand is defined by price. Usually, the superior the price for a meticulous good, the subordinate the amount that is required. Equally, as technical proceeds cause a reduction in values, the amount required raises. Far more people own PCs today than when they were first launched over twenty years ago. Why? One rationale is as PCs are cheaper today. The same is with corn, but with some amendments: the increasing population of the Earth is requiring more corn to survive.

The sensitivity of the amount required to a change in costs is gauged by the flexibility, or elasticity, which is claimed to be discussed in this paper.

The elasticity of demand and supply

The general motive for high prices related, require surpasses the supply. Being businessmen, cultivators have switched much of their house to growing corn but though this has not prevented the strain to drive up corn costs, it has had the outcome of the rising charges of lots, many other productions consume by families across the planet.

To reveal how perceptive experts are, Elaine Kub a grains forecaster with DTN in Omaha, Nebraska, stated “It’s a demand-driven market and we may not be planting enough acres to supply demand, so that adds to the bullishness of corn”.

The only matter with farming still more corn is that it will worsen price augments of those productions created from corn or otherwise relating with corn for food production, such as farm animals whose principal diet is corn. Moreover, even if all obtainable estates were dedicated to corn farming it still would not facilitate the globe to create all ethanol permitted by ridiculous climate control laws ratified by federal and state governments for use in transport production.

It is necessary to mention, that initially, demand and supply measures depend on the following factors:

Population

- Population increase significantly changes the demand indicator to the right as it augments market size.

- Transformations in tastes of the people or due to population incoming the market modification the demand indicator.

- The appearance of new illnesses and the trend towards an aging populace in some countries head for the increase in requirement for nutrition with low cholesterol.

Replacements and Complementary produces

- The number and closeness of replacements hinges on how barely one defines the product. Modifications in the accessibility and price of these replacements will originate from shifts in the demand indicator. Raised competition from cattle breeding is supposed for instance, whereas required for poultry reduces worldwide.

- Deceases or epidemics in rival industries such as the Bird Flue or Mad Cow Disease could originate sudden right changes in demand for corns.

Wealth

- The financial increase will augment restaurant vends and demand for corns in general. The global GDP growth rate is presently around 4% with higher shapes in developing states such as China with 10%.

- The financial depression or war would originate demand to lessen.

- Features such as salaries and income, roundabout tax, employment, wealth sharing, and inflation could impact the % of throwaway benefit spent on the invention. This may not only change the demand indicator but also impact its flexibility. An augment in wealth will change the demand to the increase and a decrease in % of throwaway income will make the requirement more inelastic.

The factors that impact supply extents

Technology:

- Technological advances will decrease production prices decreasing the supply rates.

- Research and development will lead to the capability to grow more corn types heading to the supply increase

- Advances in refrigeration can advance the price of storage permitting for buffer stocks and the capability to control supply.

- Upgrading in the shipping industry, as well as better logistics, would bring about lower shipping and allocation charges resulting in a supply increase.

Input charges:

- A reduction in input charges results from the supply increase. These entail production prices (food, medicine, equipment, salary, etc.), shipping charges (ships and trucks), and storage prices. Issues concerning those industries consequently (e.g. the weather for corn) ultimately affect the supply indicator. Corn price is supposed to augment.

- Communally and ecologically acceptable skills, security, documentation, and traceability are turning to be increasingly significant. These signify extra input prices and therefore make the supply rate decrease.

Corn and gasoline

Partially as a consequence of the dry conditions there is more attention in income indemnity reporting and crop revenue coverage this year, as is stated by Steve Lindholm, president, Farmers & Merchants State Bank of Clarkfield. He notes an essential number of growers, anxious about drought, have selected to buy higher ranks of yield insurance, though some are going all the way to 85% exposure, which is rather costly.

Drought talk has brightened up the viewpoint for the costs of grain that planters still have on hand. Lindholm says some farmers who already arranged the sale of last year’s grain have even bought options to try to squeeze something out of any drought-caused price rise.

Acting such dreads can be complicated, says Diana Klemme, director of the grain sphere at Grain Service Corp., an ag equivocation and risk management company in Atlanta. Although supply-and-demand thinking offers that if deficiency hits, corn costs should increase, states Klemme, lots of acres are in fabrication. Hype could lead to a supply market jolt, she offers, which is the most fortunate market expansion there is. It can last two months, she states – or two weeks.

In the interim, Lindholm’s bank has approached the end of the spring setup sequence, with most growers having come in and positioned the season’s financing. Credit requirement, down a bit generally, in accordance to a recent USDA report, was about even with last year among F&M’s consumers, he says. There will be small equipment or land buying going on, he anticipates, grounded on borrowers’ business charts.

The high price of fuel at the pump has not directly hit the classic Clarkfield farmer too poorly, states Lindholm. Nourishments and other agricultural substances also come from petroleum, in part, nevertheless, and current high crude charges may be felt next season.

Fuel, ultimately, has brought up another circumstance for the nation’s farmers. That’s the detection of traces of MTBE, a fuel preservative, in some municipal water supplies. MTBE, or methyl tertiary butyl ether, is supposed of leaking from underground storage tanks at gas locations.

Fuel dispensers doing business in those districts had to add one of two “oxygenates” – octane inoculations which commence oxygen into gas, allowing it to burn more plainly and professionally. About 30% of the gas applied generally is oxygenated. MTBE is one such oxygenate; the other is ethanol. Ethanol can be gained from a huge amount of natural resources, but the key one is corn starch. Ethanol manufacturers brew corn starch and condense off ethanol, along with other salable derivatives such as carbon dioxide.

Some USA states have had their own, year-round oxygenate regulations in action since 1997, which, not astonishingly, necessitate the application of ethanol. More than a dozen ethanol fabrics dot the central and southern US states, comprising the biggest in Marshall, about 20 miles from Clarkfield. This is a place of Minnesota Corn Processors. Ethanol symbolizes a substitution market for the nation’s plentiful corn crop and has enjoyed both federal and state funding.

Farmers profit from this both as investors inconsiderately owned ethanol plants, and as ethanol makers like MCP can sometimes pay growers more for their corn than can food producers.

The MTBE disagreement has been varying for some time, and legislation to prohibit its application has been awaiting, along with other pro-ethanol invoices, in the present Congress. In late March, nevertheless, the Clinton Administration took exploit. In a joint statement, Agriculture Secretary Dan Glickman and Environmental Protection Agency Administrator Carol Browner called on Congress to phase out MTBE. Also, to chivvy things along, EPA agendas to offer its own, dogmatic approach.

One might regard this would leave ethanol attentions sitting attractively. And at a time when planters still worry about the eventual salability of genetically modified corn, such a likelihood has to be gorgeous. The National Corn Growers approximate that barring MTBE in errand of ethanol would add 35 cents to the worth of every bushel of corn planters grow.

But nothing’s ever so uncomplicated. MTBE reports for 87% of oxygenates applied, and the oil vestibule charged the Administration with aiming to buy farmers’ errands. It also stated that ethanol can’t be transferred by pipeline, which even ethanol sponsors acknowledge means lots of barging at first, pursued by the expansion of additional railing capability for transport.

Further, the corn and renewable petroleum interests were not as generous in their commend of the suggestions as might be supposed. This is as the Administration is also offering to eradicate the necessity to use oxygenates at all. Already, California, which has a special category under the Clean Air Act, has banned MTBE efficiency in 2003 and has required EPA for a waiver of any oxygenate necessity.

The Administration backs legislation that would transform from necessary oxygenates to entailing the use of renewable fuels such as ethanol.

Corn interests worry that even talking about doing away with the oxygenate obligations could undo the centralized subsidy for ethanol. They fear the government will let go of the oxygenate obligation and not pick up the renewable fuels notion.

Minnesota Corn Growers, for example, backs a bill written by Clarkfield-sphere Congressman David Minge and others that would bar MTBE openly in favor of ethanol.

Opposing bills would not be closed so positive for ethanol. Generally, with California already requiring for the total exception, states State extension agent Rich Kvols, farmers are not relying on much.

“This could be an opportunity that might be disappointing in the end,” he says, “like last week’s rain.”

Markets and social welfare

The consciousness of the probable environmental dilapidation connected to current farming schemes and the deliberation of substitute rural expansion actions have opened significant policy conversations within the farming community. Currently, the Government is willing and determined to estimate alternative policy variants relating to the transaction among welfare and environmental deprivation. These attempts entail those to decrease the probable ecological damage imposed to natural reserve donations by the use of current technologies in agricultural manufacture which necessitate the concentrated application of chemical efforts. It is expected that the meticulous methodology expanded in this research will confirm to be useful in the formulation of resonance and financially practicable policies for the farming sector in the future. It is regarded that both, the model expanded and the practices followed in this study offer a precious effort to estimate the tradeoff between social financial welfare and environmental poverty matters. It is hoped that this attempt establishes useful in the formulation of farming policies in the agricultural sector in the nearest future.

On the social and environmental front, trade liberalization in corn would also bring about welfare gains for producers and consumers alike. Farmers would reap the advantages of the output gains connected to the more competent allotment of reserves. Buyers would also increase from the lower costs of main consumer goods, and particularly of the country’s clip food, tortillas, and different corn products.

The most essential environmental influence of trade liberalization in corn classified so far narrates to the probable loss of corn genetic unpredictability. If a pessimistic impact is to be evaded, the welfare of corn manufacturers that rely most on this genetic unpredictability has to be advanced.

Since most farming programs provide work for two or more policy tools concurrently, it is prominent that little research subsists which appraises the social charges of joining tools imperfectly or efforts to find optimal tool amalgamations. The formal advance is used to study the efficiencies of government regulations for five key U.S. crops (corn, feed grains, wheat, rice, cotton). The uncomplicated replicas offer that apart from the feed grains agenda, the scrutinized programs united policy gadgets quite incorrectly. The social charges of incompetent instrument amalgamation for all five crops are approximated to be either the US $1,733 million in terms of probable welfare gains of farmers or the US $1,911 million in terms of possible welfare gains of non-farmers (see graph). It may be concluded that agricultural investigation should place augmented emphasis on finding competent groupings of policy tools.

Opportunity cost

Money has a time charge. Most people submit to this as attention. Another term applied is opportunity costs: the cost of one application for money vs. another application. Bushels of corn or soybeans in a bin are not assisting to pay off debt or earning interest. An opportunity cost can be estimated for each crop to show the per month interest costs. Thus at 7.5% interest and $5.15 soybeans, the opportunity cost is 39 cents per year or 3.2 cents per month.

Another way to believe it is “yield cash equivalent”. The costs of a product must rise by the opportunity cost to equal produce charges. It is stated, that the “harvest cash equivalent” approximation for corn at $2.25 using a 7.5% interest in on-farm storage space (1 cent per bushel per month storage charges) and profitable storage (3 cents per month storage costs). Approximations rounded to the nearest cent.

The set and changing charges of storage requirements to be deemed in the storage decision on soybeans. Moreover, the opportunity cost per bushel for soybeans is higher since the charge per bushel is higher than corn.

Conclusion

Global Agricultural Supply and Demand: Factors Contributing to the Recent Increase in Food Commodity Prices discover the many components that have added to the runup in food product prices over the last 2 years.

The increases in corn prospects of a week ago were removed. The expected WASDE report turned to be an after-thought as improved weather/planting situations were projected. This led to defeats four out of the five trading daylights. On the surface, that creates intelligence and in realism, the run-up in corn values from the first of the year to the current time reproduces the tight supplies schemed for the 2008 crop. Corn prices have increased by $2.00 per bushel since late December and other than a large glitch in mid-March, this is a market that has had some troubles trending higher. Now, faced with an earlier planting pace, much of the weather best was taken out of corn futures along with some of the concerns of short supplies and corn futures tumbled more than thirty cents this past week.

Thus, it is necessary to mention, that the corn market is steadily increasing, and all the factors that impact the steady development of this marketing sphere are favorably united.

References

Begg, D, 2005 Economics McGraw-Hill Higher Education 8 edition

Cattle Market Notes 2008 Corn Bust, Feeders Improve, COF, cattle network. Web.

Editorial, 2007 the Price of Corn, the New York Times. Web.

Farm Market News, 2008, Corn Report. Web.

International Data Base (IDB) 2008, World Population Information. US Census Bureau. Web.

Production Cash Costs and Returns, Cost of Production – Corn and Soybeans 2006-2007. Web.

Saitone, L, 2008 Market Power in the Corn Sector: How Does it Affect the Impacts of the Ethanol Subsidy? Agricultural Issues Center University of California. Web.