Introduction

Supply Chain management is an integral part of every organization that deals with manufacturing with an aim of supplying finished products to a specific group of customers. Supply chain management ensures that organizations are able to accurately and efficiently acquire raw materials, manage work In progress and also deliver finished goods to where they are needed in good quality (Bardi & Langley 2002, 14-17).

Managers aim to stabilize demand and supply patterns through out the business cycle and thus develop strategies that efficiently manage flow of information, configure distribution networks, and manage inbound and outbound logistic activities whereby, they achieve this with the help of supply chain management (Ian & Chris 2001, 144).

If a company’s supply chain is inefficient then it is most likely that end products will end up not being of the right quality and hence consumers will not be happy due to the fact that value was not appropriately created in the first place.

All efforts of the Supply Chain Management should aim to create value for end consumers and ensure that the needs of the consumers are accurately addressed in the products that are being made and distributed to them (Tompkins & Smith 1998, 156-160).

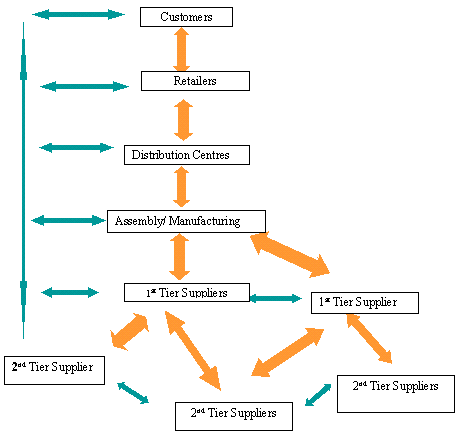

The supply chain structure in some cases may involve a lot of organizations and this usually requires companies to develop the right strategies that will manage the level of relationships between supply chain members in order to get rid of inefficiencies that may affect the quality of goods and services (Michael 2004, 90-93).

A typical supply chain is integrated and has a lot of members in each level and it thus becomes necessary that managers formulate and implement the right strategies so that the flow of raw materials, work in progress and finished goods up and down the supply chain can be flexible, timely, efficient and less costly in order for value to be created amongst all supply chain partners (Wheelen & Hunger 2010, 288).

Figure 1: The integrated Supply Chain that is typical of large manufacturers such as Honda. The Honda Co. Ltd.

The company started back in 1948, Soichiro Honda the founder of the company took advantage of the fact that there was a very big gap in the Japanese market especially after effects of World War II, it was quite expensive and hard for Japanese citizens to purchase fuel and hence Honda, utilized his manufacturing facilities and technology to attach an engine to a bicycle making transportation and movement of people quite easy in Japan. The company by the 1960’s became a giant in motorcycle market; currently the company has over 180,000 employees globally.

The Honda Motor Company is currently the second largest automobile manufacturer in Japan after overtaking Nissan back in early 2000 and later overtaking Chrysler to become the worlds 6th largest Automobile manufacturer.The company is renowned to be an excellent manufacturer of automobiles, trucks and motorcycles and its head quarters is situated in Tokyo.

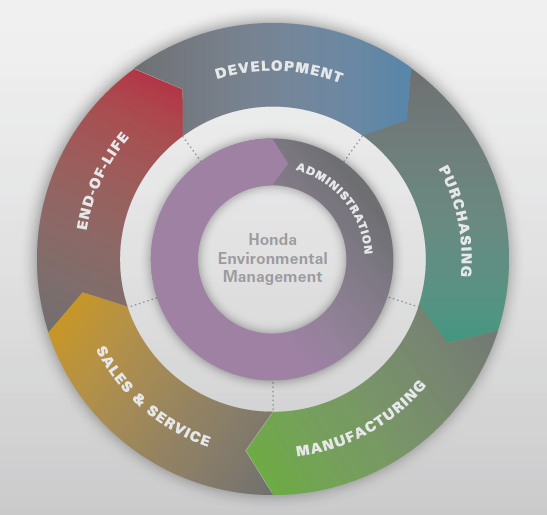

Figure 2: Business activities within Honda that contribute to its superior supply chain.

Additionally, the company also manufactures a lot of equipment including water craft generators, boat and ship engines and garden equipment. Honda has a wide variety of cars under its wing with the most prestigious/luxurious automobile brand being Acura which is very famous in North America.

The company’s success can thus be attributed to the fact that the company has put in place a very reliable and effective supply chain management system that has enabled the company deal with various members of the supply chain management appropriately thus, the company can be able to achieve its corporate vision of becoming a key player within the automobile industry (Douglas 2008, 54).

Honda’s top management policy is to operate with a short supply chain structure, this way Honda’s products can move faster, efficiently and at low costs across the supply chain in addition, the company can also create value for its customers.

It is this strategy and Supply Chain Management orientation that has enabled the company which has its presence in almost every country, to be among the top 6 largest automobile manufacturers with revenues of over $ 100 billion in the last financial year.

Since its inception back in the 1940’s; Honda has developed a very strong corporate and business structure culture. It is this strong culture, that has also boosted the company’s supply chain management strategy by enabling the company hook up with the best supply chain partners who have enabled the company achieve its growth ambitions.

The organization’s strong culture of innovation and excellence has enabled the company become a tough competitor within the automobile industry. Using a Holistic approach both the top management to the lowest level of the organization are coordinate business activities well ensuring supply chain activities are in tandem with the organizations strategy (Wheelen & Hunger 2010, 269-279).

Additionally, the organization has been able over the years to develop supply chain relationships that have turned out to be quite key to the current success of the organization by forming relationships with reliable car dealerships in various regions.

The strong financial position Honda as an organization is a key strength that has assisted the company to further its position in the industry; the company has invested funds available to it in research and development and used the funds to develop low fuel consuming engines which have become popular with consumers in the world.

Honda’s supply chain management has not become fully efficient and thus the company’s sales in various parts of the world is not yet fully exploited and this has particularly affected the sales of Honda especially during the global economy downturn (Wheelen & Hunger 2010, 204).

Other manufacturers like Toyota and Volkswagen have successfully put in place appropriate supply chain mechanisms that have enabled these companies stabilize demand patterns for their products through out the year.

Honda currently lacks the capacity to sustain stabilized demand patterns in its sales indicating a weakness in their supply chain (Bardi & Langley 2002, 83).Stiff competition from rival automobile companies poses a threat to the business model of Honda.

Toyota for example is stepping up supply chain activities and creating many automobile and engine models to rival Honda. Honda should hence carry out continuous strategic/supply chain evaluation and make continuous improvement efforts so that the organization does not slip behind but rather advance forward as a better organization (Bardi & Langley 2002, 44).

Organization Structure

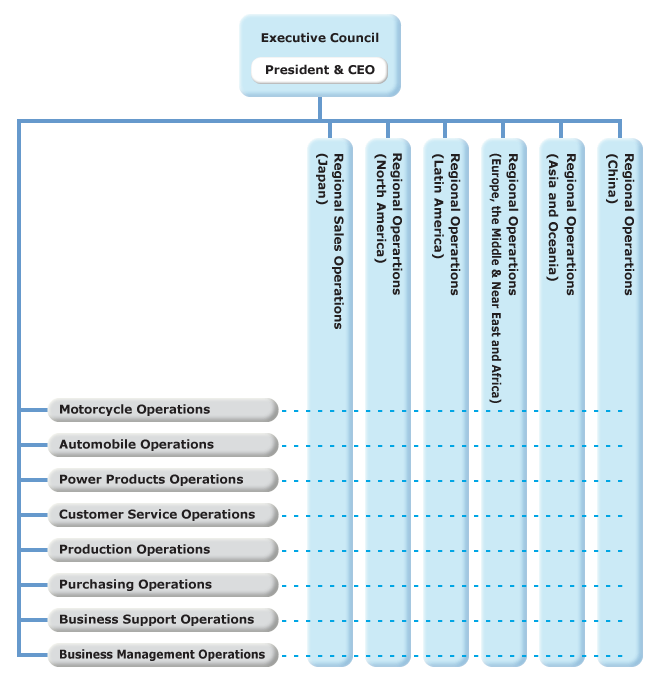

The Honda Co. Ltd.’s corporate headquarters are located in Tokyo Japan the headquarters serves as the strategic and administrative head of the company .It is hence their duty to coordinate all activities of the company and design essential business structures such as Supply Chain Management Activities.

The entire SCM activities beginning from manufacturing to the eventual sales is the duty of specially assigned general managers who are situated in the corporate headquarters. The top management and the board sets forward the company’s policies and communicate these messages to lower levels of management such as Honda’s regional offices in various functional areas.

With the top most level of managers located in Tokyo Japan, they are given the responsibility to make sure that lower levels of mangers that are located in regional centers in North America, India, China, Canada and United Kingdom operate within the set policies of the organization.

Figure 3: The Honda’s organization structure.

This type of organizational structure where communication and procedures emanate from the top has enabled Honda as an organization move in the same direction by improving coordination because lower levels of management are only expected to act by the book and this fact reduces levels of confusion within the organization.

With the organizational structure being streamlined with clear levels of authority Honda Company has been able to improve its way of doing business due to the fact that the entire organization is moving in the same direction harmoniously.

Strategic Orientation of Honda

Mission

Honda was founded on a mission of providing affordable and fuel efficient transport. The company has now stepped up its business operations and aims to provide the best high quality and most affordable transport systems and engines.

Honda’s key concern is to operate in such a way that the need of customers are satisfied at all times, this is why the company continues to invest in technology that will produce reliable vehicles that are in tandem with various demographic and personality trends of their customers. Honda strongly believes that it is their duty to move individuals from one place to another, day in day out, by providing them with the best mode of transport.

Vision

Honda’s vision is to grow and become the most reliable and the best automobile manufacturing giant globally. The company’s Vision is steadily being realized after the company overtook Nissan and Chrysler in the last decade. Honda believes that it will become the best due to the fact that they are investing in technology that will allow the company to be very efficient, reliable and affordable at the same time.

Strategic Objectives

Honda started from a humble beginning back in Japan, their manufacturing technique led to Honda realizing economies of scale thus adopting a low cost pricing model despite the fact that the company produced high quality products.

This strategy has enabled the company realize a highly competitive cost which is responsible for taking the company into the global market especially the U.S.A. Honda hence aims to utilize all avenues especially SCM to ensure that the company is able to save on costs without compromising quality of their product that way the company will be able to sustain a low cost pricing model.

Supply Chain Management Strategies (SCM) in Honda

Honda’s Supply Chain Management strategy has forced the company to shift its Asian factories to American factories and this has enabled the company shorten its supply chain to increase efficiency.

Honda as an organization strongly advocates for localization, this enables the organization manufacture automobiles and other products in the region where they sell and additionally source products from the same regions by forming relationships with local suppliers.

Localization is a reliable risk management strategy that enables Honda reduce risks that arise out of extended supply chains. Moreover, the fact that there are numerous factories across the world; this protects the company against foreign exchange fluctuations and other environmental risks.

Additionally, it has become easier for the company to implement Just in Time (JIT) inventory systems, this way the company orders raw materials appropriately and avoids wastage that comes about as a result of holding a lot of inventory.

In order to manage and link the supply of raw materials together with demand of finished goods, the company has put in place Electronic Data Interchange (EDI) this way the organization has been able to effectively manage resources of the organization more effectively. The introduction of EDI has enabled the organization improve on communication and built a supply chain coordination system.

Additionally, the fact that Honda has moved closer to its customers also helps the manufacturer understand customer behavior much better and respond to market changes more appropriately and in time especially after the company opened customer care department to deal with customer inquiries.

SCM efforts by Honda aim to increase efficiency the supply chain and move their products closer to customers, this way value is created for customers because customers are able to buy high quality goods and services at reduced costs due to the fact that the company saved on costs on the structure of its supply chain.

Moreover the company ensures that it is reliable and dynamic due to the fact that the company pays attention to their customers (Wheelen & Hunger 2010, 134). Honda’s approach over the year has been to develop relationships with both Suppliers and distributors. This format of business has led to partnerships that have been long-lasting especially in Europe and United States of America.

Since Honda is customer oriented the company has been able over years to find ways in which the company has been able to add value to their products by using customer relationship management strategies that have successfully shaped the strategies within the company’s supply chain.

The company over time has operated with the key aim to deliver high quality vehicle, engines and spare parts all over the world in the right time making the organization quite dependable to its clients. Additionally due to its successful supply chain integration strategy the organization has also successfully been able to adopt a low cost model without compromising the quality of goods and services.

Honda then subsequently passes down its cost advantages to its consumers by selling them high quality automobiles at lower prices as compared to rivals; this strategy has enabled the company become one of the fastest growing automobile companies especially in the United States of America and the Rest of North America.

“Honda overtook Chrysler due to the fact that Honda formed partnerships with suppliers who had a history of good relations with the company and the ability to deliver high quality products while at the same time meeting cost targets”(Bowersox, Closs, & Cooper 2002, 76-80).

Conversely, Chrysler formed relationships with vendors who could supply them with parts at the lowest possible cost. The company used multiple sourcing and sent out price quotations to numerous vendors waiting for their responses unlike Honda who were more involved in the vendor selection; additionally the issue of quality was not taken seriously by Chrysler.

Successes of Honda

Honda is steadily becoming one of the most respected automobile companies and the current global success of the company has pushed top management and the entire organization to put in more effort in order to ensure that the organization becomes a top automobile company in the future by creating more competitive advantage within the industry.

The company is currently the 6th largest automobile manufacturer having overtaken Nissan and Chrysler. It is streamlining all operations especially by further shortening its supply chain so that value in the form of saving on costs and delivering more quality to consumers can be realized.

Additionally, the company has for the last 40 years been the leading motorbike manufacturer thereby building a reputable and respected brand all over the world .The company has penetrated the American market at a very fast pace due to the fact that consumers within that market are particularly attracted to the design of their luxury car brands which are price friendly (Stadtler & Kilger 2004, 57-60).

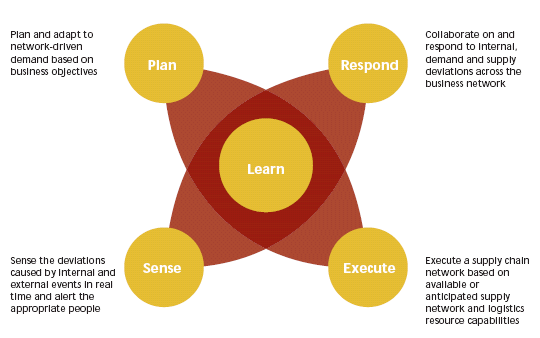

Additionally the top management used a careful approach that has allowed the company to learn from mistakes through observation hence the organization has become a careful planner and executer of supply chain activities. Honda has been able to strategically plan its operations and advance itself as a respectable company.

Moreover, Honda is one of the most responsible companies having applied green principles in their supply chain in order to reduce high levels of pollution and environmental destruction that has been a main characteristic of the automobile industry (Trott 2008, 44-46).

The wide spread success of Honda can thus be attributed to the fact that the companies top management has invested more on planning and the company used to have close to 100 research and development staff as compared to other automobile companies back in the 1960’s this has led to the culture of technological superiority which is quite important in the industry.

The company SCM strategy is one of the most successful elements of the organization that has enabled the company emerge from being a local Japanese company to a multinational giant. Asian countries especially Japan is well known for the high level of technology.

Honda was founded on principles of low fuel consumption and hence the company’s R&D department has been in the forefront of developing low fuel consumption engines. Additionally, Honda’s luxury automobile unit has been able to adapt to the highly competitive environment by quickly adopting to new technological environment.

“In fact 5 of United States Environmental Protection Agency’s (EPA) top ten in the last 25 years beginning in 1985 have all come from Honda” (Wheelen & Hunger 2010, 99).As the technological environment is changing, Honda has put in place the necessary mechanisms to ensure that the company is not left behind.

Figure 4: Honda’s approach to setting organizational strategy especially in (SCM) that has led to the success of the organization globally.

Competitive intensity

Competition is a very important part of every industry and businesses are often required to understand each aspect of the industry that they are in before making any business decisions that are of great significance (Bardi & Langley 2002, 77).

For example, if Honda is to continue expanding its business by increasing the market penetration of their vehicles it will be a must for the company to operate in a way that will grant Honda competitive advantages over other manufacturers and this can be done by carrying out a detailed industry analysis to understand threats, intensity of competition, what substitute products affect their business model and the bargaining power that Honda will have over suppliers and consumers.

Threat of new entrants

Capital and technology is a Barrier that blocks new entrants from entering the automobile industry making the business more suitable for companies like Honda. The amount of capital and technology that Honda has gained over the years is not easy to come by and this fact means that Honda faces little threats from new entrants.

Honda’s low fuel consumption technology and ecofriendly business structure including supply chain management properties make it easy for the company to succeed in the industry (Bardi & Langley 2002, 54).

Regulatory authorities in this age prevent new entrants from entering into their markets especially if the companies does not produce eco friendly automobiles and engines but Honda is one of the leading companies when it comes to making high performance but low fuel consumption vehicle models. This fact means that threat from entrants facing Honda is moderately low.

Intensity of competitive rivalry among existing firms

Automobile manufacturers are currently coming up with proactive business strategies, taking a look at automobile manufacturers such as Volkswagen, Toyota, General Motors, Ford and other companies are very radicle and are coming up with new technology that appeals to consumers and this fact means that the intensity of rivalry in the industry is high.

By using competitive strategies, innovation, structure of industry costs, switching costs or degree of product differentiation and so on, other manufacturers are slowly eating into the market share that was previously belonging to rivals and this has forced automobile companies to embark on vigorous marketing promotion and design good finance packages in order to attract customers to purchase their products.

Threat of substitute products or services

Substitutes within the Automobile industry are moderate; some include motor cycles, bicycles, airplanes, trains and Ships. Some consumers purchase vehicles as a symbol of status while others purchase for convenience (Wheelen & Hunger 2010, 64). Due to the expensive nature of acquiring airplanes and ships they pose a lesser threat as a substitute to Honda motor vehicles.

The Asian community has a culture of using motor cycles and many individuals usually do prefer to ride motor cycles in order to beat traffic in this case, hence motor cycles pose a great threat to Honda motor vehicles but since Honda manufactures great motor cycles they have the opportunity to exploit this fact and make more motor cycle sales.

The bargaining power of customers

The bargaining power of buyers depends on the number of buyers within the industry but the global automobile market has a lot of buyers and a lot of suppliers that supply automobiles (Bardi & Langley 2002, 64).

Due to the wide range of offers by these automobile companies, bargaining power of suppliers is high making it hard for automobile manufacturers such as Honda to comfortably set profit margins as they wish. Honda is thus forced to use economies of scale in order to adopt a low cost model and achieve its strategic business goals.

The bargaining power of suppliers

Suppliers supplying production inputs including raw material can limit the profitability and feasibility of an industry, the level of profits that automobile manufacturers enjoy often depend on how they source production inputs from suppliers.

The Automobile industry is an industry that is flooded by many vendors hence increasing the bargaining power of automobile manufacturers forcing suppliers to sell inputs at lower prices (Stadtler 2008, 23-31).

The concentration and number of suppliers in this industry is high and the fact that the Honda can integrate backward and manufacture some of their raw materials lowers the bargaining power of suppliers. This fact hence enables companies like Honda to operate at a low cost model and sells automobiles to the market at low prices.

Key Drivers of change

The business environment is not static and hence managers are forced to alter the way they do business regularly so that their organizations can become better organizations (Wheelen & Hunger 2010, 4).

The role of change management within commercial organizations ensures that organizations are more radical as far as handling change is concerned. Honda is a very prestigious organization that exists in a very competitive business environment.

Management within Honda should not pay attention to the imperative role that change management gradually adapt to the ever changing environment and this is why the organization has put in place a strong research and development department that is supported by a competitive intelligence department (Wisner et al. 2008, 63-66).

By taking a look at various competition trends in the industry, the organization will thus be able to track changes and take necessary actions in order to improve their business situation.

Other aspects of the environment apart from the level of competition which can be used as key drivers of change may include the economy and changes in demographic parameters. The management should thus put in place necessary mechanisms to track environmental changes which will serve as key drivers which will trigger changes in strategy and policy within Honda.

Conclusion

Honda has become one of the worlds largest automobile manufactures because the entire organization has dedicated its efforts and resources in order to ensure that supply chain activities of the organization are streamlined with the overall strategies of the organization.

The company’s superior supply management channels and clear communication system has fostered good relationship between Honda and its supply chain partners enabling the company become more successful.

It is hence necessary for the organization to carefully research and gather relevant information and set essential plans and strategies that will enable organizations to work more efficiently with both suppliers and distributors.

The introduction of electronic record keeping and ordering technologies such as Electronic Data Interchange (EDI) is so crucial in managing supply chain relationships and will hence help organizations to continuously evaluate the entire supply chain and get rid of inefficiencies within the supply chain.

It is hence through continuous improvement that comes about as a result of monitoring and evaluation that Honda will be able to improve its position in the Automobile industry and become a much better organization.

References

Bardi, E. & Langley., 2002.The Management of Business Logistics.7th edn. Mason: South-Western College Publications.

Bowersox, D. Closs, D. & Cooper, B., 2002.Supply Chain Logistical Management. McGraw-Hill, New York: Cengage

Douglas, L., 2008. Supply chain management: processes, partnerships, performance. New York: Supply Chain Management Inst.

Ian, W. & Chris, B., 2009.Business environment. 6th edn, Canada: Pearson Education.

Michael, P.2004. Competitive advantage.Illustrated edition, free press: Northampton, MA.

Stadtler, H., 2008. Supply chain management and advanced planning: Concepts, models, software, and case studies. New York: FastBook Publishing.

Stadtler, H. & Kilger, C., 2004.Supply Chain Management and Advanced Planning: Concepts, Models, Software and Case Studies.3rd edn. Berlin: Springer-Verlag.

Tompkins, J. & Smith, J., 1998.Warehouse management handbook.2nd edn. Raleigh: Tompkins Publishers.

Trott.P., 2008.Innovation Management and New Product Development.4th edn. London: Pearson.

Wheelen, T. & Hunger., 2010.Strategic Management & Business Policy: Achieving Sustainability.12th International Edn. New York: Pearson Prentice Hall.

Wisner, J. et al, 2008. Principles of Supply Chain Management. New York: Cengage learning.