Categories of Tangible Assets

Current Assets

Tangible assets are divided into two main categories. The first category is current tangible assets, which are expected to be consumed, sold, or converted into cash within a year or the normal operating cycle of a business (Gupta, 2012). Examples of current tangible assets include inventory (raw materials, work-in-progress goods, and finished products held for sale), cash (physical currency, coins, and cash equivalents), accounts receivable (money owed by customers for goods or services provided on credit), and prepaid expenses (payments made in advance for expenses like rent, insurance, or supplies). In 2009, for current tangible assets, BP reported $249 million in loans, $22,605 million in inventories, $29,531 million in receivables, $4,967 million in derivative financial instruments, $1,753 million in pre-payments, $209 million in current tax receivables, and $8,339 million in cash and cash equivalents (BP, 2010).

Fixed Assets

The second category is fixed tangible assets, property, plant, and equipment (PP&E). These are long-term assets a business uses to generate income and provide value over a more extended period, typically exceeding a year (Gupta, 2012). Examples of fixed tangible assets include land (purchased or leased by a business), buildings (physical structures used for business operations), machinery and equipment (tools, vehicles, etc., used in production or service provision), furniture and fixtures (items like desks, chairs, and shelves used in business premises), and leasehold improvements (improvements made to leased properties to suit business needs).

BP Data

In 2009, BP reported $108,275 in PP&E, which accounted for 45.9% of the company’s total assets. PP&E included $3,964 million in land and improvements, $2,742 million in buildings, $146,813 million in oil and gas properties, $37,905 million in plant, machinery, and equipment, $3,045 million in fixtures, fittings, and office equipment, $12,295 million in transportation, and $10,345 million in oil deposits, storage, tanks, and service stations (BP, 2010). In 2009, the company’s tangible assets included $15,296 million in investments in jointly controlled entities, $12,963 million in associates, and $1,567 million in other investments (BP, 2010).

Methods of Depreciation and Depletion for Long-Term Assets

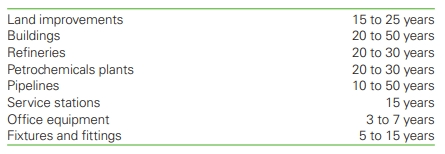

The value of tangible assets is depreciated on an annual basis. Depreciation refers to the systematic allocation of the cost of a tangible asset over its useful life (Gupta, 2012). It is an accounting method used to spread out the cost of an asset over the periods in which it is expected to contribute to a business’s operations (Gupta, 2012). BP used two depreciation methods depending on the applicable tangible asset (BP, 2010). According to the annual report 2009, the company used straight-line depreciation of PP&E based on the estimated useful life of an asset (BP, 2010). The expected useful lives are re-estimated annually within the limits provided in Table 1 below.

Methods of Depletion Used for Natural Resources

Oil and natural gas properties and associated pipelines undergo depletion using the unit-of-production method (BP, 2010). This implies that the depreciation method is used to allocate the cost of an asset over its useful life based on the actual usage or production output of the asset (Gupta, 2012). Instead of evenly spreading the depreciation expense over time, the unit-of-production method links the depreciation expense directly to the production or usage of the asset (Gupta, 2012).

The expense for producing wells is amortized based on the proven developed reserves (BP, 2010). The costs of acquiring licenses, field development, and future decommissioning are amortized over the total proved reserves (BP, 2010). The unit-of-production rate used for amortizing field development costs considers the expenditures and the approved future development expenses necessary to exploit the reserves (BP, 2010).

Case Studies

Indian Ocean Drilling Scenario

BP acquired Indian Ocean drilling rights on January 1, 2010, for $3.5 billion and purchased a $225 million marine oil rig with a 30-year life and no salvage value. Drilling began in March 2011, producing 750 million barrels in 2011, 675 million in 2012, and 825 million in 2013, from an estimated 12 billion-barrel site.

The marine-based oil rig has a useful life of 30 years and no residual value. Since it is depreciated straight-line, its value will be depreciated evenly by $7.5 million per annum ($225 million / 30 years). Thus, in 2011, 2012, and 2013, annual amortization expenses will be $7.5 million.

The oil site is estimated to contain 12 billion barrels of oil. The unit-of-production method calculates depletion expense based on the number of barrels extracted yearly. To determine the depletion rate per barrel, we divide the initial investment of $3.5 billion by the estimated 12 billion barrels:

Depletion Rate per Barrel = $3.5 billion / 12 billion barrels = $0.2917 per barrel.

Therefore, in 2011, the depletion expense will be $218.75 million (750 million * $0.2917), in 2012, it will be $196.76 million (675 million * $0.2917), and in 2013, it will be $240.52 million (825 million * $0.2917).

Gulf of Mexico Drilling Scenario

BP’s Gulf of Mexico drilling operation was destroyed, including a company-owned rig that originally cost $225 million and now has a book value of $160 million. The related oil rights, purchased for $4 billion, were 35% depleted before the destruction. You must determine how to account for the loss of both the rig and the remaining natural resources.

First, the destroyed rig should be retired from BP PLC’s books. When an asset is no longer usable or permanently removed from service, it should be retired or derecognized from the books. In this case, the rig’s book value of $160 million should be removed from the PP&E account, reducing the PP&E value on the balance sheet.

Second, the loss of the destroyed rig should be recognized based on the following calculations:

Loss = Original Cost – Current Book Value =$225 million – $160 million = $65 million.

According to BP’s accounting standards, when an asset is destroyed or obsolete, a loss should be recognized to reflect the reduction in its value. In this case, the loss represents the unrecoverable value of the destroyed rig and is recognized as an expense on the income statement.

Finally, the loss of natural resources should be recognized based on the following calculations:

Loss = Original Cost – Depleted Portion=$4 billion-$4 billion*0.35=$2.6 billion.

When natural resources are lost or depleted due to uncontrollable circumstances like an accident or environmental disaster, a loss should be recognized to account for the unrecoverable value of the lost resources. In this case, the loss represents the portion of the oil rights that has been permanently lost and is recognized as an expense on the income statement.

References

BP. (2010). Annual Report and Accounts. Web.

Gupta, P. (2012). Principles of Business Financial Accounting. AuthorHouse.