Introduction

British Petroleum alternative Energy is an excellent company from the United Kingdom operating in the energy industry. The company was incorporated in the UK in 2005 and is operating all over the world. In some parts of the world, they have been listed on the stock exchange. They are engaged in various businesses in the energy sector. It was started in 2005 by British Petroleum, which was incorporated in 1901. After incorporating, British petroleum sold off its derivative businesses to be able to run the current business (Rocsearch, 2006)

The company boasts of over 500 subsidiaries worldwide and records revenue of over $ 250 billion annually and currently tops as the company with the highest record of sales in terms of petroleum products and exploration income. The subsidiaries are in over 70 countries of all the continents that is Europe, Asia, North and South America, Africa, and Australia. Being a global energy company, they specialize in providing fuel, energy, petrochemical products, and retail services worldwide.

Europe is their largest market and they are the largest foreign investor in China. They also own a significant American market share with a fewer share in the Latin American market. Its sales also dominate both the African and Australian markets. The company has also entered into joint ventures with various companies in the same industry (Rocsearch, 2006).

British Petroleum alternative energy key success factors include exploration of oil using modern technology and maintaining their goodwill in the oil-producing countries. They also maintain customer loyalty through a constant supply of high-quality products and at reasonable prices, proficient employee work team, and sound marketing strategies(Rocsearch, 2006).

From the financial statements of the company, between Jan – September 2007, the net sales had increased by 34% and operating profits by 41% compared with the same period the previous year. The shareholders also received more earnings for each share held. There was an increase of 19% in Earnings per Share. There was no percentage change in the gearing level of the firm as this remained at an equivalent average compared to other years. The company boasted the same period revenue of more the 250 billion which was a growth rate of 35%. The company growth is associated with a new business venture that they entered into. Their asset base also increased by 21% to over 300billion.

The company has responded well to the calls for corporate sustainability. They have adapted conventional methods this is shown in the “in fossil fuels, BP is matching the high profile stance on renewable energy and combating climate change the company presents in Europe. A specific mechanism that BP has set up to break the cycle of ‘business as usual’ is a Regional Ethics Committee (REC). RECs, which BP has established around the world, aim to reinforce the focus on ethical conduct and review ethical dilemmas” (Rocsearch, 2006).

The company’s workforce comprises valuable men and women who are both skilled and motivated in the workplace. The organizational structure of British petroleum is in a way that employees do not have to follow long bureaucratic channels for communication and reporting purposes. This eases the decision–making process as well as conflict resolution in the organization.

On human resource management, the corporation recruits highly skilled manpower and retains them through motivation and training development. Using a modern tool of organization, such training & development has enabled their workers to effectively exploit BP’s resources since it acts as an incentive. Its management structure is not in a hierarchy form. This means that there exists a horizontal communication network. This has the effect of accelerating policy formulation and decision-making processes. The management comprises the chair, deputy chair, other board members, secretary to the board, Chief Executive officer, Chief finance officer, and others.

Culturally, the employees of BP alternative energy work towards accomplishing the objectives /goals of the firm. They have common beliefs and ways of doing things (Working). Because of this culture, the organization can resist such threats as labor turnover that can adversely affect the firm’s profitability since labor turnover is costly to any organization.

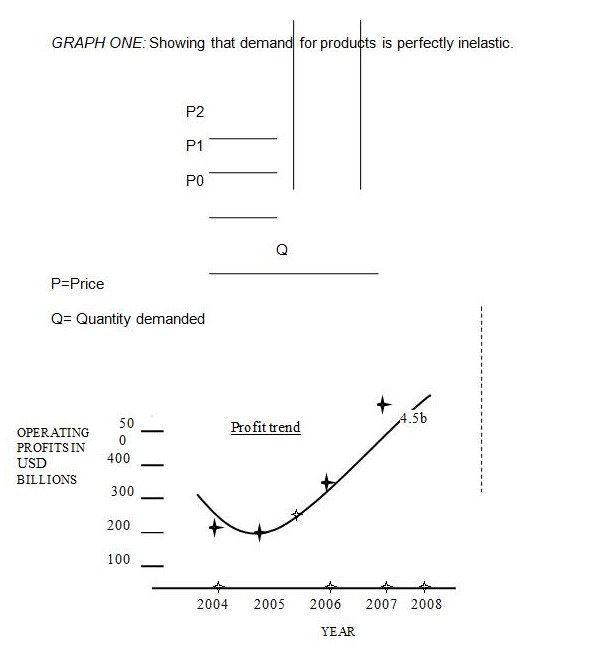

The existence of new technologies that are rare has contributed to BP’s sustained competitive advantage. It is the only energy industry that has invented modern ways of exploring oil. These rare technologies have enabled BP to improve significantly on its sales. This is evidenced by the 2007 sales of over 250 billion. Even with the increase in the prices of raw materials for its products, the demand for the oil remains perfectly inelastic as shown in graph one.

The graph shows that even with the increase in the forces of BP Alternative energy products, the quantity demanded remains the same due to customer loyalty and quality production.

- The company’s products include ARCO, Castro which is a lubricant, Amoco, Aral, LPG a gas, Asphalt, Bitumen, LNG, Solar renewable, EGAS, Aviation Fuel, Petrochemicals, and many others not mentioned. Companies operating in the same industry as BP include Exxon Mobil, Royal Dutch/Shell, Chevron Texaco, and Mobil. (Rocsearch (2006)The company has made serious progress by opening and operating in China and recently they opened a large industrial lubricant blending facility. They have had contracts to explore oil in the coastal region of Kenya and Pakistani.

- Business Description. The main objectives or activities of this company are to explore and produce crude oil, natural gas, refining the crude oil, marketing oil and related products, supply and transportation; and the manufacture and marketing of petrochemicals with a growing presence in gas and power and solar power generation. Vision: “Our aim is to be successful in everything we do by delivering outstanding performance. The test of success will be our ability to generate strongly competitive returns in a sustainable manner that aligns us with society.” (Company website) This company operates in parts of the world with goals of partnering with the local communities in assisting in economic and social development, produces shareholder value, and aligns our business values and policies with local and national aspirations (Rocsearch (2006).

Porter’s five forces

Porter, the Father of Competitive strategies identified five forces that drive competition within an industry (Porter M, 1986),. He listed them and explained how they are applied in the industry. These strategies include (1) The threat of entry by new competitors into the industry: this is the main problem of the competition. A new competitor comes in there chances that he will go with some of the buyers. Another related problem is entering a new market either through geographical or vertical expansion. ( 2) The intensity of rivalry among existing competitors that the change of strategies: the current competitors and the task of staying competitive in the current market was identified by Porter as another problem that needed strategies. (3) Pressure from substitute products. (4)The bargaining power of buyers. (5) The bargaining power of suppliers.

No matter which competitive force is to used the most important thing to keep in mind is the relationship between profit margins or returns and the intensity of competition. The higher the intensity of competition, the low is profits (Varadarajan p and Cunningham H, 1995),

Porter’s Five Forces Analysis for the Sector

Buyer Power

The company faces the threat of buyers shifting their loyalty to other rival companies. This phenomenon according to porter is referred to as backward integration. To curb this threat, BP Alternative energy has come up with three generic strategies to counter this threat.

- Cost leadership: – It has reduced the price of some of its products including the cost of offering services such as oil refining.

- Differentiation strategy: – The Company has come up with alternative products that are differentiated from the rival firms. These products should be economical and are environmentally friendly in terms of pollution.

Among the customers of the industry manufacturing firms, car industry players, homes, and almost all sectors of the economy

Supplier Power BP Alternative is faced with the threat of the suppliers being able to control the price of some of the materials they supply. The oil-producing countries have formed curtails and have come up with stringent price control measures. The labor laws are also stringent and the workers are so unionized that treating employees fairly and equitably is inevitable. To counter this force, the company extends its supply chain making the prices of for instance of crude oil come down.

The generic strategies adopted by the company against supplier power are by increasing the price of their products. In essence, the extra prices charged for the raw materials are borne by the customers. This is the differentiation strategy. Another strategy to insulate itself from this force is that of focus. Because of the higher material prices, BP has taken on the differentiation-focused strategy. In this strategy, the methodology has been improving the quality of their products. By so doing, the prices can be increased without harm being made to the customers.

Barriers to Entry

The other force challenging the industry is the entry of new companies with similar products or even more products like oil from sugar cane and many others. This would pose the threat of neutralizing the company’s profits as well as its market share. The generic position that the company has taken has been cost leadership. Through lowering its production costs and increasing operational efficiencies, the company has been able to lower the prices of its products while maintaining its profitability. This has deterred potential investors/ entrants into the industry.

The company has also produced special lubricants for special industries such as the manufacturing industry. This kind of focus strategy that also encompasses the differentiation strategy makes entry difficult.

Lastly, the company is faced with the threat of rival companies accessing its premises and imitating their production methods. However, the company has made its headquarters, inaccessible to foreigners to safeguard its patents and copyrights. In addition, their employees are well compensated, therefore; they do not have thoughts of leaving for rival companies.

Rivalry

This force emanates from other companies within the same industry like Exxon Mobil, Royal Dutch Shell, and Chevron Texaco. The threat here is that these companies capturing the market. However, the company’s framework/ strategy has been reducing prices whenever faced with such a threat. Prices are then reverted to normal after the exit of that company in the specific market segment.

Consequently, new BP products have been adopted to reduce rivalry. Focus has also been used as the generic strategy to solve these problems- rival companies cannot effectively meet the differentiated as well as focused needs of the customers. Still, so long as Energy products are not 100% substitutes for one another, the problem of switching costs arises.

Threat of Substitutes

From the economist’s point of view, the threat of substitutes arises when the demand for that good is likely to be affected when the price of the substitute changes. This elasticity of price has formed a real force that the company has to fight if it has to be sustained shortly. Energy products from other companies like Exxon Mobil, Royal Dutch Shell, and Chevron Texaco may be an alternative purchase option to the customers if BP increases the price of its products. This bars the company from effectively increasing the price of its products whenever the need arises.

To reduce the strength and danger of this force, the company has strengthened its differentiation generic strategy as its framework. Customers would then be loyal to the uniqueness of their products even when BP’s increases in price.

Pestle analysis of the energy industry

Socio-Political Trends

The Middle East wars are affecting the industry at large. This because the industry’s main suppliers are from those sides of the world. This has been complicated by the crisis of terrorists another producer from Africa that Nigeria is faced with constant kidnappings of oil workers. This has made the control of crude be based on international politics. Nations with are prestigious minerals have formed cartels that control the oil production and they meet before adjusting the price of crude oil.

Technological Trends

Nearly half of the world’s population have access to television and Internet connections in their homes In the USA nearly half of the population have access to the internet in their homes, according to the annual survey by the Pew Internet & American Life Project in July 2007. The number of home broadband users nationwide now equals the total number of Americans with any type of Internet connection in 2000, the first year the survey was conducted. Four out of 10 African-American adults have broadband access at home, compared to 15% two years ago. Nearly one-third of rural Americans have home broadband connections, compared to about half of Americans living in urban areas and the suburbs. According to Pew, income, and race are becoming less important differentiators in US broadband adoption.

In the Far East, things have taken a new dimension majority of the parents have resorted to the internet for academic purposes this has led to an increase in the need for broadband connections in homes.

Economic Trends

The US sub-prime crisis has already had a global impact on global financial markets and could affect consumer spending worldwide. At first sight, this would seem a disproportionate reaction but banks all over the world are exposed to US debt. Sub-prime lending was lending at higher interest rates as a means of helping American consumers of lower incomes and poorer credit records obtain mortgages. These loans were then sold on, in complex ways, to other institutions including hedge (higher risk higher return) funds. The treatment of sub-prime loans by the banks is likely to have far-reaching effects including, possibly, a slowdown in the US economy and confidence linked to a decline in US consumer spending.

The fact is that US retail sales rose only 0.3% in August 2007 suggesting increasing caution of the crisis ahead. US retail sales are a major driver of economic growth and may be viewed as an early response to a housing slump and financial market turmoil. Over the past 12 months, retail sales rose by 3.9% excluding autos. However, the level of spending did not indicate recession tendencies though analysts expect growth to decline shortly. There were modest increases in sales for furniture (0.5%), electronics (0.4%), sporting goods (0.3%), and health care (0.3%) compared with the same month a year ago. Thus, this national economic problem might have a small effect on the health food sector because organic foods are usually priced higher than regular food (Xinhua News Agency, 14 September 2007).

These trends affecting the world economy are contributing to the fall in demand for cars and other consumables that use the products of the industry.

Environmental

The company is very competitive; BP alternative energy is balancing its e commitment to communities they operate in through its corporate responsibility. They assist in environmental activities. Oil refineries cause environmental damage, the company is trying to use modern methods of environmental cleaning.

Legal constrains

The company is operating all over the world. Each country has its own laws to comply with. The head finds it difficult to for example convert financial statements prepared in different accounting standards and procedures. These are one of legal constrain facing this company, although accounting standards board are solving this problem through the convergence of accounting standards.

SWOT Analysis

Strengths

- Unique Product Offerings; the company is offering Unique products with a strong brand name.

- They have a strong presence in the Africa market, a strategic position in the US and Europe, and a commandeering share in the Chinese market.

- They have carried successfully in exploration Persia and other parts of the world and production strong brands

- Owning the technological know-how that is, they can alternative energy.

- A large number of working staff equipped with technology and based in and outside the UK

- Strong financial base.

Weaknesses

- Too many competitors. This include Exxon Mobil, Royal Dutch Shell, and Chevron Texaco

- Most consumers had now access to various products from different companies.

- Fluctuating financial performance: this is shown from the financial statements.

- Losses were emanating from different projects like the ‘thunder Horse project’.

- no safety provisions are taking into consideration of the Nigeria issues

Opportunities

- there is an increase in demand for fuel worldwide

- Enlarging of the Target Market

- Increasing Awareness of People About alternative energy

Threats

- Increasing drilling costs in the North Sea region

- Losses due to hurricanes

- Entry of companies from China, Africa, and Asia

- The threat of solar vehicles

Business Strategies

Potential Customers

BP alternative market will focus on customers who are based in the development and developing world especially the USA and Africa. It is expected that youths are the perennial marketing targets of car manufacturing companies and oil companies from their inception since wealth is sifting to the youths… The market for oil products has not changed much but with the change of wealth to the young generation, the demand will increase in the below 40-age range. As old people are the historical oil purchasers and users, they will continue to have a significant impact on demand for these products, therefore, forming a key target audience for low and light product producers. Young, on the other hand, have been pushed into taking a more active role in the use of petroleum purchases in recent years. In general, these youth-oriented decisions focus on speed – quick to make, quick to use.

In terms of age, the huge diesel consumers will come from 58 to 80 age brackets. However, youths are a growing market sector for two reasons.

Increased focus on high-quality refineries

The company has now focused on producing high-quality products through ultra-modern refineries. They have invested in China and Indonesia one of the most growing economies in the world.

5. Complete a 3000 word situational and internal analysis of BP Alternative Energy. This analysis must include the current situation of BP Alternative Energy – Plans of BP Alternative Energy – Value Chain Analysis – and Competition analysis.

Table 1. Financial Performance

On profitability/ performance, it can be noted that the profitability of the BP is fluctuating from a time over time. This is shown by the Gross profit margin, Return on Assets (ROA), Return on Equity (ROE), and the operating profit margin. In 2000, the ROE increased to 12.6% from 11% in 1999 before declining further to 1.1% in 2001 again it went up to 8.2% in 2002 and year 2003 it settled at 17.8%. The net profit margin also increased to 8.2% in 2000 from 6% in 1999. In 2001, it declined to -0.8% and then went up to 5.9% in 2002 before settling at 12.8% in the year 2003. In 2000, the ROA inclined to 10% from 8.1% in 1999 before declining further to 0.8% in 2001 before going down to 6% in 2002 and settled at 13.4% in the year 2003.

The Gross profit margin also inclined to 49.9% in 2000 from 48.4% in 2004. In 2001, it declined to 49.7% and before going up to 52.8% in 2002 and settling on 56.8% in 2003. Even though the profitability of the company has been fluctuating, it is still positive results but if the management does not take care, the operating costs will affect the company’s profitability. this because although there are fluctuations they are associated with operating costs as the gross profit seems to be stable.

There is no change in the debt/assets ratio is fairly stable with slight fluctuations that are 26.2%, 22.3%, 24.7%, 26.7%, and 24.2% in years 1999 to 2003 respectively. From this, I deduce that on average for every 24 cents of debtors there is $1 from the assets.

There is constant fluctuation of the debt/equity percentage although it stable that is 35.6%, 28.7%, 32.9%, 36.4% and 32% in years 1999 to 2003 respectively. These percentages are indicators of how many times the shareholder’s funds can pay total liabilities expressed in percentages. From this, I deduce that on average for every 35.6 cents of debtors they will get $1 from the shareholder’s funds in the year 1999. in the year 2000 on average for every 28.7 cents of debtors they will get $1 from the shareholder’s funds. In the year, 2001 on average for every 32.9 cents of debtors they will get $1 from the shareholder’s funds. in the year 2002 on average for every 36.4 cents of debtors they will get $1 from the shareholder’s funds and in the year 2003 on average for every 32 cents of debtors they will get $1 from the shareholder’s funds.

4Ps

Positioning – BP would like to create a niche in offering a wider array of energy products in the world market. As most competitors are offering traditional energy products. BP alternative energy will go a mile higher by offering non-crude oil products to all parts of the world.

Promotion – use of the internet, television adverts, promoting social activities, fliers, sponsoring sports, and much other promotional activity. Since we are involved in providing wider petroleum products choices, BP is inclined to product differentiation, which is essential in positioning. The products should be positioned so they can stand apart from competitive products. Their unique combinations that differentiate their products from other competitive offerings will enable customers to define the important attributes of the business.

Place – BP is situated in various parts of the world with head office in the UK.

Pricing – BP will make all the prices of their goods match the prices of their competitors but will have a hedge because they are unique.

BP products

BP products are a health and of a wide array of petroleum products to the growing market of wealthy youths in the world. It should also plan to venture into producing other products. Since there is a large market for ENERGY products, the success will rely on quality and standards. Their products include ARCO, Castro, Amoco, Aral, LPG, Asphalt, Bitumen, and LNG, Solar renewable, EGAS, Aviation Fuel, Petrochemicals, and Paraxylene

The goals and objectives of BP are as follows:

- To be a market leader in the industry.

- To provide affordable and high-quality products in the world;

- To constantly guide and inform wellness consumers about the products they offer;

- To continuously strive to make service fast, accommodating, and excellent towards all consumers in all parts of the world.

The mission statement of BP would be:

- The low content of environmental hazard products to their consumers is the main prime concern. This means they produce worldwide respected products.

Competitive Analysis

The more established competitors seen for BP are Exxon Mobil, Royal Dutch Shell, and Chevron Texaco is offering similar products also with an international presence. Since Exxon Mobil, Royal Dutch Shell, and Chevron Texaco already knows BP strengths and weakness, BP company should make themselves an inspiration to strive harder in satisfying the customer’s needs.

Bp cultural web

BP is committed to the development and economical growth of people across different cultural boundaries. Culture is all about expectations, desires, and lifestyles. The company’s website has a lot of information regarding their different brands of products. Customers can even purchase products that best suit their machines through their outlets. Through the web, they can also air their views on what new modifications they deem suitable for them. Language is another cultural factor the company has well catered for. Its brochures, magazines, and blueprints are all written in several languages to enhance communication. In their different branches globally, is an integration of human resources from different cultural backgrounds.

Value chain

BP adopted a value chain that has resulted in the maximization of value while maintaining the costs to their minimal levels.

Activities where value has been created and costs reduced include procurement of raw materials, Human Resource Management, and Technology development. Other areas include Research & Development, Sales, and Marketing.

In procurement, BP Management has ensured that the raw materials and other supplies are close to their proximity to reduce transportation costs. Oil is refined using high technology while ensuring that their products cannot suffer from impurities and obsolescence hence low obsolescence costs. They incur a significant cost in research and development but this cost is countered by the value generated therefrom i.e. products that cannot have substitutes.

Value is also added when it comes to outbound logistics. To reduce the distribution costs of oil and other products from the oil depots, the company distributes them in large quantities using tankers while also reducing the number of distribution channels.

BP tries to reduce the costs associated with recruitment and hiring of staff like for instance doing the exercise online. The benefits/value of the exercise is enhanced by recruiting and hiring a staff of high integrity, professionalism and expertise.

Conclusion

To achieve better future results, better or higher to industrial average, BP needs to cut down its operating expenses, enter new markets through vertical integration, geographical expansion, and product differentiation. This would considerably improve the profitability which is declining recently. They also have to review their policy on capital management and keep optimal levels of various items of current assets. This would improve the firm’s liquidity position. To improve the return on owner’s equity ratio, the management should invest in viable projects that would yield positive NPV’s. This has the effect of maximizing their wealth.

References

- Anonymous. A Not So Great 2008: Emerging Trends Report. National Real Estate Investor (Online Exclusive), (2007).

- British Petroleum company website

- Buckley P (2003),, Globalization and the Multinational enterprise, in Faulkner et al The Oxford handbook of Strategy: Corporate strategy (ed.), Vol. 2,

- Business Insights. The Health Food and Drinks Outlook To 2006: Consumer Insight, Market Dynamics & NPD. London: Business Insights Ltd., 2003.

- Company financial statements. Web.

- Department of Trade and Industry, Government of UK. Web.

- Ernst & Young Report on energy Market to the Department of Trade and Industry, UK. Web.

- Navroz D. and Daljit S. (2005) ‘Of Rocks and Hard Places: A Critical Overview of Recent Global Experience with Electricity Restructuring’, Economic and Political Weekly, Vol XL No 50,

- Newbery, D. M and Pollitt G. (1997): ‘The Restructuring and Privatization of the UK Electricity Supply-Was it Worth It?’, Public Policy for the Private Sector, No 124, World Bank.

- Porter M, (1986), Competition in Global Industries, Boston, Harvard Business School press.

- Quinn J B, (2003), Strategic Change: Logical Incrementalism, in Quinn and Mintzberg, the Strategy Process, Prentice Hall.

- Rocsearch (2006) British petroleum Company: company analysis. Web.