The passion for information and communication has been the driving factor towards the start up of Einstein Web Solutions. Einstein Web Solutions is an ICT firm specializing in the Search Engine Optimization business. EWS is a firm based in the United States and enjoys a capital base of more than $100, 000. This organization is intended to offer SEO services to a wide array of customers. These include personal websites, small scale organizations to large companies with the interest of increasing their web presence. This firm will provide affordable and customized internet market solutions to a myriad range of clients. The market includes small and large businesses as well as individual website services.

The minds behind this initiative as we will see later, are professionals in web designing and marketing hence making the firm to run a URL of itself. Its services will cover as already mentioned earlier an extensive range of activities including on-site and off-site SEO services. This will be geared towards organizations interested in optimizing their web rankings. During the first year of operations, focus will be on marketing aimed at building a strong client base. Other than convectional market practices, quality services to existing clients will form the basis of our services marketing initiative (Steenburgh, & Avery, 2010). The business is then projected to expand to attain regional status and eventually global over time.

It is expectant that in the initial three years, the business will direct lots of resources towards marketing. A large portion of the content will be done in-house during these three years. This will however not be a problem considering that the stakeholders are experts in the field of the business. The main source of income / revenue in this business will be offering of SEO services to website owners. Another source of revenue will be through advertisements and affiliate programs. This firm is yet to be officially opened later during the year.

Products and Services

Products on offer at Einstein Web Solutions will provide website owners with high impact e-marketing strategies. These services are meant to help organizations increase their web presence and hence allowing them to reach out to a greater target audience. Unlike similar firms, Einstein Web Solution does not just attract traffic to the respective websites but rather attracts the right traffic with a potential of turning them into sales remember sales is the prime objective of a site. Our services are aimed at having client’s websites ranked high on search engines based on specific keywords. The organization applies both convectional and technical skills to achieve this, including the use of specific algorithms for appropriate content. Einstein Web Solutions will further offer marketing management service to clients to help clients’ websites to move up the rank in their respective website categories (Rupert, Pope, & Anderson, 2014).

Essentially, Einstein Web Solutions offer white-hat SEO techniques to help website get better ranking on search engines, enjoy increased web presence, and attract relevant traffic.

Financing

The business aims to raise a loan of £100,000 from a bank. The interest to be accrued on the loan is set at 10% fixed interest for the 10 year loan.

Einstein Web Solutions’ Mission Statement

The organization’s mission is provision of an integrated SEO menu to clients. Einstein Web Solutions is committed to provision of SEO services that will raise the online presence of customer’s. This will be achieved through ongoing and relevant approaches towards integration of online advertisement in service’s menu.

Management Team

The company brings together a team of experts who enjoy over 5 years of experience in SEO industry. The business will tap into its management’s expertise to consolidate business operations and generate profit without compromising quality service delivery to the clients. The team is expected to steer the business to profitability in its first year of operation.

Sales Forecast

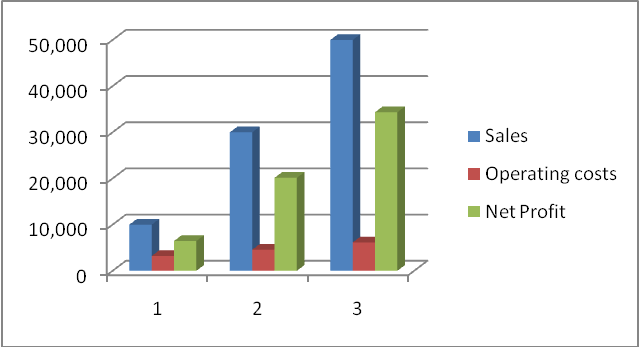

Einstein Web Solutions is a company eyeing to run profitably. To further express this motive, are our projected figures below. The company expects a steady strong growth over the first three years.

Extension Plans

The management will put in place an intensified marketing campaign in its first three years in order to see a steep rise in small and medium sized business websites which will be the hub of the SEO business.

Organization and its Financing Summary

Registered Name and Corporate Structure

Einstein Web Solutions is a registered company in Ireland offering SEO services to business interested in increasing their web presence.

Funding required

Presently, Einstein Web Solutions will acquire £100,000 for its operations funding.

Detailed description of products and services

The services offered by the business will primarily be SEO services and pay-per-click marketing.

SEO Services

This is the main service to be offered by the business. It will involve application of relevant keywords to attract traffic to a customer’s website. In essence, it uses white hat SEO techniques to improve a client’s online presence.

Pay-per-Click Marketing

This is a subsidiary income source and will involve an ongoing pay-per-click advertising service. Each click is charged by the company.

Strategic and Market Analysis

Economic Analysis

This part of this report discusses the business’s economic environment. It will also look at the accounting methods that would be available for this type of business and discuss the customer profile, as well as competitive forces within the market. Currently, Ireland is in the post-recession period and the economy is beginning to pick up. Sales are on a steep rise as business focus on going online. Many economists project that the Eurozone economy will continue to rise and business will continuously seek to boost their online presence, implying increased market (Anderson, 2005).

Industry Analysis

SEO as an industry has largely expanded over the recent years. This has largely been facilitated by the steep rise in computer technology and e-readiness of the general population. Many people now rely on computers for literally everything. In response, more and more companies are seeking a stake in the booming online market. In Ireland, and larger Europe, internet remains a major avenue through which clients interact with manufacturers and service providers. Nonetheless, despite the ever growing client base for SEO services, business offering these services is also growing at a very fast pace. In 2012, the economic census revealed that more than 20000 service providers offer similar or identical services in Ireland, not to mention the larger Europe (Hill & Westbrook, 2006).

In general, this segment is expected to continue to rapidly grow as more corporations, large and small realize the importance of hiring professional SEO services if they are to successfully compete (Menon et al., 2010). Thesis best illustrated by sky-rocketing need for these services over the last two years, more especially after most directories disallowed special placement. Additionally, introduction of pay-per-click advertisement services has made it possible for many smaller businesses to find a place in the large web platform. The company will capitalize on the increased need for SEO services by smaller and medium sized companies. These businesses will offer a continuous Einstein Web Solutions.

Consumer Profile

Every single business organization keen on expanding its online presence is a prospective client of Einstein Web Solutions. Consequently, its target client demographics is extensive and include many businesses keen on e-commerce and hence in need of strong business presence.

Competitive Analysis

Research on SEO services in Ireland and the large EU zone reveal existence of hundreds of thousands of providers. In essence, this implies high levels of competition underlying the importance of strong market and enhanced quality service delivery to ensure retention of clients. Considering that SEO optimization does not require physical presence of the SEO provider at the company offices, Einstein Web Solutions finds itself pitted against leading SEO service providers from across the world. In essence, Einstein Web Solutions operates in an environment where the risk of losing a client is so high. Pricing and quality service delivery are therefore of extreme importance given the high number of SEO providers popping daily and the cheap prices offered by new entrants into the market, who are by no means lesser than those already in the market. This is a market where barriers to entry are so limited, exposing it to competition from new entrants each day. However, other than quality service delivery and affordable prices, the pay-per-click service acts as customer retention plan.

Marketing Plan

Einstein Web Solutions seeks to persistently engage in an elaborate and continuous marketing plan that will see it get from clients not just from Ireland but also from other parts of the globe. Its marketing objectives and strategies are outlined below:

Marketing Objectives

Einstein Web Solutions has set a number of objectives reviewable after every financial year to ensure its continued success. The objectives are listed below:

- Increase client base by 25% at the end of every financial year.

- Expand operations to international level by the end of the first three years of operation.

- Lower operational costs by 10% by the end of the first 3 years.

- Expand the affiliate program by 20% at the end of the first 3 years.

Marketing strategies

The management intends to employ multiple marketing strategies to ensure the aforementioned objectives are accomplished.

- Aggressive internal SEO campaigns to ensure increased online presence of Einstein Web Solutions.

- A continuous referral relationship with other internet marketing organizations and web programming entities. It is expected that such organizations can outsource SEO services from Einstein Web Solutions at a discounted rate for purposes of resale to their clients.

- Face to face interaction with companies in Ireland.

- Use of email marketing on basis of existing directories.

- Offering quality services.

- Offering discount coupons to new customers.

- Availing after-sale services and discounts to returning customers.

Pricing

Pricing has been identified as a very important factor in a market crawling with competitors from all corners of the world (Armstrong, 2006). However, the costs incurred by the organization and the need for delivery of quality services must be factored in during pricing. While low prices are customer winners, the organization cannot compromise its service provision at the expense of offering consumers low prices. A balance must therefore be struck between the two.

Financial Plan

Underlying Assumptions

- Einstein Web Solutions enjoy a yearly revenue stream growth rate of 15% annually.

- A funding of £100,000 will be acquired to fund business operations.

- The acquired loan will accrue an interest rate of 10% on a 10 year term.

Accounting year

The chosen tax year will affect the amount of taxable income. Income, whether received or accrued with the year is reported on the tax returns for that particular year, alongside all other paid/accrued expenses. The business has an option to choose from 4 tax year options. These include:

- A calendar year.

- An elected tax year as per IRC Sec. 444.

- A 52 to 53 week tax-year that ends with reference to calendar year or a tax year elected as per IRC Sec. 444.

- Other tax-year established for business purposes.

However, it is important to emphasize that given that the business has opted for tax year other than the calendar year, IRS approval will be sought through Form 2553, rather than use Form 1128.

The chosen tax year has been aligned with accuracy of the business’s income and expenditure cycles. In this case, the business was viewed as seasonal and hence the chosen accounting period was such that it reflected the entire season constituting the period when expenses where expenses incurred and income generated as a result of the expenses were included. In the business, a majority of expenses/income for the business’s operating cycle will occur in two different years. The fiscal year will therefore start in July and end in September.

Changing Accounting Method

After filing our initial tax return in the first year, we opt to change the accounting period / method. Currently we are using the tax year. To change it we need to get permission from the IRS. The reason being this accounting period will soon be a limiting factor on how we operate our business. This request can be achieved by filling in the form 1128.

In addition the accounting method that will be used is the cash accounting method. “The cash method allows us as the taxpayer to recognize income and expenses at the point in time that the money is received or paid” (Steenburgh, & Avery, 2010, p.76). This method is advantageous because it is easy to use and very little record keeping is required.

Looking at the tax method from another perspective, there might be a need to change with time, because as the business grows the management, will need to provide documented evidence of their tax returns. The other tax method that can be used is the accrual method.

Unlike the cash method, the accrual method is more based on the performance of the economy performance. “In this method one is able to recognize an item of expense when you become liable for it, whether or not you pay for it in the same year” (Steenburgh, & Avery, 2010, p.76). This allows for flexibility. Accrual method is also the most appropriate when it comes our type of business. The firm will have several transactions to carry out and most importantly we will have to use an inventory. “Most importantly with the accrual method, it will be more difficult to minimize taxes by shifting income generating items and expenses from one year to another” (Steenburgh, & Avery, 2010, p.76).

Letter to the IRS

The following is how our letter to the IRS would read.

This is to justify the change of Einstein Web Solution’s change of accounting method from cash accounting method to accrual accounting method. The change has been motivated by the need to carry our business flawlessly. Over the one year we have been in operation, our firm has undergone numerous expansions that have come with complexities. It is therefore most reasonable that we changed from the cash accounting system to the accrual accounting system to be able to keep pace with our ever growing business.

Amongst the main reasons for this change it may enable us carry our activities in well documented manner which is provided by the accrual accounting method. Einstein Web Services also requires working with the flexibility that comes with accrual accounting method”.

Sensitivity Analysis

Considering the changing economic fortunes in target market, the company’s revenues are sensitive to the economy just like companies would want to minimize their expenditure as economy slumps and spend more as economy grows strong. However, as more and more businesses seek to enhance their web presence, demand is bound to record a steep increase. The demand of traffic is continuously on the rise irrespective of economic changes.

References

Anderson, G. (2005). Framework for marketing planning. Michigan: Michigan Business school.

Armstrong, M. (2006). A handbook of Human Resource Management Practice. London: Kogan Page.

Hill, T., & Westbrook, R. (2006). Business Analysis: It’s Time for a Product Recall. Long Range Planning, 30 (1), 46–52.

Menon, A. et al. (2010). Consequences of Marketing Strategy Making. Journal of Marketing (American Marketing Association), 63 (2), 18–40.

Rupert, T. J., Pope, T. R., & Anderson, K. E. (2014). Prentice Hallâ EURO ™s Federal Taxation 2014 Comprehensive (27th ed.). Upper Saddle River, NJ: Pearson.

Steenburgh, T., & Avery, J. (2010). Marketing Analysis Toolkit: Situation Analysis. Case Harvard Business Review, 12 (5), 76 – 81.