Introduction

There has been increasingly concerned about reports of economic, political, environmental, and social and economic changes that have been affecting the performance of those countries, thus the government of various countries has designed ways of dealing with those problems since they have been affecting the collection of revenue in those countries by designing strategies that can accommodate those changes.. The governments obtain revenue for running the affairs of the countries by collecting revenue from different companies and residents of those states through imposing taxes on them. The residents of different countries are taxed differently depending on their level of income. The individuals who have higher incomes are taxed more than the individuals who earn less income. The companies that are taxed according to profits of the company and usually submit their returns annually to the Income Tax Authorities since it’s a legal requirement to submit their taxes to the Income Tax Authorities.

Main body

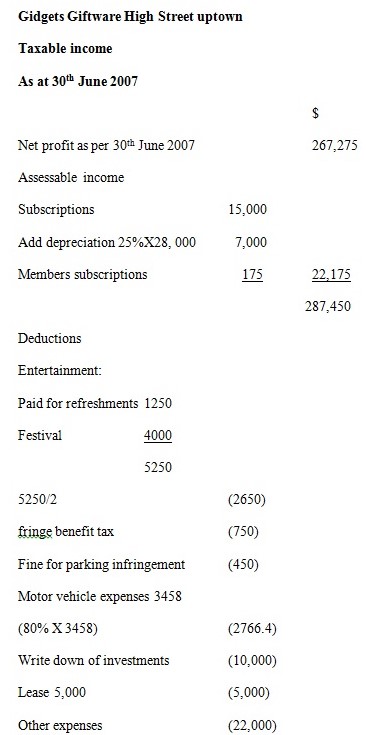

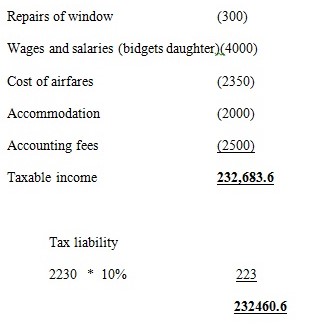

Income tax is the greatest contributor to revenue in Australia. There are some types of income that are exempted from tax and some residents do not pay tax. The residents of Australia pay tax from their income. In calculating income tax liability for any year a resident first calculates his income, which comprises salary and wages, interest payments. Allowable deductions are deducted in order to calculate the taxable income. The taxation rates are then applied to this figure to identify a gross tax figure. In taxation, an item or service is an allowable deduction if it is purchased in course of carrying out business activities. An item is not deductible if it is purchased for private use that is where an expense is not totally for business use.

The property that is received from the testator to a beneficiary in trust accounts inform of bequest, gift, and inheritance is not included as a business income. If the property that is given to trust is in form of income is paid, credited, or distributed to a beneficiary it is a taxable income. In the case of Gidget Giftware High Street Uptown sole proprietorship business, it was wrong for Gidget to credit the debt by $10000 bequest that was given to him since the bequest was not part of income. If the$10000 bequest generated income for the business it would have been taxed according to the Income Tax Act. A debt is usually written off in the year of income of a business before a tax deduction is allowed. In the case of a business it must fill in forms that act as evidence of debt that has been written off from the accounts. The taxpayer who does not carry out the money lending business is not allowed to fill in the deduction form unless the debt has been included as part of assessable income.Mr Gidget should have also followed his fathers decision since the written agreement that is will should have been followed appropriately since it is illegal to breach a contract.

When a debt is forgiven it triggers capital gains tax liability if its effect is to shift capital value although the testamentary forgiveness is treated separately. The forgiveness of debt owed by a shareholder or associate is deemed to be divided paid to the debtor within the terms of section 108 provided loans was not taken under the section. The forgiveness provisions are applied to both legally enforceable debt forgiveness and the activity that relates to economic terms of amount of debt forgiven. The amount of debt forgiven is assessed by the debtor in the year in which debt is forgiven regardless of year in which was provided. If a bad debt is not deductible under section 25-35(1) it may be deductible under the general provision. A bad debt is not deductible if the loss is of capital nature rather than revenue nature. A debt is deductible if a debtor is bankrupt or insolvent in the extent there is an amount of money that can be received.

The accounting fees only qualify as an allowable deduction in the year in which they are incurred as per subsection 51(1) of the Act. The Australian tax office is governed by publicly receivable policy. Under section 25-35(1) of common wealth income Tax assessment Act 1997 a deduction is allowable for debt that is written off in the year of income of a business.. Accounting fees are allowable deductions when they are incurred in connection with normal activities, transactions or contracts incidents. The accounting fees that are incurred for purposes of advising clients and in assisting a client in preparing and filing returns of Income Tax Authorities are deductible by virtue of section 9 and are not limited under paragraph 18(d (a) in computing business or property income to which tax returns are related.

A debt is money that is owed by a taxpayer to business. The individuals who run a business are taxed on the basis of income that they derive from that employment. The incomes of the accountants are treated as income in the year in which they become due and payable. Accounting fees are allowable deductions when they are incurred in connection with normal activities, transactions or contracts incidents. The accounting fees that are incurred for purposes of advising clients and in assisting a client in preparing and filing returns of Income Tax Authorities are deductible by virtue of section 9 and are not limited under paragraph 18(d (a) in computing business or property income to which tax returns are related

The business entertainment expenses incurred by taxable employers was removed from the fringe benefits coverage and was made assessable in employee’s hands and non-deductible to employers as from 2002-03 year of income. If employees enjoy entertainment at a set time or as part of their employment duties, the cost is not subject to fringe benefit tax. The following are specified types of entertainment that are subjected to income tax. The following are specified types of entertainment employee’s corporate boxes and exclusive areas at sporting and recreational events, holiday accommodation, pleasure craft and food and beverage.

According to Broken Hill Theatres Ltd V. FCT Legal costs that are incurred as a result of protecting the tax payers interest in exclusive of a trademark is deductible under 5 51(1) lawyers expenses in defending criminal or civil penalties are not deductible.

The legal accounting or any other professional service are deductible expenses provided they are included as part of business activities. The professional services that re not deductible according to the Australian law are services of forming, registering, liquidating or selling a business, acquisition of a license of a business, alteration of the capital structure of a business and drawing up a partnership or trust deed.

The expenditure on exploration and prospecting assets incurred prior to 1 July 2001 they were either deductible (Under division 300) or depreciated (under division 42). The expenditure that was deducted under division 40 it was deemed that the assets that were as a result of the expenditure had a cost and adjustable value that was nil at the start of 1 July 2001. The assets were acquired as a result of the expenditure they were not at any time over depreciated.

The non-profit organizations, such as clubs, society and association have their income assessed as other companies. The assessable income of the organization are capital gains made from the disposal of assets bank interest receipts, dividends and other income from investments receipts. The receipts of non organization that are not treated as assessable income are members subscription, drinks sold at the bar to club members, amounts members pay to attend dinners parties, dances or social functions organized by the club. A club according to the minister of the state is an organization that is operated exclusively for social welfare, civic improvement, pleasure or recreation or for any other purpose except for profit, no part of income was payable to the income tax act, or available for personal benefit of any proprietor member or shareholder unless the proprietor, member or shareholder was a member of the club. The Christmas club that was run by Gidget to the customers is a type of business that generated income since the contributions of the customers are used in running the affairs because he credited his suspense account with the contributed money. The preparation of suspense account was wrong because suspense accounts are prepared in the trial balances when the credits and debit balances differ while preparing the trial balances. The Christmas club should have been treated as a separate type of business since club income is subject to company tax rate of 30% under the Income Tax Assessment Act 1997 (s50-45).There are club income that exempt from tax are incomes that are associated with encouraging or promoting sport,music,or literature. The income derived from Gidget should have been subjected to tax.

The individuals who run a business are taxed on the basis of income that they derive from that employment. The incomes of the accountants are treated as income in the year in which they become due and payable. Accounting fees are allowable deductions when they are incurred in connection with normal activities, transactions or contracts incidents. The accounting fees that are incurred for purposes of advising clients and in assisting a client in preparing and filing returns of Income Tax Authorities are deductible by virtue of section 9 and are not limited under paragraph 18(d (a) in computing business or property income to which tax returns are related.

A debt is written off if it has been owed for a period of more than 450 days. The specific provisions for doubtful debts for banks are not allowable tax deductions as they are no losses that are associated with them. The bad debts that are irrecoverable and those that are written off are usually subject to tax deductions. In case of banks the deductions for specific provisions of doubtful debts are made in the following circumstances by a court, debtor has been bankrupt; debtor has been under liquidation due to failure of his business and the consequential financial problems. The deductions for specific provisions can be made when the finance company takes necessary steps to recover debt but the chances of recovering the debt are slim or rare to get. Mr. Gidget should have prepared a provision for debts account so that they would have written of the $1200 debt that was owed by an insolvent business in the year of year of income when the expense was incurred.

The business entertainment expenses incurred by taxable employers was removed from the fringe benefits coverage and was made assessable in employee’s hands and non-deductible to employers as from 2002-03 year of income. If employees enjoy entertainment at a set time or as part of their employment duties, the cost is not subject to fringe benefit tax. The following are specified types of entertainment that are subjected to income tax. The following are specified types of entertainment employee’s corporate boxes and exclusive areas at sporting and recreational events, holiday accommodation, pleasure craft and food and beverage.

The Fringe Benefit Tax (FBT) treats the entertainment of the employees and their associates as tax exempt for the organization while the income paying organizations treat it differently. An organization is tax-exempt if its income is either wholly exempt from tax or partially exempt from income tax such as the club that earns income from both members and non-members. The business taxpayers can claim the deduction of cost of goods sold, and services that are used for entertaining employees and independent contractors provided the expenses are treated as compensation in the case of employees or compensation for services rendered to the non-employees. The employees who work in the business aircraft, the entertainment deduction is not reduced more than the actual cost of using the facility of entertainment.

When employers consume or enjoy expenditure at their own discretion and within the company’s employment duties then expenditure is subject to tax Fringe Benefit Tax (FBT) such as. subsided gym memberships goods sold at a discounted price and membership to golf clubs. The expenses that are not enjoyed at employees’ discretion e.g. staff Christmas parties or entertaining customers are 50% deductible for tax purposes. The employees of Gidget Giftware High Street Uptown sole proprietorship who enjoyed the entertainments were not subject to tax since the expenditures were within the businesses budget.

An owner of a vehicle can be charged with illegal parking if the vehicle is parked on a metered space that is not paid or if for the spaces for parking has expired. If the vehicle has stayed in a metered space for an excess period of time or where the space where a car is parked is reserved for a particular class of vehicles such as bus stops, loading zones, taxi stands and motorcycles. Legal fees are deductible in taxation if a proper taxation code has been installed in the organization. The costs or expenses that are associated with recovering debt, defending business rights, preparing service agreements and appealing against rates on business premises are allowable but business expenses that are not associated with business premises are not allowable expenses.

The allowable expenses as indicated in the Income Tax Act are the expenses that a business man incurs for the purpose deriving income for his business and they are deducted from the businesses turnover for purposes of reducing tax liability of a business. The allowable expenses are good purchases for resale, rent, rates, repairs, lighting and heating, running cost of vehicles or machinery used in the business for professional fees and non-allowable expenses include expenses that are non-business related such as personal expenses or drawings, capital costs and costs that are recoverable under insurance. Depreciation is not subject to tax. In case of Bidget the business expenses were allowable deductions which were subject to tax while 20% use of vehicle by Gidget was not subject to tax as it was not a business related expense. The rent, repairs and wages to the employees are allowable to tax since the expenses are associated to business activities.

The drawings of taxpayers of sole trade and partnership business are not allowable for tax purposes. The trading of shares is like any other type of business. The long-term investors are usually taxed under favorable terms such as when gains are derived in trading in shares then that is when tax is imposed is imposed on shares. The write down value of stock is not allowed below cost of stock.

The partnership business consists of two or more people who have the same goals such as they share same costs, responsibilities and risks in order for them to achieve the goals of the business. It is a business that is not taxed the income; gains, losses, deductions and credits of the partnership business are passed from one partner to another. The items are distributed according to the partnership agreement and also on the interest that they have on those businesses. The business does not pay any tax to the government but the taxation authority verifies the returns of the business using a form 1065 as which shows how the businesses operation for a given period of time is supposed to be and they ensure shows how the items are supposed to be distributed to the partners.

The advantages of a partnership business

It is easy to form the business, as it requires little capital to begin its operation. The partners who come together enable the management of the business to run its operations effectively because they contribute ideas, opinions on how to run the business, which would enable the operations to be undertaken effectively.

The disadvantages of the partnership business

The partners may have different vision or goals of how to manage and operate the activities of the business, thus making the operation of the business to be carried out effectively to be inefficient because they may have diverse opinions since each would like their own interests to be accomplished at the expense of the businesses goals and objects thus leading to conflict of interest. The partners may not be fully committed to the operations of business in terms of their time and effort thus the goals of business may not be achieved. The partners are liable for any debts incurred, decisions made and actions by other partners thus making them to be liable for mistakes that are as a result of their own making which may affect the performance of the company. In partnership business it does not have the capacity to access finances from financial institutions as banks and international bodies as the World Bank and the International Monetary Fund as it does not have the capability to do so due to the fact that it not have enough securities to act as collateral for loans or finances so as to enable run the affairs of the business effectively (Dean, J. 1976).

Conclusion

Wagering is a process where one bets with another person with money in an online casino. A wager can claim a bonus at the casino as stated in the wagering requirements which shows how money can be distributed among the people concerned in the wagering activities. The automatic checking of the wagering requirement enhances the collection of cash in a faster way than any other process.The agreement states that money can only be paid out once an outcome occurs within an organization. The gambling activities can legal at the place where they are carried out and other times can be illegal in the eyes of law. The gambling activities can be controlled by the law where the better lives in some other place away from where the activities are carried out and in other aspects it affects the operator of the wagering games. The winnings are usually included in the wagers income on a form known as 1040 line 21.If a wager lists the activities according to how he or she wins on a schedule a then the wager can deduct gambling losses incurred during the year. Incase of Graham the income that he was deriving from the betting activities should have been subject to tax and he should have submitted a Schedule A that would indicate his deductions of losses that he obtained in carrying out the gambling activities (Pietrusza, David (2003).

References

Burns, L & Krever (1997), R, Interests in Non-resident Trusts: A Review of the Conflicting Income Tax Regimes, Sydney ,Australian Tax Research Foundation.

Burns, L (2006) “Methods of Calculating Foreign Investment Fund Income”, in J. Prebble (ed.), Taxing Offshore Investment Income, Birmingham Fiscal Publications.

Burns L. (2006) “Special Problems of Calculating Foreign Investment Fund Income”, in J.Prebble (ed.), Taxing Offshore Investment Income, Birmingham Fiscal Publications.

Burns, L & Krever, R, (2000) “Individual Income Tax” in Thuronyi (ed), Tax Law Design and Drafting, Kluwer Law International: Deventer.

Burns, L & Krever, R, (2000) “Taxation of Income from Business and Capital” in Thuronyi (Ed), Tax Law Design and Drafting, Deventer Kluwer Law International.

Burns, L & O’Donnell, P, (2000), “Australia: Taxation of Hybrid Financial Instruments In Cross-Border Transactions” in International Fiscal Association, Taxation of Hybrid Financial Instruments in Cross-Border Transactions, Cahiers de Droit fiscal international, Kluwer: Deventer pg109-134.

Deming, W. E. (1993). The New Economics for Industry for Industry, Government & Education. Cambridge: Massachusetts Institute of Technology Center for Advanced Engineering Study. (Summary).

Denna, E. L. and W. E. McCarthy. (1986). An Events-Accounting Foundation for DSS Use. In Proceedings of the NATO Advanced Study Institute. Maratea, Italy Morris, Edmund (2001). The Rise of Theodore Roosevelt. (Rev. ed.) New York: Modern Library.