Introduction

A car fringe benefit arises where the employer provides the employee with a car as part of his salary package in the employment contract. In Australia, the Fringe benefit tax was introduced in 1986. The government designed the tax benefit to assist the employees calculate their employees non-cash benefits. The employees valued their non-cash benefits at too low a value which led to the government losing a lot of revenue. The responsibility of calculating the non-cash benefits and tax was therefore transferred from the employee to the employer. In May 2011, the federal government implemented some changes to the income tax laws and one of the areas that was affected was the car fringe benefit calculations and the take home pay of employees.

Changes to the Car Fringe Tax Benefit

The government changed the statutory calculations for the Car fringe benefits with effect 7.30 P.M (Australian time) May 2011.

There are two methods that are used to calculate the tax for car fringe benefits. The methods are known as the statutory formulae method and the operating costs method. The operating costs method expects the employee to maintain a log book of all the business travels he has undertaken in order to determine the business percentage applicable to the car. Under the statutory formulae method, a statutory fraction is applied to the base value of the car to determine the taxable value. The statutory fraction depends on the total kilometers travelled by the employee during the year.

The operating costs method however is not highly popular due to its high compliance costs. Employers prefer to use the statutory method as it has lower compliance costs and is simpler to use.

Previously, the statutory calculation had been based on the number of kilometers travelled by the employee as per the table below:

Instead of the rate being applied being dependent on the kilometers travelled, it will be calculated at a flat rate of 20%. The rate will not be used immediately for all the categories of kilometers travelled rather it will be done over a four year phase as shown above in the table. The tax changes will have a considerable impact on the employees take home package. For the employees who travel less than 15,000 Km they will from the first year enjoy the lower tax charges and a higher take home salary.

For those who travel between 15,000 and 25,000 KM there will be no tax advantage as the rate introduced is what was there previously. The employees who have entered into contracts of one to four years will immediately experience a reduction in their take home salary. They will now have to pay high taxes as shown in the table above. There are several objectives that a government has when it introduces a taxation policy.

The government aims to collect sufficient and adequate revenue for its activities. The taxation system should ensure economic efficiency, equality and fairness. The calculations should also be simple or easy to understand. There have been several arguments from different scholars criticizing the previous design of the fringe for promoting inequalities, economic inefficiency and increasing global warming. Research has also shown that the use of the statutory formulae method in calculating fringe benefits causes the government to lose revenue. The previous tax structure was therefore not achieving fully or adequately the objectives of a good tax system.

There will be a positive environmental impact in the country due to the introduction of the new car fringe tax benefit laws.

People will no longer travel longer distances in order to enjoy higher tax concessions. In the previous tax structure people who travelled more than 40,000Km were only taxed the benefit at 7% while employees who had only travelled 15,000 Km would be taxed at 26%. This has changed as the number of kilometers that one travels will be irrelevant under the statutory formulae method. The fringe benefits tax had caused employees to travel longer distances at the end of a financial year in order to ensure inclusion in

higher bands of kilometers. There were even observed incidences where the employees would lend their vehicles to their friends and neighbors to use so as to assist in increasing the number of kilometers travelled.

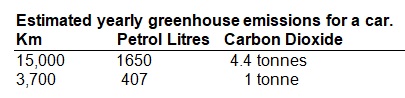

The previous tax benefit was also not consistent with the environmental policies of the government. The government of Australia is supposed to be in support of the world’s effort to reduce global warming. Efforts are to be demonstrated through the reduction of emission of greenhouse gases such as carbon dioxide from vehicles. However, the fringe benefit served to encourage more vehicle travel and thus high emission of greenhouse gases. The people end up using private cars especially during peak hours. The increased fuel prices and congestion in the cities did not improve the situation. The tax reform will now work to encourage employees to consider other forms of travelling. There has been high level of criticism that was directed at the previous car fringe benefit by various scholars in the area of environmental impact. The table below shows the increased greenhouse emission with increased mileage:

The statutory formulae method also caused a considerable amount of economic distortions when it came to collection of income. In analyzing the tax collected by the government over the economic period 2003-2004, the Institute of Chartered Australian Accountants found that the government collected less income by 43% by not using the operating costs method. The use of the statutory formulae provides a concession to the employees. The method makes the employer under value the car benefits causing loss of revenue.

There are also no concessions or benefits for the employees who use other forms of transport such as public transport or cycling. The government changes to the FBT are therefore welcome as they reduce the tendency to prefer private transport to other forms of transport. The previous car fringe tax promoted income inequalities.

It gave rise to situations where the low to middle income people were being taxed higher than the high income earner which was not fair. When the tax benefit was introduced it was meant to benefit the domestic car manufacturer. However, the tax benefit has not had the intended impact. Car importers then were subject to several taxes and quotas. At that time 85% of the cars in the country were domestically made, however, by 2004 over 70% of cars in the country were imported. The subsidy in the tax benefit goes to benefit car importers and not domestic companies.

The new law has brought fairness in the taxation process. The old structure assumed that the more one travelled, the more kilometers covered in relation to business activities. Therefore a traveler of 15,000 km was taxed at higher rates of 26% and the tax rates would reduce with more kilometers travelled. However, the assumption may not always be true. An individual could travel 15,000km on business and 25,000km for personal purposes and enjoy high tax concessions bringing about unfairness. Over the years the fringe benefits tax has caused employees to seek and demand motor vehicle salary packaging in order to enjoy the tax concessions.

Conclusion

The new fringe tax benefit reform is clearly a step in the right direction. It will reduce greatly the employee mileage. There will now be no great rush to finish certain levels of distances in order to get particular concessions. It will also make the country truly participate in world efforts to reduce global warming. The emission rates of carbon dioxide from cars will reduce. The government will be able to collect more revenue due to the application of the higher rates.

References

Black, C. (2008) Fringe Benefits Tax and the Company Car: Aligning the Tax with Environmental Policy. Environmental and Planning Law Journal, Vol. 25, No. 3, pp. 182-195.

Department of Human Services (2011) Budget 2011-12: Reform of the Car Fringe Benefit Rules. Web.

Diane Kraal, D., Yapa, P. and Harvey, D. (2008) The impact of Australia’s Fringe Benefits Tax for cars on petrol consumption and greenhouse Emissions Petrol consumption. Australian Tax Forum, Vol. 23, pp191-223.

Warren, N. (2006). Fringe benefit tax design: decision time. The Institute of Chartered Accountants in Australia. Web.

PWC (2011). Fringe Benefits Tax (FBT) Changes. PricewaterhouseCoopers. Web.