The automotive market segment has historically been essential to economic growth and development. According to Saberi (2018), it represents almost 4% of the world GDP, and, in the context of developed economies, 1% of automotive industry growth triggers respective 1,5% growth in the country’s GDP. Such a relationship is caused by the automotive sector’s strategic position in the middle of other market segments, which results in a multiplier effect. However, the industry nowadays has to face serious environmental concerns and anticipate energy crises. In this context, electric cars and the companies producing them, including Tesla Inc. (Tesla), receive much attention.

Tesla is a relatively new electric vehicle company that dedicated itself to researching, developing, and selling electric vehicles and their spare parts. It was founded in 2003 by people willing to prove that electric vehicles present a reasonable alternative to their fuel counterparts (Shao et al., 2021). Due to the specificity of Tesla’s chosen course, the company has a long history of enthusiastic research and development activity (Flehantova & Redka, 2021). However, this activity yielded little profit, and Tesla required substantial external investments to sustain itself in the first seven years (Shao et al., 2021). Eventually, the company decided to transition from being privately held to a public state.

Tesla made an Initial Public Offer (IPO), listing its shares on the NASDAQ stock exchange. The stock then grew gradually and eventually tripled its IPO value in three years (Shao et al., 2021). In 2014, the stock rose even more with the presentation of the auto-pilot function (Shao et al., 2021).

During the years that followed, the price of the stock remained approximately constant until 2020, when the share increased 4,5x more, overcoming the expectations. Thus, for the first time, Tesla managed to close a year with a positive net income.

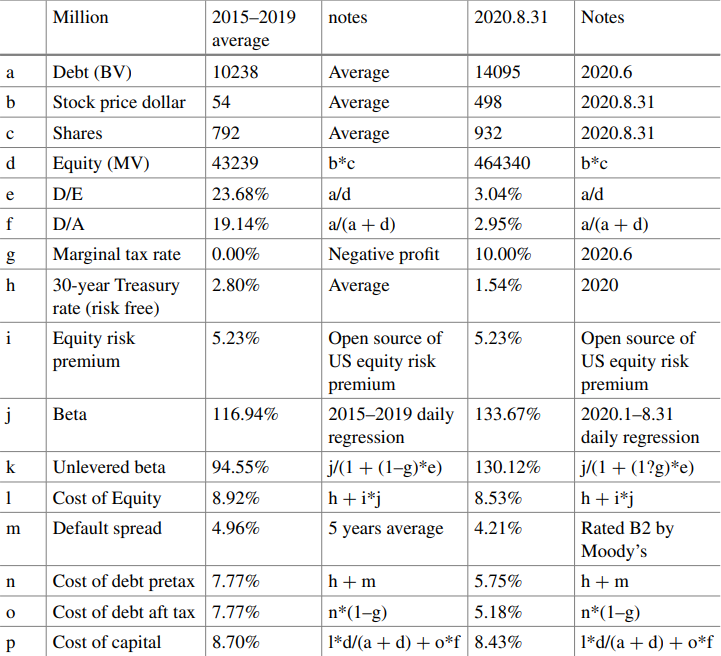

Tesla presents an interesting case in terms of its capital structure. Being in a high growth stage, it does not generate enough revenue to pay dividends. However, paying dividends is more commonly attributed to more mature companies, while recent profits can be considered promising. According to Zhao (2021), in 2020, the company had a negative EBIT due to not having profit for the previous five years. Consequently, Tesla’s interest coverage ratio can not be greater than 0, which indicates that an optimal debt ratio should theoretically be 0 (Zhao, 2021). In addition, it implies the company does not have enough profit to pay all its debts; therefore, issuing any debt in this state would not be a good idea. Table 1 presents the respective calculations of a company’s capital structure.

Table 1: Tesla Capital Structure Comparison of 2015-2019 and 2020

The fact that Tesla finally started to earn money in 2020 does not have a significant influence on the overall state. Despite the company being able to pay the interest in the first half of the year, even the lowest 5% debt ratio would not allow it to pay for the total interest (Zhao, 2021). The displayed capital structure of Tesla can be considered reasonable only due to the sharp drop in the debt ratio from approximately 19% to 3%, which caused the company’s stock price to increase (Table 1). Another implication of the presented calculations highlights a higher cost of capital sensitivity in 2020 than in the previous years. Ultimately, it means Tesla has to be more attentive to its debt ratio fluctuations than it used to be.

To conclude, Tesla’s future seems promising even despite its rather volatile stock. It operates in a new, fast-growing, and unpredictable market; consequently, it can not rely on possible high expected future returns. Nevertheless, the external factors affecting the industry are greatly in Tesla’s favor. Natural resource depletion resembles a time bomb that will eventually cause significant disruption. Therefore, a focus on an alternative to fuel means of transportation slowly rises in value.

References

Flehantova, A., & Redka, O. (2021). Innovation as the main driver for the future economic growth of the company (on Tesla, Inc. Example). In Economy and Human-Centrism: the Modern Foundation for Human Development: V International Scientific Conference (pp. 89-92).

Saberi, B. (2018). The role of the automobile industry in the economy of developed countries. International Robotics & Automation Journal, 4(3), 179-180.

Shao, X., Wang, Q., & Yang, H. (2021). Business Analysis and Future Development of an Electric Vehicle Company – Tesla. In 2021 International Conference on Public Relations and Social Sciences (ICPRSS 2021) (pp. 395-402). Atlantis Press.

Zhao, L. (2021). Capital Structure of New Energy Automobile Industry. In Proceedings of the 4th International Conference on Economic Management and Green Development (pp. 236-246). Springer, Singapore.