DuPont Analysis

ROE will be decomposed using the formula presented below.

ROE = profit margin * asset turnover * equity multiplier

Table 1. Decomposition of ROE.

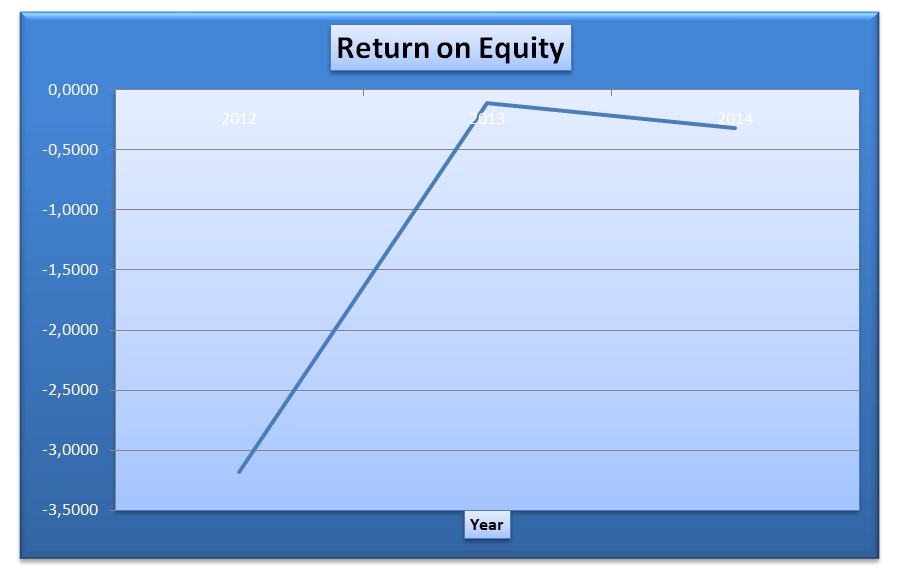

The ROE improved from -3.1773 2012 to -0.1109in 2013. The value dropped to -0.3225 in 2014 (see table 1). The negative values can be attributed to the negative profit margin. The values of asset turnover ratios are low. They show that the sales generated per unit of total assets were less than one (see table 1). The values of equity multiplier were extremely high. This signifies a high leverage. Thus, the high gearing level increases the value of ROE. The trend of ROE is displayed below.

There was no continuous increasing or declining trend of ROE (see fig. 1). The values were erratic.

Adjusted Return on Equity

Percentage of ZEV sales = 51 / 893.32 * 100 = 5.71%

Table 2. Adjusted ROE.

Comparison of Initial and Adjusted ROE

Eliminating ZEV sales has an effect of reducing the total sales and net income or loss (see table 2). The profit margin and asset turnover are also reduced. Thus, the resulting values of ROE are -0.5228, -0.2833, and -3.3665 for the years 2014, 2013, and 2012 respectively (see table 2). These values are much lower than the initial values of ROE which are -0.3225, -0.1109, and -3.1773 for the years 2014, 2013, and 2012 respectively (see table 1). The inclusion of ZEV sales boosts the sales and profit levels of the company.

Quality of Earnings

The question of Tesla’s quality of earnings is quite subjective. A review of the income statement shows that there is a tremendous growth in revenues. For instance, revenues grew by 387.23% in 2013 and 588.46% in 2014. This had a positive effect on earnings. It also indicates that it is a high growth company. The costs of sales were high, accounting for more than 70% of revenues. This resulted in low gross profit margin. There was a significant growth in operating expenses in 2014. This can be attributed to the US GAAP Standards that do not allow the capitalization of pre-production research and development expenses that were incurred in the engineering work of a new car model. The increase in selling, general, and administrative (SGA) expenses is attributed to costs that are associated with expansion into new markets. Thus, the income statement shows that the Tesla’s revenue cannot cover the operating expenses. This indicates that the company has a weak operating efficiency. The low values of return on equity, net margin, asset turnover, and cash flow is an indication that the company has a weak earnings quality.

How Tesla Motors, Inc. has Managed to Survive

Despite the negative profits, the company has been in operation for over ten years in the industry. A significant factor that has contributed to the continued existence of the company is the growth in revenue and volume of production. Secondly, the company prides itself on higher manufacturing efficiencies than its peers in the industry (Tesla Motors, Inc. 2). Also, the company has been efficient in the management of SGA expenses. This can partly be attributed to the centralized manufacturing. The company also has a low battery cost and headcount. Finally, the sale of ZEV credits has significantly boosted sales for the company (Tesla Motors, Inc. 4). Apart from the negative profits, the performance of the company does not differ significantly with those of its competitors in the industry.

Departures from the US GAAP

Tesla makes two departures from US GAAP in calculating some values. First, is in the recognition of costs and revenues that are associated with the sale of a vehicle. Revenues and costs are documented at the point where a client takes delivery of the car either in cash or credit and not when a vehicle is sold into a dealership. The second aspect is in the determination of revenue and gross profit. The company adds back deferred revenue and related costs of vehicles that are sold with residual value guarantee. Finally, stock based compensation and non-cash interest expenses are eliminated from non-GAAP per share information and expenses (Tesla Motors, Inc. 9).

Non-GAAP Measures

The company is based in the US and it is listed on NASDAQ with a ticker symbol TSLA. Therefore, based on the US laws and regulations, it is required to prepare its financial statements using the US GAAP Accounting Standards. Any deviation from the use of the US GAAP should be disclosed. The users of the reports published should be made aware of the use other set of standards that are used in the preparation of the financial reports. This explains why the company keeps on referring to the non-GAAP measures in the financial statement. Since 2002, SEC has allowed for the use of non-GAAP measures and subsequent disclosure of the measures used (Horner 291).

Works Cited

Horner, David. Accounting for Non-Accountants. Kogan Page Limited, 2013.

Tesla Motors, Inc. (2015). Tesla Motors – First Quarter 2015 Shareholder Letter. Web.