Executive Summary

The purpose of this report is to analyze the economy of Singapore and it will concentrate on the historical background of this country, human development index, monetary authority of Singapore, banking sector and major players, key economic indicators data for the last 5 years, labour market and unemployment rate, inflation rate, and key monetary indicators data. In addition, this report will focus on exports, imports, manufacturing industry, construction industry, tourism industry, Trade Balance, Budget surplus or deficit, GDP growth rate for the last five years and so on.

Introduction

Singapore is a small island known as “Pu-luo-chung”, which located in located at the Southern Malay Peninsula (Library of Congress 1; Foo 1 and White 3). However, this country is one of the smallest countries in Southeast Asia, which was a famous trading spot to the Javanese, Chinese, Malay, Indian, and Arab traders from the very beginning of the thirteenth century (Library of Congress 2 and Foo 1). However, the following table gives more information –

Table 1: – Overview of Singapore

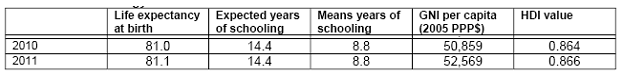

Human Development Index

Literature Review

Profile of Central Bank

Central bank of Singapore (Monetary Authority of Singapore) started its journey in 1971 to conduct monetary policy and direct financial institutions; however, different government departments and agencies served numerous monetary purposes before 1971, but they had intended to work as simple body for which government passed new act in 1970 (MAS 1; Shanmugaratnam 5 and Department of Statistics Singstat 6). The government enacted new laws in 1977 and transferred different functions under the securities industry act to perform its functions and to encourage continued non-inflationary economic growth and so on (MAS 1 and Monetary Authority of Singapore 2); however, the prime objectives of the central bank are –

- According to the annual report 2011/12 of the central bank, the major goals are to conduct monetary policy, issuance of currency, and develop policies in order to assist international financial centre (Shanmugaratnam 5);

- Three decades ago, monetary policy of the central bank concentrated more on the exchange rate because it is one of the most useful tools in managing inflation; however, its monetary policy targeted a stronger rate intended with fastening inflation expectations as well as ensuring price stability;

- Maintaining cross-border collateral settlements with central banks of different countries of the world in order to employ superior quality foreign government bonds as well as foreign currencies;

- Consistent with the statement of the annual report, the main function of Mass is to staying resilient and sustaining growth as part of macroeconomic and financial development projects;

- In 2011, MAS changed exchange rate policy to make sure more effective allocation of resources and to have a preventive consequence on the economy as well as prices;

Banking sector and major players

Shanmugaratnam (6) stated that overall banking system is still facing the challenges of the global economic downturn, for instance, European economies has severely eroded and lost investors’ confidence, inflation in Singapore has picked up and core inflation has increased gradually for which commodity prices increased significantly. According to the annual report 2011/12 of the central bank, incorporation of new banks will assist to comply capital adequacy standards of “Basel Committee on Banking Supervision 2013” and Common Equity Tier 1; however, the following table discuss about the main players –

Table 2: – Major Players of Banking Sector of Singapore

Figure 3: – Singapore Banking Sector

The Research

This report has used some primary data to describe the economic position of Singapore along with consider legal framework of the baking systems to regulate financial institutions, such as, revenue and expenditure estimates, government reports on GDP Growth Forecast, Yearbook of Statistics Singapore and the report of monetary authority of Singapore regarding the role and function of Singapore’s central bank. In addition, this report focused on numerous secondary sources, for instance, Annual report 2011/2012 of Monetary Authority of Singapore, Report of OECD about Rapid Improvement, Country Profile of Indexmundi, Tilak Abcsinghe publication about, Unique Monetary Policy, Chia Siow’s writing about Knowledge-Based Economy, report on Singapore’s Economic Transformation, Statistical Profile of Foo, and UNDP’s Human Development Report.

Data analysis and interpretation

This head will provide key economic indicators data for the last 5 years, interest rates and movement, main industries, economic sectors their performance in last 5 years, and key monetary indicators data for last 5 years with graphs.

Labour market and unemployment rate

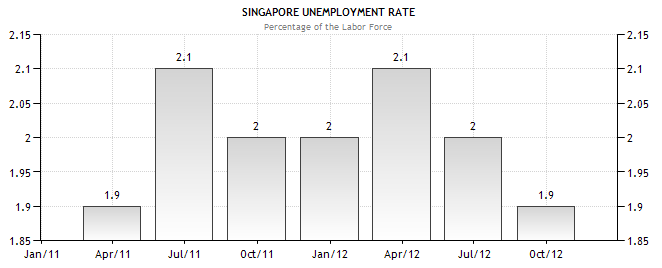

Consistent with the data of MTI (2) and Indexmundi (1), unemployment rate was comparatively high in the beginning of this century due to financial crisis in Asia and this rate decreased gradually from July 2012 and the position had not changed significantly in the period of global financial crisis, for instance, this rate was about 1.9% in 2011, but it decreased 0.2% by the fiscal year 2011; however, the next figure shows this rate for the year January 2011 to December 2012 –

MTI (3) reported that more than 65.60% of the total population is in the active workforce; according to the report of central bank, overall employment increased by 122,600 in 2011; however, the subsequent figure shows employment rate by gender –

Inflation rate

Shanmugaratnam (6) said the government faced inflationary pressures in the fiscal year 2011/12 though the inflation was about 5.2% in 2011 due to increase of oil prices and adverse economic position in the MENA region; as a result, Singapore experienced slower growth at that time. In addition, inflation rate determined the commodity prices, food prices, and so on; however, the following figure and table show the data –

Table 3: – Inflation rate of the Singapore for the year 2010 to 2011

Different sectors their performance in last 5 years

Manufacturing Industry

According to Ministry of Trade and Industry (1), the country has performed well in the 2010 and 2011 period in terms of manufacturing industry; for example, the overall outputs, direct exports, materials, and compensation increased significantly in 2010 (as shown in the table below), although the yearly alteration of increase in percentage of these indicators diminished in 2011. A detailed analysis of the key information of the manufacturing industry of Singapore by referring to all manufacturing businesses in the country is shown in the table below –

Table 4: – Key information regarding manufacturing industry

However, the key highlights of the performance in the manufacturing industry of the country in 2012 are noted below –

- According to SEDB (1), in an annual basis, Singapore’s manufacturing productivity raised by 3 percent in November 2012 (whereas excluding biomedical manufacturing, the productivity raised by point nine percent); on the other hand, in a seasonally adjusted monthly basis, the manufacturing productivity raised by two percent in November 2012 (whereas excluding biomedical manufacturing, the productivity raised by point six percent);

- SEDB (1) noted that the general manufacturing productivity raised by one percent in November 2012 in an annual basis, whilst superior productivity (8.7%) in assorted industries (supported by elevated production of batteries, steel structural components and pipe fittings) excessively counteract the deterioration in the food, beverages and tobacco (-3.2%) and printing (-8.3%) industries; general manufacturing productivity raised 2.4% annually;

- On the other hand, productivity of biomedical manufacturing raised by about 13 percent in November 2012 compared to November 2011, with pharmaceuticals and medical-technology providing superior output (SEDB 1);

- In addition, pharmaceutical-section experienced nearly 13 percent revenue, because of advanced value-added mix of dynamic pharmaceutical as well as ingredients produced; furthermore, strong export demand of the medical-devices contributed nearly 12% expansion in the medical-technology section (SEDB 1);

Construction Industry

Ramesh (1) pointed out that regardless of unresponsive financial background, the Building and Construction Authority anticipates general-construction demand to stay robust (from between SGD 21bn and SGD 27bn in 2012); however, Minister of State for National Development stated that though this anticipation is inferior than last year’s construction-demand, the country would persist to observe an elevated of onsite-construction-activity in 2013. The Minister of State for National Development also added that the Building and Construction Authority guesstimates that agreements worth between SGD 19bn and 27bn would be rewarded per annum in 2013 and 2014; additionally, strong stance of construction industry over the next three years is also an exceptional prospect for the industry to augment efficiency and attain further sustainable intensification.

Tourism Industry

AsiaOne (1) reported that Singapore’s tourism revenue observed 12% annual growth to gather $6bn for the 3rd quarter of 2011 and 15% amplification in holiday-makers to 3.5m; noteworthy tourism revenues were particularly visible from markets of Japan, Philippines, and China, at 36%, 34% and 31% correspondingly; moreover, standard-room-rate was $251 in 3rd quarter (which is an annual boost of 11%). According to Singapore Department of Statistics (20), the tourism industry of the country had remained more profitable in 2011 than in 2010; this is shown in the table below –

Table 5: – Overview of Tourism Industry

Singapore Business Review (1) noted that in comparison to 2012 prediction, the concerned Ministry has placed Singapore’s 2013 tourism-growth in range of one to three percent (however, whilst the prediction was 1.5% in 2012; Singapore welcomed 13171303 tourists); it is expected that if the global economy maintains its sluggish pace of recovery, this industry would not grow significantly in 2013.

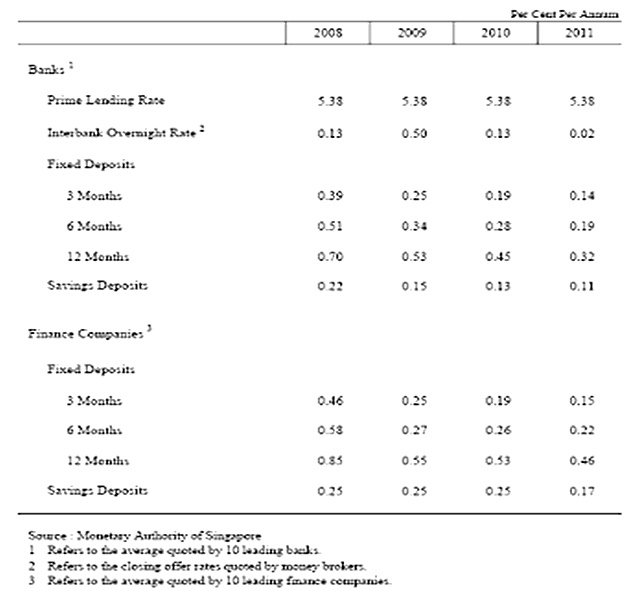

Interest rates and movement in the last 5 years

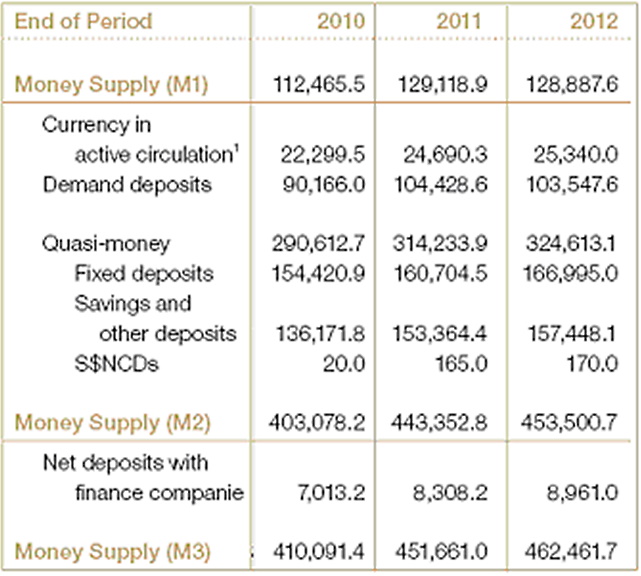

Money Supply from the year 2010 to 2012

Key Monetary Indicators Data

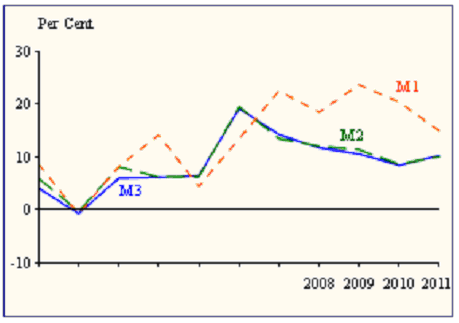

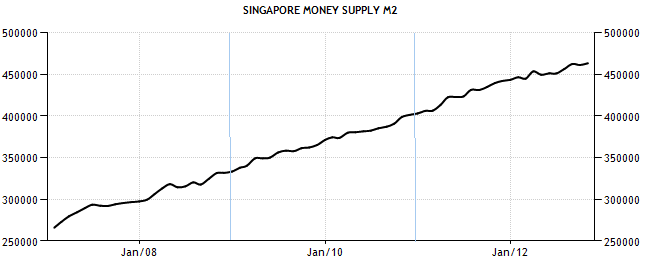

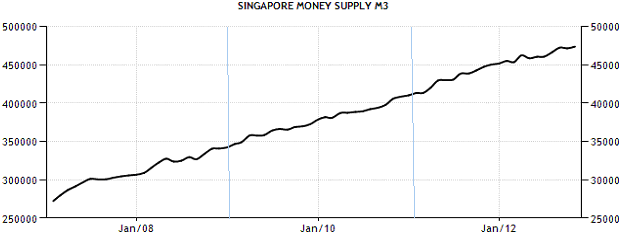

DSS (4) presented the following graphical representation for the money supply data of Singapore organized with the statistical data of M1, M2, and M3, from 2010 to 2011 that has indicated a significant increase of the overall money supply of the country that provides deep insights of the financial indication regarding the historical economic situation of Singapore.

The graph has organized with three types of money supply, where M1 incorporated the narrow money along with coins and notes that have circulated and easily convertible into cash; M2 represents the “close substitutes” of money by calculating the total amount of money that have already circulated in the market, and M3 is the sum of M2 and long-term deposits. For better understanding with the money supply data of Singapore for last 5 Years, it would be wise to discuss the Money Supply indicators separately for M1, M2, and M3 as follows-

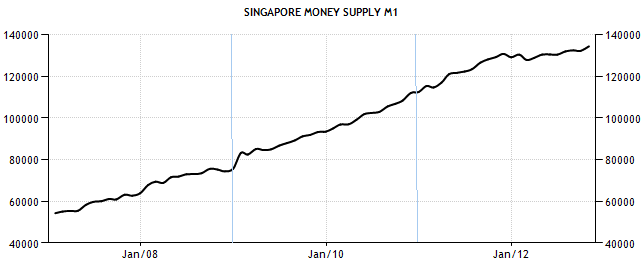

The Trading Economics (1) calculated and graphed the money supply M1 of Singapore pointing a boost of S$ 134353.70 million during October of 2012 that indicated and annual enhancement of money supply M1 of an average S$ 27007.3 million and historically recorded from in May of 1969 and mapped in the follows graph –

The Trading Economics (1) also presented the Money Supply M2 of Singapore that has enlarged S$ 463249 million during October of 2012 that represent an annual average growth of money supply S$ 124572.0 historically from 1974 while the accounts of Money Supply M2 incorporated the sun of M1 with short-term time deposits to the banks and plotted as bellow-

The Trading Economics (1) said that Money Supply M3 of the country has amplified to S$ 473655.30 during October of 2012, which is the highest gain in the history; from 1974 M3 boosted S$ 136353.6 on average per annum where the data incorporated M2 along with long-term time deposits and has plotted for five years (2010 – 2012) as follows-

Foreign Direct Investment in Singapore

DSS (7) pointed out that the FDI inflow in Singapore has increased dramatically during the recent years, in 2009 the FDI inflow boosted at SG$ 573.3 million, which jumped at SG$ 618.6 billion in December 2010 and the major FDI transferred in the country in the form of direct equity investment while small part came as net lending. Investors from all over the world are interested to investing in Singapore, but the investors of Europe are the major players that played significant role in the economic development of Singapore by contributing 36.7 %, the second largest FDI contributor for the country is Asian countries with 24% while US and Caribbean contribute 23% of foreign direct investment. The actual situation of FDI inflow in Singapore as per economic data of 2010 has presented in the following graph-

Graph 17: FDI Outflow from Singapore by Region

Key findings and learning

Exports from the Singapore (2010 to 2012)

Abeysinghe (9) stated that exports of goods contribute significantly on the national GDP and meet up the demand of global market; however, Simoes (1) and Library of Congress (11) argued that the key sources of government exports revenues are electronic integrated circuits, electronic components and parts, Petroleum oils (mainly refined oil) as these two types of sector are situated in the top two position in the list of export items. Furthermore, next table would give more idea about total earnings from exports and different sectors –

Table 6: – Total exports from 2010 to 2012

At the same time, there are some other export items those have significant contribution on the national economy, such as, Oxygen-function amino-compounds (2.30%), Medicaments – packaged (1.76), Medicaments (1.47%) Gold (about 1%) and so on; in addition, Simoes (1) stated that internal and external business environment is outstanding for the foreign investors.

Imports (2010 to 2012)

Abeysinghe (11) said that imports helped this nation to transform its economy; on the other hand, Library of Congress (10) and Simoes (1) said that Most common import items are electronic integrated circuits, machinery and parts, Petroleum oils (both refined and crude oil); however, the next table will provide additional information about total expenditures for imports of goods –

Table 7: – Total Imports from 2010 to 2012

Other import items include automatic data processing machines, transmission apparatus, machines, and mechanical appliances and so on.

Trade Balance (2010 to 2012)

Table 8: Trade balance from 2010 to 2012

Budget surplus (+) or deficit (-)

Indexmundi (1) Expressed that a budget deficit illustrates negative data where expenditures exceed total revenues; however, Government of Singapore (1) provided data related with expenditure and revenues for which it was possible to calculate primary and final budget surplus or deficit along with percentage of GDP, for example –

Table 9: Budget surplus (+) or deficit (-)

Direction of Trade

According to the report of Simoes (1), China, Malaysia, Hong Kong and the US have played most significant role for both exports and imports segment, for instance, the following tables show more data in this regard –

Direction of Exports

Table 10: – The main Export collaborates of Singapore

Direction of Imports

Table 11: – The main Import collaborates of Singapore

GDP (purchasing power parity)

Table 12: GDP (purchasing power parity) (Billion $) in 2010 and 2011

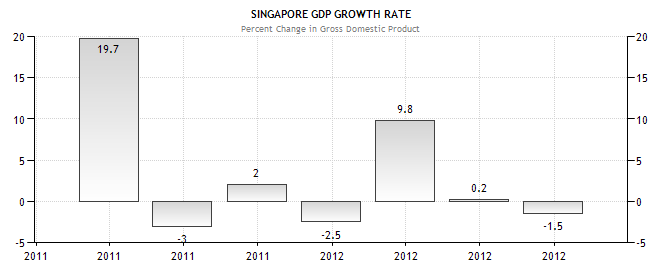

GDP growth rate

GDP – per capita (PPP) (US$)

Table 13: GDP – per capita (PPP) from 2010 to 2011

Recommendations

- Singapore is a wealthy nation for which it should increase outflows of foreign direct investment in the developing countries in order to boost national GNP;

- This report suggests the policy makers of Singapore to build mini Bengali park for the foreign Bangladeshi workers since they provide high quality services at minimal wage rate, which assist to increase economic growth; in addition, It has opportunity to increase budget for the Asian expatriates to develop the nation. However, this mini park should have modern and old buildings, rail transportation system, mosques, temples, South Asian food market and so on;

- The government should concentrate more on the tourism sector and essential to remove all dilemmas related with this sector, such as, increase facilities in the natural place while tourists would not like to see artificial landscape, and remove the conflicts between local inhabitants and tourists;

- It should require to drive more on the knowledge-based economy;

Conclusion

Singapore is the perfect nation for the business since it is situated in such geographic location, which attracted the traders and global investors all over the world. In addition, economic diversification and free trade zone helped the nation to gain very high HDI and experience GDP growth rate, for instance, balance of trade from exports and imports of earring electronic machinery, petroleum refined and crude oil contributed significantly in national economy; moreover, tourism sector is also playing vital role for the development of this country.

Works Cited

Abeysinghe, Tilak. Singapore: Economy. 2007. Web.

AsiaOne. Singapore tourism industry records double-digit growth. 2012. Web.

Department of Statistics Singstat. Yearbook of Statistics Singapore. 2012. Web.

DSS. Economic Indicators: Real Economic Growth. 2012. Web.

Foo, Shanyuan. Statistical Profile. 2009. Web.

Government of Singapore. Revenue and Expenditure Estimates. 2012. Web.

Indexmundi. Country Profile of Singapore. 2012. Web.

Library of Congress. Country Profile: Singapore. 2006. Web.

MAS. Monetary Authority of Singapore. 2012. Web.

Ministry of Trade and Industry. Principal Statistics of Manufacturing. 2011. Web.

MOH Holding. Banking in Singapore. 2012. Web.

Monetary Authority of Singapore. The Role and Function of Singapore’s Central Bank. 2012. Web.

MTI. GDP Growth Forecast Narrowed to 1.5 to 2.5 Per Cent. 2012. Web.

Phillip Securities Research. Singapore Banking Sector. 2012. Web.

Ramesh, Sen. Construction demand for 2012 to remain strong. 2012. Web.

SEDB. Monthly Manufacturing Performance November. 2012. Web.

Shanmugaratnam, Tharman. Annual report 2011/2012 of Monetary Authority of Singapore. 2012. Web. 3

Simoes, Alexander. The Observatory of Economic complexity. 2012. Web.

Singapore Department of Statistics. Singapore in Figures 2012. 2012. Web.

Trading Economics. Singapore Money Supply. 2012. Web.

UNDP. Human Development Report. 2011. Web.

White, Thomas. Country Profile: Singapore. 2011. Web.