Introduction

H&M is one of the largest companies in the world, which focuses on fashion and style. Even though the company saw several episodes of growth, the current state of affairs does not seem too optimistic. The current report is going to dwell on how available customer information could become helpful in terms of establishing additional competitive advantages and making the company’s United Kingdom (UK) stance even more confident. According to Smith, Scholz and Williams (2022) and Candeloro (2020), the two best strategies that are currently applied by the administration are

- the implementation of wholly-owned subsidiaries and

- the use of franchising in an attempt to overcome socioeconomic and political barriers.

Future expansions might be contingent on the development of additional strategies intended to retain consumers and provide them with unique experiences that are not offered by other brands. The following report is going to outline the core business insights and survey findings that might inform the best recommendations for the H&M brand in the UK.

Business Insights

Annual reports released by H&M suggest that the company is one of the best places in the fashion business to pursue a career or purchase high-quality goods. Consistent with Lopez et al. (2022), the business concept of H&M UK is that constant growth can become an important source of support on the way to providing customers with the best prices and respective fashion items. Currently, the company focuses on the creation of a variety-based range of inspiring products that can be developed together with consumers (Gonzalez et al., 2022; Jiang, 2020). This insight is crucial because increasing diversity may become the core of the future strategies employed by the company to achieve success and meet the vision. H&M UK is also known for an extendable product range which can be altered to help the administration adjust to the latest trends (Pérez-Bou and Cantista, 2022).

Another vital area of responsibility is the decision of the company to pursue sustainability initiatives. These actions are exceptionally important because they can lead to supply chain enhancements and further market extension (Bocken and Konietzko, 2022; Netz, Reinmoeller and Axelson, 2022). Overall, H&M UK does not seem to be fazed by the competition, but there could be several areas of improvement to consider.

Data Analysis

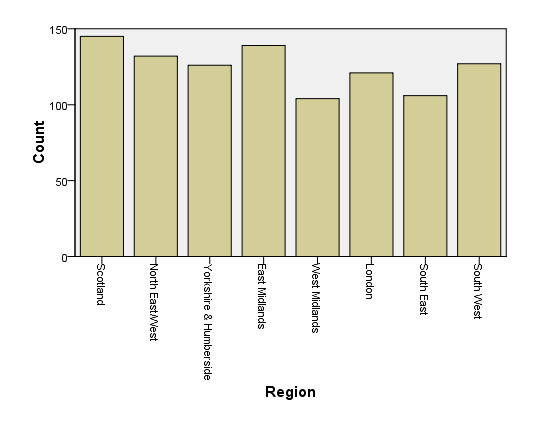

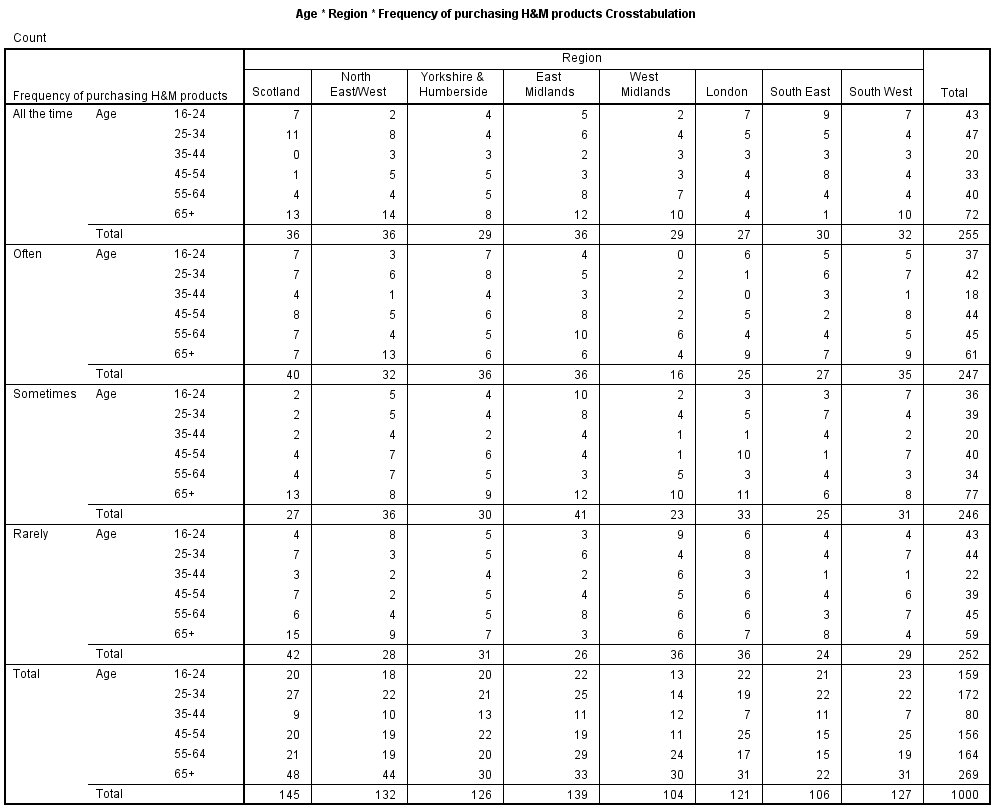

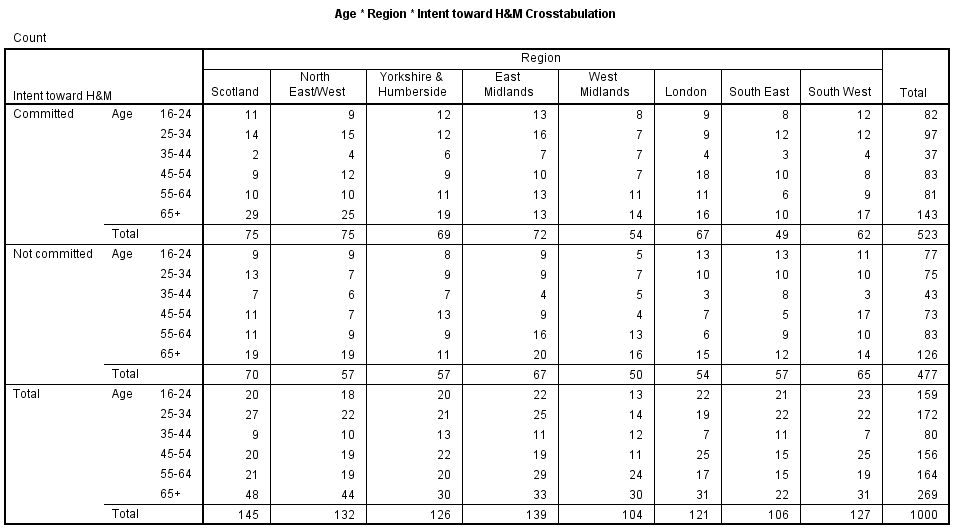

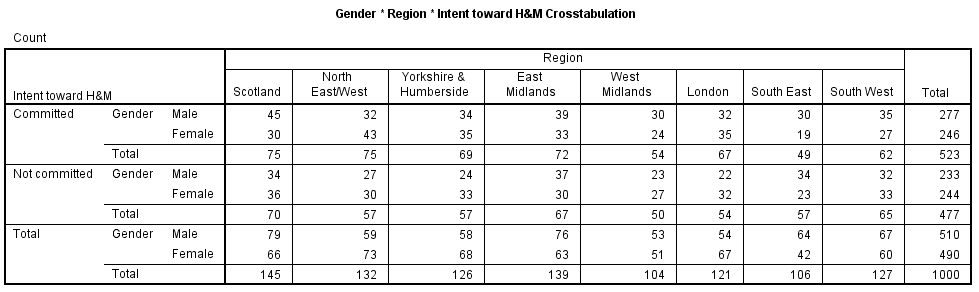

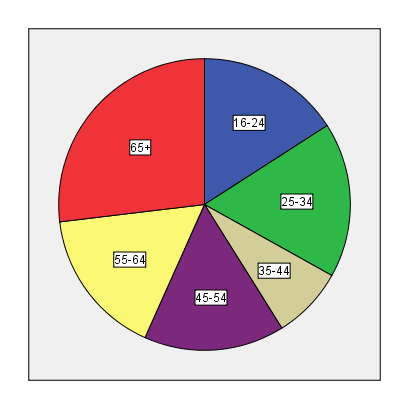

The current data were collected from 1000 respondents aged 16 to 65 and above (see Appendix A). All of the respondents were from one of the following locations: Scotland, North East/West, Yorkshire & Humberside, East Midlands, West Midlands, London, South East, and South West (see Appendix B). The survey contained 16 questions, where seven (7) questions were administered to collect general demographic data, and nine (9) specific questions were asked to gain insight into purchasing behaviours and attitudes toward H&M UK. The results of the survey were subsequently coded and analysed using the SPSS software package. The two types of insights were acquired upon the finalisation of data analysis: crosstabulations and regressions.

Crosstabulations

The first crosstabulation that has to be addressed pertains to the age variable (see Figure 1). For example, it was found that in North East/West and Scotland, the biggest target customer base that would purchase H&M UK products “all the time” was the population aged 65 and above. Moreover, the oldest cohort of respondents also led the sample in every other category of purchasers. This finding makes it safe to say that H&M is not only a brand for young adults but also an opportunity for older people to find products they would like to use on a daily basis. In each of the locations and frequency categories, the least positive age group was consumers aged 35 to 44. This finding bears an important gap for the company, as H&M should exert better efforts to appeal to middle-aged consumers.

There are also two crosstabulations that have to be analysed together in order to display a better outline of how H&M currently misses some of the major objectives due to the lack of control over vital strategies. For instance, in Figure 2, it can be witnessed how the 65+ population is exceptionally committed to the organisation, with the least commitment being displayed by consumers aged from 35 to 44. Respectively, the highest number of votes for not being committed to H&M as a brand comes from the same age group. Interestingly, there are slightly more men than women who are committed to the company. Based on the gender crosstabulation, it can be identified that H&M products are the most popular among men in Scotland and women in the North East/West region. The least committed areas are London (men) and South East (women).

Ultimately, it can be concluded that the biggest gap identified by means of crosstabulations is the lack of engagement and commitment displayed by middle-aged consumers – both men and women.

Linear Regressions

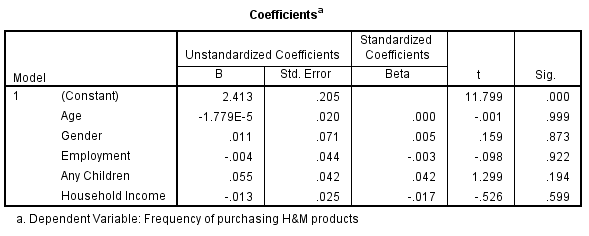

The first important linear regression was launched to consider the link between the frequency of purchasing H&M products (dependent variable) and several independent variables (age, gender, employment, any children, and household income (will be regarded as AGEAH further throughout the report)) across all of the locations (see Figure 3).

Based on the results obtained for the current linear regression, it could be hypothesised that the least connection to the frequency of purchasing H&M products was held by customers’ age. It means that the majority of consumers tend to shop at H&M stores without any particular connection to their age. The largest correlation (the p-value that was the closest to p=0.05) was found in the variable ‘any children.’ It means that the frequency of purchasing behaviors among target consumers of all ages could be associated with them having at least one child, regardless of whether they are below or above 18 years old. Household income was found to be only an average contributor to the frequency of purchasing behaviors at H&M UK.

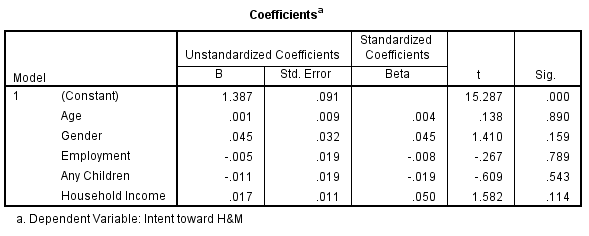

Another vital insight was the linear regression analysis of the current intent displayed by consumers toward the H&M UK brand. The level of customer loyalty was also characterised through varied p-value results for each of the variables from the AGEAH bundle (see Figure 4).

The scarcest connection to the dependent variable (commitment to the brand) was displayed between the intent and customers’ age and employment status. Again, this finding reinforces the idea that consumers of all ages could be loyal to the organisation. The employment variable plays a limited role because it does not relate to household income. Accordingly, the most tangible variators of customer loyalty are gender and household income across all locations included in the study.

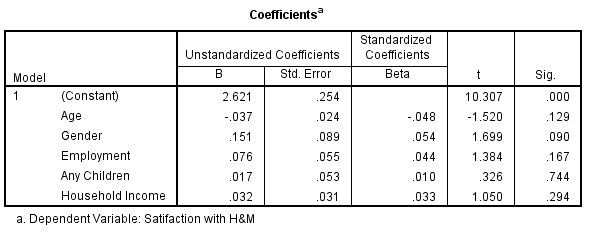

The next set of valuable evidence pertains to how the overall level of satisfaction with the H&M UK brand (dependent variable) correlates to the AGEAH variable series (see Figure 5). It was found that the worst predictor of satisfaction with the brand was whether respondents had children. Therefore, H&M UK might overlook this factor when considering new marketing strategies. The greatest level of significance was associated with gender (p=0.09), which provides the author of the report with a crucial insight into how diverse consumers could appreciate the brand based on the proposed products and services and not their individual differences. The customers’ age and employment status are the two runners-up that have to be monitored closely by the organisation.

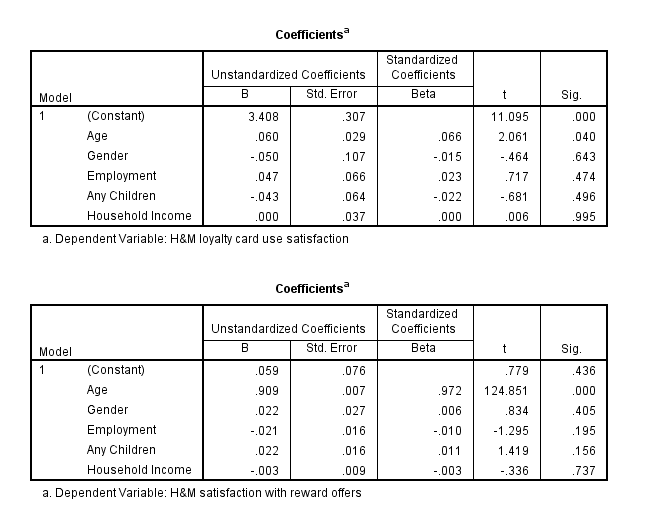

The two final dependent variables – loyalty card use satisfaction and satisfaction with reward offers – are analysed jointly due to the close connection to the AGEAH bundle (see Figure 6). The key similarity between the two variables was the statistical insignificance of the household income variable. Thus, the company does not have to target its customers based on income when launching various reward and discount systems.

It is much more important to pay attention to how loyalty card usage could be seen as correlated the most to customers’ age (p=0.04) while satisfaction with reward offers could be contingent on consumers’ children. Consequently, H&M UK buyers with children might be much more willing to engage in reward offers than customers without offspring.

Recommendations

Even though H&M is a rather popular brand across the UK, the company seems to encounter significant issues related to the need to adjust to the ever-changing business environment. Consistent with the literature on the subject, it can be recommended to gain various competitive advantages through the interface of creative products that appeal to the middle-aged target audience (Jocevski, 2020).

It will help the organisation test its products before commercialisation and make sure that the items are appropriate enough to be launched for all age groups. Also, the company should pay attention to consumer convenience and deploy more online store functionalities for older consumers to have an opportunity to look at products and purchase them without leaving their homes. H&M UK might also capitalise on consistent customer care services and improve the product mix differentiation strategies, as there was only a limited number of people who shared their income stats via the survey.

Another set of recommendations revolving around the quality of services provided by H&M relates to various discounts and rewards offered to consumers. The need to attract customers stems from the fact that prices continue to increase and make it impossible to ignore the price-quality ratio (Javed et al., 2020; Pastore et al., 2022).

To gain a larger market share, the company should be advised to sell more products online and focus on social media campaigns due to the increasing number of consumers – existing and potential – who do not visit brick-and-mortar stores. The fluctuating preference toward smartphone applications and web browsing requires H&M UK to come up with new rewards and gifts to retain them and develop a sense of loyalty even in the most reluctant buyers, such as middle-aged customers. Digital marketing could be paired with promotional events and the possibility of spreading brand awareness across the country. Even though some of the UK regions perform worse than usual in terms of customer satisfaction, the company’s future depends on how the administration transforms marketing and sales into customer attractions.

Conclusion

H&M UK should constantly evolve in order to adhere to the ever-changing business environment. It also means that the company should focus on certain customer groups more often in order to achieve better outcomes. For instance, it was found that consumers are mostly looking for reasonably priced items of decent and above-average quality. It shows how H&M UK should become committed to the idea of establishing and extending a loyal customer base.

The latter is going to be expected to react positively to all the new marketing strategies and contribute to the company’s state of affairs regardless of their socioeconomic standing. The company should also minimise the risks related to unique products that only appeal to a certain customer category. Another vital area of concern is the need to address online and on-site sales based on age and gender variables pertaining to H&M UK customers. The current report shows that there is enough room for development, and the company should capitalise on each data bit in order to improve the existing state of affairs and attract more middle-aged consumers.

Reference List

Bocken, N. and Konietzko, J. (2022) ‘Circular business model innovation in consumer-facing corporations’, Technological Forecasting and Social Change, 185, 122076.

Candeloro, D. (2020) ‘Towards sustainable fashion: the role of artificial intelligence – H&M, Stella McCartney, Farfetch, Moosejaw: a multiple case study’, ZoneModa Journal, 10(2), 91-105.

González, E. R. et al. (2022) ‘An experimental research on emotional stimuli of consumers: the case of H&M flagship store on the millennial customer experience in Barcelona’, Intangible Capital, 18(3), 386-401.

Javed, T. et al. (2020) ‘The sustainability claims’ impact on the consumer’s green perception and behavioral intention: a case study of H&M’, Advances in Management and Applied Economics, 10(2), 1-22.

Jiang, S. (2020) ‘A comparative analysis of Chinese and British consumers’ consumption behaviours and attitudes toward fast-fashion brand as Zara and H&M’, Asian Journal of Social Science Studies, 5(2), 17.

Jocevski, M. (2020) ‘Blurring the lines between physical and digital spaces: business model innovation in retailing’, California Management Review, 63(1), 99-117.

Lopez, T. et al. (2022) ‘Digital value chain restructuring and labour process transformations in the fast‐fashion sector: evidence from the value chains of Zara & H&M’, Global Networks, 22(4), 684-700.

Netz, J., Reinmoeller, P. and Axelson, M. (2022) ‘Crisis‐driven innovation of products new to firms: the sensitization response to COVID‐19’, R&D Management, 52(2), 407-426.

Pastore, G. et al. (2022) ‘Sustainable fast fashion: business case of H&M’, In Cases on Circular Economy in Practice (pp. 157-179), IGI Global.

Pérez-Bou, S. and Cantista, I. (2022) ‘Politics, sustainability and innovation in fast fashion and luxury fashion groups’, International Journal of Fashion Design, Technology and Education, 1-11.

Smith, C., Scholz, M. and Williams, J. (2022) ‘Does your business need a human rights strategy?’, MIT Sloan Management Review, 63(2), 64-72.

Appendix A – Distribution of Study Participants by Age

Appendix B – Distribution of Study Participants by Region