Executive Summary

The phenomenon of an International Debt Crisis (IDC) incorporates a range of complex concepts, which makes the process of defining it and, more importantly, locating the means to prevent it, rather complicated. While a crisis cannot be viewed as an entirely negative concept as it provides important economic and financial lessons to learn, reaching an international level, it may cause a range of troubles for developing countries and the global economy. Therefore, it is essential to study the phenomenon of IDC closer.

The IDCs of the 1980s and 2015 can be viewed as graphic examples of an IDC. Starting as a local problem and affecting the entire world, they have changed the financial landscape significantly. Therefore, by studying the given examples, one can locate the patterns that are typical for IDCs development, thus, discovering the underlying causes and evaluating the effects thereof. Hence, by comparing the specified manifestations of a financial crisis, one will be able to locate the patterns that are characteristic of the given phenomenon.

Claiming that the outcomes of the analysis will help create the framework for avoiding the instances of a financial crisis in the future would be quite a stretch. However, the issues identified will permit controlling the factors causing and inhibiting the development of an IDC better As a result, the effects of the economic shocks can be reduced as well as the negative aftermath thereof. Thus, it is highly desirable that the phenomenon of the IDC should be analyzed carefully and that the existing examples thereof should be considered closely. As soon as specific patterns are discovered, appropriate tools for responding to the emergent prerequisites of the crisis can be spotted, and the corresponding set of measures can be introduced to the designated business environment to prevent a larger economic shock.

Problem Statement and Nature

Background and Theoretical Framework

By definition, economic development cannot be even (McKinnon and Cumbers 17); economic crises can be defined as cyclic and, therefore, are bound to occur regularly. Nevertheless, they have to be managed and analyzed accordingly so that the economic disturbances having a momentous impact on the wellbeing of people all over the world should be prevented successfully. Therefore, the phenomenon known as the international debt crisis (IDC) has to be inspected correspondingly to prevent a similar economic downfall.

The phenomenon of the IDC is rather basic. Reaching its peak in the 1970s, it can be defined as the “product of repeated investments in non-sustainable development programs” (Hirschoff 131). A closer look at the IDC will reveal that its scope was unusually large and that it quickly grew out of proportions (Posen and Changyong 12). Therefore, to avert the negative effects that it triggers and learn essential lessons from it, one should consider adopting the strategy based on the characteristics of the phenomenon so that the magnitude of its effects could be reduced.

Central Question: Understanding and Managing the International Debt Crisis

The paper addresses the phenomenon of the international debt crisis. First and foremost, it is imperative to consider the issues such as the factors that triggered the development thereof; among others, the economic, financial, political, technological, and sociocultural ones will be inspected.

Apart from the key causes of the international debt crisis, the factors that enhance and inhibit it will be inspected. Similarly, the issues that affect the development of the problem in question will be split into the categories mentioned above (economic, technological, political, financial, and sociocultural ones).

Based on the information retrieved from the corresponding sources and the analysis of the data listed above, the question concerning the international debt crisis management will also have to be answered. Apart from considering the existing strategies designed to address the consequences of the problem and prevent the latter from leading to an economic collapse, the development of a new strategy will be considered, and its core features will be outlined. In other words, the third question to be answered will imply the analysis of the methods of crisis management.

Central Question: Understanding and Managing the International Debt Crisis

The tools paper in question, therefore, attempts at answering whether there are specific patterns that are characteristic of IDCs. Particularly, it is essential to locate the ones that contribute to the emergence of an IDC and its further development. As a result, the tools for controlling an IDC can be introduced so that the effects thereof should not affect the target population significantly.

Defining Methodology of the Research

Methods and Approaches: Cause-and-Effect Technique

To give the issue the attention that it deserves, one will have to apply the Cause-and-Effect Technique. Typically defined as the tool that allows for locating the points of contact between different variables (Dougherty 213), the given approach can be viewed as perfect for carrying out a study of this scale, as it allows locating the essential links between the existing variables. Seeing that the very phenomenon of an international crisis is excruciatingly broad by definition, it is only reasonable to adopt the approach that allows for narrowing the range of factors affecting the problem down and singling out the ones that truly affect the subject matter. According to a recent commentary on the phenomenon, “An essential feature of the cause-and-effect technique is brainstorming, which is used to bring ideas on causes out into the open” (Oakland 290). Therefore, it is reasonable to assume that the designated scientific method will allow for the identification of patterns that are characteristic of an IDC, thus, assisting in understanding the phenomenon.

Therefore, it will be reasonable to adopt the qualitative approach that will allow for an identification of the subject matter and the definition of its characteristics rather than the quantification of the study outcomes. Indeed, seeing that the goal of the research is to locate the factors that create premises for the development of the phenomenon, there is no hypothesis to test; instead, there is a consistent question that needs to be answered. Particularly, the study has to define the concept of IDC and determine it causes along with its inhibitors. Hence, the qualitative design and general foundational tools for carrying out the study seem to be the most adequate choice to make the research as effective as possible.

Data Sources

To retrieve the information required for an in-depth analysis of the phenomenon, one will have to consider a general overview of the existing resources, including reports, case studies, and statistical information regarding the subject matter. In addition, foundational studies regarding the phenomenon of IDC will have to be considered to retrieve the necessary information and carry out a detailed analysis.

Scope and Exclusions

The scope of the study is going to be very large as the concept of IDC as a whole has to be identified and evaluated. In other words, the study is going to consider IDC as a worldwide phenomenon. Regardless, the study will have to incorporate several exclusions to make the research narrow enough so that its question could be answered. Therefore, the study will exclude the phenomena that have too small an effect to cause any tangible change in the design of the global economy and, therefore, affect the development of the IDC.

Literature Review

Definitions of IDC and Its Interpretations

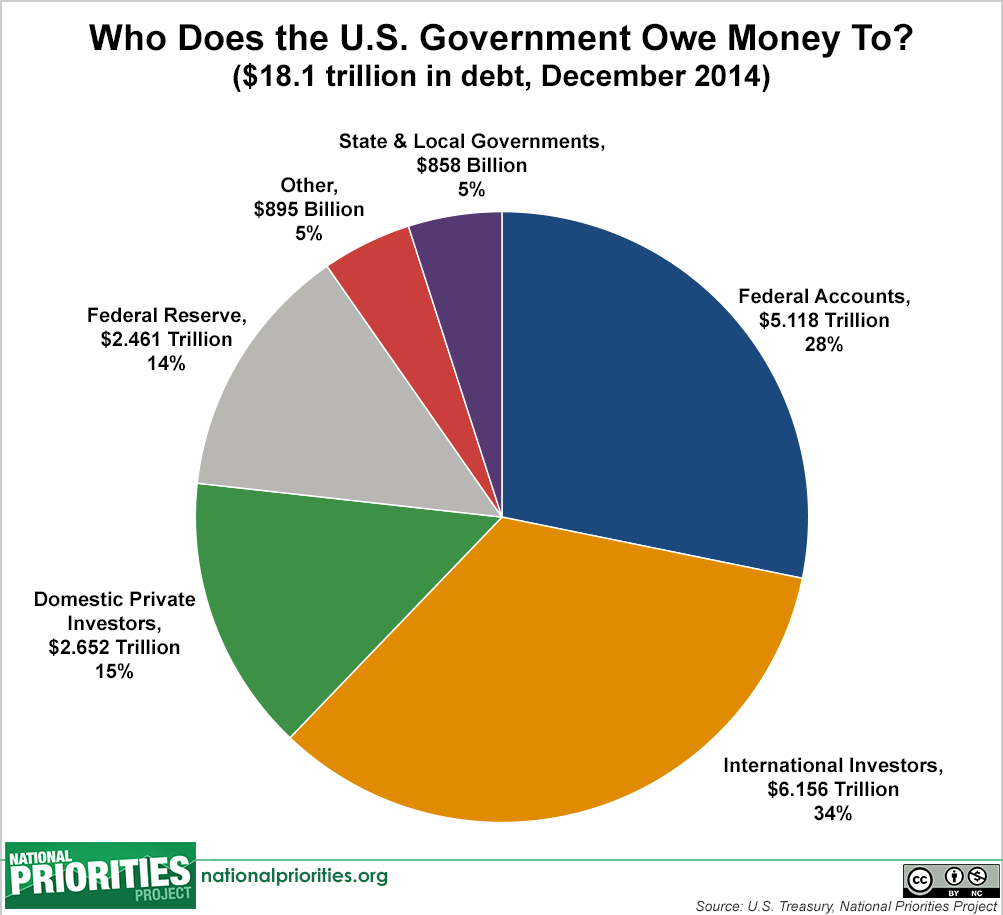

The concept of an IDC is typically rendered as the situation, in which repaying the state debt to the investors becomes impossible due to certain circumstances (Glasner 11). Although IDCs affect all states on a global level, causing an immediate rise in unemployment rates, numerous financial difficulties, etc., it affects developing countries firsthand. Seeing that the specified states have a comparatively weak understanding of their assets and have not yet designed the sustainable strategy for using them in the context of the global economy, the lack of financial stability and the increase of the debt to other governments is likely to shatter their chances to enter the global market successfully and be represented in the designated environment within a comparatively short amount of time.

On a global level, the above effects are likely to impact a range of states, impeding the processes related to the international trade (Michie 13). For instance, a recent (2015) IDC erupted in China, yet its aftereffects have caused a significant turmoil all over the world due to the economic ties that China has with other states:

Tumbling emerging-market indexes and currencies, from Brazil to Turkey and Kazakhstan, are further evidence, if more were needed, that the cocktail of Chinese growth, low interest rates and soaring commodity prices that powered emerging-market growth has been yanked away, leaving the developing world to face the hangover. (“The Causes and Consequences of China’s Market Crash” par. 9)

Models and Frameworks: Suggestions

There has been a range of attempts at explaining the phenomenon of IDC and defining the pattern according to which it evolves. When it comes to defining the framework that provides the best overview of the remedies for the IDC aftermath, one must give credit to the historical approach. The Principal-Agent Theory is suggested by several scholars (Bergh and Bjornskov 5; Dahan 17) as a tool for understanding the phenomenon of IDC. According to the specified model, the relationship between the agent (i.e., the economic, financial, and social factors creating premises for the crisis to erupt) and the principal (i.e., the phenomenon that is under analysis) are defined by the choices that the agent makes (Bergh and Bjornskov 24).

Where the International Debt Crisis Stems from: Analysis

From the perspective of the cause-and-effect technique, an IDC can be interpreted as the phenomenon triggered by the factors such as the inconsistency of a financial policy within a particular state. Indeed, a closer look at the variables will show that an IDC starts at a local level, growing out of proportions as the lack of a proper financial approach affects an increasingly large number of people. Moreover, the typical outcomes of an IDC, such as the increase in the solvency rates, should be viewed as the defining characteristics of the phenomenon.

IDC-1980s: Analysis and Interpretations

The IDC of the 1980s had a very peculiar geography; evidence shows that it was located primarily in the Latin American area (Devlin 31). When determining the prerequisites to the crisis, though, one must mention that the phenomenon had been brewing since the 19th century until it finally manifested itself in a financial disaster. The IDC of 1980-s also became apparent to most denizens of the U.S. population rather quickly, as the existing sources point.

Reasons: Defaults on Loans

In a retrospect, the mechanism of the crisis development was very basic. According to the existing evidence, the crisis was triggered by the defaults on loans, which later on disrupted the very fabric of the Latin American and the European financial systems.

Manifestation

The effects of the subject matter turned out to be outstandingly drastic for all the stakeholders involved. Researches point to the fact that the phenomenon under analysis affected every single member of the financial realm: “An international debt crisis erupted in the early 1980s that was ‘one of the most traumatic international financial disturbances’ of the twentieth century” (Cohn 341). Therefore, while starting as a local issue, it gradually evolved into a large-scale economic disaster.

IDC-2015: Analysis and Interpretations

Reasons: Poor Economic Model

Although the financial environment, which the 2015 IDC has created, is eerily similar to that one of its 1980s counterpart, the factors that have caused the 2015 issues are, in fact, rather different from the ones that caused the development of the 1908s problem. The 2015 meltdown, as numerous researchers call it, was caused by the failure of the Chinese market (Mao par. 4). While the connection between the Chinese economy and those of Europe and the U.S. might seem not quite evident, one must bear in mind that China remains one of the world’s leading industrial areas. On the surface, the causes of the financial failure are different in each case; however, on a second thought, one must admit that there are typical patterns that can be spotted in each case. For instance, the inconsistency of the borrowing strategy can be traced in each scenario.

Geography

One might argue that the crises mentioned above cannot possibly be compared due to the difference in their locations and, therefore, the cultural premises that they may have been based on Indeed, as it was stressed above, the IDC of the 80s was located predominantly in the Latin American and Asian area, whereas the 2015 IDC has spread all over the globe. However, the specified phenomenon can be explained rationally. Because of the current tendency for globalization, changes in a certain economy trigger an immediate chain reaction across the globe, therefore, causing numerous economies to experience the impacts of similar factors, hence the scale of the 2015 crisis. Therefore, the number of states involved and, therefore, the scale of the problem can be viewed as the essential difference between the two instances of the crisis discussed above.

As the comparison of the IDCs occurring at different time slots and in different geographical locations shows, the geography of the IDC varies because the economic factors in the specified locations change with time. It is, therefore, not a specific geographical location that affects the development of an IDC but the unique combination of the economic, financial, political, and, sometimes, cultural factors that affect the local economy and inhibit its development, therefore, blocking the country’s economic interactions with other states. As a result, a range of essential business processes is disrupted, which triggers an immediate disturbance in the global market. The veracity of this theory can be supported by the fact that, with the increase of the globalization pace, the development of an IDC occurs at a faster pace. Indeed, a closer look at the time slot at which the IDCs in question develop will reveal that it took approximately 30 years of the crisis of the 80s to erupt; however, the one that started in 2015 has been taking over the entire world at a comparatively fast pace. The economic ties between the contemporary states, which link the latter in the global economy, can be interpreted as the key reason for the increase in the pace of the IDC. Similarly, the factors that have contributed to the development of the specified issues can be viewed as rather different in terms of their origin yet not their effects.

Manifestation: Insolvency and Illiquidity

The ways, in which the two types of IDC manifested themselves, are also quite similar to each other. For instance, in both cases, IDCs are represented by the phenomenon known as insolvency. The phenomenon in question is typically defined as the tendency for the net worth to decline and approach a negative number (Cebola and Coceicao 45). Insolvency can be traced in both the outcomes of the 1980s crisis and the current effects of the 2015 issue.

Summary and Conclusions

Based on the information provided above, it will be safe to assume that the phenomenon of IDC emerges as a result of the inability of either physical or legal persons to discharge their financial liabilities before they mature to the point where the parties in question face bankruptcy. While seemingly obvious, the specified observation points to the fact that, in the global economy environment, the lack of financial stability within a particular market serves as the trigger of a domino reaction, thus, causing a financial crisis on a global level. Leading to the increase in the insolvency rates within the designated environment at an increasing pace, IDC can be interpreted as the effect of a combination of factors such as the inconsistent financial policy of the state government, the wrong choices made by the investors, and the threat of money loss dawning on the state residents. While the subject matter typically starts in a specific country as a local financial issue, it evolves into a much larger threat, entering the global economy domain.

Recommendations

Although the very phenomenon of a crisis is often viewed as a recurrent one and, more importantly, rather healthy for an economic development, its scale still needs to be coordinated and corrected so that it should not grow out of proportions and destroy the global economy environment. Therefore, a set of more rigid mechanisms for the market control should be introduced into the global economy realm. It could be suggested that a complex mechanism allowing for the overview of the key economic, political, financial, and sociocultural factors should be incorporated into the framework of the market regulation strategy. Thus, the emergent threats could be identified and addressed in a manner as efficient and expeditious as possible.

Works Cited

Bergh, Andreas, and Christian Bjornskov. “Trust Us to Repay: Social Trust, Long-Term Interest Rates and Sovereign Credit Ratings.” Econstor 1039.1 (2014): 1-35. Print.

Borrowing and the Federal Debt 2013. Web.

Cebola, Catia M, and Anna Coceicao. Mediation in bankruptcy: The better model for a reasonable solution? Global Business and Technology Association Managing in an Interconnected World: Pioneering Business and Technology Excellence. Ed. John Delener. New York, NY: Global Business and Technology Association, 2015. 42-49. Print.

Cohn, Theodore. Global Political Economy. New York City, NY: Routledge, 2015. Print.

Dahan, Samuel. “Chapter 8 – Conceptualising the EU/IMF Financial Assistance Process.” European Economy. Geneva, CHE: European Union, 2012. 182-212. Print.

Devlin, Robert. Debt and Crisis in Latin America: The Supply Side of the Story. Princeton, NJ: Princeton University Press, 2014. Print.

Dougherty, Michael A. Psychological Consultation and Collaboration in School and Community Settings. Stamford, CT: Cengage Learning, 2013. Print.

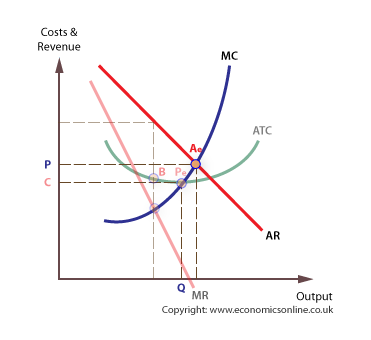

The Efficiency of Firms2013. Web.

Glasner, David. Business Cycles and Depressions: An Encyclopedia. New York, NY: Routledge, 2013. Print.

Hirschoff, Paula M. Completing the Food Chain: Strategies for Combating Hunger and Malnutrition: Papers and Proceedings of a Colloquium Organized by the Smithsonian Institution. Washington, DC: IRRI, 1989. Print.

Mao, Lei. “China’s Meltdown Shows the Country Is out of Control.”Fortune 2015. Web.

McKinnon, Danny, and Andrew Cumbers. Introduction to Economic Geography: Globalization, Uneven Development and Place. New York, NY: Routledge, 2014. Print.

Michie, Jonathan. Reader’s Guide to the Social Sciences. New York, NY: Routledge, 2014. Print.

Oakland, John S. Statistical Process Control. New York, NY: Routledge, 2012. Print.

Posen, Adam S., and Rhee Changyong. Responding to Financial Crisis: Lessons from Asia Then, the United States and Europe Now. Washington, DC: Peterson Institute for International Economics, 2012. Print.

The Causes and Consequences of China’s Market Crash 2015. Web.