Executive Summary

This report evaluates the practicality of the Seventh Generation to venture into Kuwait Market. The company is renowned for the production of eco-friendly personal care and household goods. Currently, the Kuwait market is underutilized. Hence, the company has the potential of making a profit from the market. Seventh Generation has a team of experienced scientists who help it to manufacture sustainable and safe products. The biggest percentage of Kuwait’s population comprises conservative Muslims.

They do not purchase personal care and household goods made from animal-based ingredients. Seventh Generation uses plant-based constituents to manufacture its products. Thus, it is likely to do well in Kuwait. The company requires positioning its products as sustainable and eco-friendly. Additionally, it should segment the target customers based on the level of disposable income, personality and values, and behavioral patterns. The government of Kuwait does not allow foreign companies to invest in the country. The companies have to partner with a local firm to gain entry into the country. Thus, the Seventh Generation should liaise with a local business.

Introduction

Kuwait is one of the oil-rich nations in the world. Thus, the country’s population has a significant amount of disposable income. Seo and Buchanan-Oliver (2015) aver that the demand for household and personal care products in Kuwait has been weak for the past few decades. Government policies and cultural and religious beliefs are some factors that contributed to the low demand for the products. The religious beliefs prohibited Muslims from using products that were deemed not halal. For instance, Muslims could not purchase a household or personal care products made of animal-based ingredients. Today, the demand for household and personal care products continues to rise.

Companies that manufacture household and personal care products using plant-based constituents enjoy a steady market in Kuwait. As per Chalk et al. (2012), Kuwait does not suffer significantly from the economic crisis. Therefore, companies are assured of a secure market. Seventh Generation is renowned for manufacturing household and personal care products using secure, efficient, and sustainable ingredients. Therefore, the company can do well in the Kuwait market. This report comprises an international marketing plan for Seventh Generation. The report will help the business to verify the viability of the Kuwait market.

Product and Industry Background

Seventh Generation is an American corporation that specializes in the production of household and personal care products. The company manufactures products like washing detergents, baby diapers and wipes, botanical disinfectants, trash bags, pants, surface cleaners, and liquid laundry among others (Brausch and Rand 2011). Seventh Generation was established in 1988. The company sells its products to supermarkets, natural food stores, online retailers, and mass merchants. The household and personal care products industry is a multi-billion dollar business with a ready market across the globe (About Seventh Generation 2009).

The demand for household and personal care products is high worldwide. The sensitivity of personal care products requires the industry to abide by established safety standards. Besides, the industry is obliged to manufacture products using secure and sustainable ingredients. It underlines the reason why Seventh Generation endeavors to produce products that are not only biodegradable but also safe for use. Brausch and Rand (2011, p. 1521) hold that the Seventh Generation manufactures its products using “plant-based phosphate- and chlorine-free ingredients”.

External Analysis

PESTLE Analysis

Political

Chalk et al. (2012) hold that Kuwait is a constitutional monarchy that puts a lot of emphasis on sharia laws. The country is a significant ally of the United States. The stable relationship between Kuwait and the United States paves the way for American companies to invest in the country. After the country had gained independence, some politicians pressured the prime minister to relax his policies to facilitate economic growth. Most political parties wanted the state to adopt a liberalized economy that would allow foreign companies to invest in Kuwait (Chalk et al. 2012).

Currently, Kuwait allows foreign companies to invest in the country through a partnership with local firms. The country encounters immense political interference from Saudi Arabia. Saudi Arabia’s move to lock other oil companies out of the global market has significantly affected Kuwait. Kuwait’s economy is not as vivacious as that of Saudi Arabia. The country depends primarily on oil. Thus, changes in oil prices have significant effects on Kuwait.

They affect the degree of disposable income in households. According to Chalk et al. (2007), Kuwait is renowned for oppressing women. The country’s influential political bloc enforces sharia laws that thwart women empowerment. Women and children are the primary consumers of household and personal care products. Thus, failure to empower women affects their purchasing power. In return, it affects the sales volume of companies that sell household and personal care goods. Kuwait is a democratic republic, unlike the United Arab Emirates. People have the liberty to do business with whoever they prefer. Thus, the sales volume of the Seventh Generation is bound to rise as people are not prohibited from purchasing its products.

Economic

Chalk et al. (2012, p. 34) allege, ‘Kuwait has a small, relatively open economy, which is experiencing constant growth since the Gulf War’. The primary source of income in the country is crude oil. The overdependence of crude oil renders the country’s economy vulnerable. Reduction in oil prices would have adverse effects on the country’s economy. Chalk et al. (2012) hold that Kuwait has cushioned its economy from a possible reduction in oil prices. The state sells its oil to South Korea, China, and India. These countries have stable and vibrant economies, thus guaranteeing Kuwait of a steady market. In 2010, Kuwait’s gross domestic product was $200 billion. The country continues to enjoy a stable economic growth (Chalk et al. 2012).

The government of Kuwait came up with two initiatives that sought to help the country to diversify its economy. It enacted legislation that allowed the privatization of public property. Additionally, it set aside money to facilitate foreign direct investment. Today, the government of Kuwait encourages private investors to participate in the country’s economy. It endeavors to improve the economic environment of Kuwait as a way to attract potential investors. The fact that Kuwait is open to private investment makes the country suitable for Seventh Generation. The company would not encounter numerous challenges in its effort to open a subsidiary in Kuwait. Besides, Seventh Generation is assured of a ready market due to the country’s stable economy.

Social

Social factors are critical in any market research because they provide information about the people who comprise the market (Chalk et al. 2012). According to Chalk et al. (2012), at least three million inhabitants live in Kuwait. A majority of citizens are employed. Working individuals receive high salaries. Additionally, the government offers financial assistance to the unemployed. In spite of the political class championing for women disempowerment, women in the country still enjoy significant freedom. They are allowed to own property and work.

Thus, the level of household income in most families is high. Kuwait has a large population of expatriates from different countries. The biggest percentage of the country’s population comprises Muslims. Muslims are selective when purchasing household and personal care products (Chalk et al. 2012). They have to ensure that the goods are manufactured from plant-based ingredients. Seventh Generation uses plant-based ingredients to produce all its household and personal care products. Thus, the company would enjoy a big market share in Kuwait.

Kuwait scores high regarding power distance. Individuals observe a hierarchical order. Men have influence over women. The observance of power distance in the country may affect the Seventh Generation’s performance (Chalk et al. 2012). Women comprise the highest percentage of people who use home and personal care products. Unfortunately, male dominance curtails its purchasing power. In other words, women cannot purchase some of the home and personal care products without the approval of their husbands. Kuwait scores poorly regarding individualism. The country is viewed as a collectivist society. People stick to societal norms and do all they can to abide by them. Collectivism impacts people’s purchasing power (Chalk et al. 2012). Individuals do not make decisions that would favor personal interests. Instead, they consider the interests of society. It would be difficult for people in Kuwait to make independent decisions to buy home and personal care products from Seventh Generation. They would require knowing the source of the products and how they are manufactures. Besides, they would seek approval from other people in the society, particularly the leaders.

Kuwait is somewhat a feminine society. People take care of one another. In a feminine society, individuals do not seek success and achievement. Thus, it is hard for people to purchase expensive products or lead a luxurious life. Seventh Generation may not enjoy significant growth in Kuwait as it sells products at premium prices. People may not purchase expensive products as the move would depict them as insensitive of the poor in the society. Chalk et al. (2012) hold that people in Kuwait value equality.

Thus, they opt to use products that everyone can afford. Seventh generation would require doing a lot of sales promotion to encourage customers to buy its products. Kuwait scores highly regarding uncertainty avoidance. People avoid engaging in unfamiliar activities. Besides, they are unlikely to purchase products without knowing their origin. Seventh Generation can exploit the degree of uncertainty avoidance to its benefit. The Conservative Muslims avoid purchasing household and personal care products made from animal-based ingredients (Chalk et al. 2012). Thus, the company can position its products as eco-friendly and made from plant-based ingredients. It would lead to customers having confidence in using the company’s products.

Currently, there is no score for Kuwait regarding long-term orientation. Nevertheless, the society is gradually becoming pragmatic. In the past, most of the Kuwait people were conservative (Chalk et al. 2012). However, influx of expatriates to the country has led to people embracing modern ways of life. Thus, Seventh Generation can take advantage of this gradual transformation to encourage consumers to use its products. Clients would be willing to purchase the company’s products as long as they add value to their life. Kuwait people have the capacity to manage their impulses and desires (Chalk et al. 2012). As such, people avoid purchasing products out of curiosity. Seventh Generation would require conducting aggressive marketing to encourage customers to purchase its products. Else, people would continue to use household and personal care products that they know.

Technological

Chalk et al. (2012, p. 55) claims ‘The Central Bank of Kuwait funds technical programs to promote technological transfer and help the country to advance in diversified industries’. The country has well-established transport and communication infrastructures. Infrastructural development makes it possible for companies to market and distribute their products across the country. Currently, a lot of people in Kuwait own cell phones. Besides, the country has an established network connection. Thus, it is easy for companies to use social media and mobile applications to market and sell their products.

Legal

Kuwait does not impose taxes on wages and Salaries. Thus, employees have an opportunity to spend all their wages or salaries. Failure to impose taxes on wages and salaries contributes to the high degree of disposable income amid the people (Chalk et al. 2012). Companies have an opportunity to reap from the high level of disposable income. However, the country’s commercial law dictates that foreign companies can only invest in Kuwait through local agents or distributors. It prevents foreign multinationals from exploiting the Kuwait market fully.

Environmental

Kuwait suffers from significant environmental degradation due to oil drilling and exploration. Hence, the government of Kuwait has imposed strict measures to conserve the environment. The country is in the process of adopting green energy (Chalk et al. 2012). Besides, the government encourages companies to use renewable sources of energy. Organizations are invited to use biodegradable materials to manufacture their products.

Porter’s Five Forces Analysis

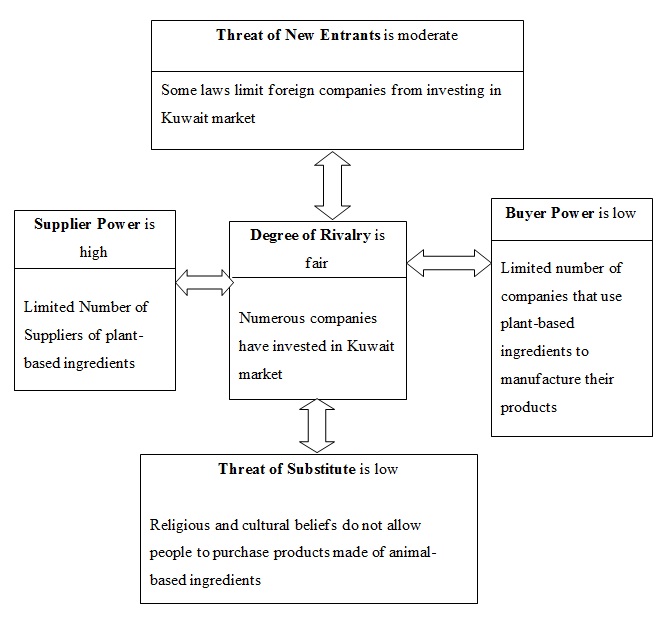

Bargaining Power of Buyers

The bargaining power of customers is small. The religious beliefs and cultural practices encourage Muslims to use personal care products that are manufactured from plant-based ingredients. Limited companies sell such products in Kuwait. Additionally, the government of Kuwait limits investment by foreign companies. Hence, many companies have avoided the Kuwait market.

Bargaining Power of Suppliers

The bargaining power of suppliers is high. Very few vendors sell plant-based ingredients used to manufacture household and personal care products. Thus, Seventh Generation is forced to raise the prices of its products to cover for production cost.

Threat of Substitutes

Religious beliefs do not allow Muslims to use products that are manufactured from animal-based ingredients. Thus, the threat of substitutes is low. Customers prefer household and personal care products made from plant-based ingredients.

Threat of New Entrants

The increasing demand for household and personal care products made from plant-based ingredients has led to many companies changing their production strategies. Currently, numerous companies use plant-based ingredients to manufacture household and personal care products. Nonetheless, the threat of new entrants in Kuwait market is moderate. The government has imposed commercial laws that discourage foreign companies from investing in Kuwait.

Industry Rivalry

In Kuwait, the degree of rivalry in the household and personal care products market is fair. Many companies avoid the Kuwait market due to government regulations. Currently, the leading player in the industry is Al-Sharhan. Seventh Generation will not face stiff competition if it invests in the market.

Product and Industry Insight

The Industry

The household and personal care products industry is lucrative. Currently, many companies have invested in the industry. A majority of the companies are multinationals. Thus, they have access to the global market. The industry faces numerous challenges as a result of changes in technology, consumer preferences, and economic uncertainties (About Seventh Generation 2009). Besides, the high number of companies that produce household and personal care products has resulted in the industry getting saturated. The need to protect consumers and environment has led to increased regulatory inspection of the industry.

The product

Seventh Generation has invested in product differentiation and innovation to boost its competitive edge. Houdet, Trommetter and Weber (2012) allege that the company has a team of scientists who assist it to use innovative ingredients and technologies to manufacture its products. Seventh Generation endeavors to produce goods that are not only safe to consumers but also environmentally friendly. The company has enhanced the quality of its wipes and diapers. The wipes and diapers are hypoallergenic and do not use dyes and perfumes. The company has specialized in the production of pure and biodegradable baby products.

SWOT Analysis

VRIO Model

The value, rarity, immutability and organization (VRIO) model refers to an analysis framework that is an integral part of the organizational strategic plan. As per Hinterhuber (2013), the issue of value determines if an organization has the capability to deal with the external threat. Seventh Generation has a team of experienced employees who help it to develop quality products, thus overcoming competition. Rarity refers to the organization’s ability to control resources that are not available in most businesses. Seventh Generation has a team of scientists who enable the company to come up innovative ways of developing products.

Imitability determines if a company’s products can easily be duplicated. Seventh Generation’s products are difficult to imitate. The company uses sophisticated technology to manufacture the products. Thus, it would be costly for other firms to imitate. Hinterhuber (2013) maintains that the question of organization determines if a firm is well-prepared to exploit the available resources to its benefits. Seventh Generation has a team of skilled workers. Besides, the organization is structured in a manner that facilitates the flow of information from the managers to the employees. The company offers incentives to employees to encourage creativity.

Competition

The increase in demand for eco-conscious household and personal care products has led to companies changing their production methods (Houdet, Trommetter & Weber 2012). Today, many companies no longer use animal-based ingredients to manufacture personal care products. Seventh Generation encounters competition not only in the United States but also in other countries across the globe. In the United States, its main competitors include S.C. Johnson and Clorox (Houdet, Trommetter & Weber 2012). The company works hard to safeguard its green turf, without which it may not compete with rivals. Currently, there are a lot of eco-conscious households and personal care products from other companies. Thus, Seventh Generation has to work hard to retain its customer base. In the Kuwait market, the company is bound to face competition from Al-Sharhan. Al-Sharhan has been in Kuwait market for an extended period. Thus, customers are aware of its products.

Marketing Audit

Marketing Mix (4 Ps)

For Seventh Generation to exploit the Kuwait market, it requires an elaborate marketing mix (Khan 2014). The competition in the household and personal care products is stiff. The Seventh Generation would encounter competition from Al-Sharhan. The company requires leveraging product differentiation to overcome competition. Seventh Generation must ensure that all its products are eco-friendly. Besides, the company has to make sure that it emphasizes sustainability in the manufacture of its products. The company should monitor its manufacturers to make sure that they adhere to the established sustainability expectations. Additionally, the company should innovate in sustainability and enhance the quality and performance of its products.

Consumers purchase products whose prices commensurate their value (Khan 2014). Thus, Seventh Generation should ensure that the prices of its products match their values. The company should use emotional and psychological perceptions of customers to set prices. Customers are likely to pay more for products that guarantee sustainability. However, the company should be conscious of the green pricing gap that may discourage customers from purchasing products. Seventh Generation can reduce the prices of some products like washing liquid to attract customers. It must come up with a correct pricing strategy to attract and retain clients in the Kuwait market.

Customers who buy eco-friendly products get them from different retailers. Thus, Seventh Generation must ensure that it uses numerous distribution channels to reach many customers. The company can sell its products through grocery retails, mass merchandisers and online stores. It would enable the business to arrive at a wider customer base (Gordon 2012). Seventh Generation should use media that can reach a broad audience to promote its products. A majority of the people in Kuwait own televisions. Therefore, the company should use television to advertise its products. Additionally, a majority of the households have cell phones. The company should use mobile applications and social media platforms to promote products. Organizing corporate social responsibility programs can go a long way towards assisting Seventh Generation to popularize itself and its products.

Segmenting, Targeting and Positioning (STP)

Seventh Generation requires segmenting its Kuwait market based on the demographic factors like gender and the level of income of the consumers. Besides, the company should group the target market based on psychographic factors like personality and values. Segmenting the target market based on behavioral factors would help Seventh Generation to know the customers who most use its products (Westjohn, Singh & Magnusson 2012). Women and youths comprise the group that uses household and personal care products frequently. Thus, Seventh Generation should mainly target the teens and women. On the other hand, the company should ensure that it sells the products at different prices to cater for both high- and middle-income earners. The company should mainly target working women and youths. The demand for eco-friendly personal care products is on the rise. Seventh Generation should position itself as a company that manufactures personal care and household goods that are not only safe for people but also the environment.

Market Entry Strategy

The Kuwait government does not allow foreign companies to invest directly in the country. The companies have to partner with local firms. Thus, Seventh Generation should partner with a local business. Establishing a joint venture with a local company will not only help Seventh Generation to exploit the Kuwait market but also cushion it from possible risks (Papista & Dimitriadis 2012).

Seventh Generation will partner with Al Shaya Company to enable it to exploit the Kuwait market. Al Shaya is a multinational corporation with numerous outlets in Kuwait. It deals with health and beauty products, footwear and fashion as well as pharmacy. The reason for partnering with Al Shaya is its broad market coverage. It will enable Seventh Generation to reach many clients. The partnership will guarantee Seventh Generation of a significant sales volume.

Recommendation

In Kuwait, the household and personal care products market is not fully exploited. Seventh Generation requires partnering with a local firm to exploit the market. The conservative Muslims do not buy products manufactured from animal-based ingredients. Thus, Seventh Generation should target conservative Muslims with its eco-friendly products that are produced from plant-based ingredients.

Conclusion

Seventh Generation is renowned for the production of eco-friendly household and personal care products. The company seeks to venture into the Kuwait market. Seventh Generation has a team of experienced scientists who help it to come up with innovative methods of manufacturing products. Thus, it is unlikely to face stiff competition from companies that are already in the Kuwait market. Seventh Generation should position itself as a company that values sustainability. Additionally, it should segment its market based on the income level, personality and values and behavioral patterns of consumers. The government of Kuwait does not allow foreign companies to invest in the country unless they partner with local firms. Hence, Seventh Generation should liaise with a local business to gain entry into Kuwait market.

Reference List

About Seventh Generation 2009, Web.

Brausch, J & Rand, G 2011, ‘A review of personal care products in the aquatic environment: environmental concentration and toxicity’, Chemosphere, vol. 82, no. 11, pp. 1518-1532.

Chalk, N, El-Erian, M, Fennell, S, Kireyev, A & Wilson, J 2012, Kuwait: from reconstruction to accumulation for future generations, International Monetary Fund, Washington DC.

Gordon, R 2012, ‘Re-thinking and re-tooling the social marketing mix’, Australasian Marketing Journal, vol. 20, no. 2, pp. 122-126.

Hinterhuber, A 2013, ‘Can competitive advantage be predicted?: towards a predictive definition of competitive advantage in the resource-based view of the firm’, Management Decision, vol. 51, no. 4, pp. 795-812.

Houdet, J, Trommetter, M & Weber, J 2012, ‘Understanding changes in business strategies regarding biodiversity and ecosystem services’, Ecological Economics, vol. 73, no. 15, pp. 37-46.

Khan, M 2014, ‘The concept of ‘marketing mix’ and its elements’, International Journal of Information, Business and Management, vol. 6, no. 2, pp. 95-107.

Papista, E & Dimitriadis, S 2012, ‘Exploring consumer‐brand relationship quality and identification: qualitative evidence from cosmetics brands’, Qualitative Market Research: An International Journal, vol. 15, no. 1, pp. 33-56.

Seo, Y & Buchanan-Oliver, M 2015, ‘Luxury branding: the industry, trends, and future conceptualisations’, Asia Pacific Journal of Marketing and Logistics, vol. 27, no. 1, pp. 82-98.

Westjohn, S, Singh, N & Magnusson, P 2012, ‘Responsiveness to global and local consumer culture positioning: a personality and collective identity perspective’, Journal of International Marketing, vol. 20, no. 1, pp. 58-73.