Price Index, Money Supply, Interest Rate and Unemployment Rate

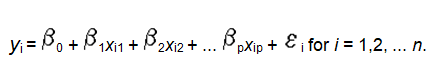

The multiple linear regression model of Ancot is a relation equation that shows the relationship between two or more variables by placing a fixing linear equation in each of the variable with regards to the set of data (Ancot et al. 143). In this model every value of the independent variables x is associated with a value of the dependent variable y as in the standard multiple linear regression model given below ‘n observation’:

This model has a wide range of application and could actually be used to analyse the relationship between the real effective exchange rates and the macroeconomic variables like the consumer price index, the money supply, interest rate and the unemployment rates in various countries.

These variables help in the analysis of the economic growth and development of a country’s efficient economic modules (Ancot et al. 144). In this study we will focus on how the above variables relate to the model in the United State and the United Kingdom.

Consumer price index using Ancot multiple regression model is usually an effective way of calculating the changes in prices of goods and services with respect to exchange rates in stock exchange where their relationship is inverse. (Ancot et al. 144).

Money supply is also a variable used in the analysis of economic growth and development of a particular country and therefore Money supply and liquidity rate are variables that are directly proportional (Barrows & Naka 119). This has an adverse effect in the sense that there will be a realisation of an upward trend in the nominal rates and nominal equity prices (Barrows & Naka 120).

The final result is that there will be an optimistic relation between the supply and the returns of stock. In fitting money supply in the model, money is usually treated like a commodity which is bought and sold in the stock exchange market.

In the market interest, nominal rates study shows that with respect to the use of the multiple regression model an increase in the market interest leads to falling of the stock prices (Ancot et al. 140). This is because when the interest rates increase more money is held hence the value of interest bearing securities decreases causing a fall in the stock levels. This has a negative effect on the nominal rates of a particular economy.

The aspect of un-employment rates is widely studied and analysed using the model and the results reveals that the exchange rate has a significant impact on the unemployment rate (Frenkel & Ros 640). This is because unemployment affects capital accumulation which has a tendency to real currency appreciation.

Therefore unemployment is negatively affected by the exchange rate thus reducing the product wage in the traded goods sector. This also implies that a higher exchange rate leads to more devaluation of domestic currency (Paterson 253).

A study conducted in the US proves that as a variable of analysis industrial production greatly determines the rate of economic growth of a particular country. The measure used is the industrial production index whereby if there is increased production in a particular commodity then the industrial production index is high and thus leading to a high level of stock returns and hence interest rates (Duffie et al. 337).

In conclusion, other variables that can be used to analyse stock returns with application of the multiple linear regression model are; the gold price, the oil price, and the foreign exchange rate. However, the variables discussed above have an adverse effect on the economic growth, development and planning of a particular country.

This is clearly depicted by the fact that the countries with high development, high economic rates have high industrial production index making the stock levels to be high. The foreign exchange rates of such countries are also high thus leading to realisation of a stable economy.

Works Cited

Ancot, John, et al. Five principles of spatial econometrics illustrated. In Chatterji, M. and Kuenne, R. E., editors, Dynam-ics and Conict in Regional Structural Change: Essays in Honour of Walter Isard. Vol. 2. Macmillan, Basingstoke, United Kingdom, 1990. 144-155. Print.

Barrows, Clayton, and Atsuyuki Naka. “Use of Macroeconomic Variables to Evaluate Selected Hospitality Stock Returns in the U.S.” International Journal of Hospitality Management 13.2(1994):119-128. Print.

Duffie, Darrel, et al. “Securities Leading, Shorting and Pricing.” Journal of Financial Economics 66.1 (2002):307-339.

Frenkel, Roberto, and Jaime Ros. “Unemployment and the Real Exchange Rate in Latin America.” World Development, 34.4 (2006): 631–646.

Paterson, Martin. “Macroeconomics of Stock Price Fluctuations.” Quarterly Journal of Business and Economics 26.2 (2000): 253-270. Print.