Introduction

The current globalisation rate has led to many changes and effects on the value of most resources and especially the financial resources. The world’s population is increasing at a fast rate while on the other hand resources are being depleted without being replenished thus causing scarcity.

As a result, economic crisis have occurred which have as well affected the living standards of a better part of the world’s population (Hardwick, 2002, p.176). Among the common effects are the high inflation and the amount of money supplied.

Economists have however established the rate of Inflation and the money supply of a nation are correlated with one leading to another. This paper is therefore an analysis of the relationship between the inflation rate and money supply.

Inflation

Inflation is said to be the increase in the prices of commodities and services in a given economy. This makes the people buy less since their purchasing power goes down as a result of the lower value of the currency. Inflation rates of most countries keep fluctuating but their central banks try to keep the rates at a range of about two to three percent.

The consumer price index is what is used to measure the inflation rates of an economy. It has been theoretically argued that inflation is caused by an increase in money supply in the economy (Hall and Taylor, 1997, p.637).

Money Supply

Money supply is an economic term which refers to the amount of money circulating in an economy. The central bank is bestowed with controlling the money supply of a country through regulation of the circulation (Williams, 2008, p.1). Money supply can be measured by looking at the value of currency, bills, credit, loans as well as other liquid instruments in an economy.

The Relationship between money supply and inflation

Economists have suggested that there is a high degree of correlation between the inflation rate and money supply in an economy. To begin with is the fact that when the money supply is high the demand for money goes down.

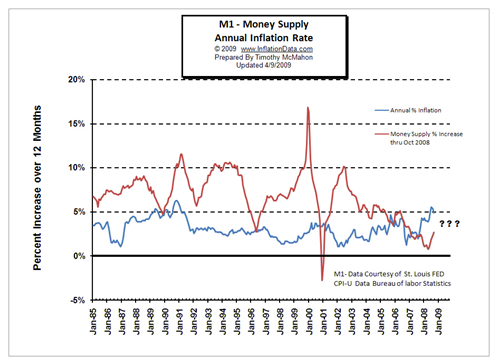

This is because people are able to afford even the high priced commodities and services that they could not have initially afforded (Mishkin, 1995, p.89). It can thus be depicted that an upward supply of money in the economy results to inflation according to the graph shown below.

A look at the graph at first glance does not show any instances of correlation however after the introduction of a time lag in which the two occur a situation of relationship is then established. This time lag is the difference in time between changes in the money supply and the changes in the inflation rates. Thus, the relationship occurs after a period of time as it can be depicted on the graph in the years 1990, 1996, 2000 and 2001 among others.

This can be practically explained in a situation whereby the people of a given small town are given the opportunity to raise a higher income than they would have before in a month. They would thus shift from using gasoline to gas as their source of fuel which costs higher.

This is because in real sense, the gas will cost proportionally lower than the price they were paying for gasoline before the increase in income. As a result, the market will bear high prices for commodities and services leading to inflation which has come about due to increased money supply (Williams, 2008, p.1).

The relationship between inflation rates and money supply can be differently explained using different economic theories. The Monetary theory explains that money supply is the most significant factor that leads to incidences of inflation in an economy.

Quoting the words of a renowned monetarist by the name Milton Friedman, he said, “Inflation is always and everywhere a monetary phenomenon” (Williams, 2008, p.1). Thus according to empirical studies conducted by most historical monetarists, it can be asserted that inflation is a monetary phenomenon. This is in accordance to the equation;

MV= PQ

Where;

- M is the nominal value of money (money supply)

- V is the money velocity

- P is the price level

- Q is the real value index (Transactions)

From the above equation, monetarists argue that the money velocity is not affected by changes in the money supply in the long-run (Mankiw, 2002, p.153). Therefore the output is highly dependent on the productivity of the economy.

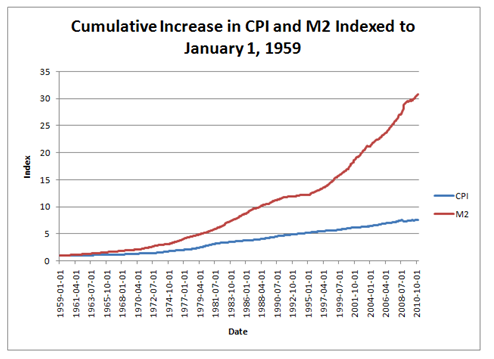

Working with these assumptions it can be said that changes in price are dependent on the changes in the quantity of money in the economy thus the money supply. The chart below derived from the above equation shows the differences in inflation reflected by CPI and the money supply reflected as M2.

Fig. A chart showing the relationship between inflation and money supply (Burda and Wyplosz, 1997, p. 267)

According to the Keynesian theory, there still exists a relationship between money supply and inflation. However, they argue that money supply is not the only big factor that causes inflation as there are also other contributing factors.

The Keynesians emphasize that aggregate demand is the main reason behind inflation and thus regulating the aggregate demands in periods of recessions and economic expansions helps stabilize the inflation rates as well. Nevertheless, the relationship comes about as aggregate demand is effectively controlled using economic instruments such as monetary policy and fiscal policy (Burda and Wyplosz, 1997, p. 275)

Conclusion

From the above discussion, it can be concluded that there is indeed a great correlation between money supply and inflation rates of an economy. It is evidenced that changing the money supply through the central banks leads to a control of the inflationary situations in the same economy.

For instance, a country with high inflation rates and willing to lower them, they will do this through the operations of the central bank whereby the lending rates and the interest rates will be increased to reduce the amount f money leaving the bank (Baumol and Blinder, 2006, p.109).

As a matter of fact, people will rush to deposit the cash they have so that it can earn as much interest as possible. This will in turn reduce the amount of money circulating in the region hence reducing the inflation rates as well.

In a situation of deflation the vice versa will be applied where the central bank will reduce the lending rates and interest rates so as to enable flow of money into the economy (Baumol and Blinder, 2006, p.109). The control between money supply and inflation rates is thus operated using the federal banking system of the central bank of the region.

Reference List

Baumol, W. and Blinder, A. (2006). Macroeconomics: Principles and Policy, Tenth edition. Thomson South-Western.

Burda, M. and Wyplosz, C. (1997). Macroeconomics: a European text. Oxford [Oxfordshire]: Oxford University Press.

Hall, R. and Taylor, J. (1993). Macroeconomics. New York: W.W. Norton.

Hardwick, P. (2002). Introduction to modern economics, prentice hall publishers, New York.

Mankiw, N. (2002). Macroeconomics (5th Ed.). Worth.

McMahon, T. (2009). Money Supply and Inflation. Web.

Mishkin, F. (1995). The Economics of Money, Banking, and Financial Markets, New York, Harper Collins.

Williams, J. (2008). Money Supply Special Report. Web.