Introduction

As far as adding to the scientific deliberation, the work of scholars gives non-specific systems to sustainable development. Such non-exclusive systems recommend that various procedures can be taken after as a major aspect of sustainable development, each of which view the idea of sustainability through various lenses, or a mix of lenses, for example, looking for general financial development and productivity; social equity, monetary opportunity, wage uniformity; and environment security (Barnes and Scornavacca 130). Nonetheless, what is missing is an exact investigation of how such techniques can be contextualized to particular nations and commercial ventures. It is because of such deliberations that effort for accomplishing sustainable improvement targets are distinguished and such recognizable proof can advise the content of arrangement and give the important pre-conditions to successful approach suggestion.

This paper solves the research gap by considering the nation setting of a developing nation and the business connection of the development of land. The setting of developing nations is deserving of study because a number of such nations, as a major aspect of their arrangements for sustainable development, are looking for procedures that empower monetary development and advancement, whilst in the meantime guaranteeing the necessities of their social orders are met. Moreover, in such nations, the development of its land profoundly affects both the economy and society, for instance through the procedure of urbanization. One such nation confronted with such difficulties is the Kingdom of Saudi Arabia, which is the centre of this paper.

Background about real estate

The real estate sector constitutes a fundamental component of a country’s overall competitiveness. According to Saied, Susilawati and Trigunarsyah, the real estate sector is broad and it involves different sectors such as the raw materials, financial systems, construction, and engineering industries (4). Alternatively, the real estate entails the stock of buildings and land (Saied, Susilawati and Trigunarsyah 4). The commercial real estate market is comprised of two main components that include the asset and space markets. Mouzughi, Bryde and Al-Shaer posit that the “space or usage market is related to the use of real property, which can be seen as the right to use space or the actual property as the land or built space” (1712). Conversely, the asset market focuses on the ownership of real estate objects similar to the capital market.

The sector stimulates economic growth through two main avenues. The first avenue arises from the sectors’ independent competitive sector while the second involves enabling other areas within the economy. The contemporary real estate sector is characterised by a high rate of change, which presents a major challenge to investors. Some of the notable constraints relate to non-transparent market, illiquidity, large unit prices, and high management intensity.

Honghao and Folmer posit that a “well functioning, evolving real estate holds particular significance in building a country’s economy and competitiveness” (22). Therefore, it can increase the rate of a country’s economic growth and development. One of the aspects that influence the real estate sector’s capacity to improve a country’s competitiveness is sustainability. Hashmi, Abdulghaffar and Edinat define sustainability to include the effective operations of properties, waste management, and efficient energy utilisation (47). Conversely, Mouzughi, Bryde and Al-Shaer define sustainability based on the triple bottom line, viz. the social, environment, and economic components (1710). The pursuit of sustainability culminates in the attainment of the long-term development of an economy.

Objective of the paper

Considering the growth in the relevance of sustainable development, it is imperative for stakeholders in the real estate to understand the significance of the value of sustainable development. The objective of this paper is to investigate the role of real estate in sustainable development in developing countries.

Scope and limitation

The research is specifically limited to the sustainable development of the real estate sector. Moreover, the research involves a comparative analysis between Saudi Arabia and Bahrain as some of the notable developing countries. Time and financial constraints constitute the major challenges encountered in undertaking research studies. To overcome this challenge, data is sourced from the available literature. However, it is ensured that only the credible sources, which are available online, are used.

Methodology

This study intends to establish a role of the real estate in the sustainable development of developing countries. Thus, the study is based on the sociological design to address the broad issue under investigation. The sociological design is implemented by employing the explanatory case study design, which seeks to develop insight into the cause-and-effect relationship between the research subjects. Therefore, the explanatory research design will lead to the generation of insight on the role of real estate in promoting sustainable development within the developing countries.

The methodology is the process of instructing the ways to do the research. It is, therefore, convenient for conducting the research and for analysing the research questions. The process of methodology insists that much care influences the kinds and nature of procedures to observe in accomplishing a given set of procedures or an objective (Wagner 69). The purpose of this research was to analyse the role of real estate in sustainable development. Exploratory research study provides researchers an opportunity to assess areas that do not have extensive research. Therefore, engaging in exploratory study contributes to the development of additional knowledge on the issue or phenomenon under investigation. This goal comes by testing the stipulated hypotheses. To undertake the research study, a comprehensive research methodology is necessary.

Quantitative and qualitative approaches

Quantitative research approach refers to the use of statistical techniques, mathematical methods and calculation techniques to analyse data (Wagner 66). The quantitative methodology aims at utilizing mathematical and statistical theories and models to analyses the data. The quantitative method validates the hypotheses and conclusions that stem from the qualitative methodology. The scientific procedures and processes that help in quantitative methodology encompass deriving models and theories; designing instruments for data gathering; controlling the variables empirically; and analysing data using models.

The qualitative approach is mostly concerned with the human motives and the reasons behind such motives (Wagner 66). The main questions that come with qualitative approach are ‘why?’ and ‘how?’ in addition to ‘what?’, ‘where?’ and ‘when?’ Concerning this, a researcher utilizing the qualitative approach will tend to use smaller samples rather than larger samples. Qualitative approach strictly generates only information that applies to the designated case study; any additional information is guesses. Once the hypotheses stem from a qualitative approach, they filter through the quantitative approach.

Research Design

There are three types of research design: exploratory research, descriptive research and causal research (Haspeslagh and Jemison 200). This study utilized the exploratory research design. The exploratory research design mainly explores the nature of the problem in order to draw inferences. In this scenario, the researcher is in a good position to understand the problem under investigation. The flow of exploratory research involves identifying the problem and seeking to find the appropriate solutions and new ideas. Exploratory research is mostly applicable in circumstances where the structure of the research problem is not definite. The interview is a good example of the methods that helps to gather information in this kind of research.

There are two popularly used procedures for sampling. The sampling procedures include prospect sampling and non-prospect sampling. In a probability sampling procedure, the samples are representative of the population. This is because all the entries have a chance of selection. On the other hand, items in the non-probability sampling do not have an equal chance. In this scenario, not all the items in the population have equal chances of selection. The data for the study came from the players in the real estate sector.

Industry analysts obtain the research data from credible secondary sources such as journals, periodicals, and reports, which are available in online libraries and databases. The data analysis is achieved through the thematic analysis approach. The secondary data collected is analysed using qualitative analysis. This goal has been achieved through the interpretation of the issues identified based on how they are related to the case. The qualitative data analysis technique is enhanced by incorporating the thematic analysis. This goal has been achieved through the adoption of the within-case analysis.

Literature review: Sustainable development in real estate

Sustainable development can be defined as the process of meeting the present issues without trading off the capacity of future eras to address their issues. Whilst there has been much consequent level-headed discussion as to its exact significance there is a general comprehension of the ideas of sustainability that are accommodated in the definition. Subsequently, sustainability is commonly conceptualized as having three widespread components, for instance, environment, financial and social, commonly alluded to as the Triple Bottom Line (TBL). These three components (environment, financial and social) normally include issues to do with individuals (social), nature (environment) and benefit (monetary) (Burns and Bush 65). In connection to urban improvement various creators have taken the WCED meaning of maintainable development and the ideas it brings and from that made their own particular contextualized meaning of practical development and the components of the TBL.

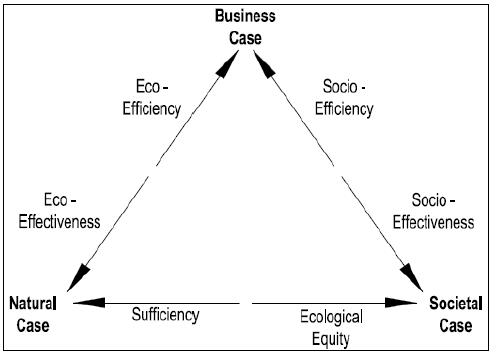

This sustainable advancement has its individual subtleties, even though they are rooted in the WCED definition and the TBL. By and by, the components of the TBL are emphatically connected and meeting every one of the difficulties for manageable improvement is liable to include tending to the three components at the same time. However, such synchronous thought can prompt elevated amounts of unpredictability in the level of understanding and cooperation (Geltner 54). As a reaction to this many-sided quality, scholars propose a halfway joining, with probably the most fascinating difficulties being at the interfaces of the TBL. The interfaces provide the space for particular issues and strife. For instance, at the conflict between the environmental problems and the social problems delimits sustainable development from realizing the environmental justice and ecological equity. This is on the grounds that ecological weights are frequently unevenly disseminated amongst the populace. In relative terms, those from monetarily and socially denied groupings can be more impeded by biological debasement than the less denied people. This is only one sample of the numerous issues that can emerge at the interfaces. Taking into account the diverse components of the TBL likewise makes distinctive sustainability cases.

Case study

The real estate industry is essential in a country’s national economic development. The significance arises from its unique characteristics in contributing to economic growth. Therefore, ensuring its sustainability should not be ignored. Sustainability influences a country’s sustainable development directly. Mouzughi, Bryde and Al-Shaer define sustainable development as the capacity to address the current needs without compromising the future generations’ ability to meet their needs (1710). Despite the view that numerous research studies have been conducted on sustainability, the studies have largely ignored the real estate. Rudie and Thoyre affirm that the contribution of the real estate to a country’s economic development is under-theorised, trivialised, and neglected (5).

The real estate market is recognised as a critical component in the attainment of sustainable development in developing countries. A study conducted by “PricewaterhouseCoopers” affirms that the developing countries will experience a high rate of migration into cities (4). Some of the cities will become centres for wealth creation while others might fail. The burgeoning population will culminate in a significant demand for real estate assets like housing and infrastructure.

Saudi Arabia: A case study

Economic growth

Saudi Arabia is characterised by a strong economic performance emanating from its oil reserves. The country has approximately 16% of the total world petroleum reserves. The oil sector accounts for approximately 45% of the country’s Gross Domestic Product, 80% of the country’s budget revenue, and 90% of the total exports. By the end of 2015, the country’s real GDP growth rate was estimated to be 3.4% while the rate of unemployment was estimated to be11.4 %. This aspect indicates the existence of remarkable pressure in the country’s capacity to maintain its economic stability (“Central Intelligence Agency” par.3).

Population growth

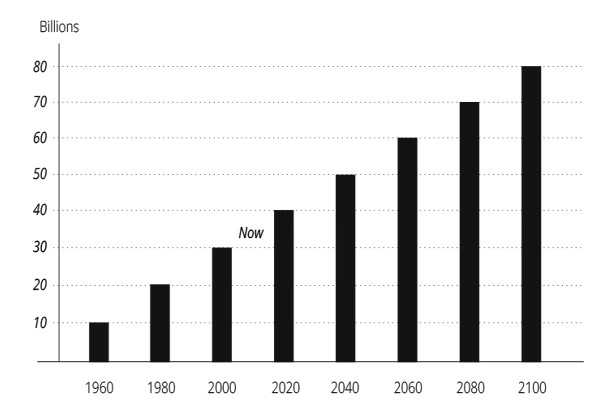

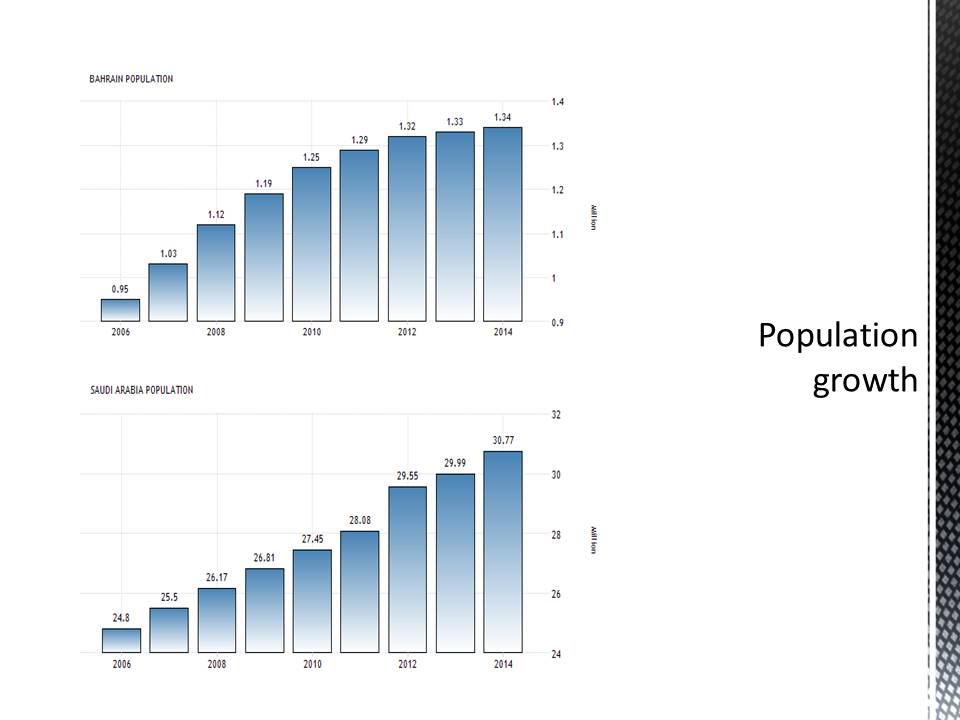

In July 2015, the country’s population was estimated to be 27.8 million. It is projected that the population will increase to 40 million by 2025. The population is expected to grow exponentially into the future as illustrated by the Graph 1 below.

Despite this aspect, only 30% of the country’s population own residential property (“Kingdom of Saudi Arabia Arriyadh Development Authority” 77). This trend of few individuals owning residential property is likely to grow due to the high level of urbanisation. The country’s economic growth is supported by diverse industries amongst them the petrochemical products manufacturing and the construction industries. In the recent past, the country has increased its commitment to the attainment of sustainable development. Subsequently, the country is advocating the growth of different economic sectors (Hashmi, Abdulghaffar and Edinat 47).

Contribution of the real estate sector to economic growth

The real estate sector in the Kingdom of Saudi Arabia is a key contributor to the country’s GDP. The sector is correlated with approximately 80-100 economic sectors. Some of the core sectors include the contracting and building materials (“Kingdom of Saudi Arabia Arriyadh Development Authority” 79). According to the Saudi Arabia Monetary Agency (SAMA), the real estate sector accounted for 5.5% of the country’s GDP, which represented a 6.7% growth compared to the 2014 performance (“KPMG” 7).

In this errand the nation has been generally fruitful. As indicated by the World Bank statistics, the nation is in the high wage, non-OECD section, having a GDP of more than $30 billion with a medium population growth rate. As far as the development of the real estate sector, pointers distributed by the World Bank survey such components related to the degree of interest of natives in the decision of government and the vicinity of things thought to be imperative in a free society, for instance, the opportunity of expression/affiliation, and an autonomous. The pointers also survey the indicators of the nature of public administrations and the level of its autonomy from political weights, the nature of policy plan and execution, and the validity of the administration’s dedication to such approaches (Neaime 234).

Utilizing such pointers to evaluate execution of nations in the GCC region, Saudi Arabia’s percentile rank positions were 69 and 16 respectively, firmly tantamount to the neighbouring GCC nations against the marker. The World Bank information demonstrates the dangers of attempting to make suppositions of uniformity between the GCC nations and an abnormal state of variability is shown when there is a scope of different variables, for example, worldwide rivalry and growth of GDP. There have been particular issues, experienced by a percentage of the bordering countries like the UAE, which recognize with financial and social sustainability criteria. In Saudi Arabia, the blast in the real estate sector came with an ascent in the number of immigrants who make up around 38% of the populace (Neaime 240). Many citizens from the western countries relocated to Saudi Arabia to work in the real estate business and in the new administration divisions, for example, the financial industry. This causes an increased demand and pressure on private properties, and consequently, prompts the costs of land to expand significantly.

Rate of construction

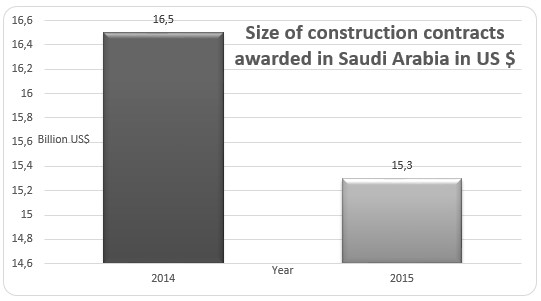

Nevertheless, the country has experienced a significant reduction in the rate of construction over the past two years, which has affected the growth of the real estate sector. This observation emanates from the identification of the reduction in the size of construction contracts awarded as illustrated by Table 1 and Graph 2 below.

Table 1.

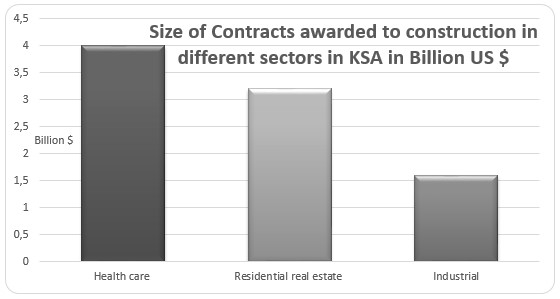

Graph 1 shows a significant reduction in the size of construction contracts awarded in 2015 as compared to 2014. The healthcare sector accounted for the largest proportion of all construction contracts awarded in the country followed by the residential real estate and industrial sector as illustrated by Table 2 and Graph 3 below.

Table 2.

According to Graph 2, the residential real estate sector performance was relatively lower as compared to the healthcare sector. However, it is projected that the real estate sector will experience a remarkable growth in the future. The growth will be spurred by the increase in commercial development and the rise in demand for housing. The real estate sector’s performance will further be enhanced by the development of the hospitality sector (“Kingdom of Saudi Arabia Arriyadh Development Authority” 36).

Demand for housing

The Kingdom of Saudi Arabia is currently experiencing a remarkable increase in demand for housing. Findings of a survey conducted by King Faisal University Department of Urban and Regional Planning showed that the demand for new housing in the KSA would increase to 2.9 million between 2005 and 2025 (“Kingdom of Saudi Arabia Arriyadh Development Authority” 37). This aspect represents an average annual growth of 145,000 units. To deal with the rising demand for housing, the KSA intends to promote the real estate’s capacity to address the housing demand by fostering building activities. The KSA intends to achieve this goal by freeing up more land for construction. Additionally, the government expects to increase its public expenditure on housing. In 2014, the KSA allocated $ 67 billion to a programme aimed at bridging the housing demand gap by building 500,000 housing units. The programme targets the low-income families (“EY” 9).

Summary

In the recent past, the Kingdom of Saudi Arabia has prioritised the real estate as a key contributor to the country’s economic growth. The KSA considers the real estate sector as a fundamental component in enhancing its capacity to achieve economic diversification. Some of the areas that the KSA considers as critical in the pursuit of economic diversification entail tourism and foreign direct investment. To achieve this goal, the government plans to establish four economic cities. Each of the economic cities will be based on a specific area of specialisation. The KSA will ensure that the economic cities are established in compliance with the stipulated environmental guidelines. The KSA will ensure that the state-of-the-art Greenfield technologies are integrated. It is expected that the economic cities will create job opportunities for the local population through the promotion of domestic and foreign investment (“EY” 5). Despite the real estate sector’s potential for growth, it has faced political and financial challenges in the past (“EY” 6). Traditionally, the Saudi banks have been cautious in advancing credit facilities to real estate development. Thus, the rate of investment in the sector has been substantially low. However, this aspect is expected to change in the future.

Comparison with Bahrain

Kingdom of Saudi Arabia

The Kingdom of Saudi Arabia is the leading in production and exportation of oil in the world and this makes it be an important member of the Group of Twenty (G20) countries. Actually, the Kingdom of Saudi Arabia is the only OPEC country in the G20. Moreover, Saudi Arabia has the largest economy among the countries in the Middle East. The other members of the G20 have more stable international financial markets as compared to the Kingdom of Saudi Arabia. However, of late, the Kingdom of Saudi Arabia has amassed enough revenue from the oil business to strengthen its international financial market. The Kingdom’s authority is completely aware of the obligations intrinsic in being a superpower on the planet oil market. They comprehend the immediate effect of high and unstable oil costs on world monetary development. The high cost of oil is not, obviously, the main issue upsetting the world economy and thwarting development, yet it constitutes one of the essential elements that add to insecurity on the planet’s economy. In this way, as an individual from the G20, encouraging the sound development of the world economy constitutes the foundation of Saudi Arabia’s oil approach.

The real estate market is rapidly developing in Saudi Arabia. It has turned into a standard practice for Saudi government’s policy-makers to demonstrate occasionally the imprint or a particular reach for what they consider ‘a sensible or reasonable cost’ for the housing facilities. The Saudi practice is uncommon, as the costs of the real estates are controlled for particular goals. Cost is an element of supply and demand. The obligation of Saudi Arabia, the world’s pre-famous oil power, and swing maker, is to keep up the supply-demand equalization. The part of swing maker has given the Kingdom impressive impact in the housing market. Actually, the real estate value dependability and the upkeep of sensible costs lie at the heart of Saudi Arabia’s housing approach. The Kingdom’s administration perceives that rising rough costs could wreck worldwide financial recuperation and leads the best approach to steep decline and that short-run pick up from high oil costs balances by decreased deals later on. Saudi Arabia delivered 13.3 for every penny of worldwide oil in 2012, and at present has a normal creation limit of 10 million barrels for every day. With its assumed 2 million or more barrels for each day of extra limit, it is resolved to hold its part as the world’s swing maker and the political and business sector impact that this gives.

The Kingdom’s initiative additionally demonstrated some concern about the impact of high housing costs on the future oil utilization and the likelihood that high housing costs could prompt ‘interest annihilation’. This could, thus, result in a lasting movement on the interest bend toward lower interest, leaving the significant oil delivering nations, particularly Saudi Arabia, with impressive ‘unmoving overabundance limit’. To a great degree low oil costs, then again, influence the development capability of the growing nations and the stream of venture to the business, which would at last undermine the real estate’s security, with negative effect on the interests of both developing and developed nations.

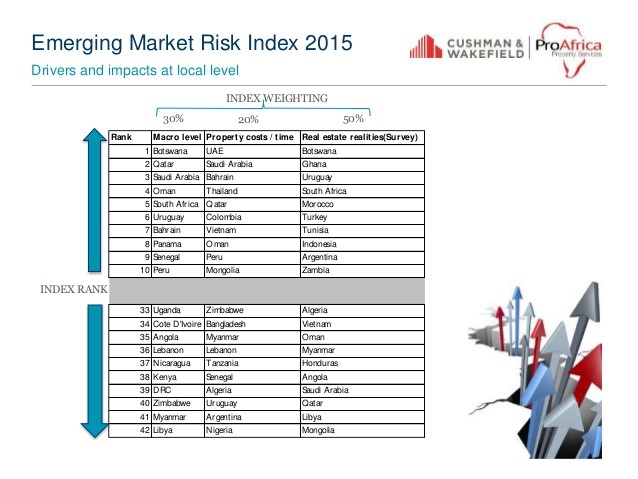

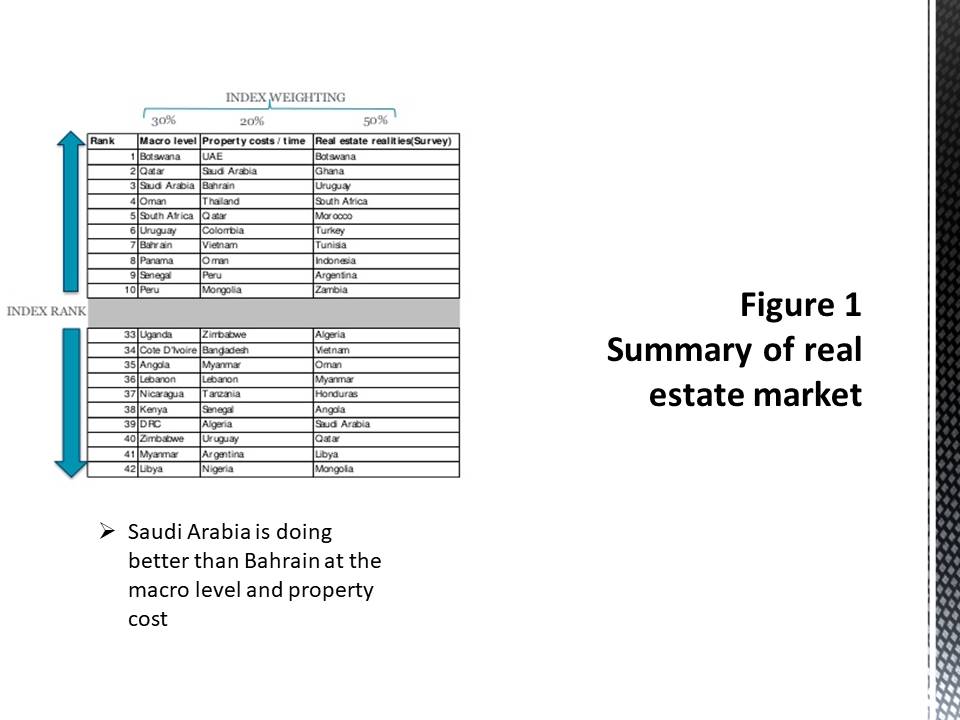

Bahraini

For the Bahraini securities business sector vacillation and oil value instability, the short run analysis revealed slight hints of high connection between the variables over the period under study, for instance, 2009 and 2010. The variables had a lag of 8 to 16 days. Over the long run, the variables had a lag of 128 days and the results revealed that there is a high relationship between the two variables (source). Considering the Bahraini economy, the outcomes are to some degree in line, as Bahrain is an administration-based economy, with immaterial dependence on hydrocarbon trade. Notwithstanding this, Bahraini securities exchange is moderately open to global speculators, and has been making a decent attempt over the past decade to create itself as the portal to the Middle East for western investors (source). With this framework of capital markets and economy, the oil value fluctuations are negative since the worldwide economies shift to the Bahraini economy. This aims at lessening the global venture portfolios or exchange to more secure securities. This assists with the comprehension that any value unpredictability in the real estate markets would affect the Bahraini Stock Market with a short slack of 4 to 8 days, yet that impact ceases to exist over that slack, and the enduring effect of that persists over the long run. Figure 1 shows the summary of the real estate markets between the two countries and other countries.

Population growth

Bahrain and the Kingdom of Saudi Arabia are experiencing a high rate of population growth, which is expected to continue into the future. However, Bahrain’s population is relatively lower as compared to that of the Kingdom of Saudi Arabia. By “the end of 2010, Bahrain’s population was estimated to be 1,234,571” (Acosta and Wiesbrock 145).

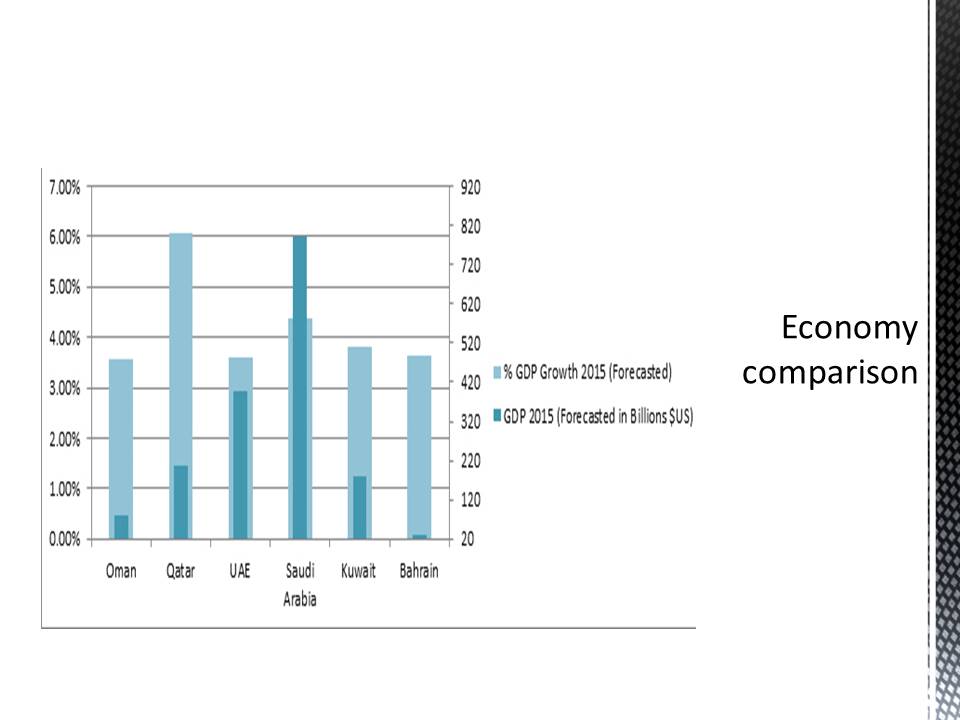

Economic growth

Unlike the Kingdom of Saudi Arabia, which is characterised by a strong economy, the Bahrain’s economic status is relatively weak. The real year-on-year Gross Domestic Product growth in 2012 was estimated to be 3.4% (Mouzughi, Bryde and Al-Shaer 1716). Additionally, the country’s rate of unemployment as of March 2013 was estimated to be 4.2% as compared to that of the Kingdom of Saudi Arabia, which is estimated to be 11.4%. Additionally, Bahrain has a “relatively high public sector debt as a proportion of its GDP” (Mouzughi, Bryde and Al-Shaer 1713).

Growth of the real estate sector

The real estate sector in Bahrain has undergone remarkable growth over the past decade, which is evidenced by the multi-billion dollar residential, commercial centres, and sporting facilities that have been developed. The country has further been engaged in undertaking numerous landmark projects such as the establishment of real estate on islands reclaimed from the sea. Similar to the KSA, Bahrain considers the real estate sector as a fundamental component in its pursuit of economic diversification. The country considers real estate as a critical component in stimulating the growth of the tourism sector.

Sustainable development

The sample of Saudi Arabia shows the trouble a developing nation can confront in meeting sustainability criteria in the process of developing the real estate sector. In the same manner as different nations in the Gulf Region, Saudi Arabia has seen a monstrous development in its real estate sector in the last decade, characterized by with billions of dollars in improvements in private properties, business centres, shopping centres, sporting facilities and relaxation offices and the formation of recreational spaces (Neaime 244). Numerous interesting undertakings have been embraced, including the construction of skyscrapers in the city, the making of land on man-made islands worked through area recovery from the ocean. The centre of these and different advancements has primarily been on meeting financial maintainability criteria, for instance, accomplishing the objective of diminishing the nation’s reliance on oil and the enhancement and privatization of its economy into such segments as account, recreation and tourism and information technology.

In the last decade, the cost of land has tripled. Bahrain from low wage regions then discovers it progressively hard to bear to purchase a house, which prompts a feeling of exclusion. Such avoidance can escalate the occurrences of social distress. The low-income groups are normally used as a source of cheap labour in real estate constructions. And in addition, the issue of rejection from housing because of the inability to afford to buy a house, as experienced by a few Saudi nationals, immigrants can likewise experience the ill effects of social avoidance, being far from family and living in a provisional settlement on destinations far from support services.

Housing prices

There are non-specific systems to sustainable development. Such non-exclusive systems recommend that various procedures can be taken after as a major aspect of sustainable development, each of which view the idea of sustainability through various lenses, or a mix of lenses, for example, looking for general financial development and productivity; social equity, monetary opportunity, wage uniformity; and environment security (Barnes and Scornavacca 130). Nonetheless, what is missing is an exact investigation of how such techniques can be contextualized to particular nations and commercial ventures. It is because of such deliberations that effort for accomplishing sustainable improvement targets are distinguished and such recognizable proof can advise the content of arrangement and give the important pre-conditions to successful approach suggestion.

The real estate segment of Saudi Arabia is fast rising. It is rising in the same rate as the one for Bahrain. In the urban centres and the major cities, the cost of acquiring a property has gone up. This is attributed to increased urbanization, in which several citizens have migrated to the urban centres in search of greener pastures. These two countries also provide refuge to immigrants, especially from Africa, who have migrated to work for the wealthy people in the cities.

Results

The analysis identifies that both Saudi Arabia and Bahrain are experiencing a high rate population growth, which is expected to progress into the future. The study identifies the real estate sector as a vital component in Saudi Arabia and the Bahrain’s pursuit of sustainable development. The sector significantly contributes to the countries’ Gross Domestic Product through direct and indirect avenues. One of the notable contributions to the country’s sustainable development relates to the creation of employment. Apart from being a direct source of employment, the real estate sector supports the growth of other economic areas such as the hospitality and health industry. This aspect has led to a remarkable increment in the consumers’ purchasing power. The purchasing power constitutes an essential element in increasing the rate of consumption, which is a key component in the growth of a country’s GDP (Mouzughi, Bryde and Al-Shaer 1715).

The high population growth rate presents a major challenge to the country’s sustainable development due to the housing problem (Mouzughi, Bryde and Al-Shaer 1717). To overcome the housing challenge, Saudi Arabia and Bahrain are increasing the size of government expenditure in promoting the availability of affordable housing. One of the notable projects in Bahrain relates to the reclamation of sea land to provide space for real estate development. Similarly, the allocation of $ 67 billion to a programme to establish 500,000 units highlights the KSA government’s commitment to leverage on real estate in the promotion of economic development. Providing affordable housing constitutes an essential aspect of enhancing economic growth. This assertion arises from the view that affordable housing improves the citizens’ living conditions.

The two countries have further identified the real estate sector as a fundamental component in achieving the economic dimension of sustainability. The study shows that the real estate sector in Saudi Arabia and Bahrain is vital in supporting economic activities in other areas through direct or indirect methods. One of the economic sectors that the real estate industry influences is tourism. Currently, the two countries are characterised by an underdeveloped tourism sector. Nevertheless, the two countries have identified the tourism sector in their economic diversification pursuits (Hashmi, Abdulghaffar and Edinat 47). However, the development of a sustainable tourism sector is dependent on the availability of accommodation facilities and efficient infrastructure. Therefore, the KSA and Bahrain governments must ensure that balance is established in promoting other industries that directly or indirectly affect the real estate sector.

Despite the sector’s capacity to promote the attainment of sustainable development, the study shows that the two countries are experiencing a challenge due to the limited space for the development of real estate. In the quest to develop the available land space, it is imperative for the governments to ensure that the activities in the real estate sector do not affect the ecosystem adversely. To achieve this goal, Bahrain and the KSA are increasingly adopting environment-friendly approaches. Some of the notable approaches entail the integration of green energy technologies.

Conclusion

The study identifies Saudi Arabia and Bahrain as some of the notable developing economies in the Gulf region. The countries’ economic growth has arisen from the rich oil reserves. However, the capacity of the oil resource to stimulate the countries’ future economic growth is limited due to the reduction in oil reserves. In the quest to achieve sustainable economic development, the Kingdom of Saudi Arabia and Bahrain have recognised the importance of diversification. One of the avenues through which the countries intend to achieve this goal is by promoting the development of the real estate sector. The rationale for focusing on the real estate sector emanates from the view that the industry contributes to economic growth through direct and indirect means. The direct means relate to the promotion of the performance of sectors such as the companies producing construction and raw materials. Conversely, the real estate sector stimulates the performance of other sectors such as the hospitality industry. The strong performances of these sectors contribute to job creation hence improving the countries’ capacity to cope with the high rate of unemployment. Therefore, the development of the real estate sector will culminate in a remarkable improvement in the sector’s contribution to the countries’ GDP. Subsequently, the two countries will attain sustainable economic development.

The private-public partnerships are a suitable administration strategy to empower advancements in such zones as structures, housing, and relaxation activities to occur in the developing nations. In such a strategy, where the right accomplices are chosen, can guarantee that sustainable advancement is both proficient and compelling and, subsequently, best meets the economic, societal and, eventually, ecological cases. Consequently, the impediments of the examination should be perceived and no cases of generalizability of the discoveries past the case are made. Nevertheless, the discoveries make a commitment to information by investigating potentially the connections between real estate development and sustainability as conceptualized by the Kingdom of Saudi Arabia. The results from the case demonstrate courses in which the real estate segment can possibly add to the accomplishment of procedures of socio-productivity and socio-adequacy as a major aspect of sustainability. In particular, it highlights the significance of tourism, job creation, cultural adaptation, affordable housing, and infrastructure. It has additionally empowered various suggestions to be produced that can illuminate the bearing of further work here and test the legitimacy of the discoveries to different cases.

In addition to economic sustainability, development in the real estate sector will contribute to the attainment of social sustainability. This goal will be achieved through the provision of affordable housing. The two countries are projected to experience exponential growth in the rate of population growth. This aspect might worsen the housing challenge that the two countries are currently experiencing. In the quest to deal with this challenge, the Kingdom of Saudi Arabia and Bahrain are increasing their government expenditure in the provision of affordable housing. This approach will culminate in the improvement of the citizens’ living conditions. Therefore, investment in the real estate sector will lead to successful improvement in the sustainable economic development in developing countries.

Presentation

Introduction

Kingdom of Saudi Arabia – Outlook

- The leader in production and exportation of oil in the world.

- An important member of the Group of Twenty (G20) countries.

- The only OPEC country in the G20.

- Largest economy among the countries in the Middle East (Lundberg 18).

Bahraini – Outlook

- Bahrain’s economic status is relatively weak as compared to Saudi Arabia(Barnes and Scornavacca 130).

- Average GDP growth of 3.2%.

- Has a relatively high public sector debt as a proportion of its GDP.

Summary of real estate market

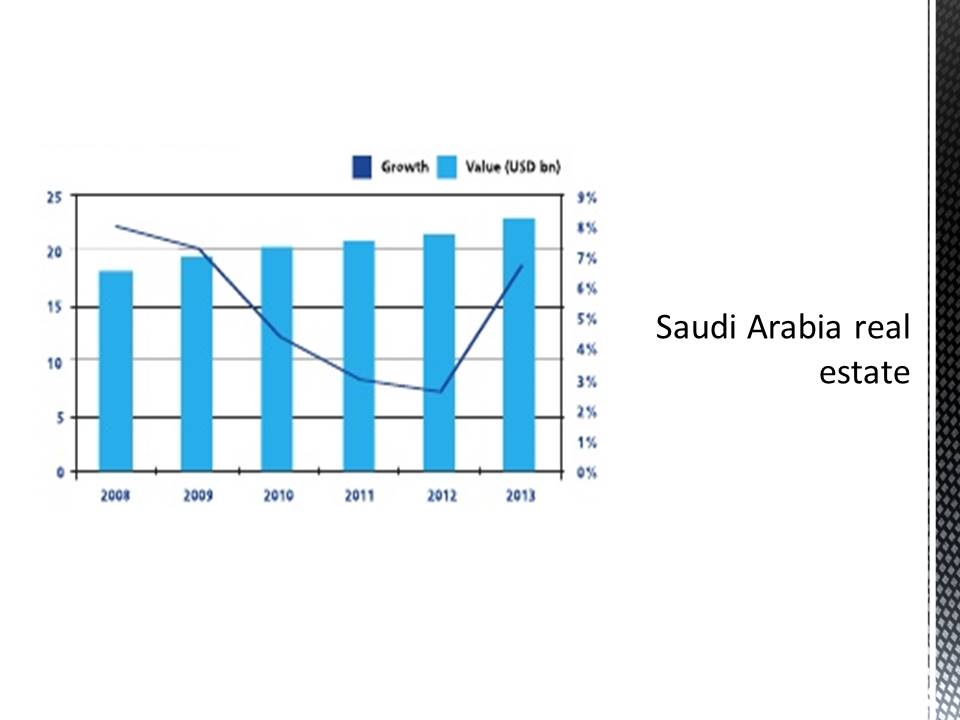

Saudi Arabia is doing better than Bahrain at the macro level and property cost.

Bahrain real estate

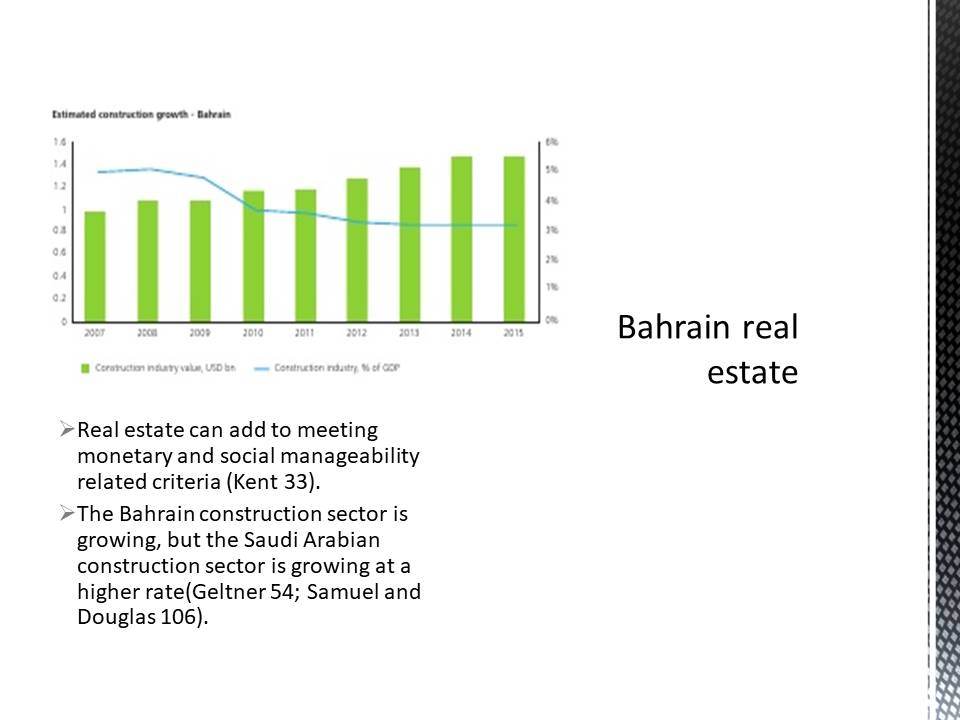

Real estate can add to meeting monetary and social manageability related criteria (Kent 33).

The Bahrain construction sector is growing, but the Saudi Arabian construction sector is growing at a higher rate(Geltner 54; Samuel and Douglas 106).

Discussion

The developed countries pay attention to natural-related sustainability issues rather than financial and social sustainability.

The requirement for eco-proficiency and adequacy is expected to develop in future.

Bigger economies benefit from large economies of scale.

Sustainability has a greater impact in the developing countries than in the developed countries.

The growth of the real estate sector is attributed to the development of infrastructure.

The development of infrastructure will necessitate the development of affordable housing and tourism.

Conclusion

There is much support from the private and public sector to support sustainability.

The growth of the real estate sector contributes to the growth of the economy.

The construction sector still has to play greater role in socio-productivity and socio-adequacy as a major aspect of sustainability.

Works Cited

Barnes, Stuart and Eusebio Scornavacca. “Mobile marketing: the role of permission and acceptance.” International Journal of Mobile Communications2.2 (2004): 128-139. Print.

Burns, Alvin, and RF. Bush. Marketing Research, Upper Saddle River: Prentice Hall, 2006. Print.

Geltner, David. Commercial Real Estate Analysis & Investments, Ontario, Canada: Cengage Learning, 2007. Print.

Haley, James. “Economic Dynamics of Work.” Strategic Management Journal 7.1 (1986): 459-471. Print.

Haspeslagh, Philippe, and DB. Jemison. Managing Acquisitions: Creating Value through Corporate Renewal, New York: Free Press, 2011. Print.

Kent, Ray. Marketing Research, London, England: Thomson Learning, 2007. Print.

Lundberg, Curt. “Toward Theory More Relevant for Practice.” Current Topics in Management 6.1 (2001): 15-24. Print.

Neaime, Simon. “Financial Market Integration and Macroeconomic Volatility in the MENA Region: an Empirical Investigation.” Review of Middle East Economics and Finance. 3.1 (2005): 231-253. Web.

Samuel, Craig, and PS. Douglas. International Marketing Research, London, England: John Wiley, 2005. Print.