Executive Summary

This report is aimed at analyzing the effects of the Euro zone economic crisis on international business. The report also gives an account on the actual and potential business risks that are likely to be experienced in the Euro zone by prospective businesspersons. The results of this report assert that the crisis in the Eurozone is not a regional problem, but goes beyond Eurozone.

Globalization has precipitated a global and interlinked business village in which economic problems are no longer solitary. Moreover, it was established that poor economic policies and a culture of impunity are some of the driving forces behind the crisis in the Eurozone economic crisis. Furthermore, the report posits that the adverse effects of the crisis in the Eurozone will reverberate to other parts of the world.

Relevant recommendations have been outlined to assist that dissects the Eurozone’s economic woos and provides a succinct analysis of the core strategies potential investors in the region may wish to pursue to cushion them against impacts of these problems.

Introduction

Countries, just like firms, operate their within the principles of theories of capital structure. The theories of capital structure attempts to provide an explanation between the mix of securities and financing sources that may be employed by nations to finance their real investments.

These theories of capital structures emphasize on the levels of debts and equities on firms and are determinants to the capacity of a nation to finance its projects. Several theories have been advanced on the debt-equity choices without one being universally accepted.

This suggests that the path a firm or nation will follow does not depend on a universally accepted throry of capital structure, but is guided by the internal structures of a nation’s financial characteristics and its debt levels.

The pecking order theory on the other hand advances that a firm will borrow, rather than issue equity, when internal cash flows are not sufficient to fund capital expenditures, suggesting that the amount of debt will reflect on the firms cumulative need for external funds.

The free cash flow theory on the other hand proposes that dangerously high debt levels will increase value, notwithstanding the threat of financial distress, when the firms operating cash flow significantly surpasses its profitable investment opportunities.

The crisis that currently afflicts the Eurozone is not a unique economic crisis to the European region. Despite the fact that its impact in the region is greater, it is shifting the balance of trade with the regional trade partners. This implies that as long as the Eurozone continues to exist within this shaky economic situation, the rest of the world must brace itself for tough economic times ahead.

As stated above, the aim of this report is to demonstrate the economic destabilizing effects that impacts on Eurozone countries. Whereas the report will make these observations, it is not limited to that scope.

Within this process on examining the effects of the Eurozone crisis on international business, the report will illustrate the potential risk areas and provide relevant recommendations. An assessment of the local impact the crisis has on businesses will be conducted alongside the global impact. Short and medium term political impacts on businesses will also be dissected in this paper.

Definition of terms

Eurozone – European countries that have adopted the Euro as national currency in a process aimed at monetary and economic unification.

Contagion-Transmit ion through contact.

Gold standard– the system of monetary organization under which the value of a country’s money is legally defined as a fixed quantity of gold and domestic currency of that country.

Discussion

Origins of the financial problems

The international financial crisis that was witnessed in 2007 to 2008 impacted hard on 16 members of the Eurozone. The impacts of the financial crisis on most countries have had significant shift in their economic set ups, their public deficit have reached record figures with and considerable increase in their public debt (Kaiser 2007).

The economic turmoil in Greece remains an avid example that cannot be blamed on the international financial crisis that rocked the world and continues to be felt. The economic woos of Greece draw their origins from wrong judgments on the part of political leaders.

Effects of the Eurozone crisis

The effects of the financial crisis in the Eurozone have not been limited to the member countries. The US president asserts that the problems of the economies of the world will continue to demonstrate weakness as long as the issues of Greece and the larger Eurozone are not addressed promptly (Peston, 2011).

Indeed, the Eurozone’s economic situation is a significant concern to the United States, which is embroiled in its domestic economic problems experienced in the last half a decade. It remains a fact that Greece’s debt problem will continue not only get complicated if effective remedies are not put in place, the United states will continue to express grave concern over Greece’s inability to service its debts.

Such economic circumstances may in turn precipitate panic in the US economy and global economy and create far-reaching implications for the US and rest of the world (Ramonde 2011). In mitigating the effects, the USA is examining effective strategies to dilute the far-reaching impacts.

Economic stimuli programs such as increasing the levels of exports to cover the gaps of recession have been proposed as viable options in addressing the challenge. However, the persistence of the Greece’s situation is likely to witness weakening of the Euro and the strengthening of the dollar. Such a set up in economic shape that makes imports to the Eurozone expensive would remain disastrous in these hard economic times.

As the situation prevails, the debt continues to accumulate; the value of the Euro will eventually decline. This will raise interest rates that will consequently make life unbearable for the common population.

Despite the fact that the European Central Bank has injected bonds from the struggling governments in an effort to try to reduce the financial pressure, a reduction of deficit levels is proving to be a tall order. Interest rates are skyrocketing and the chances of defaulting are real and banks around the world are feeling the heat under the collar (Sinclair, 2011)

Efforts to avert the crisis

Indeed, the effects of the Eurozone crisis are of concern to all governments due to the interdependence nature of the world economies. Stock and bond markets in the Eurozone are continuing to slide down sharply amid the fears that governments’ efforts in those areas are not strongly reassuring. As this happens in the Eurozone, economic sentiments outside the zone are continuously dwindling.

The UK is burning its fingers to ensure that Greece is stabilized because the opposite would be disastrous. In the event that Greece defaults on payments, UK banks that have heavily invested in Greece would definitely incur huge losses. This brings a new and complex dimension to an already grave situation.

It suffices to say that Britain is not in the Eurozone, however, as it has been shown, the problems of the zone are not limited to member states alone. The EU accounts for 40% of the exports of Britain (Laidi, 2011).

The UK has been on the forefront in lending money members of the Eurozone. Britain must be on the forefront to ensure that the advanced loans are not lost in the economic meltdown. Defaulting on the part of the countries of the Eurozone would worsen Britain’s austerity problems.

Impact of the Eurozone Crisis on Cost of Capital for Firms

How firms select their capital structures is a question that has been severally asked and analyzed without a definite answer being arrived at, given the economic realities of the specified times. The case of Eurozone economic crisis presents challenges in accessing capital for small and large firms and economic short and long terms are severe.

This will essentially bring forth the issue of capital structures of companies that are operating under credit constraints. It has been ascertained that “credit crunches” as in the case of Eurozone crisis affects the corporate capital structure decisions for both small and long-term firms. The frictions in the credit creation process result in fluctuations in the supply of bank loans.

These imperfections could result from monetary shocks, bank assets devaluations, and regulatory changes, a congregation of factors that severely affect growth of businesses. This is a direct consequence of spiking interest rates on loans.

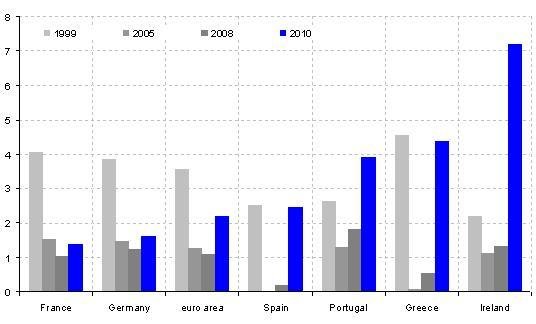

Ex-post real interest rates in different European Countries Source: European Central Bank (2011)

Basically, changes in supply frictions in the case of credit has impacts on the leverage ratio, issuance choice and the mix of debt sources of small bank dependent firms as contrasted with firms that have public market access, following positive or negative supply chokes (Leary, 2005).

For example, Leary (2005) has demonstrated that the use of public debt by firms that have access to public markets increases relative to that of small firms. This would cement the underlying believe that bank loan supply movements are important determinants of variations in firms placement of their debt and by extension, capital structures.

What is important to note is that small firms may experience more difficulties in gaining access to credit during economic crisis, given their less intense asset bases, that is required as collateral in the issuance of loans. As a result, smaller firms may actually not be highly dependent on bank loans, largely because they fail to meet loaning requirements from the financial institutions.

As opposed to large firms, small firms experience worse economic impacts in such hard economic situations. This is because their scale of operations is low, which means that they do not benefit from the economies of scale which limits their operations and generally inhibits their growth and ability to develop and dominate the markets.

The impact of Eurozone crisis on shareholder and wealth of most affected companies have been severe. According to European Central Bank (2011), the value of stock market declined sharply from 2007 to 2011 while real house prices shot up by almost a similar margin. This is because of high inflation rates in Eurozone as comparison to other regions as indicated by the graph below.

Break-even inflation rates. Source: European Central Bank (2011)

Conclusion

The crisis in the public finances of Greece and other members of the Eurozone provoked a new episode in the financial crisis in the first quarter of 2010, in what was initially called sovereign debt crisis, affecting Greece and later other peripheral countries of the Eurozone such as (Laidi , 2011).

This crisis began with the massive sale of public debt of the countries involved in the financial markets, which are caused by several motives. On one hand, the fear of investors of a default in the payment of the debt (interests and repayment) on the maturity date, given the financial difficulties of the countries precipitated the problem.

Furthermore, reasonable reaction in defense of the financial assets, some illustrious financial institutions (not only the denigrated hedge funds) involved themselves speculative operations that were intended to earn huge benefits in the short term. This kind of selfish ideologies was benchmarked on the idea that the price of bonds would collapse.

Both reasons caused a massive sale of public debt bonds, which in turn led to an increase in the risk premium. This can be explained that the financial markets indicate (with or without reason) that public indebtedness is excessive, that it has overcome admissible levels (Ramonde, 2011).

The consequence is that financing the countries affected becomes far too expensive, especially the case of Greece. Other peripheral countries of the Eurozone, derogatorily called PIGS by the English media, are increasing the difference between the interest rates.

Therefore, the countries affected (who need financing not only to address the actual public deficit, but also to repay the old debt on time), have to issue the new public debt bonds at a much higher interest rate. The financial burden that results from the crisis, especially on the interest rate of the Eurozone countries has resulted in the direct increase of the public debt.

Consequently, these countries face the risk of trapping themselves in the deficit-indebtedness vicious cycle (Peston, 2011). It comes to one’s knowledge that even though these countries are compelled to issue new public debt bonds at higher interest rates, the inevitably risk that there may be default on part of struggling countries can only be compared to putting the cat among the pigeons.

This is the case of continuing to invest in a ship that shows no signs whatsoever of recovering. If indeed this is the case, then it is obvious what is given to you is not seen by others.

In April 2010 following all economic and political forecasts, it was obvious that the deficit-indebtedness was headed for a complete cycle. Countries such as Greece had already initiated the process of formally requesting for financial aid from other member states in the Eurozone. After many doubts and delay, the Eurozone finally responded with a bailout plan for Greek public finances.

However, in spite of the Greek rescue plan, and the fact that there are significant differences in organization of public finances among member countries, there was no clear and straightforward solution to the problem. Other nations, particularly the peripheral states had their own concepts on how to deal with the situation. This led to mistrust among the financial markets, ideally worsening the sovereign debt crisis (Sinclair, 2011).

On the understanding of the large debts on properties such as homes, businesses and banks, and given the fact that there were weak perspectives of economic growth of the Eurozone countries; the situation was bound to get worse. The mistrust would later extend to the privately held bonds, the stock market, and other important cornerstones of economy.

This was particularly severe in May and June 2010. Hence, serious financial turbulences took place in the private fixed and variable interest rate markets, which lead to capital movements of financial assets in Euros to financial assets issued in other currencies, causing the depreciation of the Euro in relation to the Dollar, the Swiss Franc, gold and other reserve assets (Ramonde, 2011).

As investors began to realize that the financial markets in the Eurozone are not providing solutions to this problem, they considered taking off and thus creating a panic that resulted in the weakening of the Euro in relation to other global currencies. This weakness could have been considered a plus to the dollar, but in a subtle way, it was not necessarily the case.

The weak Euro definitely opened the way for the dollar to assert itself. The problem is that this assertion does little good to America, especially because it was working on ways to increase its exports to the Eurozone countries. Confronted with these precarious events, that worsened the crisis and threatened the overall recovery of European economies.

One particular interest was the response by Ecofin (Economic and Financial Affairs Council), which was so much delayed due to the doubts raised by countries such as Germany and other central countries as to the real benefit of helping countries with serious financial unbalances (Peston, 2011).

In order to create the European Mechanism of Financial Stabilization, a temporary institution aimed at favoring countries that could be going through serious financial problems, and the commitment of these countries, namely Portugal and Spain, to take stronger measures to overcome public deficit than those taken until then (Ramonde, 2011).

This is apart from the on-going plans to create communitarian institutions that supervise the operations of stock markets and financial institutions, to try to avoid financial imbalances in the private sector, as well as reforming the Growth and Stability Pact (the rules to ensure the balance of the countries’ public finances). This is also aimed at adopting harsher control measures and more severe sanctions to those countries that fail to comply with the rules.

In brief, the problems in Greece have affected the whole region adversely and the survival of Greece hinges on issuing bonds at higher interest rates. This translates to plunging her deeper into economic debt. The debt accumulated may be impossible to repay given the current economic realities. The question is how to handles tensions and suspicions that begin to mount in these countries.

Proposals to separate Eurozone into south and north zones may not translate to better economic situation as the problems are far entrenched into the entre global economy. Such a framework would be too expensive and would mean that those who opt out of the currency revert to their former currencies (Piris, 2010).

Recommendation

The financial institutions in the Eurozone ought to be supervised closely by the relevant authorities. In addition, the remunerations of top-executives need to be revised to be consistent with the prevailing economic conditions. When there is a clear indicator as to what ought to be done and what ought not to be done, it is simple to keep track of best approaches even in instances when not all would support the initiatives.

As demonstrated above, run away expenditure and indebtedness are only proof of lack of commitment on the part of governments within the Eurozone. This lack of monetary discipline put individuals as well as governments in awkward situations whereby the expenditure surpasses the revenue.

This obviously leads to deficits and accumulation of debt. National and international monitory organs should come in to mediate this situation. Potential investors also ought to keep a keen eye on areas where the economies run solely on credit it is not necessarily an indicator of wealth, but a desperate move for the lack of austerity in monitory issues.

The experience of this crisis informs one that anti-cyclical government policies (of stimulus facing the crisis and social protection) has limitations determined by the financial markets, limitations which they are overcome, deter public finances into entering an unsustainable vicious circle, after which comes the need to carry out unnecessary adjustment plans.

The countries of the Eurozone have to review the contents of the Stability and Growth Pact, establishing commitments that prevent excessive imbalances in national public finances (Sinclair, 2011).

The discussions presented in this paper have shown that Eurozone’s economic woos will have an impact on the cost of debts as assessed by the capital structure theories. It is has been established that the impact, largely will be moderated by the regional frameworks in handling the challenges.

As already determined above, the economies that do not exercise restraint and where the foundations of accountability are still not firm, will continue to flop, continuing to source for support from other countries.

Reference list

European Central Bank (2011). Eurozone, European crisis & policy responses. Web.

Kaiser, W., 2007. Christian Democracy and the Origins of European Union, London: EC Peston, R., 2011, Eurozone woes are us woes, News business. Web.

Laidi, A., 2011. Eurozone Problem for the United States, Council of Foreign Relations. Web.

Leary, M. 2005, Do firms rebalance their capital structures?, Journal of Finance, 60(6): 2575-2620.

Piris, J., 2010. Lisbon Treaty. Cambridge: Cambridge University Press.

Ramonde, J., 2011.The crisis of the Eurozone. Web.

Sinclair, L., 2011. Eurozone debt crisis how it will affect UK, Sky News. Web.