Introduction

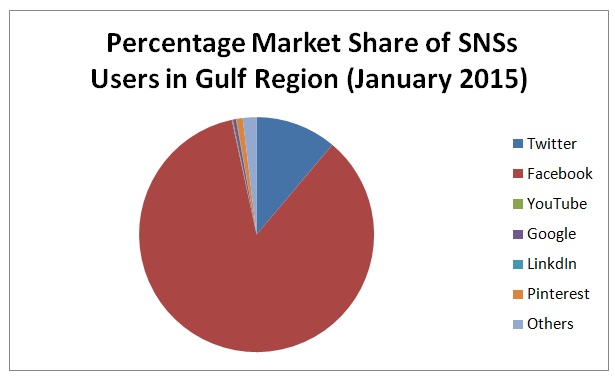

The internet has created a paradigm shift in doing business, especially in e-commerce and marketing. At present, social media have become a standard tool for day-to-day managing of different business activities. In the last decade, the growth of social media has been a hundredfold, and at present, more than 43% of the global population is active users of the internet (Al-Badi, 2014). The revolution brought about by Smartphone technology has become a game-changer in the access and use of the internet for business activities. Specifically, the Smartphone technology has made internet access very easy and interaction among other users possible, irrespective of the distance involved. At present, just by a click of the button, an individual is in a position to access the internet. The increased access to social media comes with opportunities for doing business. There are several social media platforms (SNS) that are in use across the globe in access and consumption of internet services. The SNS is basically web applications that are programmed to permit users to freely connect, collaborate, and communicate by sharing information online, irrespective of their geographical location (Kotler, Kartajaya, & Setiawan, 2016). Users across the globe have accepted the SNSs as social and cultural interaction tools as evidenced by the rise in their use from less than 10% a decade ago to 29% by January 2015 (Reyaee & Ahmed, 2015).

The common usage of SNSs includes doing business, social interaction, e-commerce, and advertisement among others. The usage and adaptability of each social network are dependent on features, accessibility, and activities supported. On average, an internet user might be registered to more than ten SNSs in order to cater to different interests including social interaction and business (Mourtada & Salem, 2012). Apparently, there is a need to focus on the usage of SNSs within the United Arab Emirates and the other Gulf States in order to predict and quantify their impact on e-commerce and advertisement as discussed in the next paragraph.

A lot of literature exists on the development of the internet across the globe, especially in the western region. The Gulf region has not been left behind in the quest for social media connectivity as the advent of technology replaces the traditional media of communication. The Arab Social Media Outlook report for the year 2014 suggests that social media is threatening to edge out traditional interaction mechanisms (Kotler, Kartajaya, & Setiawan, 2016). Specifically, more than 70 million Arabs were active users of social media in the year 2013 as part of the more than 130 million who had direct access to the internet as summarized in table 1 below (Stat Counter, 2016). The impact of social media in the Arab world was felt during the infamous Arab spring that dislodged more than ten regimes from power. Despite the action of governments in the Gulf region to censor the usage of social media, it has fueled usage as the citizens embrace the open ideology and create strong social bonds among users.

Table 1: SNSs and the number of users in the Gulf region. (Source: Stat Counter, 2016, p. 2)

Due to the high magnitude of connectively and communication within social media, several studies have been conducted to establish its impacts on different activities such as business, education, and ideological orientation among others. The proposed study attempts to explore the SNSs usage within the Gulf region and their impacts on e-commerce and advertisement.

Objective and Scope of the Study

The study attempts to review the magnitude of SNSs usage within the Gulf region with a special interest in the United Arab Emirates, Qatar, and Saudi Arabia between the years 2012 and 2015.

Methodology

Since the research is quantitative in nature, the researcher opted for secondary data because it is easily accessible and accurate. The secondary data was used to draw a clear inference and interpretation of the use of SNSs within the United Arab Emirates as compared to the trends in Qatar and Saudi Arabia. The data was collected from a credible site called the Stat Counter since it has up-to-date information on social media trends in the Gulf region. The researcher was keen to apply data coding and interpretation tools to avoid potential biases that might compromise the integrity of the research. In order to guarantee the reliability of the findings, the researcher used data for four years running concurrently to establish emerging trends.

Social Media Use Comparative Analysis

Social media use in the United Arab Emirates

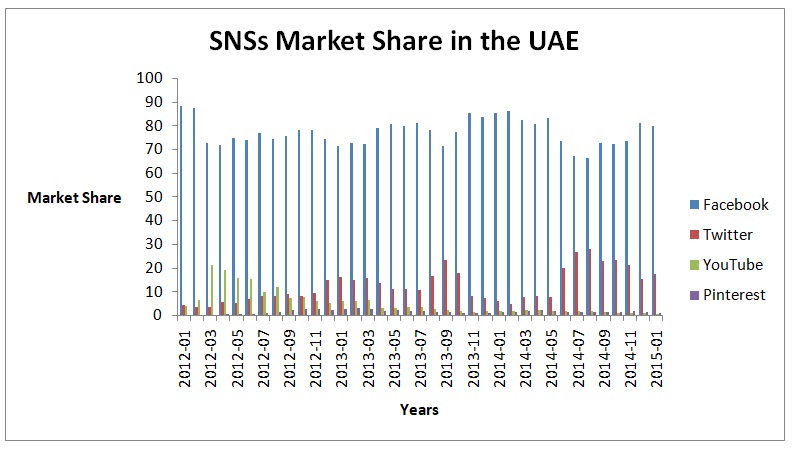

The United Arab Emirates is the second most populated in comparison to the other two case study countries. The UAE is ranked at position two in internet usage. The data collected for the four-year period indicated that Facebook dominated other SNSs as the most preferred social networking site followed by YouTube, Twitter, and Pinterest, respectively. Specifically, the growth of Facebook took a fluctuating trend of 88.27% in January 2012, 71.4% in January 2013, 85.4% in January 2014, and 79.86% in January 2015 as indicated in table 2. The Twitter site assumed a similar trend of the four-year period and was ranked in the third position in terms of the number of users in the UAE. The percentage of usage grew steadily over the years from 4.05% in January 2012, 16.18% in January 2013, 6.1% in January 2014, and 17.16% in January 2015.

Despite the growth in Facebook’s market share in the UAE, the significant rise in the market share of Twitter indicates that the former has lost 12% of its market to the latter since the year 2012. Despite having assumed a second position on the SNSs preference list in the UAE, YouTube plunged to position three in 2013 and subsequent years. Although YouTube was the third most popular site, its growth in the UAE market is very erratic. For instance, it had a market share of 3.65% in January 2012 that rose to 6.05% in January 2013 and then plunged to 1.62% in January 2014 and 0.35% in January 2015. Pinterest has assumed position four during the four-year period of study. The site had 0% market share in January 2012, 2.72% in January 2013, 1.47% in January 2014, and 1.11% in January 2015. Pinterest’s market share grew between the years 2012 and 2013 after which it took a downward trend for the rest of the study period as summarized in table 2 and graph 1 below.

Table 2: Market share of SNSs in the UAE. (Source: Stat Counter, 2016, p. 6).

Social media use in Saudi Arabia

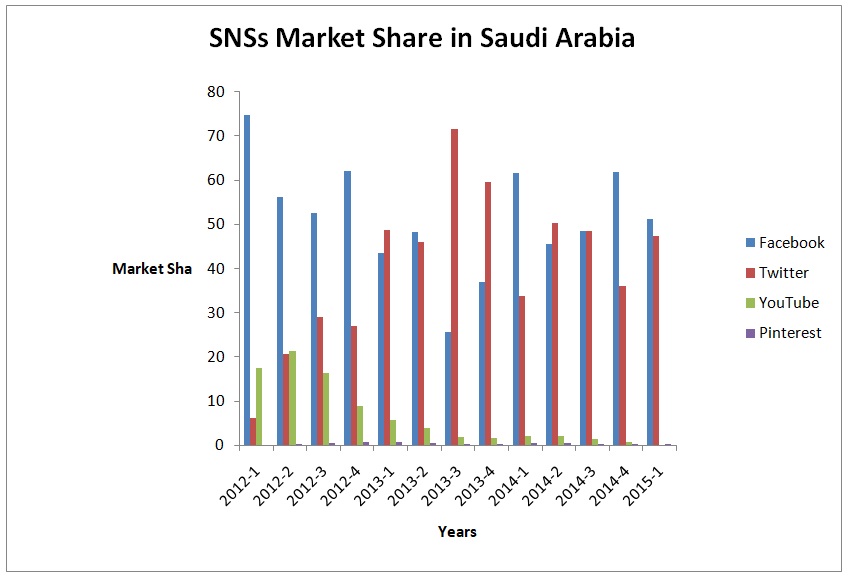

The growth of Facebook in Saudi Arabia took a downward trend of 74.75% in January 2012, 43.69% in January 2013, 61.66% in January 2014, and 51.33% in January 2015. The popularity of Facebook took a downward trend in the entire period of study with the lowest share being in the year 2015. However, Facebook is still the leading SNSs in Saudi Arabia. The Twitter site assumed a similar trend of the four-year period and was ranked in the second position in terms of the number of users in Saudi Arabia. The percentage of usage grew steadily over the years from 6.22% in January 2012 to 48.9% in January 2013. However, there was a downward plunge to 33.85% in January 2014 followed by growth to 47.53% in January 2015.

Despite being the second most preferred SNS, Twitter is eating into Facebook’s market share and might soon overtake it if the above trend persists. YouTube plunged to position three in 2012 and subsequent years. Although YouTube was the third most popular site, its growth in the Saudi market was very erratic. For instance, it had a market share of 17.5% in January 2012 that rose to 6.05% in January 2013 and then plunged to 1.62% in January 2014 and 0.35% in January 2015. Pinterest has assumed position four during the four-year period of study. The site had 0.03% market share in January 2012, 0.61% in January 2013, 0.46% in January 2014, and 0.18% in January 2015. Pinterest’s market share grew between the years 2012 and 2013 after which it took a downward trend for the rest of the study period with the lowest market share being recorded in 2015 at 0.18% as summarized in table 3 and graph 2 below.

Table 3: SNSs market share in Saudi Arabia.

(Source: Stat Counter, 2016, p. 6)

Social media usage in Qatar

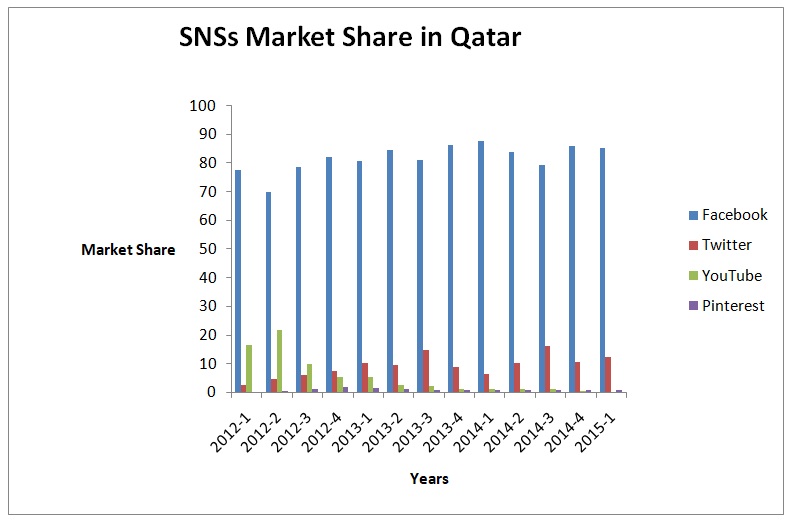

The growth of Facebook in Qatar took a downward trend of 77.75% in January 2012, 80.8% in January 2013, 88.71% in January 2014, and 85.33% in January 2015. The popularity of Facebook took an upward trend in the period of study with a slight decline in the year 2015. As is the case in other case study countries, Facebook is still the leading SNSs in Qatar. The percentage of Twitter usage grew steadily over the years from 2.44% in January 2012 to 10.18% in January 2013. However, there was a downward plunge to 6.33% in January 2014 followed by growth to 12.37% in January 2015. Although YouTube was the second most popular site in 2012, its growth in the Saudi market was very erratic. For instance, it had a market share of 16.75% in January 2012 that declined to 5.25% in January 2013 and then plunged further to 1.2% in January 2014 and 0.17% in January 2015. Pinterest had 0.08% market share in January 2012, 1.62% in January 2013, 0.89% in January 2014, and 0.7% in January 2015. These trends are summarized in table 4 and graph 3 below.

Table 4: SNSs market share in Qatar. (Source: Stat Counter, 2016, p. 10).

Research Conclusion

Research Summary

Unlike other platforms, the SNSs has the advantage of developing interaction networks that surpass cultural, religious, age, race, and location limitations associated with the traditional communication platforms. Every day, technology enthusiasts and innovators are adding new SNSs to the more than 200 existing social networks. The social networking sites have a massive impact on daily lives of users since they surpass the limitations of traditional interaction mechanisms. The most common SNSs in the Gulf region are Facebook followed by Twitter, YouTube, and Pinterest, respectively. Across the three case study nations, Facebook leads in market share of over 50%, though currently experiencing a decline in population.

The worst decline was reported in Saudi Arabia where Twitter is almost overtaking it. Interestingly, the popularity of Twitter has assumed an upward trend across Qatar, the UAE, and Saudi Arabia. Specifically, Twitter has gained an average of 25% market share since the year 2012. YouTube has lost market share is currently struggling at less than 3% of market share. The performance of Pinterest is equally erratic and controls less than 2% of market share across the three countries. Apparently, the findings reveal that SNSs have a positive outlook in terms of future trends, which are expected to grow further as more people embrace social media. The data collected for the four-year period indicated that Facebook, YouTube, Twitter, and Pinterest dominated the social networking sites in the case study countries.

Research Limitations

Since the code tracking the Stat Counter website relies on projections, data collected might not be representative of the actual situation of SNSs usage in the UAE, Saudi Arabia, and Qatar. This means that the findings might not be accurate. Besides, use of data from one source limited the researcher’s ability to carry out comparative analysis on authenticity to minimize potential biases.

Recommendation for Further Study

There is need to examine the actual impact of each SNSs on different population demographics since the current study is too broad and might not produce accurate data. This will give a clear picture of the usage of different SNSs within the Gulf region. Besides, it will create a more dynamic and focused study that addresses different demographic variables.

References

Al-Badi, A.H. (2014). The adoption of social media in government agencies: Gulf Cooperation Council case study. Journal of Technology Research, 5(18), 1-26.

Kotler, P., Kartajaya, H., & Setiawan, I. (2016). Marketing 4.0: Moving from traditional to digital. New York, NY: Wiley and Sons.

Mourtada, R., & Salem, F. (2012). Social media in the Arab world: The impact on youth, women and social change. Panorama, 2(3), 269-274.

Reyaee, S., & Ahmed, A. (2015). Growth pattern of social media usage in Arab Gulf states: An analytical study. Social Networking, 4(11), 23-32.

Stat Counter. (2016).Social media stats. Web.