The Upstream Petroleum Exploration Project

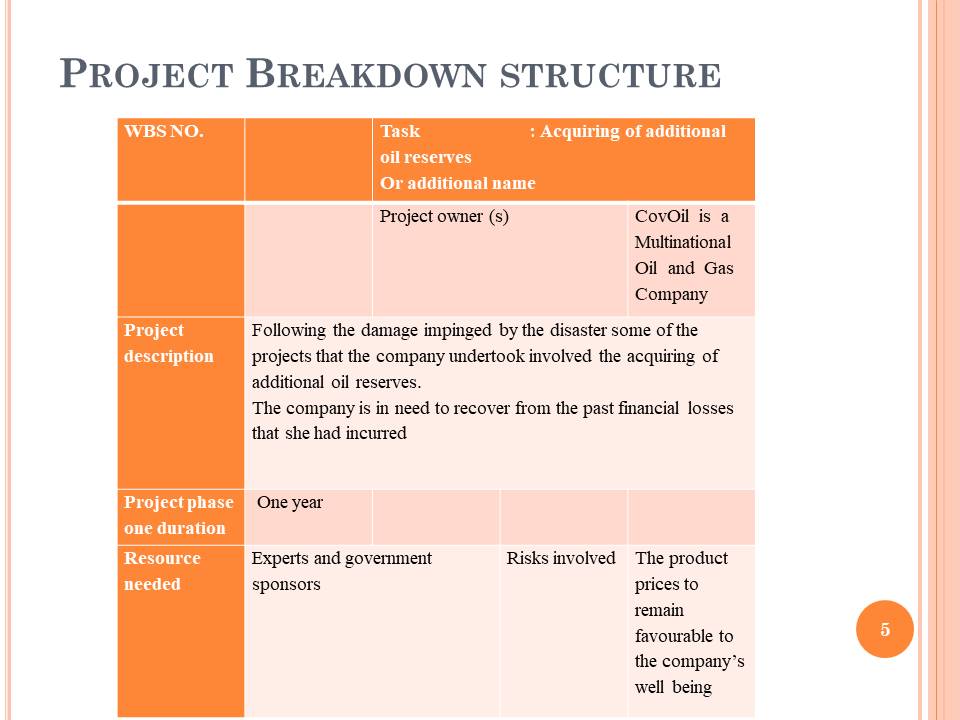

This project focuses on the CovOil multinational Oil and Gas Company.

The company is in need to recover from the past financial losses.

The disaster claimed the lives of 8 personnel with other damages being incurred by the company’s extensive offshore platforms.

As a result, the company had to cover for the disaster damages and still be able to carry out normal business operations.

Some of the measures the company undertook after the damage involved the acquiring of additional oil reserves (Kerzner 2013).

Acceptance criteria for the project

There is need to have Seismic survey for reserve identification, 3 deviated well and vertical poles that can act as petroleum reservoir (Hillson 2003).

Block stations that incorporate the procurement, delivery and installation fields.

3 Storage terminals and access roads. Other project requirements include field camps and meeting with the stakeholders.

Project milestones

The license of the president’s approval has mandated project execution without any delay, current favourable oil price and the organization CEO; Mark Jason has showed a positive response to the project materialization.

To avoid any social dispute that may arise in the future, specifically once the project has been practically and fully initiated (Meredith & Mantel 2006).

The vertical wells are important for POD calculation, which is the point of deviation.

The storage terminal serves as crude oil storage facilities. The access roads to allow for easy site accessibility and products transportation.

Projects Assumptions and constraints

The disaster’s impact that occurred has greatly affected the financial status and limits the projects investment capabilities on the company’s side.

The government is likely to be involved in additional cost sharing to actualize the project. Large lucrative projects that entail financial gain require the full participation and inclusion of the involved counties (Aven & Vinnem 2005).

The net cost of the project has affected both time and material price fluctuations. The cost calculations of majority of the materials have been calculated for one year duration and are approximately 90 million dollars.

Reference List

Aven, T & Vinnem, JE 2005, ‘On the use of risk acceptance criteria in the offshore oil and gas industry’, Reliability Engineering & System Safety, vol.90, no.1, pp.15-24.

Hillson, D 2003, ‘Using a risk breakdown structure in project management’, Journal of Facilities Management, vol.2, no.1, pp.85-97.

Kerzner, HR 2013, Project management: A systems approach to planning, scheduling, and controlling, John Wiley & Sons, New York.

Meredith, JR & Mantel, SJ 2006, Project Management: A Managerial Approach, 6th edn, John Wiley & Sons, New York, NY.