The study will compare a US market (NYSE) and a non-US market (LSE) to assess the investment opportunities and recommend the best market to invest in. Both markets are very contrasting, having, different companies listed, requirements for enlisting and a very disparate market capitalization (Širůček, 2022). Bonds, commodities, stocks, and mutual funds are investors’ most preferred investment instruments.

Dividend

The best option for investors is the market with high dividends that can be realized in the shortest period possible. The Dow Jones is the best index indicator for market performance for the NYSE (Širůček, 2022). The following graph shows the Dow Jones financial performance.

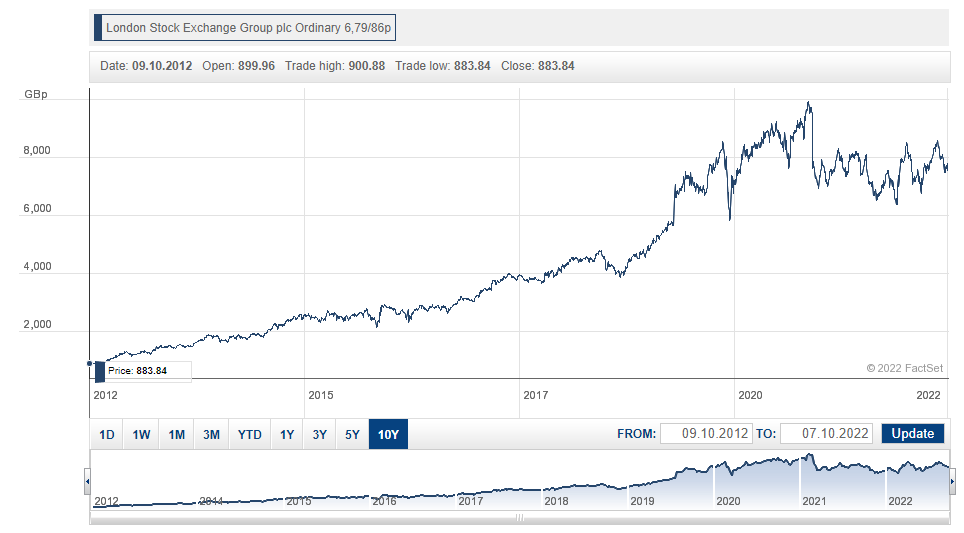

The current Dow Jones dividend is at 3.7% and is growing, as shown in the figure above. CPX has an annualized return over five years of 15.88% and an annualized return over ten years of 13.46%. On the other hand, VTI has an annualized return of over five years of 16.69% and over ten years of 13.80%. The following graph shows the divided for the LSE over the past years.

NYSE and LSE have experienced some growth, with the growth rate at NYSE higher than that of the LSE. Finally, according to Gebbes (2019), IUAG has an annualized dividend of over three years of 4.42% and an annualized return of over five years of 2.86%. In contrast, BND has an annualized return over three years of 4.67% and an annualized return over five years of 3.08%. This proves that NYSE is bigger and performs better than the LSE.

Suggest

Most investors use the NYSE market to list their companies or investments. In 2016, the total turnover of the European market reached its highest point, just above $500 billion. That includes the entire European market, not just the United Kingdom, where the LSE is based. The lowest turnover in the United States in 2013 was just over $4 trillion, which is approximately eight times the highest turnover in the European market in 2016.

Types

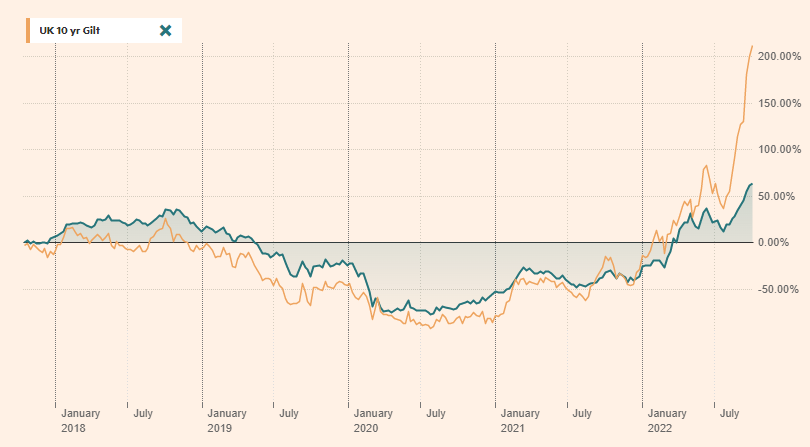

Bonds are risk-free investments that have shown growth in LSE than NYSE, as shown in the graph below.

From figure 3 above, it can be seen that the UK 10-year Gilt has lower returns on bonds than the NYSE. Lastly, due to the potential of the NYSE market, the intrinsic value of may would see the NYSE stock prices higher than the market value compared to the LSE.

Assess

The investor’s goal is to generate more money in every investment with low risks. Even so, investors understand that in every investment, a certain risk is involved, and their goal is to match the returns and the risks. The risk principle in investment dictates that the higher the risk, the higher the payback expectations. According to Pera (2019), based on benchmarks, the risk of blind investments can be evaded, although without certainty in precision. By applying the CAMP model on the Vanguard Real Estate Index Fund, having 3.07% returns over the past five years, with the 1.01 Beta percent and iShares Developed Markets Property from LSE having a yield of 2.9% with the same beta (Širůček, 2022). With these examples and assessing the rate of return, iShares Developed Markets Property listed in LSE can perform better if listed in the NYSE.

Interest and Inflation

Interest rates and inflation play a big role in investments and the risk on returns. When companies are making IPOs, interest rates and inflation are among the major factors of consideration. All investment instruments are affected differently by the changing inflation and interest rate values. According to 222, when the Federal Reserve in the US market changes the interest rate by reducing it, the spending and accessibility of capital are seen, and thus, more investments are expected. Stocks and ETFs operate best when the interest rate is lower, and thus when the Federal Reserve lowers the interest rate, these two investment instruments are complimented.

On the other hand, a low-interest rate equates to higher fixed bond rates. Thus, buying bonds in a market with a low-interest rate is much riskier. Mutual funds have a diametric relationship with interest rates. Pera (2019) says the lower the interest rates, the better the returns on mutual funds. In both markets, different inflation rates are experienced. Thus respective bodies such as the Bank of England Monetary Policy Committee for the LSE market and the Federal Reserve for the NYSE market set different interest rates.

Taxation

Tax policies in both markets are very different and pose different investment opportunities. For example, in the NYSE market, a policy dictates a 15% tax on stocks owned outside the IRA. The same percentage is taxed on stocks held for more than a year. Such taxation can affect a company, especially a global-oriented company, to list itself on the NYSE. Even though the ambiguity, the dividend, bonds, mutual funds, and the return on shares on NYSE are better than LSE, the taxation policies in the United Kingdom are better. According to Burr (2020), the double taxation treaty in the UK favors companies. The following are exempt from paying withholding tax on interest earned in the UK under the treaty, a business whose primary shares are extensively and frequently traded on a well-known stock exchange and a pension plan. A financial institution with no connection to the payer and deals solely independently is exempted from paying the withholding tax in the UK. Regarding such taxation differences, a company might prefer an IPO listing in the UK over the US markets.

References

Burr, G. B. (2020). The Incidence of Taxation in the United Kingdom. In The Sixth International Congress on Accounting 1952 (pp. 481-507). Routledge.

Dow Jones Industrial Average (^DJI). (2022). Web.

Financial Times, (2022). Bonds, US 10-year Treasury. Web.

Gibbes, G. (2019). NYSE vs LSE. Web.

London Stock Exchange. (2021). Exchange-traded products. Web.

Pera, J. (2019). The Effectiveness of Investing in Stock Exchange Markets in Central and Eastern European Countries with Regard to NYSE2-LSE-HKSE2. a Comparative Risk Analysis. Comparative Economic Research. Central and Eastern Europe, 22(2), 121-140.

Širůček, M., Ruml, V., & Strejček, P. (2022). Measuring the Performance of Leveraged and Non-Leveraged ETF’s.