Introduction

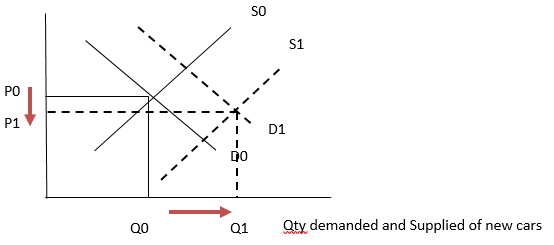

Assuming supply to be constant, an increase in the price of oil from P0 to P1 will result in a decrease in quantity demanded and supplied new cars from Q0 to Q1. If the recession occurs after the rise in oil prices, it will result in a decrease in the purchasing power of consumers. Cars are a luxury commodity thus the quantity demanded will fall as the national income per capita will fall; this will also result in a low production of cars.

Answer 1

A free trade agreement means low tariffs on the import of cars into Australia. This will result in an increased competition in the domestic market, which would eventually mean increased demand for these imported cars because of their lower prices.

As the imported cars proliferate in the market, the supply will increase. Prices will decrease because of the free trade agreement which will further increase the quantity demanded of these imported cars from Q0 to Q1. This will be detrimental for the local car manufacturers who may even be driven out of the market.

Answer 2

Normal profit is the opportunity cost of profit being earned in one industry. The economic cycle will determine the size of normal profits, which will be higher in booms and lower in recessions.

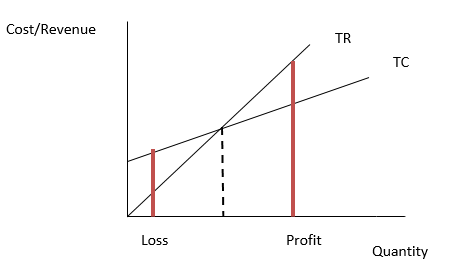

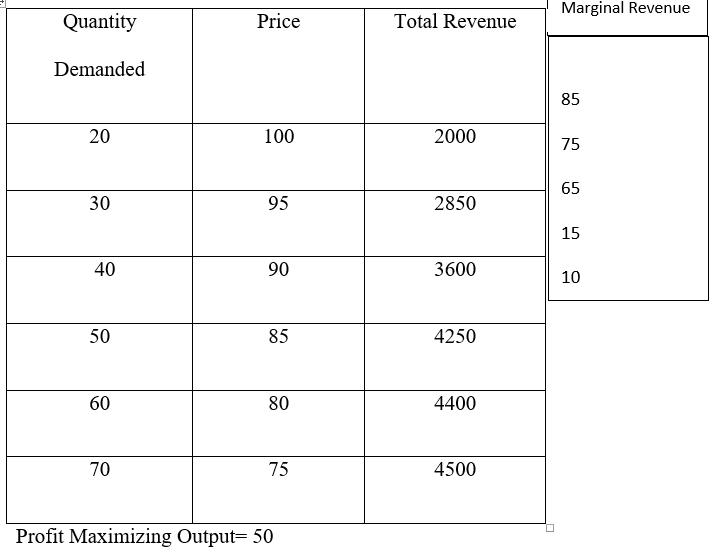

A decrease in the price of personal computers has increased the quantity demanded. This decrease resulted because of a rapid technology change, making the demand curve more elastic. This means the cost of production for personal computers has fallen due to economies of scale and it is now able to pass on the reduction in costs to the consumers in the form of lower prices, which eventually means higher revenue. As profit can be calculated by subtracting total costs from the sales revenue, as the proportion of total costs reduces, more is left in profit.

The diagram shows that initially the PC industry was operating at a loss which is shown where total cost was greater than total revenue but as it achieved economies of scale, it started making a profit whereby the total revenue is greater than total cost.

Answer 4

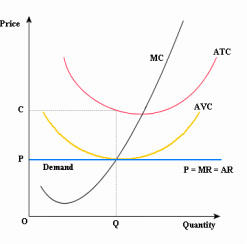

Normal profit is the minimum amount of profit needed for a company to carry on its operations. It is a component of implicit costs because it represents the opportunity cost of producing and operating in a certain business.

Firms will continue production even if it operates in a loss provided it is covering its variable costs in the short run. If it can cover its variable costs like rents, wages, etc which need to be paid off in the short run whereas fixed costs do not need to be paid off in the short run for a firm to survive. However, when it is unable to pay the cover the fixed cost, then it must shut down.

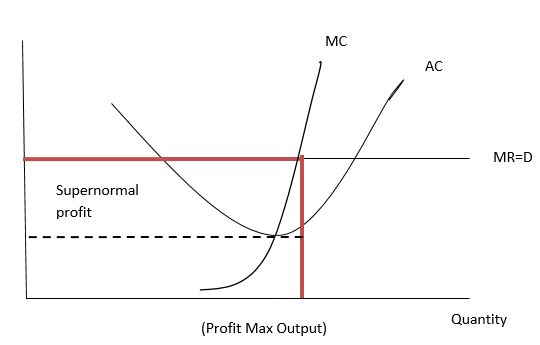

As shown in the diagram above, the firm must shut down after marginal cost increases the average variable cost.

Answer 8

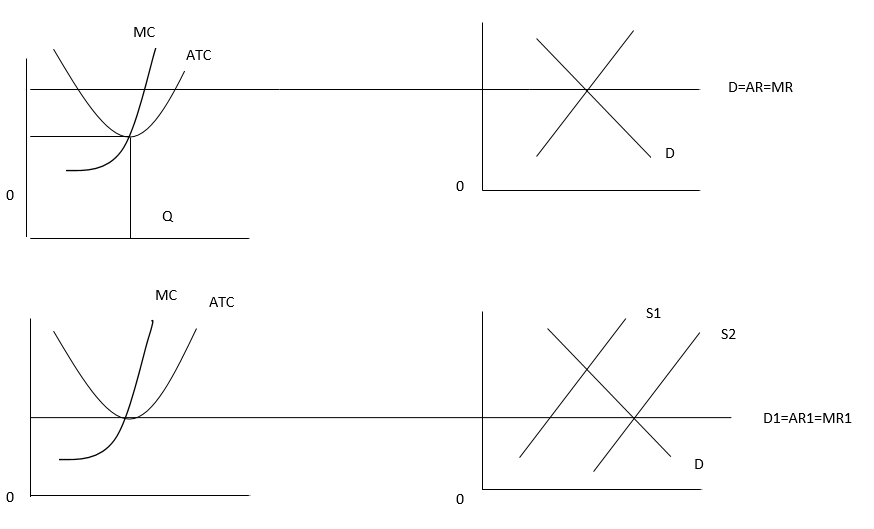

The firms will increase the output to meet the rising demand for the product. However, an increase in prices will also increase the cost of raw materials for the firms. But since they are now making more than normal profits, they may not think it is necessary to raise the output and would continue to earn abnormal profits. The number of firms in the industry will depend on the barriers to entry. Fewer barriers to entry would allow more firms to enter and share abnormal profit. So in the long run, abnormal profits cannot be sustained in a perfectly competitive market.

Challenge Question

If this firm was typical of others then it would be a perfectly competitive market structure thus, in the long run, this supernormal profit will not be sustained. Lack of barriers to entry would encourage more producers to open up in the industry causing the automatic mechanism to work.

Market Failure and Reform

The use of nuclear for power generation will result in a negative externality to society. This will include not only a private cost of much expensive process of power generation than coal to the government but may have negative social costs as well. These may include uranium particles and their side effects, the difficulty of sustaining the environment and protecting from the harmful effects of nuclear energy.

Thus this task should be centralized with the government and not be left to the market economy, as the market may fail. The private producers will be unable to provide the service at lower costs as they will have to pass the high production costs to the customers. Thus government intervention in the form of taxes and subsidies will be essential. Regulations will have to be enforced about the dumping of waste and carbon emissions (Laffont 1988).

Labour Markets

The Howard government in 2005 to replace the Industrial Relations Law in Australia passed work Choices Legislation. The main purpose was to ensure workforce protection against changes in legislation. It further protected workers against unfair dismissals, giving them legal rights to go on a strike, bargain for guaranteed benefits or conditions, and to minimize trade union activity. However, in 2009 it was replaced by Fair Work Legislation primarily to promote the bargaining power of the workforce in “good faith”.

So the fair Work gives trade unions greater bargaining power to negotiate minimum wage levels in industries, workers and managers can have a platform to discuss the issues, non-unionized workers will also benefit from the higher wages and the unions may put pressure on the government to pass legislation (Fair Work Australia 2010).

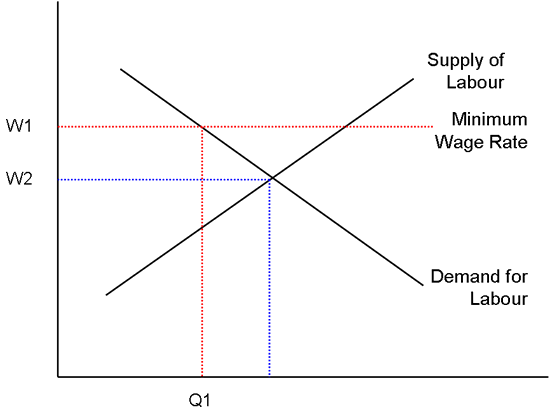

As shown in the diagram above, with the change from Work Choices to Fair Work legislation, the minimum wage rate will increase from W2 to W1 as the workers will now have more bargaining power however, the quantity demanded of labor will fall as the burden of higher wages falls on the producers who want to cut back on their costs.

List of References

Fair Work Australia, 2010. Fair Work Australia. Web.

John, S., 2007. Essentials of Economics. New York: Prentice Hall.

Laffont, J.J., 1988. Fundamentals of Public Economics. Oxford Journals 85 (4), pp. 873-875.