Abstract

The purpose of this paper was to analyze the business environment in Turkey. The analysis showed that Turkey has a large population that mainly consists of middle-class Muslims. This provides a huge market for high-quality Abaya. However, competition is high in the market. The main competitors include specialty stores such as Modanisa, Aliexpress, and Abaya Addict. A premium positioning strategy and appropriate distribution channels will be required to overcome competition.

Introduction

The business environment in which apparel companies operate in Turkey will be analyzed in this paper. The analysis will begin with an overview of Turkey. This will be followed by an analysis of market conditions. Recommendations will also be made to facilitate the launch of Abaya in Turkey by a new company referred to as Abayaexpress.com.

Abayaexpress.com

Abayaexpress.com is an online fashion retailer, which was established in 2014 in the United Arab Emirates (UAE). Currently, the company is expanding its operations by joining new markets in Europe and the Middle East. Abayaexpress.com offers a variety of high-quality conservative modern Muslim women’s apparel. The vision of the company is to be the preferred brand among Muslim women in the Middle East, Asia, and Europe. Its mission is to make dressing for work, school, or special events as easy and trendy as possible.

The company has partnered with renowned Abaya designers in the UAE to ensure that its customers are able to access high-quality products. Customers also benefit from using a variety of safe online payment methods. Moreover, the company ensures that purchased goods are delivered in time to improve customer satisfaction.

Background

Turkey is a unique country whose territories straddle two continents. It occupies part of Southeast Europe and Southwest Asia. Ankara is the capital city of the country. Turkey has a population of nearly 74 million people. Over 90% of the population speaks Turkish, which is the official language (Bertelsmann Stiftung, 2014).

Culture and Values

Although Turkey is a secular state, its culture is heavily influenced by Islamic beliefs and traditions. Nearly 99% of the population belongs to Islam (Bertelsmann Stiftung, 2014). Personal life, business, relationships, and behavior are mainly influenced by Islamic teachings. Turkish women and men prefer modest dressing for revealing clothes (Marchese, 2005). They wear both Islamic attire such as Abaya and Western designer clothes such as suits. Family is considered the most important social unit where socialization takes place in Turkey. The most important values include punctuality, respect, and loyalty.

Key Demographic Trends

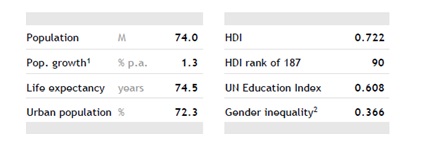

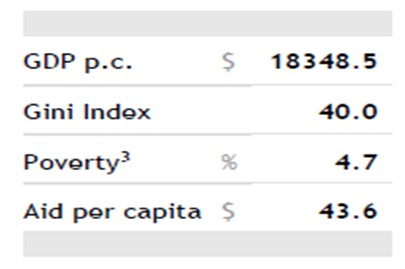

Approximately 65% of the Turkish population consists of individuals aged between 15 and 65 years (Bertelsmann Stiftung, 2014). This means that majority of the population belongs to the working class. The population is expected to reach 90 million people by 2025 (Bertelsmann Stiftung, 2014). Over 70% of citizens live in large cities such as Istanbul and Ankara as shown in figure 1. Turks and Kurds are the major tribes in the country. The literacy rate in Turkey is over 95% due to the availability of affordable primary education. The majority of Turks belong to the middle class. This means that most of the citizens are middle-income earners. Only 4.7% of the population is below the poverty line as shown in figure 2.

Market Conditions

Political System

The political system in Turkey is a republican parliamentary democracy. The constitution is the supreme law that governs the country. The government consists of three branches namely, judiciary, executive, and legislature (Bertelsmann Stiftung, 2014). The legislature consists of 550 members who are elected by the public every four years. The judiciary consists of independent courts that ensure the rule of law. The executive consists of the president, a prime minister, and ministers.

Economic System

Turkey has a modern market economy whose operations are based on the principles of capitalism. The IMF considers Turkey one of the newly industrialized countries and emerging markets due to its middle-income status (Zalewski, 2014). Government intervention in Turkey is limited to regulation and provision of public goods. Economic growth has been sluggish in the last five years due to high inflation, current account deficit, and insecurity in neighboring countries such as Syria. GDP is expected to grow by 3.5% and 4% in 2015 and 2016 respectively due to low oil prices (OECD, 2014).

Legal System

Turkish legal system promotes the rule of law by ensuring justice. The Constitution protects basic human rights and freedom. The government has adopted new laws to protect property rights through measures such as patent registration to attract foreign investors. Although impressive progress has been made in protecting property rights, the desired outcome has not been achieved (YASED, 2008). Counterfeit and contraband goods are still a major problem in the country.

Media Landscape

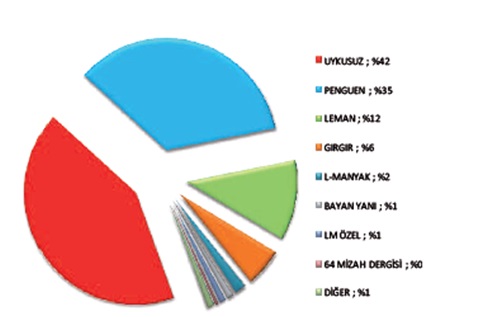

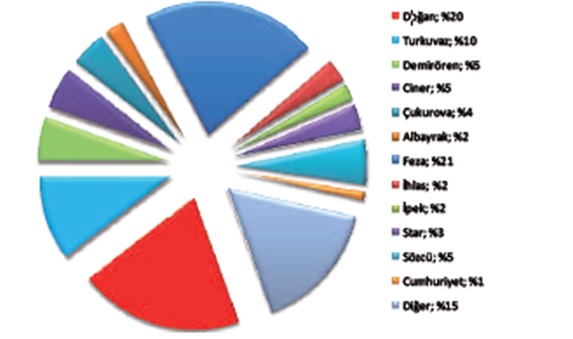

Print, electronic, and social media are readily available in Turkey. However, media freedom is limited due to political oppression. Independent journalism is hardly practiced since media owners focus on pleasing the government and military to obtain business favors (Akser & Hawks, 2012). The media industry is highly concentrated (Gunes, 2013). A few large media companies control over 60% of the market as shown in Figures 3 and 4. The implication of the high industry concentration is that large companies can exploit advertisers by charging exorbitant prices to increase profits.

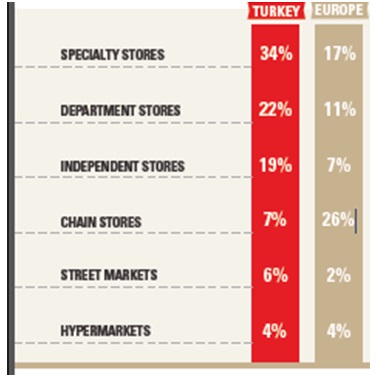

Distribution and Retail Channels

The main distribution channels in the apparel industry include specialty stores, department stores, independent stores, chain stores, street markets, and hypermarkets. Figure 5 shows that specialty stores, department stores, and independent stores are the main channels since they are used by nearly 75% of customers. These channels are preferred by customers due to their ability to provide a variety of designer clothes. Online stores are also important distribution channels since they are very popular among the youth (Modanisa, 2015).

Membership in International Organizations

Turkey is a member of the United Nations (UN), North Atlantic Treaty Organization (NATO), European Council (EC), and the Organization for Security and Cooperation in Europe (OSCE). Membership in these organizations allows Turkey to improve security within its territories. Turkey is also a member of trade organizations such as the World Trade Organization (WTO), the Organization for Economic Cooperation and Development (OECD), and the European Economic Community (ECC). Moreover, it has signed a free trade agreement with the European Free Trade Association (EFTA). Membership in international trade organizations allows businesses in Turkey to access foreign markets. It also increases competition from foreign firms.

Major Competitors

The main competitors in the Muslim conservative clothes market are Modanisa, Aliexpress, and Abaya Addict. These companies have strong online distribution channels and brand image. For instance, Modanisa controls nearly 35% of the market (Modanisa, 2015). The companies have also partnered with several designers to supply a variety of Abaya designs and other conservative Muslim attire. However, the companies lack adequate market knowledge since all of them have been in operation for less than three years. Other competitors include hypermarkets such as Carrefour, Migros, Begendik, and Bim, which supply both Western and Muslim apparel.

4P’s of Marketing

Product

Apparel products must conform to the values of Muslims in order to penetrate the Turkish market easily. Muslim women prefer clothes that cover most parts of their bodies. Thus, Abaya that promotes modest dressing is likely to have high demand. Product quality must be enhanced to overcome competition (Kazmi, 2007). In this respect, Abayaexpress.com will ensure that its products meet the expectations of customers in terms of color, decoration, and fabric to improve sales. The product will be differentiated based on quality to facilitate quick market penetration. The designers will take into account the unique tastes and preferences of Turkish customers to design relevant products. The rationale of this strategy is that Turkish customers prefer custom-made apparel to standardized clothes.

Price

Turkish customers do not price-sensitive due to their high income levels. This perspective is supported by the fact that customers prefer to buy apparel from specialty stores that use value-based pricing rather than hypermarkets that use penetration-pricing strategies. In particular, specialty stores charge high prices to recoup the cost of collecting and distributing high-end apparel. Hypermarkets, on the other hand, focus on selling their products at low prices to attract customers. Turkish customers associate high price with high quality. They are willing to pay high prices as long as product quality is excellent. In this respect, Abayaexpress.com will launch its product using competition-based pricing. This will involve charging prices that are comparable to those of the main competitors (Pride, 2004). Competition-based pricing will allow the company to avoid price wars that are likely to reduce its profit margin. Moreover, it will enable the company to maintain its premium brand image. The Abaya will be launched at an introductory price of USD 89. However, actual prices will depend on the chosen design and fabric.

Promotion

Promotion programs such as advertising should focus on creating awareness about product quality to attract customers. The young working population can be reached easily through social media, which is readily available through smartphones and computers. The cost of advertising can be reduced by using social media in conjunction with print and electronic (TV and radio) media (Pride, 2004). Abayaexpress.com will use both print and electronic media to advertise its product. Print media will include popular fashion magazines and newspapers with nationwide circulation. Adverts will also be posted on popular TV and radio channels. This will enable the company to reach a large number of customers. Social media websites such as Facebook, Google+, and Twitter will be used to convey personalized marketing messages to customers.

Apart from advertising, loyalty programs will be used to increase sales. Customers will benefit from coupons that will allow them to save up to 15% of the value of various Abaya designs. Public relations will also be used to create awareness about the product. Media releases will be used to influence the public to develop a positive attitude towards Emirati Abaya designs to increase sales.

Plac e

Specialty stores, department stores, and independent stores should be used as the primary distribution channels due to their popularity among customers. The stores should be selected based on their location, brand image, and market share to ensure high sales. Online distribution channels such as sales websites should also be used since they are already popular among customers and are being used by major competitors such as Modanisa. Abayaexpress.com will use its sales website as the main distribution channel. It will also collaborate with third-party sales websites such as Alibaba.com, Amazon.com, and eBay.com to distribute its product. Online distribution will allow the company to serve customers in all parts of Turkey at a low cost by eliminating the cost of establishing retail outlets (Pride, 2004). Customers will also benefit from the convenience of shopping from their homes or offices. Specialty and department stores that are strategically located in major cities will also be used to distribute the product. This will allow customers who cannot make online purchases to buy the product.

Recommendation

The product should be launched in Turkey due to the large size of the market. Product quality should be excellent to satisfy diverse tastes and preferences. This will ensure brand loyalty, which in turn will increase sales. Product designs should be protected using patents to prevent competition from counterfeits. Moreover, promotional strategies should focus on positioning Emirati Abaya as a premium product to overcome competition from local and foreign firms that are also able to supply high-quality products (Kazmi, 2007).

Conclusion

Turkey is one of the emerging market economies with a rapidly growing apparel industry. Its young and wealthy Muslim population provides a strong demand for high-quality Abaya. Nevertheless, competition from local and foreign companies is high. The competition can be countered by providing high-quality products. Moreover, the right distribution channels should be used to reach potential customers.

References

Akser, M., & Hawks, B. (2012). Media and democracy in Turkey: Toward a model of neoliberal media autocracy. Middle East Journal of Culture and Communication, 5(2), 302–321.

Bertelsmann Stiftung. (2014). Turkey country report. Gutersloh, German: Bertelsmann Stiftung.

Gunes, A. (2013). Turkish media at a glance. Ankara, Turkey: Republic of Turkey, Office of the Prime Minister.

Kazmi, S. (2007). Marketing management. London, England: Sage.

Marchese, R. (2005). The fabric of life: Cultural transformations in Turkish society. Binghamton, NY: Global Academic Publishing.

Modanisa. (2015). About Us. Web.

OECD. (2014). OECD Economic surveys: Turkey. Istanbul, Turkey: OECD.

Pride, W. (2004). Marketing. New York, NY: McGraw-Hill.

YASED. (2008). Protection of intellectual property rights in Turkey: Impact on foreign direct investment. Istanbul, Turkey: YASED International Association.

Zalewski, P. (2014, September 10). Turkey’s economic growth slower than expected. Financial Times. Web.