The world market becomes more transparent as international organizations introduce new laws and regulations to comb money laundering and resist tax evasion. The legal maintenance of counteraction to the legalization of criminal incomes is carried out by means of a system of laws and regulations, controlling financial, bank, and customs relations and establishing the order of licensing and registration of companies for anti-money laundering.

In plenty of countries, specific laws act as a framework for legal measures to combat money laundering supporting international prospects. This paper proposes the importance of the study of anti-money laundering law in the struggle against this worldwide menace in the UAE. The research will be conducted in terms of the economic growth framework, which refers to increased economic capacity. In particular, it is expected to explore gross national product (GNP) and gross domestic product (GDP) concerning the analysis of money laundering.

It is suggested that the major benefit of anti-money laundering laws in the UAE is the provision of additional resources to support the country’s economy. The review of the specialized economic analysis will provide a basis for comparing the UAE and other countries and the subsequent conclusions and recommendations.

Definition of Major Concepts

Money laundering refers to the concealment of the factual source of income when real transactions are replaced with fictitious ones, and documents may be falsified or used by the third parties. For money laundering, criminals traditionally utilize offshore banks, the banking systems of which ensure anonymity and confidentiality of the beneficiaries, as stated by Kumar. Among the most prominent and valuable activities of anti-money laundering (AML), there are the Organization for Economic Co-operation and Development (OECD) initiatives, the European Union (EU) directive, and the Foreign Account Tax Compliance Act (FATCA). The UAE’s core financial regulator regarding money laundering is the Anti-Money Laundering and Suspicious Cases Unit (AMLSCU).

Literature Review

In the international law, the detailed definition of money laundering, or legalization, of proceeds from criminal activity is given in the United Nations Convention against Illicit Traffic in Narcotic Drugs and Psychotropic Substances, which had a significant influence on the development of the relevant legislation in various countries. The above document recognized money laundering received from illicit drug trafficking as a crime. Simultaneously, the development of organized crime led to an increase in the incomes of criminal organizations obtained from other spheres of illegal activity, including the slave trade, prostitution, human organ trafficking, etc.

The fight against money laundering is global in nature and is coordinated at the level of both intergovernmental and local organizations. Cox considers that ensuring the adherence to laws and regulations, they monitor the activities of the participating countries in the above area, collect and systematize useful information, and participate in specific national projects in this field. As noted by Kumar (2012), “money laundering causes a diversion of resources to less productive areas of the economy which in turn depresses economic growth”.

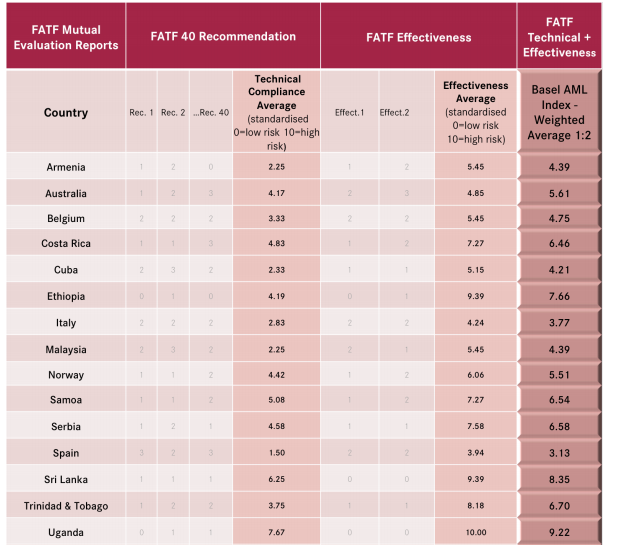

Among the countries with the highest rates of money legalization, there are Afghanistan, Uganda, Cambodia, Kenya, etc. Speaking of the current tendencies, one may note the effectiveness of the Financial Action Task Force (FATF) (see Table 1).

Nevertheless, it is essential to consider the literature on the UAE compared to the experience of other countries rather thoroughly. It should be noted that the UAE’s economy is characterized by the presence of the trading companies, exchange houses, hawaladars, plenty of immigrants, cash couriers, a wide-ranging offshore financial center, etc. All the mentioned issues are money laundering vulnerabilities that need to be considered while studying the economic benefits of anti-money laundering laws in the UAE.

The Federal National Council of the United Arab Emirates adopted a bill aimed at combating money laundering and financing of terrorism in accordance with the international recommendations of FATF. The latter noted that the UAE is one of the areas of the high risk of money laundering, yet, at the same time, through the adoption of the new legislation, the country is actively fighting money laundering and activities related to it.

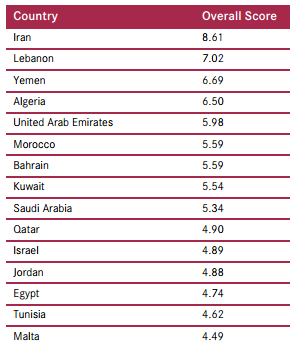

The above conclusions are based on IMF and World Bank data. Recently, sanctions against countries that fall into the risk zone have become tougher, fulfilling the list of countries of high risk by Iran, Sudan, and Russia. The detailed information on the Middle East and North Africa is presented in Table 2.

According to the new law, a special body will be established at the state level, which will include representatives from several government agencies of the UAE to monitor the work, combat money laundering, and elaborate measures.

At the legislative level, money laundering will be punished by a fine or imprisonment for up to ten years. Money laundering by an individual or company was attributed to criminal offenses in the UAE in 2002, while the Central Bank has the right to impose sanctions and revoke the licenses of banks that contributed to money laundering. According to the new legislation, all founders, managers, and employees of an organization will be held accountable for not reporting the company’s activities aimed at money laundering.

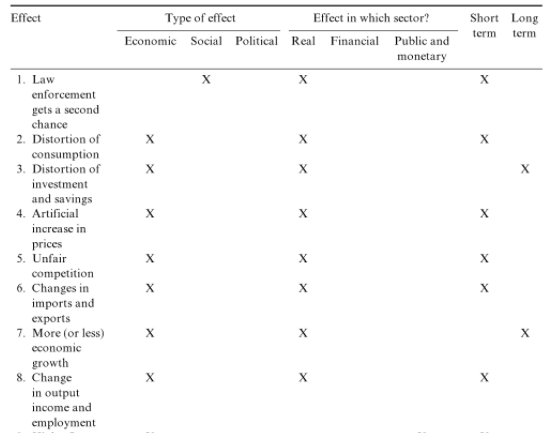

In 2015, AMLSCU announced the strengthening of the fight against money laundering. In particular, it is expected to oblige all brokers in the UAE to toughen methods for combating money laundering and report to the Central Bank of the United Arab Emirates on all questionable and suspicious transactions. For such a struggle, the mentioned organization will utilize the technical system called Unit, which proved to be a reliable method, combining an enhanced level of security to keep all customer transactions electronically, thereby detecting the fraudulent financial schemes. Table 3 reflects the key economic consequences of money laundering.

Problem Identification

The differences in the legislation of individual countries are associated with the definition of the list of acts that can be regarded as the source of origin of legalized funds. In the legislation of some countries such as the US, the UK, etc., all incomes fall under the definition of the so-called “dirty” money, the receipt of which is accompanied by any violation of the criminal law. In some countries, money received in the form of bribes that refers to corruption is also included in the category of “dirty” money.

In this regard, it becomes evident that there is a need to adequately identify money laundering definition in every country. More to the point, the mechanisms of money laundering are extremely diverse and cover different operations that significantly complicate the regulation of this problem based on legislative acts. The main idea of the recommendations provided by various organizations is that the financial system should become more transparent so that illegal transactions with cash can be discovered and reported to the corresponding instance.

Since the principal goal of the criminal activity of transnational criminal corporations is to extract maximum profits, it seems that one may state that international cooperation in combating money laundering is the most promising direction for this crime.

The assistance in investigations and litigation, the adoption of preliminary measures, such as the freezing or seizure of property, which may be subject to a request for confiscation, and the confiscation of property that presents income from criminal activity, may significantly reduce money laundering rates. It should also be noted that the transnational crime and its money laundering activities are one of the most important problems facing the world community today and are a factor in the threat to international security in its most important spheres, including economic, political, military, and environmental. However, the research shows the lack of data on the economic benefits of anti-money laundering initiatives.

Objectives of the Proposed Study

With these problems in mind, it is necessary to emphasize the importance of the research on the positive and negative effects of the current anti-money laundering law in the UAE. The information regarding the UAE may be different from that of the other countries due to their economic peculiarities that make it beneficial to focus on the given country. It is also necessary to identify the key spheres, organizations, and banks affected by this law, analyzing their economic indicators and providing interviews with their chief managers. Furthermore, it is essential to provide several recommendations based on the collected data.

Hypotheses and Research Questions

The struggle against money laundering allows for resolving three rather important tasks. First, a set of measures aimed at combating money laundering protects the legal economy from criminal investments, as noted by Aluko and Bagheri, and, consequently, from the establishment of control by the criminals. Secondly, the identification and confiscation of criminal proceeds undermine the financial basis of criminal activities and obstruct their further development.

The restoration of the entire chain of motion of money laundering allows tracking from the lowest level executors to the leadership of a criminal organization. The effective anti-money laundering laws and regulations allow improving the economic state of the UAE in general by providing a safe and secure platform for financial operations.

Taking into account the specifics of the selected theme, the research questions for the proposed study may be identified as follows:

- Research Question 1. Is the current UAE law of anti-money laundering effective? This question will be answered based on the analysis of the economic indicators between 2010 and 2015-2016 revealed from the official sources and the literature review. Also, the identification of the effectiveness may be specified, focusing on the success of the preventative measures taken against money laundering. Most importantly, the level of economic growth will also serve as a significant indicator of the current anti-money laundering effectiveness in the UAE. Either reduced or increased cases of money laundering are another means to make relevant conclusions.

- Research Question 2. Is there a need to have new regulations or laws in the financial system?

- Research Question 3. What are the differences between the anti-money laundering laws of different countries?

Methodology

To conduct the proposed study, it seems appropriate to apply the method of literature review. Considering time constraints, the research will be provided online, focusing on credible peer-reviewed journals, official websites, and other related sources. In particular, the UAE anti-money laundering standards, and the effectiveness of the Financial Action Task Force (FATF) will be analyzed and interpreted. Also, the information to be collected will embrace data on several years, so that a researcher will be able to identify any positive or negative tendencies and come up with appropriate conclusions.

Primary and secondary data analysis will allow considering the main concepts and theories relevant to the selected field of research based on the recent works in this field. It will also show how the proposed research relates to previous studies in this area, revealing their strong and weak points, thus enlightening the potential niches for future research. The literature review as a method of investigation will promote the substantiation of arguments, providing a review of the essential number of references to reliable sources. Simultaneously with the identification of the collected material, data will be grouped and compared.

Such a classification will make it possible to penetrate the essence of the topic under consideration in the shortest and correct way. Neuman and Robson state that it will facilitate the search and help to establish previously unnoticed connections and patterns. Throughout the process of studying the data, interpretation and analysis will promote accurate, relevant, and evidence-based conclusions. All this is likely to contribute to the core goal of the proposed study that is to either verify or reject the hypotheses and pinpoint potential implications.

Conclusion

Drawing from the evidence presented in this paper, one may conclude that anti-money laundering effectiveness leaves many questions and needs to be explored in future studies. This proposal revealed the necessity of the problem and enlightened the key prospects of the given theme. It is expected that the UAE focused research will promote the understanding and transparency of the economic benefits of anti-money laundering laws and regulations.

Bibliography

Abiola, J. O. (2014). Anti-money laundering in developing economy: A PEST analysis of Nigeria situation. Review of Public Administration and Management, 3(6), 1-9.

Alhosani, W. (2016). Anti-money laundering: A comparative and critical analysis of the UK and UAE’s financial intelligence units. London, UK: Springer.

Al-Tamimi, H., & Hussein, A. (2014). Corporate social responsibility practices of UAE banks. Global Journal of Business Research, 8(3), 91-108.

Aluko, A., & Bagheri, M. (2012). The impact of money laundering on economic and financial stability and on political development in developing countries: The case of Nigeria. Journal of Money Laundering Control, 15(4), 442-457.

Al-Zaqibh, A. A. M. (2013). International laws on money laundering. International Journal of Social Science and Humanity, 3(1), 43-47.

Baird, I. G. (2014). The global land grab meta-narrative, Asian money laundering and elite capture: Reconsidering the Cambodian context. Geopolitics, 19(2), 431-453.

Basel AML Index 2016 Report. (2016). Web.

Bin Belaisha, B., & Brooks, G. (2014). Money laundering in Dubai: Strategies and future directions. Journal of Money Laundering Control, 17(3), 343-354.

Choo, H. C., Amirrudin, M. S., Noruddin, N. A. A., & Othman, R. (2014). Anti-money laundering and its effectiveness. Malaysian Accounting Review, 13(2), 109-124.

Cox, D. (2014). Handbook of anti-money laundering. Cornwall, UK: John Wiley & Sons.

Gamal, A. A. M., &Dahalan, J. (2015). Estimating the size of the underground economy in the UAE: Evidence from Gregory-Hansen cointegration based currency demand approach. Review of Integrative Business and Economics Research, 4(3), 183-206.

Goby, V. P., & Nickerson, C. (2015). The impact of culture on the construal of organizational crisis: Perceptions of crisis in Dubai. Corporate Communications: An International Journal, 20(3), 310-325.

Idowu, A., & Obasan, K. A. (2012). Anti-money laundering policy and its effects on bank performance in Nigeria. Business Intelligence Journal, 6(3), 367-373.

Joshi, D., Vyas, A., & Joshi, M. M. (2012). Money laundering: An overview. Global Disclosure of Economics and Business, 1(2), 120-127.

Kassem, M. (2017). Stricter UAE bank rules against money laundering hurt SME borrowing. The National. Web.

Kumar, V. A. (2012). Money laundering: Concept, significance and its impact. European Journal of Business and Management, 4(2), 113-119.

Neuman, W. L., & Robson, K. (2014). Basics of social research. Boston, MA: Pearson.

Monteiro, N. (2017). UAE boasts one of the stringent anti-money laundering regulations. ZAWYA. Web.

Rahman, F. (2016). The UAE stresses need to combat money laundering. Gulf News. Web.

Trautsolt, J., & Johnson, J. (2012). International anti-money laundering regulation of alternative remittance systems: Why the current approach does not work in developing countries. Journal of Money Laundering Control, 15(4), 407-420.

Unger, B., & Van der Linde, D. (2013). Research handbook on money laundering. Edward Elgar Publishing.

Zhang, Y., &Lavena, C. (2015). Anti-corruption strategies: A cross-cultural perspective. Boca Raton, FL: CRC Press.