Introduction

It is projected that total money laundered internationally in a year is ranged between $ 500 billion to $ 1 trillion. According to FinCEN (Financial Crimes Enforcement Network) that over $ 750 billion in illicit funds is being transferred worldwide annually, of which $ 300 billion is laundered in the US alone, which is corresponding to total gross sales in 1996 of two world-leading automobile producers like Ford and General Motors.

If money laundering is left unhindered, it can exhaust a nation’s economy by altering the demand for cash, forcing exchange rates to be more volatile and making interest rates down and resulting in a high inflationary trend in the country where criminal elements are freely allowed to tread. Money laundering has been recognized as a bad element for the economy as it siphons away billions of dollars a year from the economic system of a nation.

Terrorism Financing

The act of raising money through both legitimate and illegitimate means to finance acts of terrorism is known as terrorism financing. In one another chief methodology employed by the fraudsters is to open an account at a gambling website. The ill-gotten money would be deposited in the account using a pay pal account, and then some money is used on gambling. However, the balance money after the sham gambling is transferred to another ordinary bank account, thereby creating a legal status for the laundered money as if it has come from gambling and will be employed for terrorist financing.

Financing Terrorism through Money Laundering

Money laundering injects funds that act as fuel for terrorists to function and to enlarge their activities. Funding for terrorism through money laundering can hamper the economic prosperity and financial stability of any nation. When a financial institution is employed intentionally by a terrorist, it will create harm to a financial system of a nation. If a financial system of an economy is being used to channel financing or launder funds to terrorists, the injury may be much copious. When a financial system is employed for money laundering mainly to finance terrorist activities, then such a financial system will be later disowned by investors for investment purposes. One another great risk is that when a financial system is manipulated by criminals, then the integrity and confidence of such a system will be at stake.

For some nations and jurisdictions, the financial and economic impingement could be colossal. If the integrity of a financial centre or institution is brought into question, its prosperity, in the long run, will be at peril with credible, serious economic impacts. The economic growth of a nation will be sluggish if there is a lack of integrity in financial systems where a resolution on the distribution of resources are tainted and investment is misallocated, it will hamper the economic growth.

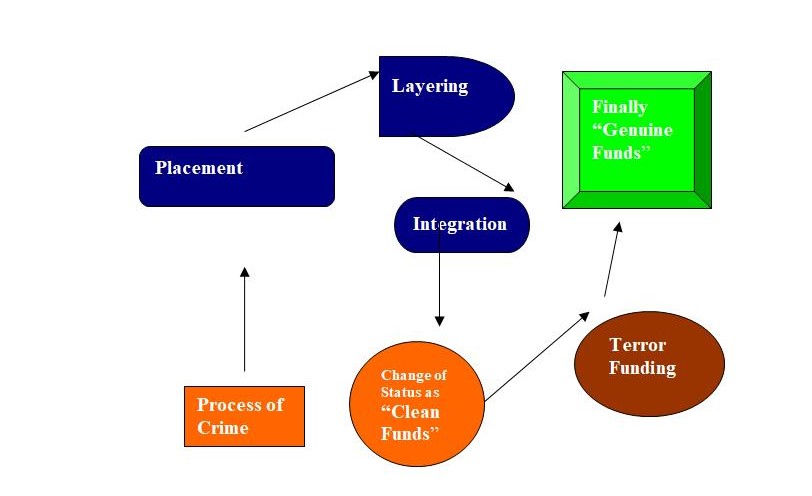

Money laundering is nothing but transforming the proceeds of crime money into a usable form, thereby camouflaging their illegal activities. Once the criminal proceeds are pumped into a financial system, they are laundered through an assortment of transactions and financial vehicles and, in the end, invested in financial and real estate. Money laundering always involves international business transactions as a device of “layering” or clouding the origin of funds. Perhaps, money laundering is fundamentally international in nature. If one jurisdiction or one country stiffen its regulations on money laundering and terrorism financing, then it will be immediately shifted to another unregulated location. Thus, even if a nation does not have any crime or very little money laundering, it has to tighten its economy to shun the “immigration” of the issue.

Terrorist financing can be explained as swearing the property from any legitimate source to be employed to finance terrorist activity that has been or will be unleashed at a future date. Furthermore, out of proceeds of crime, several terrorist organisations are financing their activities. However, there is a vast dissimilarity between terrorism financing and money laundering in many ways which influences public policy. Terrorism financing is much more intricate to identify than money laundering since it is aimed mainly at the future activity.

Further, the terrorist activity requires only a small quantum of funding and hence it is easy for a terrorist to launder the money for possible future terrorist activity. For example, the 9/11 attacks on the pentagon and World Trade Centre were estimated to have cost less than $ 1 million as compared to other types of financing activities.

Both the international community and national government are constantly working together to combat both terrorism funding and money laundering. After the 9/11 attack, the combat against terrorism has been intensified. Some of the countermeasures perused to defy terrorism funding are to embark on tightening regulation and increased supervision at the national level and on plugging the loophole with critical information, especially all-around borders.

The efficacies of anti-money laundering initiatives (AML) and efforts to combat the financing of terrorism (CFT) foot on the conception of a rational system of retaliatory measures, which must include a number of decisive ingredients.

Further, these initiatives must be supported by measures like curbing criminals from taking control of the financial systems. If a criminal is able to penetrate into the nation’s financial system, then it will be an arduous task to identify and uproot the financing of terrorism or money laundering for terrorism purposes. Hence, it is very critical that major stakeholders and senior executives in any financial institution should express that they are ‘fit and competent to maintain these positions of control and omission. These prerequisites apply at the preliminary licensing phase but require to be sustained as stakeholding changes hands and as the management turns over.

Further, financial institutions must launch systems of recognising and reporting suspicious or unusual monetary transactions. These institutions should train the staff in such a way so that they sound an alarm when they encounter a suspicious money laundering transaction, and they should have clear procedures for reporting back to the authorities immediately.

If bank officials who deal with the clients are unable to recognise and report back suspicious transactions, then elaborate CFT / AML systems will be regarded as ineffective. What can go wrong can be illustrated by way of a recent example where a bank hired more employees to handle the increased quantity of new, large-denomination banknotes which were being deposited by one customer. In the first instance, it was thought that the transaction might be connected to money laundering, but in the end, the cash deposits were proved to be of criminal origin.

Further, both the testimony of know your customer and unusual transactions rules need to be corroborated by enough record keeping. Whenever a suspicious transaction is discovered, it is wise to have an audit trail turning back as far as five years.

The government has to form apt institutions, and such institutions should be vested with the resources and power to make sure that the pertinent commercial enterprises adhere to the rules and regulations and any suspected cases of money laundering or terrorist financing can be overseen. For instance, a bank manager has to see that the bank has in place the tools to limit susceptibility to money laundering. Further, banking supervisors in various countries should have a mechanism of exchanging information, and this will assist in controlling the widely located active institutions internationally.

Combating the Financing of Terrorism

G-7 Finance Ministers, in October 2001, declared an Action Plan to fight the Financing of Terrorism and vowed to work with the wider international community to attain results. The Plan contained immediate actions to prevent the flow of terrorist funds as well as fundamental changes to safeguard against the employment of the international financial system for the financing of terrorism.

Blocking the Flow of Funds to Terrorists

The Action Plan includes the following:

- To freeze terrorist assets,

- To adhere to the International Convention for the Suppression of the Financing of Terrorism and the provisions of the relevant United Nations Security Council Resolutions.

After September 11, more than 160 countries and authorities have initiated concrete action to immobilise terrorist assets, and about US $112 million in terrorist-associated funds has been frozen worldwide. Over 200 countries and authorities have supported the G-7 by declaring support for the battle against terrorist financing.

According to UNSC Resolution 1267 established under the UN Security Council Committee, which presently lists 313 individuals and business entities whose financial assets have to be frozen by member countries. In response to the UN Security Council Resolution 1373, many individual nations, as well as the European Union, have also recognised and listed terrorists for the reason of applying sanctions.

On April 19, 2002, G-7 Finance Ministers announced the first joint G-7 recognition of individuals and terrorist entities and harmonised asset freezing in all G-7 countries.

These accomplishments have been made possible by the bizarre efforts of financial regulators and institutions, which have coordinated with the relevant authorities to make sure that the assets of listed terrorists are recognised and frozen.

With the definitive endeavour of countering all terrorist activities, the G-7 will work together in recognising, disrupting, and finishing down sources of terrorism financing.

International benchmarks to protect against Terrorism Financing.

The G-7 Action Plan includes the following.

- Development and execution of international standards

- Vigorous execution of the relevant UN instruments

- By directing the Financial Action Task Force on Money Laundering (FATF) to formulate special recommendations to counter-terrorist financing.

- It also encouraged the World Bank and the International Monetary Fund (IMF) to speed up their collaborative work with the FATF on a wide-ranging framework for evaluating compliance with measures against money laundering and terrorist financing.

Execution of United Nations Instruments

United Nations Security Council Resolution 1373 mandates that all UN members shall illegalise the financing of terrorism and desist from offering any kind of support to those involved in terrorist acts. The Committee is constantly reminding the 15 members that have not yet forwarded their reports.

All G-7 countries have adopted the International Convention for the Suppression of the Financing of Terrorism. Over 130 countries have now adopted the Convention, and 45 countries have approved it.

Special Recommendations by FATF

The FATF, on October 31, 2001, issued eight Special Recommendations on Terrorist Financing. As demanded by the FATF’s plan of action, all FATF countries have finished a self-assessment of their compliance with the recommendations and are dedicated to ensuring the compliance. To date, over 100 nations have submitted self-assessment questionnaires to FATF.

Recognition of Nations that require Appropriate Measures

At their comprehensive meeting held on June 19-21, 2002, the FATF decided to commence a process to categorise jurisdictions that lack suitable measures to fight terrorist financing.

G-7 Finance Ministers appreciates FATF’s pains to develop a process to recognise countries that lack suitable measures to counter terrorist financing for follow-up evaluation and/or technical assistance by the World Bank, IMF and the United Nations. It is necessary that these international bodies extend their full support and collaboration to this exercise, especially to make sure that there exists adequate technical assistance.

The Role of IMF

After the 9/11 attack, IMF started to include AML/ CFT issues in its work on the financial system. Thus, IMF has started to play a facility part, thereby spotlighting the stability and integrity of the international financial system and working intimately with FATF, other standard setters and with the World Bank. IMF is especially focusing its attention on the probable risk arising out of money laundering and terrorist financing.

IMF has considerably stepped up their involvement relating to anti-money laundering and combating the financing of terrorism. From February 2002, the IMF has included the assessment of countries’ anti-money laundering and fighting the financing of terrorism measures in line with their Financial Sector Assessment Program (FSAP) assessments and their assessments of offshore financial centres’ regulatory, legal and supervisory systems. These assessments have assisted to recognise weaknesses, which the World Bank and IMF are assisting countries to address.

Thus, IMF plays only a watchdog role and does not involve itself in law enforcement matters. Combating the laundering of illegitimately obtained revenue and the financing of terrorism is one of the international community’s main concerns. Therefore many countries, especially the world’s developed countries, are initiating steps aimed at waging war against the legalisation of criminal proceeds and employing the same for the financing of terrorism. Financing terrorism through money laundering presumes great synchronisation of efforts among all the constituents of the system for combating “dirty” money and to kindle interdepartmental collaboration. Financial institutions assume the key accountability for revealing illegal efforts endeavoured at legalising criminal proceeds and financing terrorism. A nation’s central bank policy regarding preventing the legalisation through the laundering of illegitimately obtained revenue and the financing of terrorism should be aimed at attaining the following objectives:

- Not allowing the banking channel to be employed as an instrument to launder money and then to finance terrorism;

- It is safeguarding the business standing of the bank and its clients.

World Bank efforts

World Bank and IMF Executive Boards in mid-summer 2002 authorised proposals to further augment their contributions to the international attempt on anti-money laundering and the combat against the financing of terrorism (AML/CFT) efforts. The Boards conceded to include the FATF 40 plus 8 to the list of standards to be considered, to approve methods for undertaking assessments and arranging reports on AML/CFT, and to shore up a 12-month pilot program. The G-7 encourages these initiatives and looks forward to the full amalgamation of comprehensive anti-money laundering and combating the financing of terrorism assessments into Bank and Fund operations.

Technical Hep

Initiatives are taken to organise and deliver technical assistance quickly and most notably by the UN Counter-Terrorism Committee and by the IMF and World Bank. The UN Counter-Terrorism Committee has started to collect a directory of available help. The IMF and World Bank are instituting a coordination mechanism for technical assistance for both anti-money laundering and combating the financing of terrorism among various members.

G-7 countries will offer technical support to willing and committed nations on a mutual basis as well as support the initiatives of the international organisations.

Resolution 1617 of the United Nations Security Council’s is aiming the support networks of Taliban and al-Qaeda, which authorises permission for the international community to initiate vital action to cut off al-Qaeda’s lifelines in and around the world.

Efforts of U.N Security Council

Resolution 1617 fortifies what the most dominant instrument for global action might be against those who offer arms, money, technology or other help to the Taliban and al-Qaeda.

When an entity or individual is identified pursuant to the resolution, governments are compulsorily required to freeze their assets, refuse them for admission into the financial system and stop them from acquiring arms or travelling internationally. Anyone who wishes to entertain them will encounter the same consequences.

Proposed sanctions are mainly well suited for dismantling terrorist networks. Their most distinct advantage lies in closing down the pipelines through which terrorists raise and transfer money. It is true that individual terrorist attacks may be economical, but terrorist organisations need far more than explosives to endure. They need money to educate, recruit, pay operatives and their families, travel, bribe officials, purchase cover and false documents as well as purchase various materials. Restricting the flow of cash to terrorist groups can also increase disagreement within their ranks and files and will activate hasty communications and actions that expose their operatives and organisers to be easily detected.

Further, past identifications have helped to immobilise financial assets and having offered precious intelligence about facilitators, donors and end recipients.

Resolution 1617 has the probability of being an extremely effective tool. It foresees 191 UN member states acting as single to cut off al-Qaeda’s supporters, both financially and physically.

The effect of these sanctions depends, however, on the depth and breadth of their application. Money will be looked out through the path of least obstruction. Regrettably, earlier iterations of Resolution 1617’s sanction programme have not come near to realising their perspective. Some governments, in Europe and elsewhere, had abstained from bringing terror supporters to the Security Council’s notice, even when these individuals were known to be encouraging al-Qaeda within their own country borders. Further, many nations restrict compliance simply by including designated names to a ‘list’ with no mechanisms to make sure that the sanctions are really being enforced. If financial institutions are not informed instantly upon the declaration of a target and if regulatory authorities are not conforming that financial institutions are properly screening accounts and transactions and in such cases, the financial bite of designations will be fruitless.

Resolution 1617 of the Security Council articulates a clarification and detailed definition of what is tantamount to relations with al-Qaeda and is having enhanced due process of provisions to make sure that the designation procedure is as fair and open as possible. With respect to accomplishment, these solutions embrace standards issued by the inter-governmental Financial Action Task Force that offer internationally endorsed direction on maintaining effective sanctions regimes. The resolution further requires some member states to corroborate regularly to the UN on accomplishment benchmarks, like travel controls and transaction screening.

Requirements for Processing Payments in Foreign Currency

To curtail terrorism financing through money laundering, a country’s central bank shall not permit to carry out payment instructions in which the payer is a bank or company based in a nation in which it does not physically exist or is not associated with a synchronised financial group, or if the recipient is registered or is maintaining an account in a nation that has a low criterion of auditing controls of customers with respect to fighting the legalisation of illegally received revenue. On the basis of news published by OFAC and FATF, nations with a high peril of criminal revenue legalisation are the following:

- Iraq

- Cuba

- Iran

- Libya

- Liberia

- Sierra Leone

- Zimbabwe

- Syria

- Myanmar (Burma)

- Nigeria

- Sudan

European and American banks have blocked money transfers to these countries.

Patriot act of USA

Patriot Act has assisted the financial institution in preventing fraud, controlling the spread of terrorism and identifying terrorism financing, thereby stressing the financial institutions and banking sector in the USA to gain more information on new banking accounts. So as to help the USA government to fight the funding of terrorism and money laundering activities, now federal law demands that all financial institutions confirm, obtain and record information that recognises each person who opens an account. As such, it has become obligatory now to offer any identification like driver’s license etc., by the applicant while opening a banking account in the USA.

Financial institutions and consumers are facing abundant problems because of identity fraud. As per FTC, in the last five years alone, about 27.4 million people have been affected due to identity theft. A report indicates that U.S. lenders are estimated to lose about $ 1 billion annually due to identity theft.

With the help of identity documents received from the prospective customer and corroborating the name, address, social security number and date of birth by checking with multiple data sources, one can come to a conclusion about the accuracy of information provided and to protect against the fraudulent activity before it happens. Due to identity verification technology and programs employed because of the USA PATRIOT ACT, the institution can now vouch and also screen government lists, identify and store transactions from online applications. Thus, the personal information obtained from the prospective client can thus be corroborated with the credit bureaus, ChexSystems, detailed background search tools and SAR form. Though complying with the USA Patriot Act is time-consuming and labour intensive, it protects against fraudulent activity before it occurs in an enhanced security environment.

Celent Communications, the financial services research firm, has estimated that for the security dealers, banks and insurance companies, compliance with the provisions of the USA Patriot Act will cost about $11 billion by the end of 2005. News week reports that two-thirds of financial records obtained through section 314 of the USA Patriot Act were mainly in money –laundering cases.

Just to beef up cases, there is an increasing number of prosecutions in which a money-laundering charge appears to be included where the underlying charge is minor. Basically, the Act requires all financial institutions to (1) Establish a more formalised Anti-Money Laundering program; (2) Designate an AML compliance officer; (3) Implement an ongoing employee training program; (4) File Suspicious Activity Reports (SARs) on an ongoing basis; (5) Verify the identity of new account customers; (6) Determine whether the potential customer appears on a list of known or suspected terrorists that are being provided to financial institutions by government agencies; and (7) Continue reporting and sharing of information.

Federal statues on money laundering

To deter money laundering activities, U.S has enforced many regulatory and legislative standards, and most important of these are as follows

- The USA Patriot Act (Title III, International Money Laundering Abatement and Anti-Terrorist Financing Act 2001).

- Anti–Drug Abuse Act of 1988.

- Money Laundering and Financial Crimes Strategy Act of 1998.

- Section 206 of the Federal Deposit Insurance Corporations Improvement Act of 1991.

- Section 2532 of the Crime Control Act of 1990.

- The Annunzio-Wylie Anti –Money Laundering Act. (Title XV of the Housing and Community Development Act of 1992).

- The Bank Secrecy Act (Currency and Foreign Transaction Reporting Act of 1970)

- The Money Laundering Control Act of 1986.

- The Money Laundering Suppression Act of 1994. (Title IV of the Riegle-Neal Community Development and Regulatory Improvement Act of 1994.

The Bank Secrecy Act (BSA) was intended to struggle with money laundering, drug trafficking and other crimes. The main object of this Act is to desist banks and financial intermediaries for or being deployed to camouflage any deposit or transfer of money resulting from criminal activity. The BSA enforced an exploratory ‘paper trial’ by mandating regulatory reports and requirements like the currency transaction report and by a subsequent amendment enforced record keeping requirements for wire transfers.

The Anti-Drug Abuse Act of 1988 complemented and toughened anti-money laundering efforts by raising the levels of sanctions and penalties for money laundering crimes and by mandating severe identification and documentation of each purchase of certain monetary instruments.

The Money Laundering Control Act of 1986 altered the BSA to augment its effectiveness and to strengthen the U.S government’s capability to fight money laundering by declaring it as a federal crime and by enforcing structuring transactions to avoid BSA reporting requirements as a criminal offence.

Section 206 of the Federal Deposit Insurance Corporation Improvement Act (FDICIA) of 1991 permitted the OCC and other bank supervising authorities some laxity in revealing to foreign bank regulatory or supervisory authority’s information gathered during its supervisory role. However, such revelation shall be not bigotry to the interest of the US and appropriate and must be subject to appropriate measures of secrecy.

The Amunzio –Wyle Anti-money Laundering Act of 1992 augmented penalties for depository institutions found responsible for money laundering. The Act included various major provisions to the BSA, including the intimating of doubtful transactions. The Act also made the running of illegal money transmitting businesses an offence and required that banking regulatory agencies formally consider revoking the charters of any depository institution convicted of money laundering.

Section 2532 improved the federal banking agencies enforcement position by extending its power to work with foreign banking authorities on investigations, enforcement or examination dealing with possible bank or currency transaction related violations.

The Money Laundering and Financial Crimes Strategy Act of 1998 necessitated the Secretary of Treasury, in consultation with the Attorney General and other relevant agencies, including local agencies and state, to execute and coordinate a national approach to address money laundering.

Treaties, Acts, and Agreements to prevent money laundering and financing terrorism

The United States first enacted money laundering laws in 1986. And since then, money laundering has slowly become a global problem. It has been considered then that this act involves international financial transactions, currency smuggling across borders, and laundering of proceeds in one country to be committed in another.

Along with all these countermeasures to fight money laundering are acts, policies, bills or treaties, which all serve to back all these actions up. The Money Laundering Control Act declares proceeds of certain criminal offences as a crime. These offences are termed “Specified Unlawful Activities” (SUA) and are defined in Title 18 of the United States Code (1956, 1957) and Title 18 of the United States Code (1961). This secret service has observed a great increase in money laundering activities. These actions are connected to Specified Unlawful Activities. And this is especially true in financial institution fraud, access device fraud (credit cards, telecommunications, and computer investigations), food stamp fraud, and US currency counterfeit.

The secret service of the United States has also enforced the Counterfeit and Fraudulent Identification law in 1982. This law is found in Title 18 of the United States Code, Section 1028, which states that someone who knowingly and without lawful authority produces, transfers, or possesses a false identification document to defraud or deceive the US government is considered a criminal. These criminals, in general, use desktop publishing hardware or software to counterfeit and produce different forms of identification to be able to illegally obtain funds.

The Omnibus Crime Control Act of 1984 was also brought to the secret service. Ever since 1985, there has been a noticeable rapid growth in the number and type of criminal misuse and abuses of electronic technology. Worse, the degree of sophistication of a criminal has also advanced over the years. Computers are now extensively used to investigate electronic crimes like credit card fraud.

US President George Bush also signed the USA Patriot Act on October 26, 2001, a law that was passed under the suspension of Congressional rules while the country was healing itself from the devastating terrorist attacks on September 11 of the same year. It was designed for the purpose of interrupting money flows that help supports terrorist activities (Fisher, teal, 2005). This Act led to the expansion of surveillance activities, taking away the notion that looking into the personal information of customers is an intrusion of law enforcement into the lives of American citizens.

There also exists the Anti-Money Laundering and Counter-Terrorism Financing Bill of 2005. This paves the way for certain important considerations on privacy in the financial sector of the economy. This bill requires financial institutions like banks to obtain more personal information about their customers and dig into their transactions like opening of new accounts to see if there are other suspicious activities going on. And over time, this disclosure requirement has greatly increased as the level of money laundering impact increased. The information abstracted from these customers is very sensitive personal information that proves to be very valuable for these institutions (Privacy Issues from the Anti-Money Laundering and Counter-Terrorism Financing Act of 2005, 2005). While financial institutions collect, analyse, and disclose this information, they still have to ensure the trust they get from customers. This information, by the way, should be used solely for AML/CTF purposes unless otherwise given consent by the customer. And when individuals request access to their personal information done under the Privacy Act, the institutions must separate the information they have to disclose from the information that AML/CTF prohibits them from disclosing. Financial institutions may also choose to explain to the customers the reason for them collecting additional personal information. They also need to assure them of the limitations on its use and the presence of appropriate security measures in protecting it.

Works cited

- (2001)’International Instruments against Terrorism.’UN Chronicle, 74+.

- (2002)’Financing Domestic Terrorism.’ The Washington Times.

- (2005) International Journal of Comparative Sociology 46, no. 1-2: 79+.

- (2006)’Teams to Target Financial Crimes; Lawless Region Feeds Terrorism.’ The Washington Times: A13.

- (2007)’Fighting Terrorism – ASEAN Style.’ Manila Bulletin: A.

- Boran, Christopher. (2003)’Money Laundering.’ American Criminal Law Review 40, no. 2: 847+

- Buckley, Mary and Rick Fawn, eds. (2003). Global Responses to Terrorism: 9/11, Afghanistan and beyond. New York: Routledge.

- Cortright, David. (2005)’Can the UN Battle Terrorism Effectively? Security Council Resolutions Have “Mobilised States for a Campaign of Non-military Cooperative Law Enforcement Measures to Combat Global Terrorism.’ USA Today (Society for the Advancement of Education), 62+.

- Crimm, Nina J. (2004) ‘High Alert: The Government’s War on the Financing of Terrorism and Its Implications for Donors, Domestic Charitable Organisations, and Global Philanthropy.’ William and Mary Law Review 45, no. 4: 1341+.

- Cuellar, Mariano-Florentino. (2003)’The Tenuous Relationship between the Fight against Money Laundering and the Disruption of Criminal Finance.’ Journal of Criminal Law and Criminology 93, no. 2-3 311+.

- Jalata, Asafa. “State Terrorism and Globalisation: The Cases of Ethiopia and Sudan.”

- Lagasse, Paul. (2007)’U.S.A Patriot Act.’ In The Columbia Encyclopedia 6th New York: Columbia University Press.

- Linde, Erik Van De, Kevin Oíbrien, Gustav Lindstrom, Stephan De Spiegeleire, Mikko Vayrynen, and Han De Vries. (2002) ‘Quick Scan of Post 9/11 National Counter-Terrorism Policymaking and Implementation in Selected European Countries: Research Project for the Netherlands Ministry of Justice ‘. Santa Monica, CA: Rand.

- Perkel, Walter. (2003) ‘Money Laundering and Terrorism: Informal Value Transfer Systems’ American Criminal Law Review 41, no. 1: 183+.

- Ronczkowski, Michael R. (2004)/Terrorism and Organised Hate Crime: Intelligence Gathering, Analysis, and Investigations. Boca Raton, FL: CRC Press.

- Thackrah, John Richard. (2004).Dictionary of Terrorism. New York: Routledge.

- Weiss, Peter. (2002) ‘Terrorism, Counterterrorism and International Law.’ Arab Studies Quarterly (ASQ):11+.

- Zagaris, Bruce. (2002) ‘The Merging of the Counter-Terrorism and Anti-Money Laundering Regimes.’ Law and Policy in International Business 34, no.:1 45+.