Introduction: Put on the blue hat and answer the following

What is the proposal?

The proposal is for the UAE residents to start paying income taxes in order to help the government to finance more projects in the sectors such as education, health, and provision of other public goods.

What is the current situation regarding this policy?

At present, the UAE residents are not paying taxes on their income. The proposal has been made and currently being debated by the Federal National Council (FNC). The proposed policy might be good in the long run since the government will be able to finance more public goods that are beneficial to the residents of the UAE.

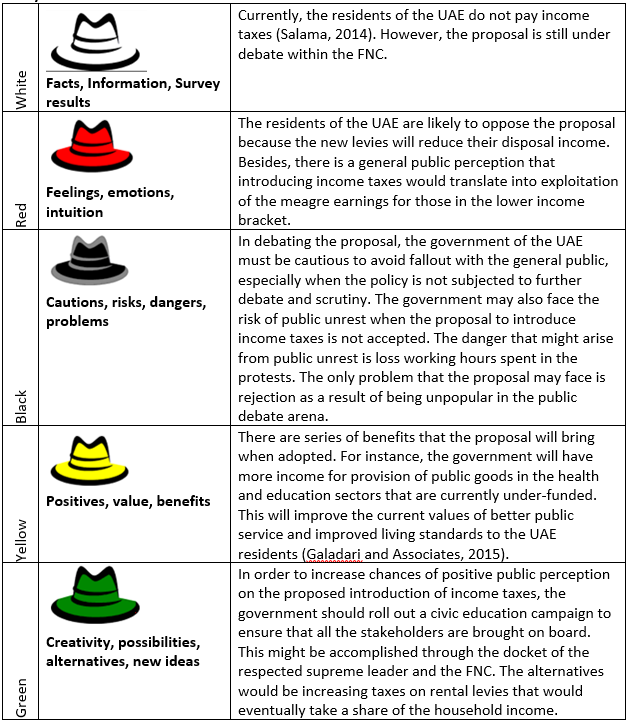

Analysis

Recommendations

It is important to win the general public before implementing the proposed policy change. This will cushion the government from any negative fallout with the residents of the UAE who currently hold a negative opinion about the proposal. Besides, the government will avoid the dangers and risks of a potential public unrest. In order to guarantee acceptance of the proposal, the government of the UAE, through the supreme leader and the FNC, should roll out civic education to promote the benefits of the proposal such as better healthcare services, improved education standards, and improved income for provision of public goods (Baldwin, 2011). The government might also consider increasing the current rental levies that will have same effects as introducing the income taxes.

References

Baldwin, D. (2011). The cost of being tax free in the UAE. Web.

Galadari and Associates. (2015). Taxation in the United Arab Emirates. Web.

Salama, S. (2014). No plans for taxes in the UAE next year. Web.