Introduction

The energy industry is a fundamental component of the UK economy. The industry serves diverse customer groups, which include individual and institutional customers. The sector supports diverse economic sectors, hence contributing to domestic consumption, which is critical in improving a country’s economic growth. In 2013, the industry generated approximately 6% of the country’s total Gross Domestic Product (Consultancy UK 2014).

The industry is a fundamental economic investment because it contributes to the country’s economic prosperity and stability. In 2013, the industry provided energy to over 26 million businesses and households, which translated into £ 25 billion [direct economic benefits] (Department of Energy & Climate Change 2013). By providing energy needs to the two consumer groups, the industry was in a position to deliver an additional £ 71 billion to the country’s economy. Therefore, the industry’s contribution to the country’s economy amounted to £96 billion in total (Consultancy UK 2014).

This report evaluates the market structure of the UK energy sector, the reasons for the current structure, and the possible future structure. The report further assesses the impact of the industry structure on strategy decisions of firms established in the industry. The contribution of the sector to the economy is also examined. Moreover, the report identifies one of the industry players coupled with analysing the effect of the government’s sustainability targets on the industry’s business plan.

Overall market structure

The UK energy industry can be described as an oligopoly, which entails a market dominated by a few industry players. The oligopoly market structure is differentiated in nature, which is evidenced by the fact that the industry players offer diverse product categories. Additionally, the ability of the industry to offer differentiated products arises from the existence of numerous small firms. The industry is dominated by six big companies, which include the British Gas, E.ON, EDF Energy, nPower, SSE, and Scottish Power (Earnst & Young 2015).

Between 2007 and 2013, the big companies managed to increase their level of profitability by 10 times. This aspect shows that the large companies have been in a position to exploit the industry profit by implementing diverse strategies. For example, the big companies are in a position to diversify their operations into different market segments. This approach enhances their capacity to maximise their level of profitability.

The firms can make abnormal profits through collusion. The firms’ motive to collude is to eliminate competition from new entrants and the small organisations operating in the industry. In addition to the above aspects, the six big companies have adopted the concept of vertical integration in an effort to strengthen their oligopolistic practices. Wu (2014, p. 5) affirms that vertical integration ‘involves a ‘combination of technologically separable and sequentially related economic activities within the confines of a single firm’. The six big oil companies mainly engage in vertical integration in their energy generation process.

Through vertical integration, the big six companies are in a position to exert their control in the UK energy industry. For example, the firms make it extremely difficult for customers to switch, which enable them to sustain their high-profit trends (Pym 2015). Moreover, vertical integration enables the energy companies to manipulate their profit levels. Therefore, the companies hinder the existence of fair trading practices within the country’s energy sector.

Through this approach, the six big companies have managed to integrate monopolistic practices. For example, the firms collude in making price and output decisions. Therefore, one can argue that the big firms do not allow the market forces to determine the product prices, which means that price determination is not transparent.

Measuring oligopoly

The oligopoly nature of the market can be assessed by determining the concentration ratio. The six big companies control over 78% of the total in the UK (Pym 2015).This aspect means that the six firms’ concentration ratio is 78%. The other small firms that operate in the industry account for 22% of the total market share, which represents a very small proportion of the total market. Therefore, the individual market share for the other small firms is considerably small.

Reasoning

The main reason, which explains why the energy market in the UK operates as an oligopoly, is the high cost of energy production. In 2014, the British government launched a plan to establish its first nuclear energy generation plant. The project is expected to cost £24.5 billion (Pym 2015). However, according to Vincent de Rivaz, the EDF Chief Executive Officer, the cost of generating the energy from nuclear sources could be over £34 billion (Pym 2015).

Over the past few decades, the UK has undertaken measures to enhance competition in the energy generation market. One the measures relates to the liberalisation of the markets. Despite the liberalisation efforts, the industry’s structure has not changed. The new entrants into the energy market have not gained a significant foothold. This scenario arises from the high cost associated with generating energy in large-scale. The new entrants are not in a position to develop a strong competitive edge as opposed to the big six companies. McDermott (2013, par. 10) affirms that the ‘UK has some of the highest electricity prices in the European Union’.

The big six companies generate over 70% of the country’s electricity. Due to their strong competitive edge with reference to energy generation, the big six companies do not comply with the wholesale price requirement. On the contrary, the companies engage in vertical integration, which increases their market domination (McDermott 2013).

Future structure

The UK energy sector is expected to experience significant growth in the future. This change will arise from the high demand for energy. In order to address the increment in demand, it is imperative for the industry players to consider improving their energy generation capacity. Additionally, the industry players must consider generating renewable forms of energy in order to align with the demand for clean energy. A study conducted by the European Union shows that the regional demand for clean energy by 2020 would increase 20% (BBC 2015). On its part, the UK expects to generate over 15% of its energy from clean sources. These changes are likely to increase the attractiveness of the industry to potential investors (BBC 2015).

In spite of the above changes, the structure of the UK energy market will be transformed. The oligopoly nature of the UK energy industry is likely to change considerably in the future. The change might emanate from the intervention by Ofgem, which is the industry regulator. A recent study conducted by the Competition and Markets Authority shows that the big six companies have increased their level of profitability from £ 233 million to £1.1 billion between 2009 and 2012 (Gosden 2014).

However, the CMA emphasises that the increment in the level of profitability is not due to efficient operations, hence the reduction in the cost of operation. On the contrary, the big six companies engage in price leadership practices. The six firms implement the price leadership model in an effort to avoid a price war through collusion in setting the price rules. The six firms’ cooperate in an effort to eliminate cooperation, hence increasing their capacity to reap monopoly profits. The industry regulator affirms that the six big companies are in a position to exploit the loyal customers consistently through their high price points. Consequently, the six big firms replace competition with cooperation (O’Connor & Faille 2000).

In an effort to meet the country’s energy demand, the UK government is committed to ensuring that the market is competitive in order to attract investors into the market. The intervention by the UK government through the CMA and the Office of Fair Trading in an effort to enhance competition within the market will significantly minimise the market power possessed by the six companies. Consequently, the likelihood of the industry being transformed into a monopolistic competitive market is high.

Impact of the structure decisions on strategy

The current structure of the UK energy market greatly affects the strategies adopted by the industry players. The six strong competitors have exerted their power with reference to pricing over the past years. Their adoption of the price leadership model by cooperating with each other in setting the price of their products illustrates the extent of their market domination. However, the big six companies implement differential pricing strategy. Patra (2004) asserts that the companies’ decision to implement the differential pricing strategy is to maximise sales revenue from diverse market segments. Through this strategy, the big six companies have established a considerable market barrier that limits the small firms’ ability to gain a considerable competitive edge with reference to supplying energy. Additionally, the six big firms have developed strong brands that have penetrated the local market successfully.

Small firms and the new entrants are increasingly considering entering the UK energy industry in an effort to exploit the economic profits. However, their ability to enter the market successfully depends on the type of strategy adopted. One of the strategies that the other industry players are considering entails the consolidation strategy. This strategy is being implemented through the formation of merger and acquisition.

According to PricewaterhouseCoopers (2014), the motive behind consolidation by the small firms is to attain substantial cost reduction. For example, British Petroleum, which is a well-established oil and gas company, entered a merger with Amoco in 1999. According to the PricewaterhouseCoopers (2014, par. 8), ‘oil prices remaining at the current level for sustained period will light the touch-paper for mergers and acquisitions in 2015 and as the UK industry positions itself for a more uncertain future, deal activity levels are expected to pick up throughout the year’.

Due to the ‘big six’ companies’ ability to influence the price of energy in the UK market, the small companies are increasingly considering the diversification of their energy generation activities. The small companies have increasingly ventured into new market niches. One of the market niches that the small firms have considered relate to the generation of renewable sources of energy (Koh 2014). Between 2010 and 2013, the UK has experienced a considerable increment in the size of investment with reference to electricity generation. From 2010 to 2013, investment in renewable sources of energy increased to £ 7 billion. Additionally, investment in electricity generation within the country was increased by £ 8 billion in 2013. Furthermore, in 2014, over eight renewable energy generation projects were launched (Department of Energy & Climate Change 2014a).

The above aspect indicates that the trend with reference to investment in alternative forms of energy will increase the intensity of competition in the industry.

Moreover, adopting this strategy will enable the small firms to gain edge in the market. This move will be achieved by increasing the firm’s ability to generate alternative renewable sources of energy. Consequently, the firms will attract diverse customer groups according to their energy demands. Therefore, it is evident that the current structure of the industry will stimulate the industry players to consider adjusting their strategic business practices. This goal can be achieved by adopting collaborative strategies such as the formation of mergers and association. The approach will enable the small firms to break the oligopolistic market characteristics.

Contribution of the sector to the UK economy

Employment

Governments are charged with the responsibility of ensuring a high rate of economic growth. The attainment of this goal depends on the quality of macroeconomic policies adopted by the government. Thus, a high level of macro-economic stability must be ensured. Over the past few years, the UK has experienced considerable macroeconomic instability. One of the sources of the instability relates to the high rate of unemployment.

In 2011, the UK was characterised by a high rate of unemployment especially amongst the youth, which was estimated to be 8.4% (European Commission 2014). However, the rate of unemployment has declined considerably over the past few years. The decline has emanated from the private sector investment. In 2012, private investment in the UK amounted to £ 11.6 billion, which is considerably higher as compared to the total investment in the public sector such as the health and education sector (European Commission 2014). The energy sector accounts for a considerable amount of the total investment in the UK. For example, investment in renewable energy grew by 31% (Earnst & Young 2015).

The energy industry constitutes one of the fundamental components of the UK economy. Apart from the direct economic contribution, the energy industry enhanced the country’s economic performance through the provision of employment opportunities. The industry offers the UK citizens different types of jobs such as technical jobs and engineering jobs. The energy-generating firms in the UK have created over 131,000 direct employments and over 549,000 indirect jobs within the immediate supply chain. Therefore, the industry has created over 680,000 jobs (Earnst & Young 2015).

The ability of the industry to provide equitable distribution of employment opportunities across the UK has arisen from the increased investment in the generation of diverse forms of energy. It is expected that the industry’s momentum with reference to job creation will be sustained into the future. For example, between 2010 and 2013, the size of employment with reference to the generation of renewable sources of energy increased from 3,151 to 6,850 (Earnst & Young 2015). The industry is well distributed around the country, which means that it has contributed to effective distribution of job opportunities to the UK citizens unlike most economic sectors that are located around London. The energy sector has created jobs in Eastern and Southern England (Consultancy UK 2014).

Contribution to the UK Gross Domestic Product

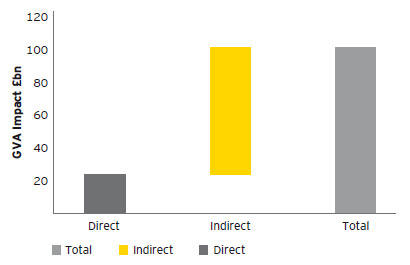

The energy industry ranks amongst the biggest contributors to the UK Gross Domestic Product. According to Earnst & Young (2015), the industry’s direct contribution to the UK GDP increased from £21 billion to £ 24 billion between 2011 and 2012. In addition to the direct contribution, the industry’s indirect contribution to the country’s GDP during the same period grew to £102 billion. The indirect contribution arises from other players within the supply chain such as biomass and gas suppliers. Moreover, the energy generation process also involves extensive consumption of capital goods and services. For example, successful energy generation requires the construction of effective infrastructures. These consumption activities further stimulate growth in the country’s GDP. In addition to the above aspects, the industry remitted over £3 billion in corporate taxes. Ernst & Young (2013, par. 6) emphasises that energy ‘has a larger positive impact on its supply activities as compared to other capital-intensive/infrastructure sectors’.

It is estimated that every £1 invested in value addition within the energy sector translates into value creation of approximately £ 3 in other economic sectors. Consequently, one can argue that the energy industry is characterised by significantly strong positive multiplier effect (Farag & Komendantova 2014). The graph below illustrates the direct and indirect contribution of the energy sector to the country’s GDP.

Sectoral productivity

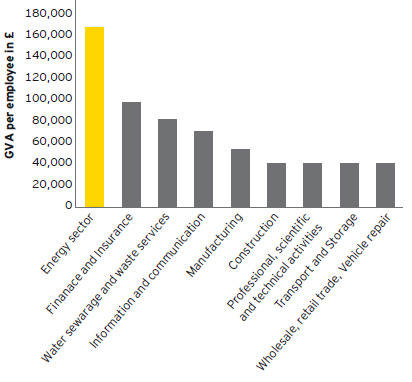

The energy sector ranks as the most productive economic sector in the UK as evidenced by the Gross Value Added [GVA]. The GVA measures the labour productivity of a particular economic sector. It is estimated that the GVA per employee within the UK energy sector is £ 164,000 per employee. This rate accounts for twice the value of GVA associated with the insurance and finance sectors and 5 times the GVA in the retail and wholesale sector. One of the reasons that explain the high GVA in the energy sector is the intensive capital investment. Graph 2 below illustrates the GVA per employee drawn from different economic sectors in the UK.

Appraisal of sustainability targets

The UK government has increased its commitment to protecting the environment over the past years. Its focus towards environmental protection has arisen from the high rate of climate change that is progressively threatening the country’s economic growth. One of the areas that the UK government has focused on relates to the reduction of greenhouse gas [GHG] emissions. In 2008, the government formulated the Climate Change Act, which outlines the intention to reduce the country’s GHG emissions by 80% by 2050 (Cambridge Econometrics 2014). By implementing this Act, the UK government expects to stimulate its net GDP growth by 1.1% by 2030. Moreover, this approach will create an additional 190,000 jobs, hence translating into an increment in household’s real disposable income by £ 565 (Cambridge Econometrics 2014).

The government’s commitment to reducing GHG emissions shows its resolve to entrench the environmental dimension of sustainable development. Clini, Musu, and Gullino (2008) define sustainable development to include an organisation’s development practices that enable it to meet its needs successfully without affecting the future generations adversely. The UK government’s quest to achieve the sustainability targets will depend on its collaboration with the private sectors. One of the sectors that the government should target relates to the energy sector. The energy sector plays a critical sector in minimising or eliminating GHG emissions in their energy generation and distribution roles.

According to the Department of Energy & Climate Change (2014b), the energy sector in the UK has enhanced the reduction of GHG emissions despite the increment in demand for energy. The achievement of this aspect has arisen from the increased investment in alternative forms of energy such as nuclear, biofuel, and solar energy (Bumpus et al. 2014). Between 1990 and 2013, the demand for electricity in the UK has increased by approximately 11%.

This goal has been attained by focusing on how to minimise GHG emissions during the energy generation process. Therefore, the energy generating companies such as British Gas will be required to consider adjusting their energy generation processes. Since its inception, British Gas has been focused on offering diverse energy products. The company specialises in the provision of diverse energy needs such as gas, electricity, home appliances services, renewable energy, and boilers and central heating systems (British Gas 2015). However, its success in offering diverse energy products in the wake of the new sustainability targets by the UK government will depend on its commitment to complying with the government’s GHG emission requirements.

In a bid to achieve this goal, British Gas will be required to make a number of adjustments in its strategic operation. First, the firm will be required to focus on its energy generation process in order to determine its contribution towards climate change. For example, British Gas should end its dependence on petroleum-based energy sources in its electricity generation process. This move will require a comprehensive restructuring of the firm’s manufacturing operations, which constitute a fundamental element in the business planning process.

Moreover, British Gas will be required to integrate renewable sources of energy such as nuclear energy. In a bid to achieve operational efficiency, British Gas will be required to integrate a mixture of fuel. By using diverse forms of renewable energy, British Gas will be in a position to minimise supplier power by procuring the supply of energy required in the generation process from different suppliers. However, move this will require the firm to change its production infrastructure such as technology in order to be in a position to utilise diverse forms of renewable energy. Thus, a significant amount of cost will be incurred during the initial stage.

Apart from the direct production activities, British Gas will be required to make significant adjustments in its entire value chain. Thus, the firm will be required to evaluate the GHG emissions arising from its distribution process. This move will require the firm to make a significant adjustment in the company’s distribution strategy. For example, the firm should ensure that its automobiles do not emit greenhouse gases. Therefore, the company’s cost of production will increase considerably. However, the firm should be in a position to break-even and continue with its profit trend.

Conclusion

The above industry analysis highlights a number of aspects that firms in the UK energy industry should consider in their strategic management practices. Currently, the industry is characterised by an oligopolistic market structure. The industry is characterised by numerous players, which enable customers to access diverse forms of products such as oil, gas, electricity, and renewable forms of energy. However, only six firms dominate the market. The ‘big six’ have continued to generate abnormal profits by creating structural barriers that make it difficult for new entrants. One of the models adopted by the firms entails the price leadership models.

The companies cooperate/collude with each other in setting the price of their energy products. Through collusion, the big companies are in a position to set relatively high price of their energy products. Therefore, one can argue that the firms are in a position to implement monopolistic practices.

The prevalence of the oligopolistic structure of the UK energy sector has arisen from the high cost involved in the energy generation process. This aspect makes it difficult for new entrants and small firms to develop a strong competitive edge successfully despite the liberalisation of the sector. The industry’s structure is subject to change in the future. The change will arise from intervention by the UK government through the various energy regulatory bodies. The UK government is committed to transforming the country’s energy industry into a competitive market by entrenching fair trade practices amongst the industry players. The incorporation of fair trade practices will make it possible for small firms to gain an edge in the market through successful exploitation of the industry’s economic profits.

The oligopolistic nature of the energy market has significantly influenced the industry players’ strategic decision-making process. One of the most notable strategic impacts entails the incorporation of industry consolidation practices. The industry players have progressively considered forming mergers and acquisition in an effort to enhance their capacity to cope with the competitive pressure arising from the market dominance of the six big companies. Through mergers and acquisitions, the small industry players will be in a position to deal with the operational challenge arising from the high cost associated with energy generation.

An analysis of the industry’s contribution to the UK economy shows that the industry is critical in the country’s economic performance. First, the industry has been an important source of employment for a number of UK citizens. Moreover, the industry indirectly contributes to the country’s GDP through improved sectoral productivity (Earnst & Young 2015). Therefore, the industry has contributed significantly to the improvement in the country’s domestic consumption. Consequently, the UK government should implement measures that will culminate in the improvement of the energy market structure.

In spite of the industry’s oligopolistic market structure, the UK government has undertaken measures aimed at entrenching the concept of environmental sustainability. The UK government considers sustainability as a critical element in stimulating the country’s GDP. However, the government should not adopt a lone-approach in its pursuit to minimise the country’s contribution to climate change. On the contrary, the government should ensure that businesses operations adhere to environmental sustainability. This approach will have a significant impact on the industry players’ cost of production due to the necessary adjustments required to ensure that the firm’s execute environmentally sustainable operations.

Firms intending to enter the UK energy industry must appreciate the prevailing market structure. The market structure comprises a fundamental element in the strategic decision-making process. First, the knowledge gained from the industry analysis provides insight into the most effective operational and marketing strategies to adopt. Moreover, industry analysis aids in understanding the potential impact of external market forces on the firm’s operational processes.

Reference List

BBC: Case study; changing energy use in UK 2014. Web.

Bumpus, A, Tansey, J, Henríquez, L & Okereke, C 2014, Carbon governance, climate change and business transformation, Routledge, New York. Web.

British Gas: Industry insights 2015. Web.

Cambridge Econometrics: The economics of climate change policy in the UK 2014. Web.

Clini, C, Musu, I & Gullino, M 2008, Sustainable development and environmental management; experiences and case studies, Springer, Dordrecht. Web.

Consultancy UK: EY; energy sector huge contributor to the UK economy 2014. Web.

Department of Energy & Climate Change: UK energy in brief 2013. Web.

Department of Energy & Climate Change: Delivering UK energy investment 2014. Web.

Department of Energy & Climate Change: UK greenhouse gas emission, provisional figures and 2012 UK greenhouse gas emissions 2014. Web.

Ernst & Young: Powering the UK in 2013; the sector’s contribution to the UK economy 2013. Web.

Ernst & Young: Powering the UK 2015. Web.

European Commission: European economy; macro-economic imbalances 2014. Web.

Farag, N & Komendantova, N 2014, ‘Multiplier effect on socio-economic development from investment in renewable energy projects in Egypt’, International Journal of Renewable Energy Research, vol. 4, no. 4, pp. 1108-18. Web.

Gosden, E 2014, Energy companies face break-up threat over high profit and prices. Web.

Koh, L 2014, Exploring key questions around entry to the UK energy supply market for small firms. Web.

McDermott, J 2013, The real big six- the problem with Britain’s energy market. Web.

O’Connor, D & Faille, C 2000, Basic economic principles; a guide for students, Greenwood Press, Westport. Web.

Patra, D 2004, Oil industry in India; problems and prospects in post APM era, Mittal Publication, New Delhi. Web.

PricewaterhouseCoopers: The UK oil and gas industry-PWC’s top five predictions 2014. Web.

Pym, H 2013, Energy; is there enough competition in the market. Web.

Wu, C 2014, Strategic Aspects of Oligopolistic Vertical Integration, Elsevier Amsterdam. Web.