Executive Summary

Scottish and Southern Energy serves the energy needs of household clients in the United Kingdom. The SWOT Analysis shows the many strengths, weaknesses, opportunities, and threats of the company. Likewise, the PESTEL analysis delves in the political, economic, social, technological, environmental, and legal aspects of the energy-providing company. The Porter’s five forces analysis explains the inputs from the current competitors, consumer, substitute, supplier, and new entrants on Southern and Scottish Energy’s marketing strategies.

The financial statements indicate that Scottish and Southern Energy profitably resolved each significant hurdle or opportunity along its path to achieve organisational goals and objectives. The company’s profitable stature points to strong recommendations to continue its currently successful innovative company policies.

The balance scorecard shows that the company overcomes each obstacle with flying colours. Indeed, SSE maximises the factors within the SWOT, PESTEL, Porter’s 5 forces, and other frameworks to profitably surpass benchmarks in the United Kingdom energy market segment.

Introduction

The company, Scottish and Southern Energy (SSE), maximises the SWOT, PESTEL, Porter’s 5 forces, and other significant variables to profitably succeed in the United Kingdom energy market segment. SSE is an organization engaged in the energy market segment. The company’s head office is strategically located in Pert, Scotland. It is the second largest supplier of energy needs in the United Kingdom.

The research focuses on the company’s financial statement analysis, SWOT analysis, and balanced scorecard with the United Kingdom. This paper evaluates the company’s success in terms of its competitive environment by implementing effective corporate strategies.

Scottish and Southern Energy: Industry Analysis

PESTLE Analysis

- Political environment. Scottish and Southern Energy complies with all political requirements of the nation. Government legislation encourages organisational, including Scottish and Southern Energy, to provide a variety of jobs to reduce the increasing unemployment rate (Balchin,1994). Scottish and Southern Energy hires employees from communities where each power plant is strategically located; consequently, the company aids to government in reducing unemployment rate (Taylor, 2007).

- Economic situation. In terms of company’s significant macroeconomic situation, the current financial crisis during the past few years precipitated from the current economic recession enveloping the United Kingdom and other parts of the world. The global online population will grow to about more than 2 billion by 2014 , or more than 40% from 1.6 billion in 2009. Due to the global financial crisis of 2008, Scottish and Southern Energy reduces avoidable expenses to a bare minimum to retain a profitable financial picture (Taylor, 2007).

- Social environment. Czinkota (2006) theorised due to a variety of social changes, the Scottish and Southern Energy expands to increase its revenues. The increasing influx of immigrants from European countries under the European Union charter increases the demand for electricity, gas, and other energy-related needs. The increase in the number immigrants living within the territorial boundaries of the United Kingdom creates an increase in the demand for Scottish and Southern Energy’s products and services. Dubrin (2008) opined because of the increase in the prices of basic commodities, British consumers are forced to reduce the use of electricity, gas, and other energy needs.

- Technological. According to Adrian Davies (2006), Scottish and Southern Energy incorporates green technology as on of its popular energy product alternatives. Starting in 2004, Scottish and Southern Energy implements its green energy policy using wind energy to generate electricity. Wind (patterned after Holland’s windmill technology), water, and future nuclear energy sources are patterned fill the residents’ increasing preferred energy needs. Steven Fuller (2005) observes the company has entered into a technology agreement with other power conversion organisations to research and develop an innovative direct current process with the use of windmill-based power technology

- Legal. Baumueller (2007) opined the company complies with all the laws of the United Kingdom. The Scottish and Southern Energy company pays each subordinate the minimum daily allowable by United Kingdom and other related laws. The company complies with all tax, cultural, employment, and other statues implemented in communities where each Scottish and Southern Energy site is located within the United Kingdom.

- Environmental. According to Piranhar (2006), the company does not throw its waste products into the crystal clear waters located near any of its energy-generating sites. With the current climate change issues, Scottish and Southern Energy offers wind, water, and future nuclear energy-based energy sources as environment-friendly alternatives to using pollution-triggering fossil oil.

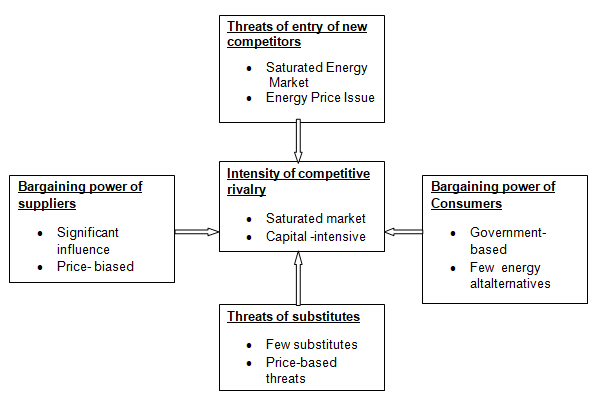

Porter’s Five Forces

Using the five forces model by Porter (1980) the following are the derived results:

- Threat of New Entrants. There are a few competitors eager to unceremoniously snatch each household client of Southern and Scottish Energy. The Saturated Electricty and energy price issue confronts competitors including British Gas, Scottish Power, EDF Energy, and Powergen (Davies, 2006). The continuing increases in electricity costs forces Southern and Scottish Energy to increase its prices; this triggers the public’s demand for cheaper alternative sources of energy.

- Bargaining Power of Suppliers. According to Yilmaz (2009), the major suppliers of Southern and Scottish Energy can significantly bargain to ensure a constant purchase of their supplies. Supplier preference is price-based. Energy suppliers include the fossil oil producing companies and water energy suppliers.

- Bargaining Power of Consumers. Porter emphasized that companies avoiding to innovate may suffer in terms of revenues. The government statutes affect client’s bargaining power. The consumers have few alternative energy choices. Consequently, many clients may shift to the competitors’ energy products and services (Porter, 1980).

- The Energy Competitors may produce similar or even better substitutes. Ritz theorised (2005) the price-based U.K. energy industry offers few alternative substitutes; candles and firewood cannot offer similar benefits as Scottish and Southern Energy sources in the electricity, gas, and other energy sources. In the Energy industry, there are two substitution forms; product for product and substitute for need.

- The Competitors may have the Power to Bargain. According to Janet Wood (2007) the saturated electricity, gas, and other energy-generating market segments in the United Kingdom continue to trigger the capital-intensive competitors in the local energy industry to creatively innovate to keep abreast of the competition. Currently, Scottish and Southern Energy uses renewal energy to reduce pollution.

SWOT Analysis

This part summarizes the discussions made in the Scottish and Southern Energy external environment using the five-force model (Porter, 1980) and those made from internal analysis using unique company characteristics and financial analysis.

- Strengths. According to Davies (2006), the company, Southern and Scottish Energy , has many sources to fuel the electricity and other needs of its household 3,600,000 clients within the United Kingdom. The client-centred company’s alternative sources of energy include water (hydroelectric power), wind (windmill technology), and fossil fuel. The company focuses on continued research and development activities. The company is a synergetic combination Scottish Hydro, Southern Electricity , SWALEC, and other companies.

- Weaknesses. According to Webb (2010) the Southern and Scottish Energy often increases the prices of its energy supplies to its 3,600,000 United Kingdom clients. Specifically, the company increased its December 2010 household electricity charges by £ 67 to recoup its increasing expenses within Southern England, Wales, and Scotland communities. The clients may seek other sources of energy to alleviate the increase in electricity costs.

- Opportunities. The company, Scottish and Southern Energy focuses on a new source, nuclear energy, to fill the communities’ energy needs. The use of nuclear energy eliminates the use of fossil oil, a big contributor to smoke pollution. Smoke pollution; smoke pollution causes damage to the environmental.

- Threats. According to Webb (2010), the increase in the electricity prices prompts many Scottish and Southern Energy clients to seek alternative sources of energy. The competitors, British Gas, Scottish Power, EDF Energy, and Powergen, are eagerly awaiting every chance to steal the company’s clients.

Market Structure

Davies (2006) emphasised the United Kingdom energy market structure is saturated. Scottish and Southern Energy supplies the electricity, gas, and other energy needs of residents within the United Kingdom. The company is currently complying with the government’s emphasis on the use of environment-friendly energy sources. The company’s focus includes the use of renewable energy. Renewable energy includes the use of water wave (hydroelectricity) and wind (green technology) to fill the electricity, gas, and other energy needs of people living within the United Kingdom territory.

SSE’s Financial Performance Analysis

According to Maguire (2007), Scottish and Southern Energy continues to maintain a profitable image by implementing a customer –based strategic energy sources. The economic depression cropped up and affected worldwide industries from 2008 to the present; the depression reduced the company’s ROCE and other ratios from 2008 until the present.

According to Helfert (2001) the Return on Capital Employed (ROCE) formula calculated in Table 1 (appendix) shows the Scottish and Southern Energy ROCE has drastically decreased from 14 percent in 2007 to only 12 percent in 2008. Similarly, the 2008 figure had decreased further to only 1 percent in 2009. The same 2009 figure rose to 11 percent in 2010.

The computation shows Scottish and Southern Energy was less profitable in 2009 as compared to the 2010 Scottish and Southern Energy ROCE computation. The economic depression started to lessen in 2010. Analysing the 2008 to 2010 period indicates an overall profitable business.

Thomas Russo (2008) mentioned the 2008 economic depression triggered the reduction in SSE’s 2007 financial statement ratios. Based on the gross profit ratio shown in Table 2 (appendix), the 2007 gross profit ratio of the company declined due to the economic depression starting in 2008. 14 percent declined to only ten percent in 2008.

The 2008 economic depression reduced the gross profit ratio from 10 percent to only 2 percent in 2009. Lastly the 2009 gross profit ratio declined increased to 11 percent. Overall, the ratios indicate the company’s gross profit ratio is favourable.

Based on the net profit ratio shown in Table 3 (appendix), the economic depression starting in 2008 reduced the 2007 net profit ratio to only 6 percent in 2008. Likewise, the 2008 economic depression reduced the 2008 net income from 6 percent to only 0 percent in 2009. Lastly the improving 2010 economic depression propelled the 2009 profit ratio from the 0 amount in 2009 based figure to a 6 percent financial statement ratio.

The improving 2010 economic condition increase the 2009 profit ratio from a lower percentage n declined position to the higher 6 percent. The quick ratio shown in Table 4 (appendix) indicates of the 2007 to 2010 quick ratio figures remained fixed at one percent. The improving 2010 economic condition encourages more people to buy and sell SSE and other products and services.

Corporate Strategies Currently Pursued by the Company

Palmer (2004) proposed the corporate strategies pursued by SSE include its marketing strategies that are focused on diversification of its product, price, place, and promotion strategies. The company sells high quality electricity, gas, and other energy products at reasonable prices.

The company advertises its products in and sets up its power generating plants to strategically reach current and future clients. Kotler (2008) proposed In addition, the company’s corporate strategy focuses on dividend distribution.

Balanced Scorecard

- Financial. Mayo (2007) theorised SSE’s financial scorecard shows a passing grade. The company was able to show that it was able to generate profits for the shareholders. The company’s objective of generating profits has been reached. The company’s net income data indicates a passing grade in the measurement, target, and initiative areas (Yilmaz, 2009).

- Internal Business Processes. As evidenced by the income statement, SSE is able to maximize its scarce internal resources to increase revenues and by maximizing its opportunities and strengths (Feldman, 2007). The company was able to attain its objective to improve its internal business processes by surpassing its measurement standard of increasing revenues and profits (Stickney, 2009).

- Learning and Growth. DuBrin (2008) observed the SSE’s financial statements indicate that it was able to achieve its vision to sustain its current top spot in terms of the United Kingdom electricity, gas, and other energy-based market share.

This has been backed by the company’s ability to change and improve its marketing and production strategies to innovatively retain its hold on a majority of the market segment. The company has been able to attain its objective, target, and initiative by to changing its strategies to retain its share of the measurement gauge known as market segment.

- Customers. According to McDonald (2007), the SSE’s income statement indicates that it has been able to achieve its vision of offering its current and prospective clients high quality electricity, gas, and other energy-based products at reasonable prices.

The company has attained its objective of generating profits by satisfying the clients’ needs (Mun, 2006). In terms of measurement, target, and initiative, the company’s positive financial ratios indicates clients are happy with the company’s services (Weygandt, 2009).

Competitive Advantage

According to Rix (2007), Scottish and Southern Energy is one of the top suppliers of household electricity, gas, and other energy-based products and service quality. At this level, product differentiation (wind, water, and fossil oil based energy) is an effective marketing strategy.

Strategic Map

- Stakeholder Perspective. According to Chapman (2007), the company, SSE, provides its stakeholders with opportunities to expand their benefits and leverage through collective knowledge and experiences from regular business reports. Next, the company will provide the basics for facility management professionals within the organisation to be promoted to higher responsibilities and position.

- Internal Perspective. According to Weihrich (2009), SSE ensures the efficient and effective production processes to maximize scarce labour, material, and time resources. The company continues to deliver high value electricity, gas, and other energy-based products and services to its members, clients, and partners.

- Learning and Growth Perspective. Weihrich (2009) opines SSE continues to creatively enhance its popular SSE culture by maximizing scarce energy-generating plants to fulfil the company’s goals, vision, mission, and objectives. The company incorporates innovation, challenge, and passion in its electricity, gas, and other energy-based marketing activities. The employees attend regular trainings to improve their work outputs.

- Financial Perspective. Weihrich (2009) proposes the company’s financial statement ratios. The company continues to successfully generate revenues. The revenues translate to net profits. Consequently, the company has more than enough funds to focus on increasing its market presence; the nuclear power plant research is one of the company’s recent goals.

Conclusion

Based on the above discussion, the success of the Scottish and Southern Energy business organisation is firmly grounded on many significant factors. The financial statement ratios show Scottish and Southern Energy gets a high passing grade for maximizing its assets to generate profits.

The company focuses on offering high quality energy produces and products. Lastly, the company ensures there is an uninterrupted supply to of electricity, gas, and other energy needs reaching each household.

This paper focuses on the profit maximization strategies employed by SSE for the years 2007 and 2010. The financial statement ratios show that the company did financially well before 2008 debacles. The SSE Company maximises the SWOT, PESTEL, Porter’s 5 forces, and other significant inputs to profitably succeed in the United Kingdom energy market segment.

Recommendations (Future Strategic Direction Based on Balanced Scorecard)

In terms of balanced scorecards’ financial perspective (Yilmaz, 2009), SSE must continue its current strategic direction of generating net profits by filling the clients’ electricity, gas, and other energy needs at affordable prices over the next ten years.

Based on the company’s balanced scorecard indicating the company continues to generate net profits for 2007 to 2010 from satisfied household clients, the current favourable financial success must be continued by offering high quality products at reasonable SSE prices.

In terms of the balanced scorecard’s customer aspect, the company continues its current strategic direction of advertising the company’s image over the next ten years. The income statement’s net income data shows the company generated profits.

In terms of the SSE’s balanced scorecard’s internal business process aspect, SSE management must continue its current strategic direction of improving the company’s current high quality supply chain strategy over the next ten years. The company’s internal business process balanced scorecard status indicates the company successfully profits from its huge chunk of the United Kingdom electricity, gas, and other energy market segments.

In terms of the company’s balanced scorecard’s learning and growth aspect, SSE, must conduct random community surveys as a new basis for instituting client-based strategies over the next ten years. The company’s balanced scorecard grade under the learning and growth aspect indicates the company is able to achieve its vision and mission to sustain its energy market leadership.

Appendices

Table 1. ROCE.

Table 2. Gross Profit Ratio.

Table 3. Net Profit Ratio.

Table 4. Quick Ratio.

The above table shows that the quick ratio does not change from 2007 to 2010.

Table 5. Debt to Equity Ratio.

The above table shows that the company the 2007 percentage has the best debt to equity ratio. The 2007 ratio is the lowest at 2.65 percent. The best debt to equity ratio is 100 percent.

Table 6. Scottish and Southern Energy. Income Statement (thousand pounds).

Table 7. Balance sheet.

Table 8. Return on Assets.

The above table shows that the 2010 return on assets result has a better results (7 percent) when compared to the 2009 return on assets amount (one percent).

Table 9. Scottish and Southern Energy Market share.

References

Anon (2011) Scottish and Southern Energy Financial Statements. Web.

Balchin A. (1994). Part-time workers in the multiple retail sector: small change from employment protection legislation. Employee Relations, 16(7), 1-3.

Abele, E., (2008) Global Production: A handbook for Strategy and Implementation. London, Springer Press.

Baumueller, M. (2007) Managing Cultural Diversity. London, Lang Press.

Bragg, S., (2006) Outsourcing. London, Wiley & Sons.

Chapman, C. (2007) Handbook of Management Accounting Research. London, Elsevier Press.

Czinkota, M., (2007) International Marketing. London, Cengage Press.

Davies, E. (1999) Fundamentals of Operations Management. London, McGraw-Hill.

Dubrin, A. (2008) Essentials of Management. London, Cengage Press.

Feldman, M. (2007) Crash Course in Accounting and Financial Analysis. London, J. Wiley& Sons.

Fisk, P., (2006) Marketing Genius. London, J. Wiley & Sons.

Helfert, E. (2001). Financial Analysis: Tools and techniques: a guide for managers. New York, McGraw-Hill Press.

Kotler, P. (2008) Corporate Social Responsibility. London, Wiley & Sons.

Kumar, N. (2003) Management Process and Organisational Behaviour. London, Anmol Press

Maguire, M. (2007) Financial Statement Analysis. London, Grin Press.

Mayo, H. (2007) Investments: An Introduction. London, Cengage Press.

McDonald, M., (2007) Marketing Plans: How to Prepare them, How to Use Them. London, Butterworth –Heinemann Press.

Mun, J. (2005) Real Options Analysis: Tools and Techniques for Valuing Strategic Investments and Decisions. London, J. Wiley & Sons.

Piranhar, H. (2006) Flexible Management of Logistics in Response to Turbulent Oil Prices, International Journal of Business Environment, 1(3), 280- 300.

Porter. J. (1980) Competitive Strategy. London, Free Press.

Puller, J. (2005) Electricity Deregulation: Choices and Challenges. London, UC Pres.

Rix, P., (2007) Marketing: A Practical Approach. London, McGraw Hill Press.

Russo, T. (2008) The 2008 Financial Crises and its Aftermath. London, J Wiley & Sons.

Stickney, C. (2009) Financial Accounting. London, Cengage Press.

Taylor, J. (2007) Principles of Economics, London. Cengage Press.

Webb, T. (2010) Energy bills likely to rise after Scottish and Southern Energy announces price increase. Guardian. Web.

Weihrich, H., (2009) Management. London, McGraw Hill.

Weygandt, J. (2009) Managerial Accounting: Tools for Business Decision Making. London, J. Wiley & Sons.

Wood, J. (2007) Nuclear Power. London, IET Press.

Yilmaz, K. (2009) The Balanced Scorecard. London, Grin Press.