Introduction

Under Armour (founded in 1996 by the present-day CEO, Kevin Plank) is currently one of the most well-recognized sports brands in the world. Initially, the company was focused on the production of inner wear for American football players; however, in a rather short time, Under Armour expanded its scope to encompass other sports by providing innovative, high-performance clothes, footwear, digital fitness platforms, and other accessories for professionals and amateurs of all age groups and genders.

The mission statement of the company runs as follows: “To make all athletes better through passion, design, and the relentless pursuit of innovation.” Over the past decade, Under Armour has achieved a significant growth in scope, stock value, and brand recognition, which allowed it to overcome its competitors and win its high standing in the U.S. market (Thompson, 2013).

Under Armour specializes in the production of high-performance goods for sports activities in any kind of environment as they allow for maintaining stable body temperature and keeping the body dry in any climatic conditions. The main product line is apparel, which is divided into heat gear, cold gear, and all-season gear. The core market is North America (91% of all revenues); the better part of the income comes from wholesales to national, regional, and independent retailers, although the company also has direct sales channels (websites, factory houses, and brand stores, etc.).

The revenue increased dramatically (32.3%) in FY 2014 due to brand recognition, expanded distribution channels in EMEA and Latin America, and the introduction of e-commerce (the core of the current distribution strategy). Under Armour uses a generic differentiation strategy: Before introducing a new product, the company tests its viability and assesses the competitive advantages it can provide, which allows it to compete with such industry giants as Adidas and Nike. As far as grand strategy is concerned, it is focused on (Ratten & Ferreira, 2016):

- innovation (impressing consumers with highly innovative goods);

- market development (selling products to emerging markets);

- market penetration (improving footwear and accessories sales);

- product development (finding new categories of goods);

- research (studies of emerging technologies that would allow for producing goods superior to those offered by competitors).

Strategic Issue

Under Armour differentiates itself from its competitors by producing apparel made of innovative synthetic material that maintains the normal temperature of the body. However, it is not enough to ensure brand loyalty. Therefore, the major current strategic directions are (Ratten & Ferreira, 2016):

- at the business level: increasing market share in the female market as the company is now perceived as a male-oriented producer;

- at the corporate level: partnering with professional, college, and university teams as a sponsor to be able to advertise its products;

- at the domestic level: targeting individual sportsmen and sporting teams to find stars that could represent the brand, increasing its recognition;

- at the global level: expanding to global markets (especially to Europe and Asia) through the establishment of new distribution channels and tailoring products based on local demand.

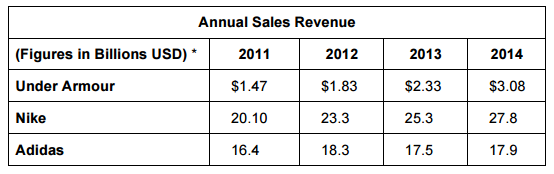

As far as strategic challenges are concerned, the major one is connected with increasing the company’s market share since it has to compete with the undeniable leaders of the industry, Nike and Adidas. Both competitors are brands with a long history, high brand recognition, efficient supply chains, and a large customer base (Thompson, 2013). Although Under Armour has already achieved a continuous growth of revenue, it lags far behind the two giants as their figures are incomparably higher (Rothaermel, 2015):

This makes it possible for the competitors to push Under Armour out of the market. Moreover, this threat is aggravated by the lack of its presence in the global market as North America still accounts for more than 90% of the revenue. Brand equity of Nike and Adidas hinders global expansion since their influence and recognition are unparalleled. The problem is that the company’s strategy to focus on such sports as American football and baseball automatically limits its scope of action to North America.

Thus, the major strategic issue for the company is whether it should continue relying upon the selectivity of the target audience or redirect its attention to sports with a larger global presence, leaving its differentiating strategy behind.

External Analysis

The sportswear industry has seen significant growth in the U.S. over the last decade due to the increasing popularity of healthy living and fashion for the casualization of dress codes (wearing sports clothes and shoes for performing daily activities). The present-day leader of the industry is Nike, which holds a 22% value share (Ratten & Ferreira, 2016).

The industry is expected to remain strong and continue growing at high speed. This is explained by the trend of making everyday apparel casual and functional: It is likely to become acceptable to wear sports clothes at various social gatherings. Such popularity of sportswear outside the world of sports will allow current leaders to expand their target audience and will certainly bring new players to the market (Thompson, 2013).

Porter’s Five Forces Analysis

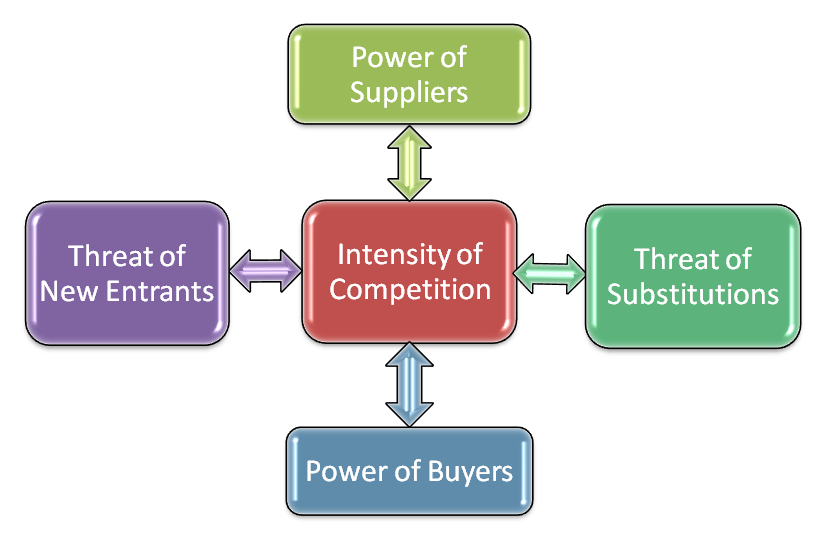

Porter’s Five Forces Analysis is a powerful tool that demonstrates the strengths and weaknesses of the business situation as well as the current positions of the major competitors of the industry. In most general terms, the analysis can help determine whether new entrants to the industry have any chance of becoming profitable. The model consists of five components (see Fig. 1).

For the sportswear industry, the analysis gives the following results (Ratten & Ferreira, 2016):

- The threat of new entrants – moderate. The industry is highly competitive, with the leaders having significant market coverage, which sets high entry barriers. Existing competitors have been investing in the advertisement, market research, and innovation to win brand recognition for many years. This allows them to retain their performance advantage over potential entrants.

- Power of buyers – moderate. The number of customers is huge in the market; therefore, companies have to advertise their products and differentiate their goods from the competitors’ products. However, the emergence of e-commerce has increased accessibility and created even closer relationships between customers and brands, thereby increasing commitment. For instance, Nike lets its buyers customize their footwear according to their preferences, even printing customers’ names on their shoes. Such superior quality of products, coupled with brand recognition makes it possible to retain customers.

- Bargaining power of suppliers – low. The sportswear industry has a great number of input suppliers with little differentiation among them. This makes their bargaining power close to non-existent as all the materials (leather, rubber, cotton, plastic, etc.) can be purchased anywhere in necessary quantities. Moreover, many of the suppliers have become dependent on industry leaders as their major clients.

- The threat of substitutions – moderate. On the one hand, there are many firms manufacturing sports products, which implies that the customer has a lot of alternatives to choose between. On the other hand, the propensity to substitute is not high if we analyze the market in comparison to other apparel and footwear markets. In this case, it is next to impossible to find a replacement (e.g., boots, sandals, or dress shoes do not provide the level of comfort and safety needed to perform sports activities).

- The intensity of competition – high. There is a great number of competitors in the industry, yet very few of them (such as Puma, Reebok, Brooks, and Under Armour) have the power to compete with Nike and Adidas.

Thus, the analysis shows that the strategic implications for the companies would be to emphasize differentiation to obtain a competitive edge. The growing and prospering industry may seem attractive for new entrants; still, a closer look reveals that despite a considerable number of competitors, the market is dominated by several companies with aggressive policies that have the power to push out newcomers.

Key Success Factors

Key success factors are the major factors ensuring that the company is going to prosper and out-compete its rivals. There are three main success factors of the industry under discussion (Rothaermel, 2015):

- Innovative products. Every brand in the sportswear market strives to create authentic goods. Strategically, it implies that a company has to invest in innovation to create new, previously non-existent benefits for its potential customers. Since we are not dealing with every day but rather with special apparel, it is not enough for it to be attractive. The manufacturer has to bring out the innovative qualities that the item features.

- Good marketing and promotion. The promotion and advertising strategies of sportswear companies have to be rather aggressive to succeed. Generally, they agree to sponsor everyone, starting from individual sportsmen to national teams, to increase brand visibility. Some of them even provide beginning athletes with clothes and footwear to ensure their future loyalty to the company. It is also popular to devise spaces in sports stores devoted solely to one brand.

- Research and development. In a highly competitive industry, it is essential to be one step ahead of your rivals. That is why much attention should be paid to studying new technologies, market analysis, opinion polls, and other forms of research that help with collecting valuable information about changes that occur in the market.

Industry Profile and Attractiveness

The external analysis has revealed that the industry presently faces a moderate threat of new entrants (due to the influence of well-established brands); moderate bargaining power of customers (who stay loyal to the selected brand due to its quality and recognition); low power of suppliers (as all the materials required for production are easily accessed); the moderate threat of substitutions (since customers can give preference to this or that company only within the sports industry); and high intensity of competition (due to a large number of newcomers) (Ratten & Ferreira, 2016).

The key success factors for the industry are innovation, good marketing and promotion, and research (Rothaermel, 2015). The major strategic implication for the brands is making an emphasis on differentiation as only producing goods that will stand apart from those offered by rivals can give a company a chance to survive in this aggressively competitive environment. It is crucial to create an authentic brand that would have room for expansion in all directions (internally and externally, nationally, and globally).

As far as the prospects are concerned, the industry is likely to continue growing. It will remain highly attractive to new players despite harsh competitive conditions as it promises huge profits in the case of success.

References

Ratten, V., & Ferreira, J. J. (Eds.). (2016). Sport entrepreneurship and innovation. London, UK: Routledge.

Rothaermel, F. T. (2015). Strategic management. New York, NY: McGraw-Hill.

Thompson, A. (2013). Under Armour’s Strategy in 2013 – good enough to win market share from Nike and Adidas?