Introduction

The United Kingdom opted out of the European Union Monetary and Economic Union (herein referred to as EMU) for several reasons, specifically what came to be referred to as the five economic tests. In retrospect, the “opt out” was not a good decision for the British business given the fact that businesses in this country effectively became outsiders to the Eurozone, and will be affected by policies made by this union just like any other foreign country.

Verdun (1999) provides a working conceptualisation of the term monetary union. This is the definition that will be adopted throughout this essay. According to this author, a monetary union can be viewed as an agreement between several nations to use a common currency amongst themselves (Verdun 1999: Stauffer n.d). The nations may go as far as establishing a single central bank and other centralised agencies that are tasked with the role of regulating the financial aspects of the nations.

The European Economic and Monetary Union (EMU) is such an example of a monetary union as defined by Verdun (1999). According to Adiong (2008), this union was to be implemented in three stages over a period of several years. Adiong (2008) refers to these steps as discrete but evolutionary, meaning that a step builds on its predecessor.

It is not all European Union nations that joined the EMU and this can be attributed to several reasons. There are those, specifically Greece and Sweden, that failed to meet some of the criteria put down to qualify member states to be part of the monetary union.

Others, like the United Kingdom, negotiated for what Willis (2010) refer to as opt outs. This means that these nations are exempted from the provisions and regulations of the monetary union, and they can join whenever they feel like, provided of course they meet all the necessary conditions.

This essay is going to look at the case of United Kingdom’s opt out from the European Monetary and Economic Union. The author is going to look at the reasons why this country opted out this union among other issues. The author will especially critically appraise whether the decision to opt out was the best or not for British businesses.

The European Economic and Monetary Union: Overview

Before looking at the reasons why the United Kingdom opted out of the monetary union and analysis of the impacts of this decision to the British business, it is important to provide a brief overview of this union. According to Stauffer (n.d), the European Economic and Monetary Union’s idea can be traced back to the year 1979.

This is the year that the European Council ratified the decision to adopt the European Monetary System [herein referred to as the EMS] (Stauffer n.d). This system was mostly concerned with the regulation of the union’s currency exchange rates.

However, the European monetary and economic union was not to be formed until the year 1992. This was the year that saw the signing of the famous Maastricht Treaty, the treaty that led to the founding of the European Union (Stauffer n.d). In this treaty, provisions, referred to as the convergence criteria (Adiong 2008), that were to be met by each of the European union member states before they could be allowed to join thee monetary and economic union.

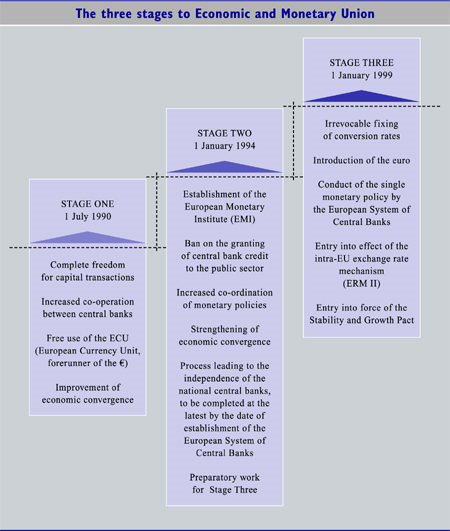

The European economic and monetary union was to be set up in three steps, a process that was recommended by the findings of the Delors Report (Bojden 2010). This was the report of a commission that was structured by thee European council to look into stages that can be followed in forming and adopting a monetary union for the European Union member states. The figure below depicts these steps and the provisions of each of them:

The first stage of the adoption was initiated on July 1st, 1990, and it provided for the elimination of virtually all restrictions imposed on the movement of capital from one European Union state to the other (Cash and Jamieson 2004). The second stage of the adoption saw the structuring and adoption of the European Monetary Institute (herein referred to as EMI) and the European Central Bank [herein referred to as ECB] (European Central Bank 2010).

This second stage commenced in the year 1994. The third stage begun on January 1999 (European Central Bank 2010: Blackstone, Lauricella and Shah 2010). This stage is still continuing, and it aims at fixing a common exchange rate for all the members of the monetary union.

The United Kingdom has remained in stage two of the adoption of the monetary union. It has failed to move with the other members to the third and final stage of the EMU that would have seen the abolishment of the sterling pound and replacement of the same with the euro. This move has been informed by several factors, ranging from political, economical to social considerations.

The United Kingdom and the European Economic and Monetary Union: Why the Opt Out?

Overview

The United Kingdom has been cynically referred to in many quarters as the master opt outs. This is given the fact that her majesty’s government has an affinity to negotiate for exemptions from major treaties, the provisions of which would have naturally affected the nation.

The latest in these escapades is the country’s total “opt out” from the provisions of the Justice and Home Affairs policy region (Willis 2010). Her Majesty’s negotiators were able to secure this preferential treatment during the negotiations that went into the Lisbon Treaty (Willis 2010: Blackstone et al 2010).

It was thus not entirely surprising when the United Kingdom negotiated for opt out from the European Economic and Monetary Union in the year 1992. The provisions of this opt out were that this country will be exempted from the participation in the third stage of the adoption.

Addressing the issue of the country’s participation in the third stage of adoption, the government was of the view that this will depend on several factors. This included the achievement of five economic tests as formulated by the then Labour Party Chancellor and later Prime Minister of the United Kingdom, Gordon Brown (Bojden 2010). When the five tests are met, a referendum will be held, seeking the approval of the British citizenry before the joining of the union.

Why the Opt Out?

As earlier indicated, several obstacles stood in the way of the adoption of a single currency by the United Kingdom’s government. These included economic, political and social obstacles (Cash and Jamieson 2004).

Economic Barriers

One of the major economic reason informing the refusal to join the economic union is the fact that the economy of this country is “out of synch” (Willis 2010 p4) with the others in the European continent.

This is especially so considering the fact that the sterling pound, the United Kingdom’s currency, has performed relatively well as compared to other currencies in the region. It is also noted that the unemployment rate, economic growth rate ad other aspects of the United Kingdom’s economy are not at par with the rest of the region’s (Bojden 2010).

It is also important to note that, at the time the United Kingdom negotiators worked out the opt out provisions, the degree of trade interdependence that the United Kingdom had with the rest of the economies making up the European union was quiet low (Willis 2010). This is unlike in the case of today, where sixty percent of the United Kingdom’s foreign trade is made up of trade between this country and the European Union economies (Willis 2010).

Political and Social Barriers

It is important to note that, despite being an economically oriented treaty, a lot of political and social overtones are discernible in the European Economic and Monetary Union.

The European Monetary Economic and Monetary Union and the European Union in extension have been very unpopular with the British public. Successive opinion polls and surveys have consistently indicated that the United Kingdom citizens do not support the idea of the country embarking on the third stage of adoption.

This realisation might have informed the decisions of the negotiators credited with the EMU opt out. For example, in the year 2005, 57 percent of the public polled opposed the country’s adoption of the euro (Bojden 2010). This opposition has been consistent over the years, with 59 percent opposing in 2008 and 64 percent in 2009 (Blackstone et al 2010).

Majority of those opposing the adoption of the euro and the elimination of the sterling pound are of the view that their opinion is not only economically motivated, but also social to a large extent. They are of the view that if the country adopts the single currency policy, it will lose its identity in the process (Blackstone et al 2010). This is given the fact that majority of the citizens in this country have a strong attachment to the sterling pound, and have come to regard it as part of their national heritage.

These are some of the social considerations that have ensured that the United Kingdom remains an “opt out” as far as the European economic and monetary union are concerned. Politicians- eager to appease the populace and win votes necessary to keep them in power- have ensured that the country hangs onto the sterling pound, adhering to the provisions of the “opt out” clause.

This line of thought is significant given the fact that Gordon Brown, who was the chancellor who formulated the five economic tests, rose up the political ladder to become the country’s prime minister (Willis 2010). As the incumbent of this position, Gordon Brown has ensured that the country remains an “opt out” case, giving this phenomenon one of its most obvious political overtones.

These economic, political and social barriers are inexplicably interlinked with the five economic tests that Gordon Brown formulated. Following is an analysis of these tests:

The Five Economic Tests

The following are the five economic tests for the United Kingdom:

- Convergence of business cycles

- Economic flexibility

- Improvement of foreign and domestic investment

- Improvement of United Kingdom’s financial services

- Positive effects on growth, stability and employment

A detailed analysis follows:

Convergence of Business Cycles

According to this test, business cycles in this country have to be compatible with those in other economies in the European Union region (Adiong 2008). Several indicators for this test were identified, and it is the achievement of these indicators that will determine whether the test itself is achieved or not. These include inflation and interest rates, output differences between the economies and currency exchange rates (Adiong 2008).

According to this test, the inflation rate had to be less than 1.5 percent of higher term (Adiong 2008). This is when compared to the mean of the three lowest inflation rates, according to this test (Adiong 2008). As far as the interest rate is concerned, it had to be less than or equal to two percent above the three lowest such rates that have been recorded (Adiong 2008). The deficit of the government’s financial estimates, according to this test, should not be above 3 percent of the gross domestic product (Adiong 2008). The debt of the government should also not exceed sixty percent of the gross domestic product (Adiong 2008).

Flexibility of the Economy

The second test provides that the economy of this country, before the adoption of the single currency, should be resilient enough to ensure that the local economy can absorb any fluctuations in the euro economy (Adiong 2008). For example, the labour market in the United Kingdom must be flexible enough to cushion the economy against adverse developments in the euro economy.

Foreign and Domestic Investment

If the United Kingdom was to take part in the single currency economy, the third test that must be met provides that there must be proof that this participation will improve investment (Adiong 2008). For example, there must be proof that in the long term, the number of local and foreign investors in the United Kingdom economy will increase, as well as the increase in the number of United Kingdom investors able to expand their wings to other economies outside the border of this country. This means that the exchange rates, the restrictions and such other provisions of the single currency must be friendly to investors.

Financial Services

According to this fourth test, the competitive advantage of the country’s financial services sector must be enhanced by the adoption of the single currency economy (Adiong 2008). This is especially so considering the fact that the United Kingdom’s financial services market is one of the most competitive ones in the world, and as such, the government will not adopt policies that threaten this position.

Growth and Stability

Gordon Brown and his advisors were of the view that the integration of the United Kingdom in the single currency economy must impact positively on the employment and growth rates of the country (Adiong 2008). This improvement can be gauged by the effects that the euro zone will have on this country’s foreign trade and economic stability.

A review carried out in the year 2007 found that only one of the tests has been met fully (Bojden 2010). This is the first one, the one on convergence of business cycles. This means that this country is not ready to adopt the single currency economy in the near future.

This state of affairs is not good at all to the business in the United Kingdom. This is given the fact that businesses in this country stands to lose a lot if they remain outside the euro zone, despite the public’s opposition of this kind of integration.

The Opt Out Bad for Business

The businesses in this country are losing from the adoption of this decision by the country’s political class keen on appeasing the emotions of the public. For example, the businesses are losing as far as exchange rates are concerned. This country, as earlier stated in this paper, imports and exports a lot within the euro zone as compared to other economies in the world (Willis 2010).

This means that the business people in this country have to incur the extra costs of exchange rates, a cost that they could have avoided if the country was operating on the euro currency (Willis 2010).

The businesses in this country interact heavily with the euro economies. However, despite these interactions and interdependency, British business is treated as foreigners or outsiders in the euro zone (Blackstone et al 2010). This means that they are affected like any other outsider by the economic decisions that are ratified and adopted by the economies party to the monetary union.

There are arguments within the circles of those proposing the adoption of a single economy, arguments to the effect that should the EMU economy succeed, this will sound a death knell to the United Kingdom businesses’ competitive advantage (Bojden 2010). This is given the fact that competitive advantage brought about by the success of this monetary union translates into losing of business for economies outside the union, Britain included.

Conclusion

There are those who argue that, by opting of the EMU treaty, the United Kingdom made the right decision which was the best for its businesses. They argue that, given the foreign nature of this country in relation to the EMU, United Kingdom businesses will not suffer negatively from instabilities within the union.

This is for example the fluctuations and weakening of the euro against major currencies such as the US dollar, fluctuations that may affect British businesses negatively. A lot of political friction, according to the views of these conservatives, is inevitable in the process of the United Kingdom’s adoption of the euro. This includes public outrage within the United Kingdom and political misunderstandings with other nations. All of this can be avoided by sticking to the “opt out” clause.

However, objective analysis of the situation reveals that the British business stands to gain more from the adoption of the euro economy. The public opposition to this is motivated by irrational fears of the unknown together with unrealistic and emotional attachments to the sterling pound.

References

Adiong, N. 2008. United Kingdom’s challenges in the European Monetary and Economic Union (EMU). New York: Free Press.

Blackstone, B., Lauricella, T., and Shah, N. 2010. Global markets shudder: Doubts about U.S. economy and a debt crunch in Europe jolt hopes for a recovery. The Wall Street Journal.

Bojden, K. 2010. The United Kingdom-does it belong in the EU? Wall Street Journal.

Cash, B., and Jamieson, B. 2004. The strangulation of Britain & British business: Europe in our daily lives. Web.

European Central Bank. 2010. Economic and Monetary Union (EMU). Web.

Stauffer, A. n.d. What is the European Monetary Union? Web.

Verdun, A. 1999. The role of the Delors Committee in the creation of EMU: An epistemic community? Journal of European Public Policy, 6(2): 308-328.

Willis, A. 2010. Van Rompuy: Eurozone will bail out Greece if needed. EU Observer.