Executive Summary

The main objective of this research paper is to analyze Voestalpine’s competitive advantages in the Chinese Steel industry by using Porter’s five forces model. Austrian Steel Company Voestalpine was established in 1938 with different business segments and it captured a significant market share of the global steel industry. However, the present aim of this company is to enter the Chinese market since it is a prospective market for steel producers due to the availability of raw materials and efficient workforce. As a result, this research paper focuses on external and internal factors of the Chinese steel industry, the prospect of the market and influential forces or threats of the market, and many other issues related to Porter’s five forces model. This paper considers the background of Voestalpine and the key features of the Chinese steel industry to evaluate the market for the company.

Introduction

Background of Voestalpine

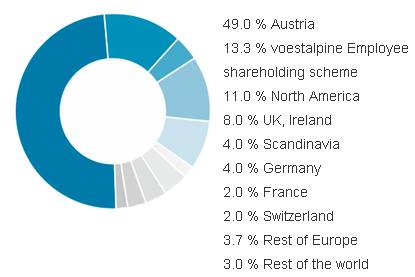

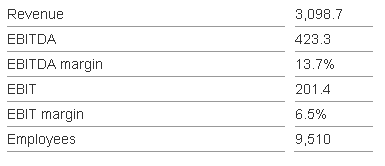

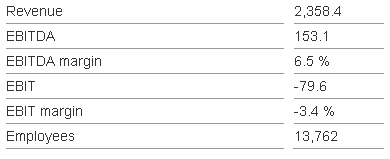

Austrian Steel Company Voestalpine started its journey in 1938 and this company has many business units in the global market. However, the steel division is one of the most profitable segments for the company because the steel demand is increasing everywhere and it is extremely difficult to find a substitute product, which can reduce this demand. According to the annual report of 2010, this company has more than 36,400 employees (among them 23,262 employees are working in the steel segment), out of which 47% are Austrian and the rest parts are recruited from international markets. The net sales revenue of this company has severely decreased due to the global financial downturn; for example, its net revenue from the steel segment was € 2,358.40 million in 2010, which was 33.2% less than the previous year’s revenue. However, the following two figures show key features for the last two years and the net revenue of Voestalpine for the last five years –

Voestalpine’s Customers of the Steel Segment

According to the annual report 2010 of Voestalpine, the main customer of steel segments is the automotive industry since Voestalpine supplied nearly 375 of its steel products to the auto industry. On the other hand, Voestalpine supplied 16% steel products to the energy industry, 21% to the civil and mechanical engineering industry, and 13% to the building and construction sub-suppliers.

Markets of the Special Steel Division

The following figure demonstrates that Germany is Voestalpine’s largest market as 26% of its profits are generated from this market. On the other hand, it has a significant presence in other European countries; for example, 4% of profits generated from France, 6% from Italy and 21% generated from other countries in Europe. However, its presence in Asian markets is not satisfactory enough; as in 2010, this company occupied only 15% market share in the Asian zone. As a result, Voestalpine’s strategy of entering the Chinese market would be helpful to increase its market share in Asia.

Background of Chinese Steel Industry

Competition

DeSapio and others (2008) defined the Chinese Steel Industry as “manufacturers of steel products” including SP Sheets, GI Sheets, FR sheets, HR Sheets, CR sheets, GI Sheets, AI Sheets, structural iron bars, deformed bars, rails, stainless, carbon and alloy steel and other steel and iron materials. There are myriad steel mills in China including stainless steels and carbon alloy steel article producers for both the public and private sectors within the country. Geographically, almost every province of China has steel production except that of Tibet; conversely, the Northern Province of Hebei is the largest producer of steel and coal in terms of quantity (Hinton, 1986).

The government of China has deep concerns with the rapid growth of the steel industry while nearly 60% of the steel producers are state-owned companies and 40% are in the private sector with high competition in the domestic market (Diana, 2011). The concurrent steel policy aimed to restructure the private sector by nourishing large producers and trimming down several steel producers through merger and acquisition, whilst the government has targeted to decrease the number to at least half by 2010. However, there are more than 8000 steel manufactures in China and the key competitors in the Chinese Steel Market are –

Table 1: Key competitors of the Chinese Steel Market. Source: self-generated from Tang (2010) and annual reports.

The Impact of the Global Financial Crisis

Hong and others (2010) pointed out that starting from 1996, China has turned to be the pioneer of global steel supplier, even under the global financial crisis in 2008; and it has produced 500 million tons of steel while the recessionary impacts have seriously influenced the global economy and the Chinese Steel industry has gone through a curtailed time. In January 2009, to overcome the impact of the global financial crisis, the Chinese government designed a strategic plan for its steel industry that aimed to massively improve steel production by 2011. Another aim of the policy is to terminate unparalleled competition in local markets. In the Chinese steel industry, the majority of steel producers are relatively large but are suffering from a high level of competitiveness, resulting in reducing outputs for many companies. The merger among the industry members could form competitive advantages for steel producers and shape sustainable developments in the Chinese steel industry.

Growth

CMA (2011) pointed out that the CISA (China Iron and Steel Association) is the state-run alliance of the Chinese steel manufacturers, and it announced that all members of the organization have already recorded 24.46 billion RMB as an aggregate net profit within the first three months of 2011. It is nearly 21.8 billion RMB higher than the previous year. The CISA has reported that the industry’s average profit margin is close to 2.91%; while in the current years, the cost of production jumped up 27.5% due to a price increase of imported iron ores. The price has increased to the US $ 157 on the CIF basis. Moreover, the local production of iron ores increased only 8.7% and accounted for 169.9 million metric tons during the first three months of the year 2011.

The increasing price of iron ore in the global market is one of the most significant causes of reducing steel manufactures’ profit margin. The CISA also predicted that the productive capabilities of the Chinese steel industry have accounted for at least 768 metric tons during 2010. The industry is in threats of overproduction, which means that the supply of steel exceeded the real local market demand. Moreover, the country has aimed to increase its steel production by 6% by 2015. Chinese steel industry experienced rapid growth due to relatively high product quality with comparatively low price; for instance, the following figure demonstrates the development of Chinese crude steel comparing with the US, Japan, Russia, and India (Tang, 2010).

Size

Tang (2010) argued that the statistics of 2009 demonstrated China has become the largest producer and consumer of steel products in the global market with a production of 567 million metric tons of crude steel, which accounts for 50% of the global steel production and ten times more than the US steel production. Due to the government policy for the Chinese steel industry in 2008, the FDI inflow of the steel sector has dramatically blown down, as the policy restricted the foreign investors to own a controlling authority in the steel industry; therefore, the country necessitates a huge quantity of iron ore importation to support this sector.

Moreover, the increasing shipping cost and increased iron ore price in the global market has created serious pressure on the industry; however, coke manufactured from the local mines provided the industry with a competitive advantage on production cost. Nearly 80% of the coke has been consumed by the Chinese steel industry and the production of coke has increased continuously by overlapping the local market demand and exporting to the international market. The Chinese government has set up export-prohibited regulation with the aim to depress coal mining and to ensure the relatively low price of coke supply for the steel industry. On the other hand, the Chinese steel industry has achieved remarkable export records in the global market. The US has turned to be the largest importer of Chinese steel products; the importation of steel has dramatically jumped 1400% from 2003 to 2007.

Literature Review

This chapter concentrates on the theoretical framework considering the background of Porter’s Five Forces model, description of the model, implementation of the model, strategies for defying the model, manipulating power of the model, criticism of the model, and development of alternative theories.

Background of the Model

The popular Five Forces Model is first discussed by Michael E. Porter in his book published in 1980; and the model was referred to as “techniques for analyzing industries and competitors”. The Five Forces Model has been used as a significant management tool for evaluating companies’ strategies in industrial formulation procedures. This tool is helpful for companies to meet scopes and challenges in their exterior environment. Porter has recognized the five factors, which could format different industries and could indicate companies to understand the competitive intensity along with the potential profitability of the corresponding industry. Therefore, since the important factors in the Five Forces Model are laid out systematically, by analyzing five forces, a company could oversee its position in the industry and quickly discover the areas that need to be improved.

Description of the model

Porter’s model consists of five interrelated factors, as-

Bargaining power of suppliers

Manufactures need raw materials, which establish a connection between companies and their suppliers. Therefore, if suppliers are powerful, they may induce an impact on manufacturers such as selling materials at the escalated price for gaining profits (Marketing Teacher, 2011).

Several factors are notable which determine the arena where suppliers are powerful. When a limited number of vendors operate the entire market apart from a split supply source and when there are no alternatives for a specific input, suppliers become powerful. On the other hand, the fragmented existence of the buyers indicates suppliers’ priority while the customers also face higher switching expenses for trading with other suppliers (Recklies, 2001).

Forward integration by a group of vendors also makes them more powerful in the market in terms of high-profit margins. Such a condition becomes true when the supplying industry possesses less profitability than the buying ones and integration would yield scale economies for vendors and the purchasing sector obstructs the distribution sector throughout the advancement and enjoys low impediment to entering into the complex market situation. All of those issues influence the suppliers to skim a higher price from the market. Therefore, a powerful vendor condition can minimize the strategic choices for the company (Ehmke and others, 2010).

On the other hand, suppliers become weak at some particular points. The most prominent weakness comes from the standardization of the traded items that creates more competition in the market. Afterward, buying commodity-type goods may also create several vulnerabilities (Griffin, 2006). If the customers develop viable backward integration among themselves, suppliers would be negatively affected by this. Finally, concentrated customers are also a threatening issue for vendors (Business Resource Software, 2011).

Bargaining power of buyers

The customers of a highly competitive market enjoy a very high level of bargaining power that produces a specific relationship of customers with the manufacturing industry, by mainly benefiting the consumers. More specifically, it is the state of the market, which consists of many vendors, but a single customer group. Under this circumstance, the buyer is the single body for determining the price. Practically, there are limited existences of pure monopsonies, even though there are few asymmetries between the manufacturing industry and the customers (DMST, 2011).

There are several cases where buyers are more powerful when they are concentrated. It means that when limited buyers occupy notable market shares, they become powerful. Such power tends to be more exercised when they buy the highest portion of the total output of the industry or in the case of the standardized item. Notable backward integration by the customer also creates a severe threat of purchasing goods from other competitors (Business Resource Software, 2011).

Similarly, there are some cases where customers are in a vulnerable position. When the manufacturers are integrated forwardly, or they have personal distribution or retailing channels, buyers become weak. Switching costs and customer fragmentations are other weakening issues for them. Finally, when the manufacturers offer a critical part of customers’ input regarding the allocation of buying patterns, it becomes a weaker point for the buyers (Business Resource Software, 2011).

The threat of new entrants

The existing competitors are not the only threatening factor for the company, but the potential newcomers can also create competitive challenges. Theoretically, any company is capable of entering and leaving the industry if there is a chance of free entrance and egress. Here, earnings need to be nominal. Entry barriers are highly important because the adjustment of the equilibrium point is generally made by the market. Because of the rising income, it can be anticipated that more and more firms will penetrate the market for gaining benefits of high earnings, and with the time that earnings fall for all the co-partners (Kramer and others, 2002).

Such a decrease in profits pressures some companies to leave the market by restoring an equilibrium point. Thus, the price decrease discourages competitors to enter the market. Further, reluctance may result in terms of entering into highly uncertain markets, especially, while it requires excessive fixed costs. Those are general assumptions, but it would not be true for an especial case when the organizations individually maintain the price at a lower level in an imitative way for restricting the potential new players from entering into the market (The U.S. Pharmaceutical Industry, 2008). There are several areas from where entry barriers may explode, such as-

- Government is the first and foremost body for creating barriers. In general, the prominent role of government in the market is protecting rivalry in terms of anti-trust activities, but the government is also entitled for restricting such rivalry by monopolistic actions and rules and regulations. The utility sector is an example of a government monopoly. Another factor is the required knowledge about patents and properties for being introduced in an industry. Distinct ideas also offer competitive advantages, as a patent of such kinds of assets that are restricted for others’ use by the means of developing an entry barrier. Property specificity acts as another form of barrier that can be explained as the situation where an organization’s properties can be used for manufacturing a dissimilar product. It is possible while the industry needs sophisticated technology, apparatus, and plants, possible newcomers are uninterested in making a contact for having specialized properties beyond of selling or changing into other application in case of the backwardness of the firm (Laudon and others, 2002). In short, asset specification is considered an entry obstacle because of two causes. Firstly, because of having specialized properties, firms are bound to deliver the highest labor for protecting their market share from new ventures. Secondly, possible new entrants are unwilling for investing in highly specialized properties (Miller, 1998).

- Internal scale economies should also be considered in this regard. MES (Minimum Efficient Scale) is a popular term here, which focuses on the point where minimum costs are incurred per unit production. In other words, it can also be termed as the cost of efficient production. A company’s low market share with low-cost entrance can be easily calculated if the MES of that company is identified. Therefore, the higher the gap between access unit expenses and the MES, the higher is the projected barriers to access. For functions with a lower MES, the company must have consent for selling at a skimming price regarding domestic monopoly or differentiation. In some cases, the industry may have a limited volume of significant resources. For example, the industry would have limited qualified experts for which the new ventures would hesitate for having an entrance (Porter, 2004).

- Exit barrier is another factor that plays a major role here as it confines a company’s capability for departing the market aggravating competition for existence. Higher capital and licensing costs can also be effective. In short, there are some causes for which it becomes easy for the firms to enter, for example, using of ordinary technology, access to supply chains, low brand loyalty, and little threshold level, etc. Relatively, some challenges for such entrance are proprietary knowledge, conservative supply networks, critical brand shifting costs, and more threshold level. Conversely, some conditions of simply leaving the market involve salable properties, small costs to leave, and open businesses. Some related challenges are property specialization, integrated operations high expense, and so on (David, 2008).

The threat of substitutes

According to Porter’s model, substitutes can be defined as those products and services, which are being used or will be used in the future to meet the same needs as met by the identified product manufactured in other industries. Economists feel that when the demand for the product has influenced due to the change of the price of the substitute, and that products serve similar purposes, then the possible threat occurs from such substitute (Chapman, 2009) and (Hitt and others, 2001). The existence of close alternative product retrains a firm to increase its price in the industry (Chapman, 2009). There are several factors, which determine the threat of substitutes, such as, customer brand loyalty, customer intimacy, customer switching expenses, performance value of the substitute and recent trends, etc. (Chapman, 2009).

There is a common question regarding whether a product within a particular market would be considered a remaining product, new product, or a potential substitute (DMST, 2011) Such as-

- Consideration of cross-price elasticity of demand, which results from the percentage change in demand from the percentage change in price;

- Analyzing the residual demand curve means pricing scenarios within a specific context of the market will not be limited by the switching potential of buyers.

- Making a strategic correlation of price if there are two vendors present in the industry facing a similar demand scope, they can undertake correlated pricing decisions. Although it is not a sophisticated method, it is the least way to act together for fighting against the competition;

- Consideration of other factors, like the- firm price- demand elasticity;

- Uniform goods trading within a similar geographical location are not alternatives that focus attention on industrial trade flows.

Rivalry among existing firms

This force explains the competitive strength among the existing companies running their operations within the industry. According to the conventional economic point of view, higher competition among firms tends to decrease profitability. However, the rivalry is imperfect and the market players are advanced inactive price takers. Here, the firms try to gain a competitive advantage over other competitors. The intensity of the desired competition generally differs from industry to industry (Porter, 2008).

Various measures can be used to determine the intensity of industry rivalry among which the Concentration Ratio (CR) is one of the most significant. According to the cyclic report of the Bureau of Census, CR is mostly used for SIC’s or Standard Industrial Classifications which shows the market shared percentage occupied by the four mega organizations. Here, a high CR points out that the biggest organizations own a high concentration of market share as the concentration point of the industry. Conversely, a low CR represents that many competitors feature the industry while no one does not have a prominent market share (DMST, 2011). If competition among the companies is low, the industry is said to be disciplined which would come from the industry’s historical background, the position of the top company, an informal agreement with a basic code of conduct (DMST, 2011). There are various strategic alternatives and the firms have the option to use these tools to gain an advantage over competitors, such as-

- An increase or decrease in price would help achieve a short- term competitive benefit. Offered products can also be differentiated in terms of features, innovative ideas, or production procedures (Kotler and others, 2006).

- A distribution channel is another option of differentiation through which the firm can differentiate itself by vertical or horizontal integration. Relationship with the vendors can also be demoralized for that purpose (Johnson and Others, 2008).

Moreover, some specific features of the industry manipulate the competitive rivalry of the business environment. Many firms operating in the same industry increase competitive pressure as they target similar customers with equivalent resources. Slow market expansion is another factor, which forces the firms to fight more for obtaining major share. Higher fixed costs in terms of economies of scale, highly perishable goods in terms of higher warehousing costs, and low switching expenses are also liable for extended rivalry. Minimum product differentiation as opposite to branding, strategic risks, and high exit barriers are some other factors. Cultural, philosophical, and historical diversity also intensify rivalry (VBM, 2011).

Internal industry rivalry can also be associated with price or non-price competition. There are six factors to support price competition (DMST, 2011) those are –

- Structure of the industry, which consists of numerous sellers;

- Less importance on product differentiation by the manufacturing of homogenous products;

- Characteristics of a selling system, which would be large, secretive, or lumpy;

- Utilization of overcapacity;

- Nature of buyers who are provoked and capable of spending.

Research Methodology

Research Approach

This chapter describes the application of this theory and information on secondary resources to organize the research paper related to Porter’s five forces model and Voestalpine’s competitive advantages. The author of this research paper would organize the report considering the case study approach of Robert Yin, as this method is perfect while in-depth assessment is essential about a precise issue. However, Tellis (1997, p.1) and Sekaran (2006) pointed out the importance of the case study approach by stating that Yin has combined several formulae, but not followed any particular formula; as a result, the researcher has scope to apply own discretion to formulate the research paper. Moreover, the researcher will merely take into account the qualitative research approach to formulate the whole study, and the researcher would avoid quantitative data, as gathering primary data is a time-consuming issue, and the researcher had a limited time to organize the paper with appropriate research.

Justification for Case Study Approach

- To analyze Voestalpine’s competitive advantages in the Chinese Steel Industry, Yin’s approach would help to co-ordinate the knowledge with Porter’s five forces model because the analysis chapter concentrates both on theoretical and realistic perspectives (Yin, 2003).

- A research paper on Voestalpine would help the researcher to upgrade future investigations in this topic and recommend the world leader of the steel industry to check the prospect in China.

- Moreover, the study about Porter’s five forces model of Voestalpine, comparing with other similar companies in the entire industry would support the main issues about the external and internal environments of the Chinese market.

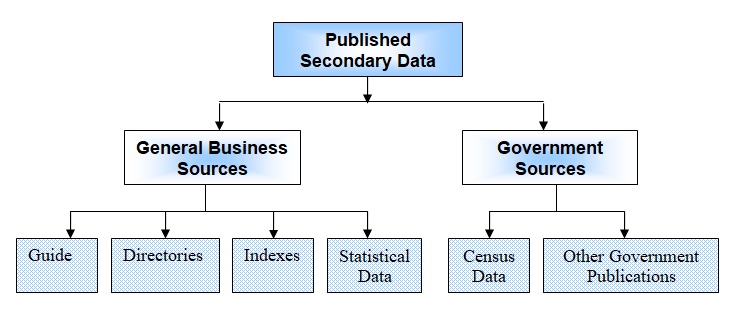

Secondary data

According to the view of Saunders and Others (2006), and Malhotra (2009), secondary data sources are more reliable and research-based because these data have already been organized with proper research. However, Cohen and others (2007) and Zikmund (2006) further pointed out that the data sources have been acknowledged by the renowned publishers, universities, and journals; therefore, these sources will assist the researcher to recognize the issues related to Porter’s five forces model. However, the researcher will mainly focus on secondary data to evade the pressure of field survey while huge reliable secondary data (for instance, books, journal articles, and online sources) are available regarding the Porter five forces model and steel industry in China.

Data Collection Method

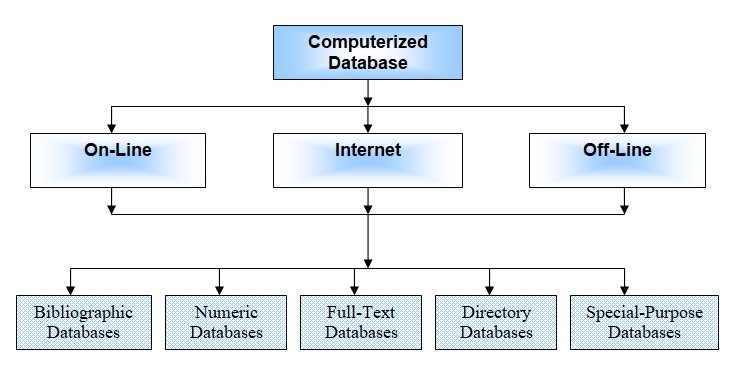

Sekaran (2006) and Malhotra (2009) stated that there are mainly two data sources, which are primary and secondary data sources, where the face-to-face interview is the most effective process to collect primary data from respondents. On the other hand, Cohen and others (2007) have pointed out that there are many systems to gather primary data, such as telephone, email, mail, and technologically developed systems. However, this research paper only concentrated on the secondary data and chosen case study approach as this study will deal with a single company “Voestalpine”. In this context, the data collection method for this research paper is comparatively different, for instance, this paper mainly focuses on published data and computerized database. However, the researcher had prepared an outline rather than a questionnaire to gather knowledge about the required information. In this case, the researcher of this paper has also used academic sources besides online publication to analyze porter’s five forces for Voestalpine. However, the following figures give an idea about the secondary data sources –

However, the researcher focused on internet databases as it can easily and less expensive method of data collection. Here, the China Fact sheet is an excellent guide, which properly analyzed the Chinese Steel Industry and measured possible risks of the Voestalpine group to operate in this market. On the other hand, the Annual report 2010 of Voestalpine with other reports of the Company’s websites helped the researcher to give an overview of the company with statistics that describe the strength of the company. Many academic sources have been used to analyze provide a theoretical framework of Porter’s five forces model. Useful books that helped to formulate the literature review were Michael Porter’s three books on Competitive Strategy, Johny Johansson’s Global Marketing, Gerry Johnson’s Exploring Corporate Strategy, Phillip Kotler’s Principles of Marketing, Alex Miller’s Strategic Management, and so on.

At the same time, helpful books to formulate research methodology were Louis Cohen’s Research Methods in Education, Naresh Malhotra’s Marketing Research- an Applied Orientation, William Zikmund’s Business Research Methods, and Robert Yin’s Case Study Research: Design and Methods. It has already been mentioned that online resources played a vital role to formulate the paper, particularly, online resources were essential to analyze the Chinese steel market in light of Porter’s five forces for the Voestalpine with real evidence.

However, this paper mainly selected three online resources to find out the threats of substitute for the Voestalpine, such as Warren Hunt’s The China Factor- Aluminum Industry Impact, Wen Xianjun’s article Chinese aluminum industry operation in 2010, SMM Information & Technology’s report on China Aluminum Industry and Gonilho Pereira’s Composite Rods as a Steel Substitute in Concrete Reinforcement. Also, many reports and journal articles were collected online to identify competitive forces, such as the reports of Global Times, journal articles of Mark Kramer and Others, China Steel News, and The China Daily.

Methodology of applying Porter’s five forces in the Chinese Steel Industry

The required model would be analyzed considering the secondary data to describe the major five components or forces. The first is termed as rivalry among existing players, which states the way to measure the intensity of rivalry in a selected market by using a technique known as Concentration Ratio. This CR is useful for determining the market share owned by the four biggest organizations of the market. For gaining competitive advantages over the competitors, companies can prefer several options regarding lower prices, differentiation through products and delivery networks, and suppliers relationship. The second force is concerned with the potential challenges coming from alternative items.

Such forms of threats include shifting costs, customer preference for the alternative, value performance, and the costs of substitutes. The third force is the bargaining power of buyers, which comes from bargaining influence, amount of purchase, information available for the buyers along with their expected response towards price, branding value, challenge from customer integration, and offer differentiation. The fourth force is the bargaining power of suppliers.

This issue involves the concentration of the vendors, input differentiation along with effects on expenses, potential supplier integration, and costs efficiency. The ending force is challenging for the new firms where barriers of the entrance are the prime factors. They include cost benefits, government regulations, scale economies, brand value, access to delivery, experience curve, and probable relation, and many other issues. Three generic strategies Porter have considered useful to countering those five forces regarding cost leadership, differentiation, and focus (DMST, 2011). Implementation of this model integrates other three basic analyses, which are related to statistics, dynamics, and options. Next, the power of the model can be manipulated by applying several strategies, like- partnership, brand loyalty, maintenance of scale economies through operations, lawful actions, and avoidance of price wars, etc. as viable for different forces.

Notable limitations of the model incorporate time obsolesce, a narrow focus on simple market, light focus on IT and other techniques as cooperative alliances and virtual networking informative value chain, etc. (Recklies, 2001). Digitalization generally encompasses the standard use of information technology at various sectors of an organization involving manufacturing, sales, and marketing, supply chain and customer services, etc. Many researchers think that in this current era of a dynamic world, a competitive advantage does not come only by offering a low price or product differentiation rather than some extra creativity as sophisticated IT support. Globalization is the meaning of thinking of the world as a global village that is being greatly implemented in the business world benefiting both suppliers and customers. Lastly, deregulation is highly related to rules and regulations of the governing body that can affect the survival or profitability of businesses (Recklies, 2008).

Scope of the research

This research paper has scopes to discuss the topic area more elaborately, for instance –

- This paper allows scrutinizing the Chinese steel industry to assess the prospect of a new market of Voestalpine;

- The literature review of this report depicts the theoretical framework of Porter’s five force model with the observation of the renowned researchers in these regards;

- It also monitors the effectiveness of this model at the time of penetrating a new market and attain competitive advantages;

- Also, the availability of the data sources help to evaluate the topic with better understanding;

- However, the number of words were sufficient to organize the paper properly;

- At the same time, this paper will apply Porter’s five forces model for Voestalpine with evidence and a practical viewpoint of the entire industry.

Limitation of the research

Besides scopes, it has many barriers to conduct research, such as –

- The short time frame for planning and organizing the paper was one of the most difficult aspects as planning is the foundation of the research paper;

- This research paper was organized considering the secondary data sources because of limited time, but there was scope to consider primary data sources;

- This paper would only deal with a single objective.

Analysis

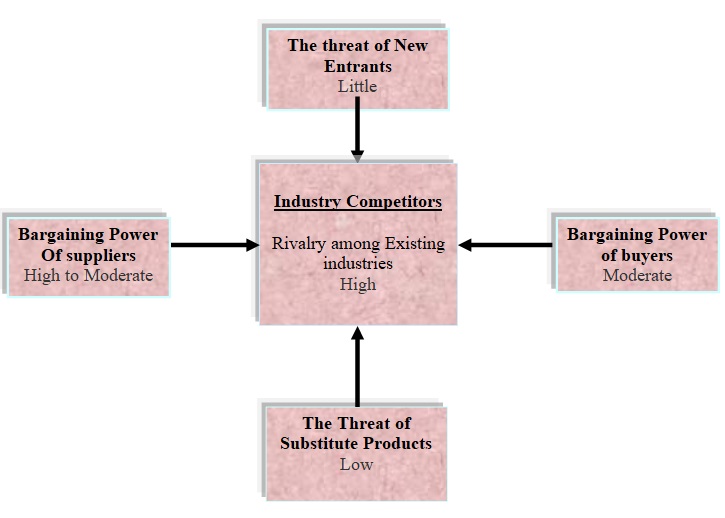

The purpose of this chapter is to illustrate Porter’s five forces model of Voestalpine with a practical perspective and this part provides information about the competitive forces of this company to enter and operate in the Chinese steel industry. However, the following figure demonstrates Porter’s five forces model of competition for Voestalpine –

Bargaining Power of Suppliers

Before analyzing the practical position of the bargaining power of the suppliers of the steel industry in detail, it is important to consider how the theories suggested in the second chapter are interrelated with the reality faced by the industry.

The second chapter has already addressed the meaning of the bargaining power of the suppliers and this part explains the Austrian Steel Company Voestalpine. However, the above figure demonstrates that the bargaining power of the suppliers is high to moderate due to several reasons such as Chinese government policy, the volatility of the price of raw materials, global financial crisis, shipping costs, and transportation facilities, and so on.

As argued in the second chapter, if the suppliers are influential, then they can put an influence on the industry and the customers, such as selling raw materials at a higher price than expected for gaining higher profits – practically, the leading mineral exporters have great bargaining power and for the Chinese steel industry they also benefit from parallel bargaining opportunities. This shows the fact that these mineral exporters because they are highly powerful and industry giants, use their market position to charge higher prices despite the Chinese governmental strategies. Therefore, from these suppliers, the Voestalpine group will see greater bargaining power.

As stated in the second chapter, when a few numbers of giant suppliers operate in the world market, they become powerful; practically, suppliers of iron ore has demonstrated high bargaining power with a small number of giants like Companhia Vale do Rio Doce, BHP Billiton, and Rio Tinto and that the three big suppliers possess own rivalry relation with the mining industry. As a result of such high bargaining power between a small number of market players, the Chinese government’s strategy was to look for alternative suppliers and from new locations and provide its local steel business with cheap supplies from small scale local suppliers. The Chinese government, to reduce the bargaining power of the international suppliers of coal, also emphasized the local market; to ensure that coke suppliers from the local market can supply the steel producers with cheap supplies by operating efficiently, the government placed an embargo to export in the global market, which has lowered their bargaining power.

It is suggested previously that forward integration by the suppliers also make them more influential in the market in terms of high-profit margins as they can gain economies of scale by merging or acquiring with its customers like steel producers. In practice, apart from giant players like Companhia Vale do Rio Doce, BHP Billiton, and Rio Tinto, a new supplier may show relatively high bargaining power in near future in the international market as well as in the Chinese market – the Fortescue Metals Group Ltd. What is more important is that this group will be showing such a high bargaining power because of the reason that it may soon come into join venture or mergers and acquisitions with any suitable top ten steel producer of China. Also, the fact that merger by the suppliers increases their bargaining power has proved by the fact that the suppliers of the China Steel industry are turning to be way stronger as a result of the merger of BHP with Rio Tinto.

The practical position of the bargaining power of the suppliers has been discussed in more detail in the paragraphs below.

SJU (2010) mentioned that the foremost mineral exporters possess extensive bargaining power and the Chinese steel industry also enjoys similar opportunities to bargain, though the Chinese governmental strategy always strives to overcome such powers by differentiating suppliers and increasing domestic production. The suppliers of the iron ore have demonstrated high bargaining power with the increasing iron ore price in the global market for the reason for the tremendous shipping costs. Though the three big suppliers have their rivalry relation with the mining industry, all of them almost behave in the same manner for the Chinese steel industry.

The China Daily (2008) reported that CVRD (Companhia Vale does Rio Doce) of Brazil, BHP Billiton, and Rio Tinto of Australia are the most influential iron ore suppliers in the global market and to the Chinese steel industry while it is notable that these three suppliers dominate almost eighty percent of the world’s supply of ores. Rather than the three giant suppliers, FMG (Fortescue Metals Group Ltd.) is another supplier of iron ores from Australia to the Chinese steel industry, and the company already signed a memorandum of understanding to supply 4 million Mt of iron ores in China and to do so it will develop railroad and port with three million dollars.

FMG already agreed with thirty-five Chinese steel mills to supply 170000 MT iron ores per month, In the current contract the price would be negotiable every year, and FMG does not agree to predict forthcoming price level. As a new supplier in China, FMG has some loyal viewpoint to the Chinese steel industry and they demonstrated their cooperative views by expressing interest to import finished heavy equipment from shown the Chinese steel mills, but due to strong bargaining power, it provided no opportunity to bargain price. Moreover, FMG’s interest in China encouraged it to come in a joint venture and it looks for merger and acquisition with any suitable top ten steel mill of China.

Ericsson and others (2010) pointed out that these three prevalent iron ore suppliers have greater control than before over the global iron ore production, which was almost 35.4% of the global market share in 2009; also, the emerging market of the Chinese steel industry is becoming unstable due to the suppliers’ pact. Yan (2009) argued that the bargaining power of the suppliers of China Steel industry has turned out to be stronger due to the merger of BHP with Rio Tinto, which has created massive threats for the China steel industry; moreover, the price for iron ores are predicted to rise higher in the next year or so.

Hume (2010) added that due to the strong bargaining power of suppliers, China’s governmental strategy always look for alternative suppliers and from new locations, for instance, the Chinese State-owned corporation CRMCC (China Railway Materials Commercial Corp.) has invested about £153 million to Tonkolili, an iron ores supplier of Sierra Leone, and ensured to buy forty percent of its total production. Meanwhile, China is striving to break down the strong bargaining power of suppliers. CRMCC also signed an agreement to purchase iron ores from African Minerals, Canada, India, and Canada, and so on.

Ulrich (2009) pointed out that another category of raw material suppliers for Chinese steel is the coal suppliers, which also gained strapping bargaining power due to the restriction of local coal production. Due to increasing shipping and transportation costs, the coal suppliers have increased their contracted price and Chinese steel has nothing to do without just agreeing to the higher price. For coke suppliers from the local market, governmental embargo to export in the global market has generated unparalleled competition with low bargaining power over the other raw materials suppliers.

At this point, before considering how the bargaining power of suppliers is “high to moderate” for the Voestalpine group, it is important to consider some basic facts about the Chinese market. Considering the value of exporting iron and steel products to overseas markets like the USA and Europe, China has achieved tremendous success since 2006 though during the recession fall in demand bothered their production and supply a lot. By the Chinese steel industry profile, currently, China is the largest steel producer and conversely, leading iron ore importer. Also, to carry on their steel supply in association with the global steel price negotiation enterprises, Chinese producers have now worked hard to negotiating high iron ore prices by the Rio Tinto and additionally, rejected to cut of 33.0 % of the increased price. Other than China, Japan, and South Korean steel producers have also given a hard observation into China for successful negotiation proposing a reduction of the unacceptable high price of iron ore by 40.0 percent; therefore, Chinese domestic steel markets would also survive with the continuation of international demand.

Meanwhile, in producing and supplying steel products, China has suffered an infrastructural crisis to conveying sound benchmark as a result, and annual iron-ore negotiation program has severely harassed and iron ore supply deed the Chinalco as well. On the other hand, during mid-2009, China accused the staff of Rio Tinto of stealing state secrets with their bribes, and consequently, M&A with the Australian government was drastically affected. In short, it can acclaim that hostile affiliation with Rio Tinto has created a severe impact on purchasing power to carry on the superior position of supply and production of steel. At the same time, besides the cancellation of the Chinalco agreement, the Chinese steel industry has now suffered from a misinterpretation with associate international producers, but the proactive decision of arrest corrupted Rio Tinto staff would assist Chinese steel producers by significant bargaining role by reduction of iron ore prices. Hence, it is uncomplicated for China for carrying on their trade internationally by kick out all of the irregularities (Hong & Mu, 2010).

At this stage of the paper, after considering both the theoretical ideas of the bargaining power of the suppliers in the Chinese steel industry and what is happening in practice, it is now time to consider how the conclusion has reached. As shown in figure-eight (Porter 5 forces model of competition for Voestalpine), the bargaining power of suppliers “high to moderate”.

There are several reasons why the bargaining power is “high to moderate”. Firstly, as discussed throughout the first segment of chapter four, the bargaining power of the suppliers in the Chinese market remained high as well as the global market. This was because a few numbers of global giants had the whole market full of many customers in their hands. Such market giants (for example, Companhia Vale do Rio Doce, BHP Billiton, and Rio Tinto) used their strong positions and skills in supplying iron ores to charge a great price from the Chinese and other steel producers.

Also, the merger of BHP Billiton with Rio Tinto, and the materialization of a new potential market power “Fortescue Metals Group Ltd” that has expected to show high bargaining power in the future because of its projected mergers or joint ventures in the Chinese market posed a great threat for the steel producers as well. These companies would utilize their market position and market share to gain extra profit by charging an elevated price for its supplies. Due to all these features of the giant suppliers in both the global and Chinese steel industry, it can consider the bargaining power of the suppliers to be high.

On the other hand, it can be argued that the bargaining power of the suppliers is “moderate” because of several reasons – most importantly, the strategies undertaken by the Chinese government by using numerous methods to control the suppliers in the local market. As stated in the arguments above, for example, for the coke suppliers from the local Chinese market, the government placed an embargo to export in the global market, which has lowered down their bargaining power about the other raw materials suppliers. Placing an embargo on exports means that the coal suppliers will not be able to sell some amounts of their products outside the Chinese market, so, there will be more supplies for the same type of product.

As stated in the second chapter, when a few numbers of suppliers operate in the market, they become powerful; this means that with the rising number of supplies the bargaining power of the suppliers is ought to reduce. Therefore, after placing an embargo on exports, the local supply business will have with them more amount of raw material, which they will have to sell to the local steel businesses. With abundant supplies, they will have to charge the customer with lower prices, which will lower their powers. Therefore, for local steel manufacturers, the action of the government will help them get advantages from low or moderate bargaining power.

It is essential to note that for the Voestalpine group, the bargaining power of the suppliers will be “high to moderate” because of several grounds. According to the China Factbook (2010), the Voestalpine group entered the Chinese market with joint ventures. This means that because it will work together with a local business, it will be able to enjoy moderate bargaining power from the suppliers. However, there are still dilemmas of whether the Chinese government will allow any foreign businesses to benefit from low bargaining powers. Therefore, due to adverse governmental steps, the Voestalpine group will face high bargaining powers. Moreover, if the Voestalpine group sees that the quality of the supplies that comes from local Chinese suppliers are poor than the supplies of the global giants and that the resultant products from poor supplies are destroying their image to customers, it will try to find suppliers with high bargaining powers from the global market.

Bargaining Power of the Buyer

The bargaining power of the buyers in the Chinese steel industry is moderate as there are no suitable substitute products, competitive pricing structure in the market, government initiatives, and high demand for this product influence the market.

Identification of buyer groups for Steel Products

There are more than six massive industries in China to buy steel products from both domestic and international markets, and the government has planned to invest about RMB 1.10 trillion within the next three years. Also, the government has taken a project to construct a transmission line of 260,000 km, which would supply 110 kilo-volts along with transformer competency of 1.35 billion kilo-volts per amperes. Secondly, the railway industry, during 2009, the Chinese railway industry has invested RMB 600 billion to buy railway infrastructures as well as an enlarged budget of RMB 50 billion for surpassing the outcome. Alternatively, between 2009–2010, China approved a construction plan to build 10,000 km long new railways that carries a cost of RMB 1.0 trillion. On the other hand, the Chinese government recently revised a new railway building that proposes 120,000 km, and hence, investment volume would be double as well as would increase annual steel consumption by 9.0 million tonnes.

Thirdly, in the real estate industry, the Chinese government has a key focus on low rent housing for the next three years as a result government’s aim is to build over 4.0 million economic houses where aggregate investment required is RMB 900 billion and also the annual investment of RMB 600 million for next three years. Fourthly, the energy industry, in recent time government has approved two large nuclear power projects (Guangdong Yangjiang Nuclear Power Project & Qinshan Nuclear Power Expansion Project) where aggregate investment required respectively RMB 95.50 billion and RMB 93.0 billion. Conversely, numerous energy infrastructure projects have been approved during 2009 that included one of the largest oil refinery plants in China namely the Chengdu and this oil plant has proficient to produce 10.0 million tones. However, the Chinese water infrastructure projects have estimated RMB 20.0 billion to buy steel and iron products to develop this water supply system since 2008. On the other hand, the transport industry is the vast investment area of government where several projects have been approved for the next two years with an annual fixed investment of RMB 1.0 trillion.

Moreover, currently, the government has approved an RMB 10.0 billion transport infrastructure project that required a vast supply of steel products. On the other hand, other than fuel supply, the transport industry has stimulated through the construction of machinery, which also demands a vast supply of steel products as a result, consumption and buy of steel products increased (35–40) percentage in the alarming zones of earthquakes as well as floods.

Then again, the government has announced an economic stimulus package among that 45.0 % would spend diverse areas of transportation (Railways, highways, airports, urban and rural power grid) and 90.0 % of aggregate investment meets requirements of steel products for energy sector along with post-disaster reconstruction tasks. The main feature of the Chinese economy is that it pays utmost attention to local economies and hence, buyer groups for steel products are mostly focused on diversified local industries rather than international buyers. In another word, the domestic steel market of China required to consume 54 – 55 % of global steel production, and thus not only in production volume but also in consumption China ranked top position. Regarding these purchasing initiatives, it has been revealed that all of these projects required purchasing a vast amount of diversified steel products. (KPMG, 2009)

Analysis of buyers’ purchasing power

Earlier hypothetical view of buyers’ bargaining power in the paper focused on the fact that the manufacturing industries conveyed trade-off with their target consumers and that the buyer’s group is termed as the key identity of the market. In other words, the buyers played a dominant role in determining pricing strategies, but an opposite scenario is also experienced in several market environments. It is important to argue that the theoretical view of the buyer’s purchasing power discussed in chapter two is not completely appropriate because of the Chinese business atmosphere together with the government trade regulations.

From viewpoint of the Chinese buyer group profile, it has pointed that principal buyer groups of this industry are state-owned diversified sectors (Real Estate, Railway, Nuclear Power Project, Energy Industry, Machinery Manufacturing Firms and so on) that has the strong bargaining power to take the lead role over suppliers with the support of government tax rebate as well as forthcoming subsidies. However, there are still large groups who possess low bargaining powers; so, on average, it can consider that the bargaining power of the buyers is moderate. Taking into account these circumstantial facts of entrance into the Chinese industry, Voestalpine would have required facing tough bargaining force though they have already covered the crucial market segment globally.

Meanwhile, global recession along with the elevated high price of iron ore would make an obstacle to supply steel products of Voestalpine. Conversely, it is recognizable that the Chinese government has officially followed a shift in regulations, and despite this, China is capable of earning the largest exporter internationally, in an aggregate export volume of 43.0 million tons which has greater by 109.60 % than last year. Alternatively, the aggregate import value was 18.51 million tons, which was inferior to last year by 28.30 %. In another word, Chinese steel products have been sold or exported in aggregate form by 24.50 million tons whereas import or buy iron core by 2.50 million tons which has reduced by 20.10 % than last year. At the end of the first quarter of 2007, to generate a trade surplus, the Chinese government withdrawal a 13.0 % export rebate in favor of more than 83 types of steel and iron products.

Meanwhile, the government has charged an export duty ranging from (5.0–10.0) % on selected 83 types of steel and iron products including few more steel items (Hot–rolled Plates, Wire & Steel Sections) as a result, the export tax has increased proportionately by (10.0–15.0) % on steel billets along with steel ingots. Implementation of the export rebate regulations dramatically increased export volume by 45.80 % that amounted to about 62.65 million tons; whereas import volume declined by (88.0–22.60) percent, which amounted to 16.90 million tons.

Then again, blockbuster buyers like the US and Europe of Chinese steel products have incessantly created pressure in increasing export tariff and hence, CISA (China Iron and Steel Association) has enforced to increase of export tariff by 25.0 % on semi-finished steel and iron products. As a result, export volume, as well as export value of finished steel products, significantly decline by 15.0 %. All of these circumstances had demonstrated Chinese buyers’ purchasing power during the entrance of Chinese steel products by Voestalpine. Finally, it should notice that the Chinese steel industry has severely suffered from environmental pollution due to their poor technological equipment and the entrance of Voestalpine has the strong potentiality to enjoy a pollution free supply of steel products (China Knowledge, 2011).

Threat of New Entrants and Entry Barriers

Practically, the threats from new entrants are quite little in the industry because of several reasons. The new entrants lack sufficient finances, skills, knowledge, human resources, technical assistance, and appropriate equipment with which they can penetrate the market and pose threats to the existing players. However, the analysis of the entry barrier by considering the former government of China has revealed that primarily China has followed its policy-making manner where the entrance of foreign companies imposed to overcome tough challenges as well as crafting competitive advantages. On behalf of WTO, major entry barriers should involve six categories, namely

- cost of production,

- product varieties,

- capital structure,

- consumer switching costs,

- supply chain management (SCM) or distribution channels, and

- government restriction.

By the WTO membership deed, China is committed to assessing six considerations during foreign entrance where the first issue was the cost of production, which is treated as an entry barrier if any company is not competent to fulfilling large consumer demand in the market as well as failing to occupy international benchmark during production. The second entry barrier included three features

- unbundling,

- customization and

- small product line, and the third feature was capital structure, which referred company profile with international financing policies.

Forth barrier was consumer-switching costs that justified investment return along with promotional tools and the fifth issue was SCM or distribution channels required to prove representation of the SEZ (Special Economic Zone) location of the host the country China along with the accomplishment of import license to reach Chinese buyers. Finally, the Chinese government’s entry barriers are involved with the practice of business policies with sound policy knowledge as well as convey of social responsibility and ethics.

- Government regulation: in government regulation during the entrance of foreign entities, China preferred and offered a joint venture approach to the foreign companies and strategically preferred leveraged companies therefore that would successfully overcome challenges of entry barriers. During mid-2010, CSC (China’s State Council) circulated a set of industry consolidations to expedite the domestic steel industry. This circulation has kept an eye on two major issues i) repair of environmental pollution and ii) modes of policy assessment and thus, circulation of the CSC attached with government regulations of challenging foreign entrance. In brief, here are the key issues of government regulation (Tang, 2010).

- Steel Capacity Expansion Reduction: until the end of 2011, the government would not approve a single expansion as well as replacement of obsolete plants.

- Expediter Capacity Closures: MIIT has recently announced a list of steel intensives that forcibly closed. For instance, the increase in electricity price.

- Facilitate Industry Consolidation: aggregate production capacity of the top 10 domestic companies in China was 44.0 % during 2009; and within 2015, it is expected to grow by 60.0 %. To employ the goal government has designed a consolidation plan that started to implement during 2010–2011 with support of land accessibility as well as financial resources.

- Repair Environmental Damages: through an adjustment of exporting low-value-added raw steel products government has now aimed to increases the recycling rate along with EAF adjusted steel production.

- Provide More Incentive on Technological Advancement: enlarge investment volume for the advancement of technology of the domestic steel industry and product quality development.

- Encourage Chinese Importers for Domestic Mining: rather than overseas mines government has now announced to afford incentives for domestic importers to supply iron ore domestically.

Patents and proprietary knowledge

In China, such a pattern of issues can inhibit Voestalpine to have an easy entrance into the steel industry (Weinstein, 2011). Although there are some sorts of liberalization in patent law after the country’s involvement with the WTO agreement, in terms of TRIPS (Trade-Related Aspects of Intellectual Property Rights), Voestalpine must go after the following options for a smooth entrance that can act as barriers-

- Formation of JV with local bodies other than taking of formal licenses of their technology or production tactics;

- Divide different manufacturing processes among various plants.

- Introduction of vertical distribution to deliver assure the best quality goods.

Assets specificity

It is highly influential for the Chinese steel market, which should be carefully considered by Voestalpine. As the steel market is certainly characterized by the investment, utilization, and implementation of those plants, equipment, and materials, which are greatly specialized and cannot be used or sold for other purposes, the company would be at great risk for remaining successful for long- run. Having specialized assets would create a lot of pressure on Voestalpine to undertake effective measures for posing intensive protection of the market shares, which is very difficult in reality. Also, the Voestalpine Steel would be caught by full loss because any unexpected fall is another risk (PR Newswire, 2010).

Organizational economies of scale

In China, the steel sector is greatly concerned about scale economies in production by producing a larger volume of products with low costs. For example, Chinese giant venture Bao Steel has adopted various methods to achieve and enhance its economies of scale in production (Wei, 2011). Regarding the modern line of assembling, the company follows the steps below-

- Usage of core materials (main coal) followed by frequent casting and then, completely regular rolling mill.

- Implementation of alloy bar manufacturing line generally for making automotive and bearing steel followed by 5- instrument- 5- strand frequent billet casting machine and ongoing rolling mill.

For achieving such a level of scale economies, Voestalpine must also integrate technologies and resources to gain cost benefits regarding the procurement of raw materials, sales, supply chain, fixed and R & D costs. Jiangsu Shagang Group and Bao Steel undertook those measures to gain such a level of cost advantages. Between them, the former one initiated an M & A strategy under which it was able to enhance the level of economies of scale through the shifting and management of taken over firms. After then, it centralized the treasury administration, buying and selling, and functional integration as the phase of its restructuring program, which was resulted in the generation of scale advantages (Deloitte, 2010).

Therefore, the achievement of the capacity, which will generate more production at lower costs, is foremost for sustaining in the Chinese steel market. Sometimes, it would be highly crucial and closely related to the question of overproduction and demand fluctuation. The production of special steel items generally results in more output although total market demand for this demand is not so high, which frequently breaches the potential of achieving, scale economies (Wei, 2011).

According to the theoretical aspect, entry barriers are high if the industry experiences scale economies, brand loyalty, high capital investment, strict government regulations, policies, and so on. In the case of Voestalpine’s Chinese market entrance, not all of these variables would work similarly, or the excessive pressure of one factor might lessen or neutralize the pressure of another. For example, for entering into this industry, Voestalpine will need huge assets as capital investment, which acts as a basic barrier for many companies to enter into a foreign market.

Next, brand loyalty also has the chance of affecting the company because of the existence of some traditional and well- repudiated players. Since the practice of scale economies is one of the most prominent features of the Chinese steel industry, Voestalpine will face resistance from this factor. Since the Chinese government is now relatively liberal than before regarding the operation of foreign ventures, Voestalpine will experience comparatively lower complications for entrance. As a completely new venture, it would also suffer from the problem of perfectly making contact with the customers. Customer brand loyalty and limited tendency to deal with new brands are generally responsible for that. Another barrier is that most of the steel companies have formed joint ventures and other forms of strategic alliances with one another or with their suppliers (Jing, 2010). This relationship will also be a threat for Voestalpine. Finally, it will encounter a potential challenge from a high degree of retaliation (Deloitte, 2010).

Threat of Substitutes

One of the major players in the steel industry, the Voestalpine Group would like to enter the Chinese market with its existing product line; as a result, it is important to assess the threat of substitute products. However, the threats of substitute products are relatively low in this steel industry in China because the modern world depends on steel solutions for an inestimable reason, such as these steel products have long been used everywhere from the construction industry to skyscrapers. As a result, the risks of substitute products are low though the research is going on to develop technologically advance substitute products of steel and they hope to innovate new products within a short time. However, there are few technologically advanced products, which can use instead of steel in some cases considering the weight, temperature, and other related issues such as market demand, customer preference, and so on. However, the inventors try to produce composite rods, aluminum framing solutions, composites, and plastics which could be potential steel substitutes.

The literature review has already discussed when the threats of substitute products would be high or low; and this part aims to measure the threats of substitute for the Voestalpine Group in the Chinese Steel industry with a practical perspective. However, the literature review described that the threat would be high if there are enough substitute products in the market that are available at a lower price and can use for the same purposes.

Here, figure 8 demonstrates that the threats of substitutes are low for the Voestalpine and the researcher considers two factors to reach this conclusion, these are – there is no alternate and cost-effective solution of steel, which can replace the use of steel products or decrease the sale in large extent. However, the researcher mainly considers Aluminum and Composite rods as substitute products of Steel in some cases though it is not possible to use these products for the same purposes most of the time. As a result, Voestalpine need not take any preventive steps to protect the risks of substitute products to enter the Chinese steel market, as it is not going to face any challenges from substitutes excluding few Aluminum products used in the automobile and construction industry.

Potential substitutes for Steel Products in China: the prospects of the products have discussed below –

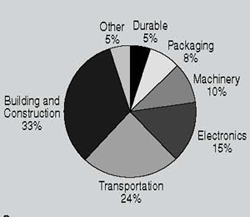

Aluminum: Due to the global financial crisis, the aluminum industry faced severe challenges, but aluminum products have been hugely used in Chinese markets for many reasons. SMM Information & Technology (2011) reported that the heavy demand from end-users one of the most influential factors to increase the price of aluminum in the previous year, and both huge local requirement in the Chinese market and increasing application opportunity of this metal has laid a solid base for the future progress of aluminum industry in China. However, the following figure shows the aluminum consumption in this country –

Xianjun (2011, p.4) pointed out the importance of aluminum in the Chinese market by stating that the demand for primary aluminum increases by 14.93 million tons or 27.65% and 26.49 million tons or 23.33% each year. However, Hunt (2004) stated that the economic position of China has changed from 20 years ago and the membership of WTO would change the external business environment; so the people would be able to understand the importance of aluminum in the national economy. Here, it is important to note that the Chinese aluminum industry has already captured a significant share of the global market particularly the transport sector and the construction industry largely depends on Aluminum products. As a result, the government of China has already taken initiatives to increase alumina manufacture ability to meet the mounting demand (Hurt, 2004).

Here, it is important to note that the demand for Aluminum is increasing Chinese market, but it would not be possible for this product to replace the use of Steel due to the difference in melting temperature between Aluminum and Steel. On the other hand, the customers use Aluminum for different purposes, but they do not think to use it as a substitute for Steel. In this context, the theoretical consideration like cross-price elasticity of demand, pricing scenario within a specific context of the market, the switching potential of buyers, and geographical location would not be considered to conclude that the threats of substitutes are low.

On the other hand, the concept of switching off costs is a relevant factor to decide whether the threats of substitute are high or low, but there are no alternative products of steel in a real sense, so, switching off costs is immaterial consideration for Voestalpine Group. However, there are few sectors like- construction industry where buyers can use either Aluminum or Steel, then the switching off costs may become one of the most important factors in this situation; therefore, Voestalpine Group should offer a low price for those items.

Composite rods: On the other hand, Pereira and others (2011) researched on mechanical characteristics of composite rods to develop this metal as a steel substitute in concrete reinforcement and this product has limited influence in China market.

Analysis of the substitutes and their impact on Steel Products:

Aluminum: This metal has captured the market of steel particularly in the construction industry, where steel and aluminum are equally important to the customers. However, automobile manufactures are always eager to find out substitute products of steel and they use Aluminum instead of steel to reduce the weight of the products; therefore, its use increased 11.4% on average in the last four years in China. In this context, Voestalpine Group has to offer to reduce the price for its steel products and it should extend the budget for research to introduce products of similar weight and quality at a lower price.

Rivalry Competitor analysis

Voestalpine Group has to face intense competition in the Chinese market because rivalry among existing firms is high. Similarly, the Chinese steel industry is getting more and more competitive day-by-day as a large number of domestic and foreign competitors are penetrating the market frequently by using different entry strategies (Roc Search Ltd, 2006). Major steel competitors include Bao Steel, An Steel, Wuhan Iron and Steel, Hebei Iron and Steel, Anshan Iron & Steel Group Corporation, Shandong Iron and Steel Group, Anshan Iron & Steel Group Corporation, Angang Steel Company Limited and Valin Steel Group, and so on. Among these multiple companies, Bao Steel, An Steel, and Wu Steel are the most prominent ones about which a rivalry analysis can be made by incorporating various factors regarding product differentiation, pricing perspective, distribution, and supply chain, and other issues (China Knowledge, 2011). All of those aspects are being described below-

Prices of the products

The rise and fall in iron ore prices pressurized the steel industry to change the relative prices of all the produced items. Thus, it can be said that there exists price instability. For example, many companies reduced the volume of total output by cutting steel prices down, like- Bao Steel and others have reduced the price of the products in 2009 to increase sales volume and these companies experience more than $12 billion in profits (Zhang and others, 2011). This strategy has been adopted by other mega competitors like An Steel and Wu Steel, which reflects the presents of a frequent price war in the Chinese steel industry (Zhang and others, 2011). However, Voestalpine Group has to face this dilemma if it operates with a significant market share in the Chinese steel market.

Later, a quarterly pricing system was introduced which was influential enough to make people realize that the iron and steel sector is one of the most potential ones for making money (Steel News, 2011). Holiday effect acts as the motto to increase steel price while overcapacity acts as the motivator for certain price falls. Since Wu Steel is specialized in producing silicon steel than Baosteel and An Steel, it possesses an opportunity to enhance the grain-oriented electrical steel price.

Reduced demand coupled with higher costs of energy and raw materials, transportation, and iron ores is responsible to fall short steel prices by creating a certainty of a price war among competitors. This is the foremost reason for which Bao Steel can suffer from a lower profit margin in 2011. About 700% lift in the import prices of iron ores is liable for the higher price of steel would create pressure on average profit on the company (Zhang and others, 2011). Because of the presence of local and domestic counterparts, price competition in this industry is severe, which may create another problem for the Voestalpine Group. Conservative scrap- sourced special steel producers frequently face higher price rivalry than the local producers, like- An, Bao, or Wu Steel regarding the supply of iron (Wei, 2011).

Product differentiation

The name of the world’s second mega crude steel producer and the largest one in the domestic market is Bao Steel of China, which produces approximately 20 million tons of oil in a year. This company is well- recognized for having several differential advantages over major competitors including An Steel and Wu Steel. Its dynamic competencies have a widespread impact considering several areas ranging from utilization of differentiation strategies to maintenance of the higher level of supplier integration. According to the previous knowledge, the quality and product differentiation level of the Chinese steel industry was not so much sophisticated a few years ago. In this regard, domestic competitors were lagged behind their foreign counterparts as many of the overseas steel companies in China occupied a major competitive advantage over the domestic ones in terms of producing high-quality steel.

However, nowadays, this scenario has been changing gradually. For example, recently, Bao Steel is producing high- tech and high-quality premium steel with enhanced production capacity. The company’s production covers three major criteria that encompass carbon, stainless, and especially- alloyed steel. Among these, the last type of steel is extensively used in various industries, like- automobile, petrochemical, domestic devices, energy and transport, building, construction and decoration, petrochemical, manufacturing of equipment, metal items, electronics goods, etc. To sustain its competitiveness, the company has also initiated operations at an international level by covering more than 40 nations, like- South Korea, Japan, the USA, and Europe, etc. (Baosteel – China, 2011).

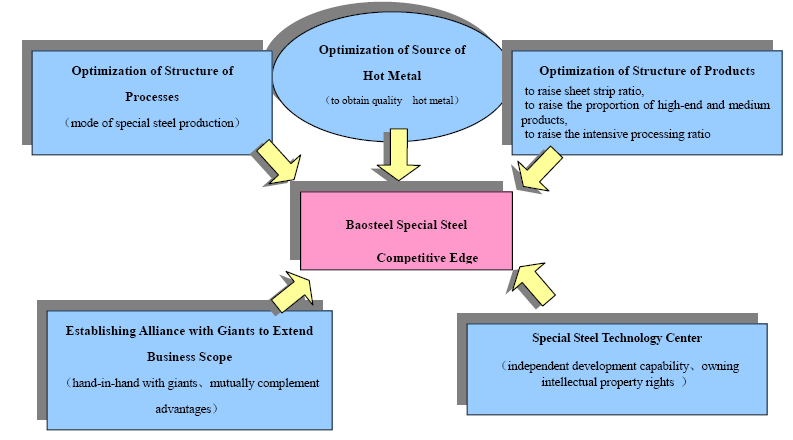

Product differentiation of Bao Steel encompasses various issues (Funding Universe, 2011), such as –

- Production of high-end steels along with standard strength of additional value for its global customers.

- Higher productivity with possible low costs of production;

- Sophisticated managerial capabilities:

- Following the way through which it is helping put rising pressure on expenses.

Additionally, to meet the global demand for special steel and the present structural challenge between supply and demand in the local market, Bao Steel has taken an especial restructuring program. It involves the restructuring of special steel assets as well as product optimization machine (Xie, 2011). It focuses on differentiation through the following means-

- Delivering those values what other competitors do not have to offer.

- Modifying offers what other competitors already have;

- Delivering new items while other competitors have already modified the offers.

Since the company’s major goal is to sustain over a scale economy entailing low cost with high quality for being itself differentiated from others, an especial four-stage process is used which assures for manufacturing globally accepted steel grades with the frequent radiating machine (Xie, 2011). Thus, this complex procedure involves-

- Present a small electric heating system.

- Secondary distillation or particular metallurgy.

- Block casting.

- Flourishing or forging.

- Expertise continuing mill.

Bao Steel maintains all of these steps for producing a diversified quality and limited volume of steel integrated by domestic renovation and upgraded technology. Those are helpful for the company for building a high technology and high worth nickel types of normal alloy, titanium alloy, and high alloy equipment and die steel (Xie, 2011).

“A Steel” is one of the most prominent rivals of the Chinese steel market as the company occupies the second-highest position in the mainland market of the country. It also tries to differentiate itself by producing a large variety of steel items, for example. Some forms of their manufactured products are cold rolled sheets, billets, cable rods, thick plates heavy railing and color varnish plates, etc. (Yu and Yang, 2010). It also produces high-end goods, which is a major contribution of the Bayuquan plant as the company’s 4.61 million sophisticated steel goods were produced through this plant in 2009 (Li, 2010).

Wu is another Chinese steel production company, which produces various steel made items as hot rolled normal sheets and section sheets, tinned and galvanized sheets, cold rod-based, and non- based silicon sheets, etc. Being the third mega venture in China and sixteenth in the rest of the world, it is also well- known for producing all of those mentioned items within approximately a hundred diversities. For example, the bridge, automobile, cold rod silicon, container and high-performance construction steel, etc. have recognized as “High Quality and High Value-added Products” as well as branded items not only in the home market but also in the foreign market. The company has also diversified its formal product lines by producing coke, chemical, mechanical, refractory, ferroalloy, electrical, copper- sulfur- cobalt intense ores, powder metallurgical goods, unusual gases, and oxygen, etc. (Baosteel, 2011).

Therefore, it is apparent that, among those three mega rivals, Bao Steel appears to have the foremost competitive rivalry in terms of differentiating products. The company is further advanced in the adaptation of modern technology, cost-effectiveness, and event segmentation. In this regard, for Northern zones focus on building long goods and pieces of pipework for meeting the intended demand has resulted by Western expansion initiation and utilization of energy. Moreover, for becoming more competitive, it has also diversified its entire product categories as high, medium, and low (Deloitte, 2010).

Brand identity

From 1988, Bao Steel had been well- recognized by getting a steel industry flagship of the Chinese government which had also assisted the company with an extraordinary status. Branding also affects sales of An Steel and Wu Steel for sustaining over potential rivalry in the market (China Knowledge, 2011).

Exit barriers and switching costs