Introduction

A financial plan can be viewed as an evaluation of an individual’s current and future financial status. The assessment is carried out using different variables like assets, cash flows, and withdrawal plans. The variables are used to predict the future (Schlosser, White and Lloyd 135). The firm “We Guessed and You’re Wrong” (WG & YW) is a consulting partnership owned and operated by four friends. The business uses computing technology and data mining software to help people predict the future of their ventures. In this paper, the author will conduct a financial analysis of the firm to determine its net worth and economic value. The financial evaluation will provide a five-year planning horizon for WG & YW.

A Five-Year Financial Plan for WG & YW

A good financial plan must take into consideration a number of important factors. Some of them include set-up costs, forecast income statement, expected future cash flow, and potential statement of financial position (Min and Galle 1232). WG & YW will use the forecast income statements given the nature of the items provided. Forecasts provide information regarding the financial health of a firm. It can be good or bad. Investors rely on the information in the statements to decide whether to fund or buy a firm.

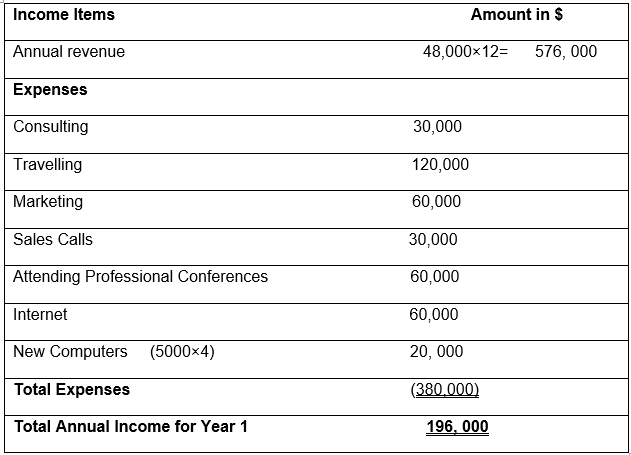

Revenue Plan for Year 1

The above income statement shows that the firm is making profits. It is clear that the business can finance its obligations as and when they are due. The total annual income for year 1 will be carried forward to year 2. It will add to the operating income of the consulting firm. Statistics for year 2 are not provided in this case study. As such, revenues and expenses are expected to be the same as those in year 1. Additional information also states that inflation and interest rates should be ignored. Consequently, the revenue plan for year 2 is as provided below:

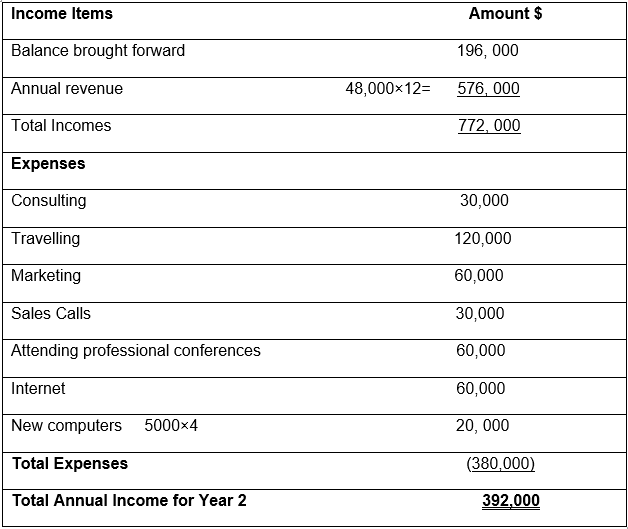

Revenue Plan for Year 2

The income for year 2 also shows that the company is on a profitable trend. For year 3, the business aims at expanding the number of customers from 2 to 4. The revenue per customer is estimated to be $6000 per month. What this means is that the revenues generated from the clients will be $72,000 per customer per annum. Total revenues will be $115, 200 (72,000×16). Nothing else in the financial plan will change. According to the additional information provided in the case study, the increase in the number of customers will not lead to a rise in expenses. Similarly, inflation and interest rates are to be ignored in year 3. It is assumed that the four partners will share the profits equally at the end of year 5. In light of this, the income statement for year 3 is as provided below:

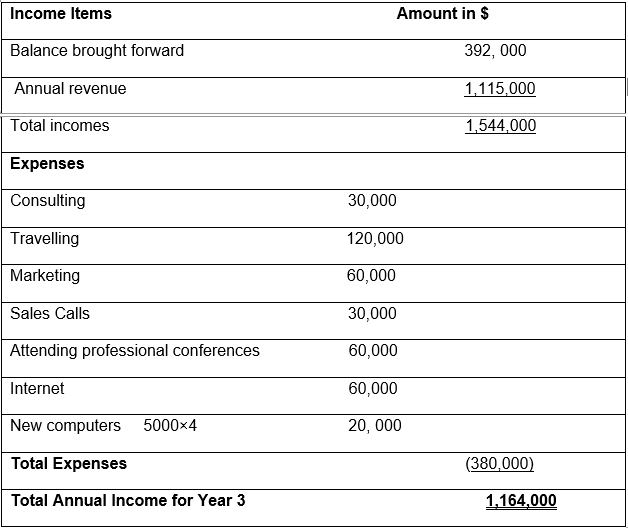

Revenue Plan for Year 3

The revenue for year 3 has increased by a significant margin. The expansion is brought about by a number of factors. One of them is the increase in the number of customers served by WG & YW. It is also noted that the retained earnings for the business continue to grow.

Information regarding changes in revenues and expenses for year 4 is not provided in the case study. As such, it is assumed that operations will remain the same as in year 3. In addition, the total income for year 3 will be carried forward to year 4 as retained earnings. Similarly, inflation and interest rates will not be taken into consideration for year 4. As such, the financial plan for year 4 is as outlined below:

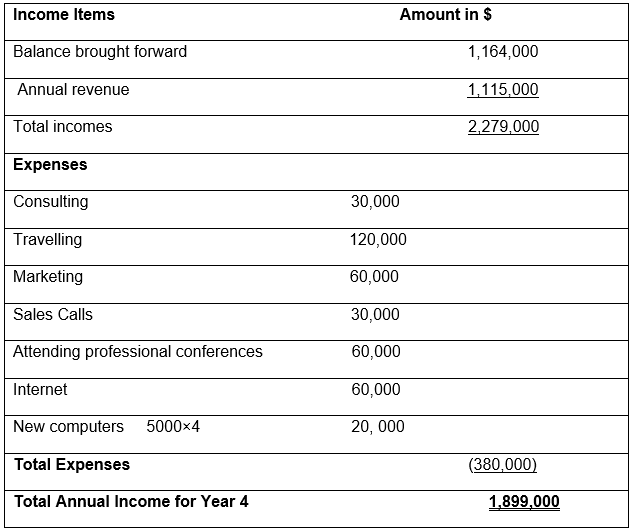

Financial Plan for Year 4

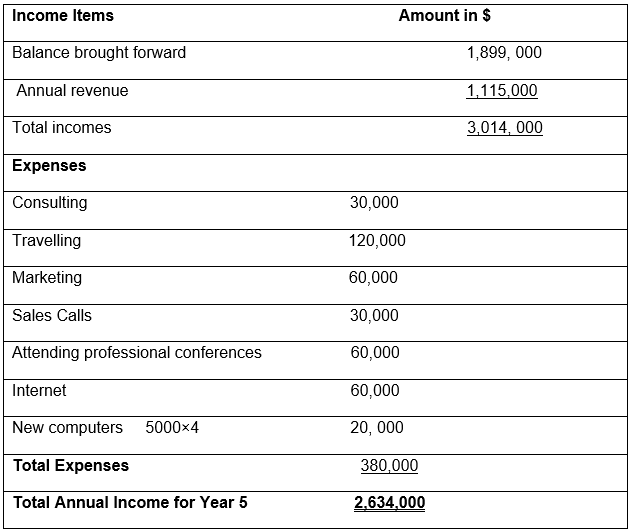

It is noted that expenses incurred for the five years of operation remain constant. One of the reasons behind this is that inflation and other factors are not taken into consideration. For example, information provided for year 5 does not show any increase in the company’s operating expenses. As a result, the financial plan for the fifth year will contain retained earnings, which are the incomes for years 1, 2, 3, and 4. Consequently, the financial plan for year 5 is as follows:

Financial Plan for Year 5

As shown in the financial statement above, the total annual income for year 5 reflects the total retained earnings for the five years. The total price for the four partners is $2,634,000. It is the amount that remains after deducting expenses from the incomes (Baldwin and Okubo 323). The case study does not provide information regarding the ratio to be used in sharing the net proceeds or the profits from the operations of WG & YW. As such, it can be assumed that the four partners will distribute the earnings in the ratio of 1:1:1:1. What this means is that the investors will share the profits equally among themselves. Consequently, the value of each partner will be 2,634,000 ÷ 4 = $658,500 by the end of year 5.

Selling WG & YW

At the end of year 5, an entrepreneur offers to buy WG & YW consulting firm. Several assumptions are made to come up with the amount of money to sell the business for (Nicolaou 101). For example, it is apparent that the company is worth more than $2 million. The value can be deduced from the financial statements of the five years WG & YW has been in operation. As such, the business should be sold for more than this amount.

From the financial plan, it is clear that the value of the retained earnings for the company continue to increase from one year to the other. It is expected that the trend will persist in the future if the management remains accountable to the business owners (Kaplan, Sensoy and Stromberg 99). Accounts payable for the firm are not provided. As such, it can be assumed that the firm does not owe money to any party. The fact that WG & YW does not have any debts increases its value in the market. The expenses in the income statement are constant. As such, the investors do not have to worry about an increase in expenditure, which may lower the net profits.

Information provided in the financial statements does not indicate any start-up cost. The expenses are incurred by every business entity. Start-up is also a difficult stage in the growth of a venture. It can make the company incur a lot of expenses. As such, it should not be ignored. When these assumptions are taken into consideration, it is made clear that the firm can be sold for approximately $10 million. The amount is the average cost that the company is expected to achieve in the near future (Barber and Odean 801). The money will cover the start-up costs for various miscellaneous expenses that could not be included in the financial statements. It will also cater for the expenses that could not be accounted for. It is also noted that the location of the firm increases its value in the market.

Works Cited

Baldwin, Richard, and Toshihiro Okubo. “Heterogeneous Firms, Agglomeration and Economic Geography: Spatial Selection and Sorting.” Journal of Economic Geography 6.3 (2006): 323-346. Print.

Barber, Brad, and Terrance Odean. “All That Glitters: The Effect of Attention and News on the Buying Behavior of Individual and Institutional Investors.”Review of Financial Studies 21.2 (2008): 785-818. Print.

Kaplan, Steven, Berk Sensoy, and Per Stromberg. “Should Investors Bet on the Jockey or the Horse?: Evidence from the Evolution of Firms from Early Business Plans to Public Companies.” The Journal of Finance 64.1 (2009): 75-115. Print.

Min, Hokey, and William Galle. “Green Purchasing Practices of US Firms.”International Journal of Operations & Production Management 21.9 (2001): 1222-1238. Print.

Nicolaou, Andreas. “Firm Performance Effects in Relation to the Implementation and Use of Enterprise Resource Planning Systems.” Journal of Information Systems 18.2 (2004): 79-105. Print.

Schlosser, Ann, Tiffany White, and Susan Lloyd. “Converting Web Site Visitors into Buyers: How Web Site Investment Increases Consumer Trusting Beliefs and Online Purchase Intentions.” Journal of Marketing 70.2 (2006): 133-148. Print.