Southwest Airlines is an American low-cost air company founded in 1967 by Rollin King and Herb Kelleher. The main idea of the creators was to make an airline that has low prices and works fast and efficiently. Nowadays, the company has expanded all over the United States and is having international flights. Southwest Airlines uses only Boeing 737 as the aircraft which helped reduce the costs for its maintenance. Throughout the history of the firm, it has always upgraded its aircraft and has ordered new versions of the Boeing 737. During the 1980s Southwest Airlines adhered to the idea of a low-cost ticket company and offered Senior Citizens programs allowing elderly Americans to buy airplane tickets only for $25 one-way.

Within 9 years (from 1990 to 1999) the aircraft number increased from 100 to 300. In 2006 the company got a win with the Wright Amendment Reform Act. This allowed Southwest Airlines to sell tickets and offer interconnecting flights from Dallas-Love Airport, the company’s major bases. In 2010 it purchased the AirTran Airways and extended its international routes. Nowadays, Southwest Airlines is one of the most popular air companies in the United States and constantly transports passengers both with domestic and intercontinental flights. The total equity of the company was $9.853 billion by 2018, and it keeps growing within time. Investing in Southwest Airlines stock is beneficial as customers will always choose a low-cost company and, withing the growth of the market, the stock price of Southwest will relatively increase.

Southwest Airlines has a fundamental business model for a low-cost carrier with a constantly growing network and smart pricing behavior. An average customer will always choose a budget price for a ticket along with trust in the company that exists several decades. That means a demand for a low-cost carrier will remain high, and the value of Southwest on the market will never lose its relevance comparing to full-service airlines.

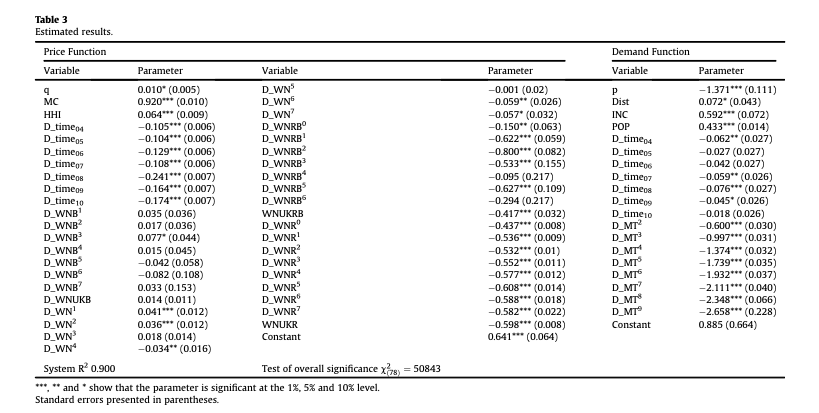

Moreover, Southwest remains a leader in pricing behavior affecting participants of the market to respond to its actions and set competitive prices. An empirical study by Asahi and Murakami (2017) assessed synchronized demand and price calculations using airline industry data for the fourth quarter of 2003-2010. The results showed that Southwest did not change its price strategic plan within time and also influenced the rivals’ behaviors. Table 1 below shows estimated results from the study of Southwest Airlines’ price changes and its rivals’ pricing behavior after Southwest entered the market.

Southwest shows a smart strategy during market plunges which gives a positive impact on its sustainability and survival on the market. For instance, in 2008, along with rising fuel prices, Southwest created a hedging fuel approach that saved millions on an annual basis. According to Cote (2018), Southwest Airlines had long-term contracts to purchase its fuels at the equivalent of $51 for a barrel in 2009.

The value of those hedges climbed up as oil raced above the $91-a-barrel mark, and they are now worth more than $2 billion. With a flexible strategy to maintain the crisis and the market drops, the company deserves respect and special attention in purchasing its stock as it shows high sustainability and persistence on the market. Along with dominative position in setting costs and leadership in price behavior, Southwest remains actual in the airline industry of the United States.

With a low-price strategy, buying stock from Southwest is profitable now as it has a relevant tendency to grow within the development of the market. Price versus value might seem confusing when deciding to buy stock; however, it is obvious that these two categories have a separate meaning. If the price of the stock goes down for some economic reasons, the value can still be high in the long-term perspective.

For instance, figure 1 below shows the decrease in the stock price of Southwest Airlines in February 2021 and June 2021. These changes are more likely connected to the spread of COVID-19 infection and the delta-mutation that caused the third peak of contamination in June 2021. However, after the pandemic, the economy will grow again that will consequently cause a rise in the stock market. The value of the stock is still high and will remain high even though the price varies within different issues. A low-cost company with a decent strategy to fight a respectable place in the airline industry will remain valuable and highly demanded. It has higher chances to stay in the market for many decades as it shows flexibility and smart policy even throughout economic fall. According to Papke (2021), the greatest returns are from companies that capture value from low-cost business strategies.

It is hard to disagree with Papke as Southwest Airlines along with that, shows high sustainability and corporate social responsibility in business leading. Observing the static entry game model by Ren (2021), the results show that Southwest has a remarkable and negative impact on the payoffs of other carriers. Southwest’s nonstop presence enforces more descendant stress on opponents’ profits than its attaching presence. That means the leadership position of Southwest remains up-to-date and influences its competitors on the market. With a constantly growing net, expanding directions, having a sustainable price behavior, Southwest Airlines is worth investing in.

Thus, investing in Southwest Airlines is beneficial as it is a sustainable business with a firm trade strategy and a leadership position on the market. With the growth of the economy, the value of the stock will correlatively grow. Risks in investing in this company are minimized as it shows a respectable tendency to survive during market plunges and flexibility while leading a business strategy. The low-cost carrier is also actual on the market comparing to the full-service airlines. The most profitable approach in investment in Southwest will be a long-term investment that can bring a higher dividend income.

The COVID-19 pandemic will eventually end which will consequently cause a rise in the economy and an increase in stock price. Now, in a low-cost stock moment, it is the most profitable period for investment as it is the weakest time for economy and air company policy because of border restrictions. The cites such as finance.yahoo.com and stockcharts.com can show a wider picture of Southwest Airlines’ stock value and its development within time.

From my perspective, Rollin King and Herb Kelleher, as the founders of the Southwest, created a beneficial idea of a low-cost carrier that eventually became a successful business. The initial goal was aiming to give Americans the opportunity to take an airplane ticket worth less than taking the other way of transportation on the same distance. With developing this idea, the company expanded various routes all over the United States and now is providing passengers with international flights.

References

Asahi, R., & Murakami, H. (2017). Effects of Southwest Airlines’ entry and airport dominance. Journal of Air Transport Management, 64, 86–90. Web.

Cote, R. (2018). Leadership analysis: Southwest Airlines-Herb Kelleher, CEO. Journal of Leadership, Accountability & Ethics, 15(1), 113-124.

Papke, B. (2021). The Evolution of Investing. Finance Undergraduate Honors Theses, 62, 1-20. Web.

Ren, J. (2021). Effects of Southwest Airlines on carrier profits and entry probabilities. Mathematical Problems in Engineering, 2021, 1-9. Web.

Stockcharts. Web.