*Sources: Bureau of Labor & Statistics, U.S. Dept. of Commerce/BEA

The four major macroeconomic themes that stand out and that have affected the profitability of the commercial banking industry since 2007 are:

The level of real national income (GDP)

A country’s gross domestic product, or GDP, is the price tag placed the economic products produced in any given year. It is measured by adding (personal consumption expenditure, gross private domestic investment, net exports of goods and services and government consumption) minus the imports” (Wolfe,2012, par.1).

A “real” Gross Domestic Product considers inflation and the measure of the value of the goods and services using their prices from the previous year. A country’s real national income and rates of interest can be connected to the effect that change in income has on the interest rates (Wolfe par. 3)

Real national income decreased from 2007 to 2009. This could have a negative effect on the commercial banking industry in the following ways:

Reduced real GDP can result in reduction of the rates of interests on loans. This is because reduction in GDP can mean the economy is in a recession, therefore less investors will be spending their money and hence there is less demand for funds.

As a result, the banks are likely to reduce the lending rates therefore reducing its profits. Reduced GDP can also mean that the government will reduce benefits such as subsidies therefore discouraging investments the more.

The real national income increased from 2009 to 2010. This could have a positive effect on the commercial banking industry in the following way:

Increase in real GDP or national income can cause interest rates to rise. This is because the economy is performing well (booming) and therefore more people will be investing. Investors take advantage of the booming economy by establishing monetary, educational and administrative institutions and facilities.

In order to finance such projects, they will have to obtain funds. Mostly, the funding is in form of loans and mortgages from banks. This demand for loans will force the banks to increase the lending rates resulting in increased profits.

Unemployment rate

It is the percentage of the workforce that is registered as unemployed. The unemployment rate increased from 2007 to 2010. This could have been caused by recession among other factors. Unemployment reduces the level of investments because investors feel that the market lacks sufficient money to buy their commodities.

When investors are discouraged from investing, the demand for funding reduces. In addition, the unemployed persons tend to spend and consume less (Kibilko par. 2). They don’t have a tendency of acquiring loans either. As a result of reduced funding demand or loans, banks will reduce the interest rates consequently reducing their profits.

Standard CPI (Consumer Price Index)

It is a measure of weighted average of prices of a basket of consumer goods and services. Changes in the standard CPI are used in assessing price changes that are associated with the cost of living.

There was increase of standard CPI between 2007 and 2008. This could denote a period of inflation. Inflation is accompanied by falling purchasing power since the cost of living rises when inflation rate increases. Due to inflation, investments are also likely to reduce since the prices of building or investment materials are high.

These factors can lead to reduced lending rates by the banks (“Consumer Price Index:Definition of Consumer Price Index-Cpi” par. 1). As a result, there is reduced profitability in the commercial banking industry.

On the other hand, there was fall of the standard CPI in 2009. The drop is an indicator of deflation. Deflation means that the cost of living of living is low. This will increase the purchasing power of consumers. The investors are attracted by positive consumption habits and therefore they will want to invest more at this time.

In order to obtain funding, investors will end borrowing loans or commodities from the banks. The banks as a result, will increase the lending rates. As a result, the commercial banking industry realizes increase in profits.

10 Year Treasury Rate

The Treasury rate refers to the recent rate of interest that investors acquire from debt securities that are issued by the Treasury. The federal government uses various ways of borrowing money from the public. One such method is by issuing 10-year notes which earn interest in every six months (Langsdorf par. 2).

10 Year Treasury Rates reduced between 2007 and 2010 meaning that investors earned less interest from them. Investors get discouraged by investments that yield little income to them.

That is why many big investors go for the long term instruments such as bonds and notes. Such investors expect high benefits in the long run. If such expectations are not met, it could discourage them.

With fewer investments, banks will experience reduction in the level of borrowers. They will result to reducing their lending rates in order encourage borrowers. The repercussions of this are that the profits decline.

Agreement or disagreement with specific numbers including comments about the Congress, the White House, the international scene, and the Fed up to date

Real GDP Growth

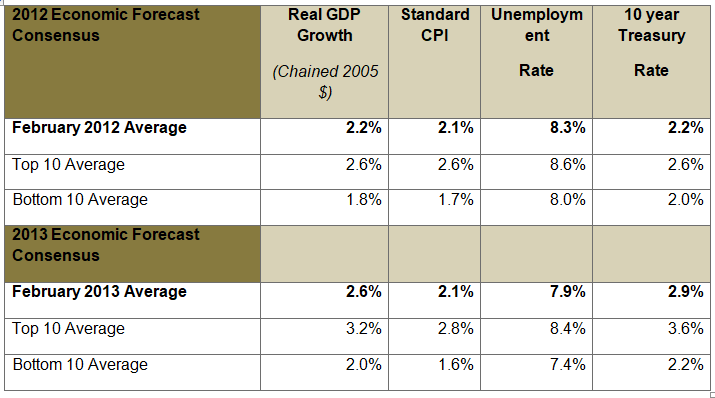

The real GDP growth is expected to rise from 2.2% in February 2012 to 2.6% in February 2013.

I tend to agree with the focus because there arms or bodies in the government that have authority to implement favorable rules that can increase national income. For instance, Congress has power to regulate commerce with foreign nations and among states.

Actually, the sixteenth Amendment gives Congress the power to collect a national income tax without apportioning it among the states. Therefore, real national income is likely to increase given these circumstances.

Internationally, businesses are stable and this could work out performance The Fed also has the authority to affect economic growth positively. For instance, it can regulate the monetary policies about price control, interest and tax rates in order for them to favor economic growth.

Standard CPI

The Standard Consumer Price Index is expected to remain constant at 2.1%.

I agree. The level of prices is likely to be the same because the consumer levels are expected to change narrowly. Since the level of income growth is minimal, it is possible that consumer’s expenditure levels will be almost insignificant.

Additionally, the level of government spending will be less. With reduced spending patterns, demand for commodities will be minimal and since prices are determined by demand, the prices of commodities are likely to remain constant.

Unemployment Rate

I disagree that the level of unemployment will reduce from 8.3% in February 2012 to 7.9% in February 2013. This is because the policies being put in place to control the rate of unemployment are either slow in implementation or they are ineffective.

For instance, the Congress had to debate on how to extend federal unemployment benefits which were to expire at the end of the 2011.

Actually the law makers were uncertain how long it was going to take and the strings to be attached to an extension. This uncertainty in solving important issues such as unemployment is an indicator that the level of unemployment is not likely to reduce any time soon (Hook and Peterson 22).

10 Year Treasury Rate

10 Year Treasury Rate is expected to rise from 2.2% in February 2012 to 2.9% in 013. I agree. This is a government borrowing instrument that takes an investor up to 10 years to recover.

Given that the international markets are stabilizing after recession, many countries are increasing their investments locally and internationally. Additionally, many investors are coming up in order to take advantage of the stable and promising income.

They invest intensely on local and international treasury instruments as well as establishment of international markets. As a result of the extensive investments, and the favorable market conditions, the investors are likely to benefit from increased income in interest.

Fed Actions

The Fed conducts monetary policy. It does this through three means: open market operations, changes in reserve requirements and changes in the rates of discounts. Government bonds, securities, price control, and subsidies.

Reserve requirements is the money that the banks are expected to maintain for smooth operations. “Discount rates are benefits obtained from massive buying of commodities such as reduced prices” (“Cliffnotes: Monetary Policy” par. 1).

Fed Actions over the next six months

In order to improve economic growth, I expect Fed to increase its open market operations such as purchase of government bonds in order to obtain more funds from the public.

When Fed borrows from the public it will increase income capacity. Additionally, it can increase reserve requirements of the banking sector which will increase their lending capacity, and investments. As a result, the economy’s GDP is expected to rise.

Fed Chair should try to create a stable currency and reduce inflation rate instead of going by the Fed’s main monetary policy which is price control.

Since price should be controlled by market forces, Fed should consider using Friedman’s suggestions to stabilize the dollar. For instance, it should use other monetary policies such as the regulation of the monetary base, reduction of inflation and unemployment rates.

Fed should also aim at job creation and educating job seekers so as to overcome obstacles that prevent equal employment.

It can do this by targeting employment initiatives, educational job training” (Weller par. 2). It should also exercise collective bargaining of wages and benefits in order to reduce the gap between the high and low income earners. Educating people on equality can also reduce this gap in earning.

Encouraging of self-employment through creation of youth funds can also help alleviate unemployment rate and poverty levels in the short run. Since the job market is saturated, Fed can allocate funds to the unemployed in order to help them implement creative ideas. This way, the level of income is likely to increase.

Fed can also organize trade fairs and seminars in order to help businesses to promote and advertise the local products. This will increase awareness and sale of such products. With time, the level of income will increase.

Fed Actions over the next two years

In the long term I expect Fed to change its monetary policies. It should change its rules and fundamentals in order to have a wider base of controlling economic growth.

Instead of Fed using the price control as its main tool to regulate macroeconomic factors of the economy, it can use other tools such as reduction of unemployment and inflation, reduction in tax levels, subsidies, reduction in trade regulations and lowering of interest and exchange rates. As a result, the level of real GDP is expected to rise.

The White House is also encouraging short term borrowings in order to achieve long term solutions. President Obama advocates of this economic mechanism. Although short term borrowing can lead the country to financial crisis, if used carefully, it can generate income as well as create employment in the long run.

Fed should also consider increasing its exports. This involves increase in selling of the country’s goods and services to international buyers.

When exports rise above the level of imports, income is likely to increase. On the other hand, the country should reduce its imports by encouraging local production. This will mean that it is spending less in obtaining goods and services.

Another strategy is removal of tariffs on imports. If the country removes tariffs on its imports, it is very possible that its neighboring countries will remove tariffs from its exports. This way, the level of income will rise because there will be increased revenue from increased exports.

Conclusion

Macroeconomics involves external factors that affect the level of economic growth. These external factors include national income (GDP), unemployment rate, standard CPI and treasury rates. GDP growth is the value of a nation’s products and services.

Its determining factors are consumer expenditure, exports, government expenditure, investments and imports. Increase in real GDP determines the interest rates, level of expenditure, and investment in a country therefore affecting borrowing and the level of profitability of the banking industry. On the contrary, decrease in GDP will result to reduced profits.

Unemployment rate is another external factor that affects the profitability of the banking industry. It reduces the expenditure levels therefore discouraging investors. Once investors feel that their goods will lack sufficient demand, they resist from taking the risks and therefore shy away from investing.

This affects the commercial banking industry since there will be reduced borrowing from the investors. Otherwise, when the rate of unemployment is low, the level of profits is expected to rise.

Standard CPI accounts for the level of prices as determined by consumer demand. When the consumer demand is increasing, it can indicate inflation which subsequently means that the cost of living is high. This is accompanied by reduced borrowing and loss in profits by the banks.

When the Standard CPI is reducing, it can be an indication of deflation. Deflation is associated with lower cost of living and improved expenditure patterns. As a result, the banking industry achieves increased borrowing for investment purposes therefore increasing profits.

An increase in the 10 Year Treasury Rate means that the investors can reap higher interest incomes from their investments. They will in turn result to borrowing from the banks in order to increase their investments. This results in improved profits by the banking industry.

The Fed can initiate several factors in order to increase the level of economic growth. These are subsidies price controls, regulation of interest, import and export rates, incentives, removal of tariffs, encouragement of local production, increase in exports, decrease in imports, seminars and trade fairs and allocation of youth funds to encourage innovation.

With these factors in place, the level of economic growth is very likely to increase. The level of GDP is expected to rise as well as the 10 Year Treasury Rates. On the other hand, the unemployment rate will reduce, as well as the Standard CPI.

As a result of increased economic growth, the banking, educational, administrative, manufacturing and other industries in general, are expected to increase their profits.

Works Cited

Cliffnotes: Monetary Policy. Web.

Consumer Price Index: Definition of Consumer Price Index-Cpi. Web.

Hook, Janet and Kristina Peterson. “Congress Wrestles with 2012 Unemployment Benefits Extension.” The Wall Street Journal (2011). Print.

Kibilko, John. The Effects of Unemployment. Web.

Langsdorf, Jonathan. Treasury Rate Definition. Web.

Weller, Christian. Spotlight on Poverty and Opportunity: Short-Term Labor Solutions Can Help Persistent Poverty among Minorities in the Long Term. Web.

Wolfe, Martin. The Effect of Real Gdp on Interest Rate. Web.