Overseas Investment by Type for the Past Five Years

According to Heil (2012), Multinationals Companies (herein referred to as MNCs) can invest in foreign markets using different strategies. This form of investment is what is referred to by many analysts as Foreign Direct Investment. Heil (2012) and Hill (2007) identify four major strategies adopted by MNCs in the world today. These are trade, investment, strategic ventures, and the establishment of franchises or licensed outlets in the host country (Heil 2012).

Acer Inc. is an MNC that has adopted these foreign investment strategies. Following is a table illustrating the forms of overseas investment made by Acer over the past 5 years:

Table 1: Overseas Investment by Type.

The above activities can be described as an overseas investment given that the companies acquired or bought out by Acer Inc. are based outside Taiwan, Acer’s home country.

Examples of Foreign Investments

2007 Acquisition and Mergers

On 27th August 2007, Acer acquired Gateway Inc. This is a US-based rival. Transaction costs 710 million US dollars (Acer 2009). The strategy seems to be effective as the company emerges one of the most popular suppliers of PC in America. Worldwide, Acer Inc. is voted as No. 2 notebook and No. 3 desktop PC producer (Acer 2009).

2008 Acquisition and Merger

In January 2008, the MNC acquired a 75 percent stake in Packard Bell (Acer 2009). The move is effective as the MNC emerges No. 3 and No. 2 for the total number of PCs and notebooks sold in the year respectively (Virki 2011).

2009 Acquisition and Merger

This MNC acquired E- TEN as an acquisition and merger strategy. It also acquired a 29.9 percent stake in Olidata (Virki 2011). The move also appears effective as sales and revenue of the company continue to soar despite the global economic downturn.

2010 Franchising

In August of this year, this MNC signed an MoU with Founder Technology to continue their cooperation in selling PCs (Heil 2012). The MNC is rated No. 1 worldwide as far as the supply of notebooks is concerned. The strategy is effective.

2011 Acquisition

In July this year, this MNC buys out ware Inc. for 320 million US dollars (Heil 2012). The increased sales indicate that this strategy was effective.

The Criteria that can be used to Analyse the Success of Acer Inc.

Several criteria can be used to gauge the success of any given MNC (Bhaumik & Gelb 2003). Heil (2012) on his part argues that an MNC wishing to succeed in the international market must take into consideration four aspects of its international marketing strategy. This researcher will use these four considerations as the criteria to analyze the success of Acer Inc. as an MNC. The four areas listed below:

- Scope of the MNC’s operations.

- Resource allocation.

- Competitive advantage.

- Synergy.

A Factual Assessment of Each of the Four Criteria Above

In this section, a factual assessment of each of the four criteria above will be provided. A critique of these criteria within the context of Acer Inc. will be provided later on in this paper.

Scope of the MNC’s Operations

The success of a given MNC can be gauged by the scope of its operations (Punnett 2004). This criterion takes into consideration the geographic locations (countries and regions) within which the MNC operates. It also takes into consideration “….possible markets and niches” (Heil 2012: p. 9) in different regions in the world. A successful MNC should be able to select those regions that optimize the profits.

Resource Allocation

A successful MNC should be able to use its resources in such a way that it can compete effectively in the market it is operating within (Florini 2003).

Competitive Advantage

This criterion takes into consideration the ability of the management to determine where and how the MNC can attain a competitive advantage over other MNCs within the industry (Heil 2012). To this end, the management can identify the strengths and weaknesses of the company as well as the threats and opportunities.

Synergy

Heil (2012) is of the view that a successful multinational should be able to establish a plan which brings together the various operations and functions taking place. To this end, the various functions and operations should benefit from one another, meaning that they should complement each other (Bhaumik & Gelb 2003).

A Critical Analysis of the Criteria and Conclusions

Scope of the MNC’s Operations

This company has operations in most developed and developing nations in the world. It has expanded its operations beyond the borders of Taiwan, the company’s country of origin (Shi 2000). The country now operates in more than 50 countries around the world. These range from countries in the Americas, Europe, the Middle East, and the Asia Pacific. To this end, the company can be considered as having succeeded so far.

Resource Allocation

As already indicated, this aspect takes into consideration the ability of the company to use limited resources to increase its competitive advantage in the market. Again, Acer Inc. seems to have scored positively to this end. For example, the company has reduced the size of its labor force while increasing investment in foreign markets. In 2005, the company had downsized the labor force to just 7,800 employees worldwide (Virki 2011). In the same period, revenues increased to more than 11 billion US dollars in 2006 as compared to the 4.9 billion US dollars recorded in the year 2003 (Virki 2011).

Competitive Advantage

Acer Inc. has also succeeded as an MNC judging by this criterion. As of the year 2010, Gartner and IDC ranked this MNC as no. 1 in the whole world as far as production and shipment of notebooks were concerned (Virki 2011).

Synergy

In the year 1998, this company reorganized itself into five different subsidiaries (Shi 2000). This seemed to work negatively as the five organizations lacked synergy. Critics were of the view that Acer Inc. was competing with itself. In 2000, the company spun off some of the organizations and remained with only two. Synergy was restored as a result of this. Today, the company operates plants that manufacture, supply, or repair the products in different parts of the world.

On a scale of 1- 10, how much does Acer Inc. Need to Adapt to Local Markets

In the opinion of this author, the need to adapt to local markets lies at around 3 on a scale of 1 -10 (taking 1 as the least need to adapt and 10 as the critical need to adapt). This is because the company seems to have already adapted itself to most local markets. Shi (2000) is of the view that the company has adopted the global brand, local touch strategy since the early 1990s. This has enabled the company to maintain its international appeal while taking into consideration the special needs of the local market within which it is operating.

Examples of how Acer Inc. has Succeeded and Failed to Respond to Local Markets

Like any other MNC out there, Acer Inc. has at times made decisions or adapted strategies that seemed to work negatively for the company. The company has also adopted strategies that have turned out to be successful in the long run. Given the fact that the company is a multinational, there is a need to examine how it has responded to local markets in the countries within which it is currently operating or it has operated before. This author will look at some instances of success and failure as far as responding to local markets is concerned.

Examples of Success to Respond to Local Markets

- The decision by the company to enter local markets through mergers with and acquisitions with local companies. This is the case of the acquisition of Gateway Inc. in the United States of America.

- The decision to use locals as employees in these foreign companies. According to Acer (2009), the company recruits employees according to the host nation’s labor laws and customs. There is no discrimination based on nationality.

Examples of Failures

- Virki (2011) is of the view that senior employees of Acer Inc. have complained about the tendency of the company to focus more on operating from Taiwan. If this continues, the company will lose touch with local markets on the international market.

- The decision by the company to use expatriates in managing local franchises. As much as the company strives to recruit from the local labor market, it is noted senior positions are reserved for expatriates. This may lead to alienation on the part of the company.

On a scale of 1-10, How Much Does Acer Inc. Need to Respond to Cost Pressures and Why?

On a scale of 1 to 10 (1 being the least need to respond to cost pressures and 10 being the critical need to respond to cost pressures), this author places Acer Inc. at 4. According to Charmike (2012), the overarching competitive strategy adopted by this multinational is that of being the lowest cost provider in the market. The aim here is to maintain cost leadership in the markets within which the company is operating. This has been fairly successful to some extent given the fact that Acer Inc. remains the third-largest producer of PCs in the world. This author gave it a 4 because the company needs to react more to cost pressures to maintain its third position or reach position one in the future.

How Acer has Succeeded or Failed to Respond to Cost Pressures

Successes

- The decision to sell the products anywhere in the world while sourcing for raw materials and carrying out production from cheaper sources.

- The decision to adopt acquisitions and mergers as the preferred mode of foreign investment. This reduces the cost of starting a new company from scratch in a new market.

Failures

- The company has retained too many brands, meaning that it has so many products. This has led to increased expenditure in marketing to promote these brands.

According to the Theory, which MNC Strategy should Acer Inc. be using and why?

Several theories have been formulated and proposed to explain the operations of MNCs on the international market. These theories address several issues such as challenges and opportunities facing MNCs both on the local and the international market. One such area which is addressed by MNC theories is the strategies that can be adopted by these companies to effectively operate on the international market.

It is the opinion of this author that Acer Inc. should be using the international strategy in operating within the international market. This is whereby the firm concentrates or focuses on expanding its operations in foreign markets. As explained by Heil (2012), this strategy enables the MNC to have an international presence while maintaining a local touch as far as the services and products supplied are concerned.

Which Strategy is Acer Inc. Adapting in Practice?

Charmike (2012) is of the view that a given MNC may be using a single strategy to operate within the international market or a combination of several strategies. When several strategies are combined, it is noted that the MNC may combine some provisions of one major strategy with those of other strategies. The combination is informed by the perceived need by the MNC to respond to both the international and local markets.

A critical analysis of Acer Inc. reveals that the MNC is using the international strategy as explained by Heil (2012). As much as the strategy employed by Acer Inc. may be considered as international in orientation, there are subtle differences that are discernible between the provisions of the international strategy and what Acer uses.

Acer Inc. may attain a competitive edge over other companies in the industry such as Dell and Toshiba by using the international strategy. The company can realize this by identifying areas within which it has a competitive advantage over the other companies. To this end, the company may decide to concentrate on the production of a few strong brands as opposed to the production and marketing of so many brands as it is the case currently.

Which are the 3 Most Significant Strategic Challenges Facing Acer Inc. in the Context of International Strategy?

- Manufacture and supply of a large number of brands. The company manufactures and supplies a range of electronic items such as smartphones, a large number of different laptops, and personal computers among others. It proves difficult to maintain brand awareness in this context.

- Taiwanisation of the production process as a whole (Virki 2011). This is whereby the company tends to focus most of its operations on Taiwan, the home country. This is the reason veteran employees such as Lanci have resigned.

- The increased production and supply of substitutes such as pads and iPhones threaten Acer’s traditional market niche.

Will Cost and Local Responsiveness Pressures Force Acer Inc. to Change its Strategy in the Future?

It is noted that business organizations are forced to change their marketing and operational strategies in the course of their operation to accommodate changes that may be taking place in the market. In other words, business organizations are forced to change with the market. This is given the fact that failure to change may relegate the organization to oblivion by making the products and services obsolete (Hill 2007). The same case applies to multinational corporations. These companies are especially vulnerable to changes given the fact they are operating across borders within societies and markets that are significantly different from that of the home country.

Local and responsiveness pressures may force Acer Inc. to change its international strategy in the future. This is not surprising given the fact that the company has changed strategies in the past. In the early 1990s, it adopted what Shi (2000) referred to as a global brand, a local touch strategy to enable its penetration of foreign markets such as the United States of America. Production costs and dynamics of the local market may necessitate the establishment of a blue ocean (Charmike 2012) for this company. This is to means that the company may need to identify niche markets to accommodate the change in production costs and the varying tastes and needs of the international consumer.

Value Drivers and their Application in Acer Inc.

Different scholars provide us with varying definitions of the term value drivers depending on their professional and academic orientation. However, all of them seem to agree that a value driver is an activity or something that “……..enhances (adds) the value of a product or a service…..” (Akalu 2002: p. 23). The value of the said product or service is enhanced “…….in the perception of the consumer……” (Michalet 2000: p. 56). This in turn creates value for the company producing and supplying the said product.

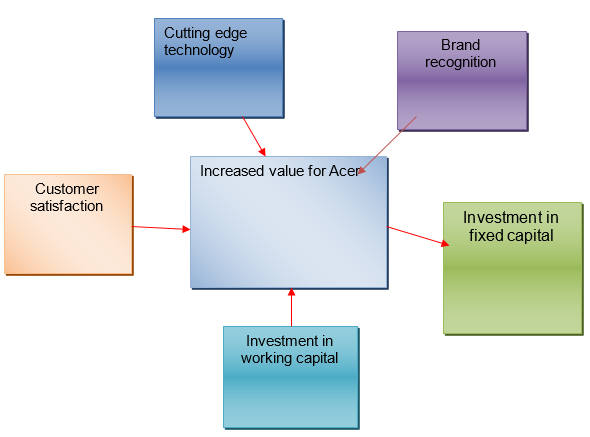

The chart below indicates how Acer Inc. has made use of five value drivers in its operation over the years:

Other Reasons Used by Acer Inc. to Argue for its International Development and their Economic and Political Validity

Companies will always try to justify their expansion or investment in the international market. This is especially so because most multinationals are owned by many people or many parties who have come together to invest. This being the case, it becomes important for the management to justify their decision to adopt an international development strategy to the shareholders and other stakeholders (Akalu 2002).

Acer Inc. is such an international company that had to convince the investors of the need to adopt an international marketing strategy. For example in the company’s 2008 annual financial report, the management made efforts to inform the investors on the need to adopt the “……5 keys to a sustainable future” (Acer 2009: p. 22). It is noted that these keys are aimed at adopting an international strategy to market the company. One of the reasons given for an international strategy is the fact that the PC market is an ever-changing one. This being the case, there is a need to adopt the changes most of which are brought about by globalization.

This was an economically valid reason given the fact that failure to adapt to changes will have made the company obsolete. The management has also justified the recent mergers and acquisitions on the need for growth. This is again is politically and economically justified. It is valid economically because it is an efficient strategy to increase the international presence of the company. It is politically valid given the fact that Acer Inc. will have to use the local networks of the acquired company to access the local market.

Examples of Main Business Development Strategies used by Acer Inc. Since it Started

- Cutting- edge technology where the company is always investing in research and development to provide the consumer with the latest technology.

- Mergers and acquisitions to enhance global presence.

- Use of competitive advantage strategies by providing the consumers with high quality but affordable products.

- Multi-brand strategy to provide the consumer with a wide range of products, hence increasing the size of the market.

- A global brand, local touch strategy in the early 1990s to keep in touch with the local markets.

Analyzing the Success of these Business Development Strategies

There is no doubt that the above-mentioned business development strategies have succeeded to some extent in promoting Acer Inc. and making it one of the top producers and suppliers of PCs in the world today. A global brand, local touch increased the sales of the company given the fact that the products became acceptable to the local consumers. Mergers and acquisitions also had a positive impact on the company’s revenues. For example in the first quarter of the 2010 financial year, the company recorded a 36 percent increase in revenue. Revenues stood at 5.2 billion US dollars while net profit stood at 104.7 million US dollars, a 63 percent increase (Yip 2010). The multi-brand strategy also seemed to work as the company has maintained its third position on the global market.

Recommendations Regarding the Development of Acer Inc.’s Business in the Next Five Years

- The company should try to find a blue ocean with the market to better cope with competition from other companies such as Dell.

- Acer Inc. should try to use sustainability as a strategy to support innovation and the envisaged blue ocean (Charmike 2012).

- Maintain economic alliances and cooperation with other players in the industry such as McAffee (Charmike 2012). This is to support the long term business strategy that will be adopted by the company.

- Acer Inc. should also make efforts to support the distributors and help them come up with effective distribution channels for the company’s brand. This will enhance market penetration in the long run.

Proposed Business Development Strategies

As already indicated, many business development strategies can be adopted by an MNC operating within the global market (Zaheer 2008). Acer Inc. seems to have adopted an international business strategy. Here are some other strategies proposed for this company:

Value Chain Configuration

Currently, Acer seems to prefer the concentrated value chain configuration when it comes to the management of its business operations across the globe (Manrakhan 2009). The company should think of adopting the dispersed value chain configuration where it replicates the production and marketing activities from one country to the other. This way, the company can effectively cater to the unique needs of the local consumer (Zanfei 2010).

Intra- Corporate Coordination as a Strategy

This strategy involves the mutual co-ordination of the company’s internal processes (Zanfei 2010). Using this strategy, Acer Inc. can run global operations seamlessly from its headquarters in Taiwan (Michalet 2000). This is especially so given that there is a need to ensure that the global operations complement each other rather than competing with each other.

References

Acer 2009, Acer Incorporated 2008 annual report. Web.

Akalu, MM 2002, Measuring and ranking value drivers, Tinbergen Institute for Economic Research.

Bhaumik, SK & Gelb, S 2003, “Determinants of MNC’s mode of entry into an emerging market: Some evidence from Egypt and South Africa,” Centre for New and Emerging Markets London Business School.

Charmike, F 2012, Acer competitive strategy review. Web.

Florini, A 2003, “Business and global governance,” Brookings Review, Spring 2003, 5-8.

Heil, K 2012, Strategy in the global environment. Web.

Hill, CW 2007, International business: Competing in the global marketplace, London, Thimble.

Manrakhan, DR 2009, Marketing strategies for the MNC, New York, Free Press.

Michalet, CA 2000, Strategies of multinationals and competition for foreign direct investment, FIAS/PREM Seminal Series.

Punnett, BJ 2004, International perspectives on organisational behaviour and human resource management, Armonk, MESharpe Inc.

Shi, S 2000, Going global the Acer way. Web.

Virki, T 2011, Taiwanese focus risks Acer’s future- former CEO. Web.

Yip, YN 2010, International business strategies, London, Thimble.

Zaheer, LL 2008, International business development, New York, Free Press.

Zanfei, OU 2010, Competitive advantage for MNCs, London, Thimble.