Alinma bank is one of the leading organizations in the finance industry and has been operational in Saudi Arabia since 2006. Alinma is known for providing a wide range of Shariah-compliant retail and corporate banking and investment services to many people. Nonetheless, the company faces competition in the industry, with Bank Albilad, Al Rajhi, and Riyad banks being its main competitors. Therefore, this report will involve an industry analysis where various factors that can impact Alinma bank’s performance will be examined.

Analysis and Prediction of Industry Profitability

An industry’s profitability can be determined by various aspects such as demand for products and services, cost of production, competition, and the general economy. In this case, one can examine competition in the sector to determine whether the organization has high chances of gaining profits. Typically, competition in business is factual in all industries and unavoidable. However, the company can make profits using various strategies such as advertisement and improving its services. The demand for the services is another essential factor that shows the industry is profitable. Many people in Saudi Arabia acquire money from the sale of petroleum products. The presence of many investors in the country shows that the demand for financial services is high. Globalization has also enabled many people to engage in Foreign Direct Investment (FDI). Thus, many people desire to invest in Saudi Arabia, mainly in the petroleum sector, which increases the demand for corporate banking and investment services.

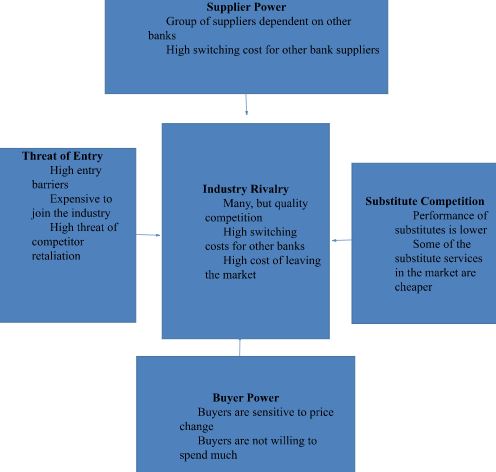

Porter’s Five Forces Framework

Level of Industry Profitability Based on the Porter’s Five Forces Framework

Porter’s five forces have been used to determine the level of profitability since the model helps identify competitive rivals, potential new entrants, and substitutes that can limit a company’s output. High, intermediate, and low ranks of productivity are attained using Porter’s five forces approach. In this case, one can argue that Alinma’s finance industry’s viability level is intermediate since factors such as competitive rivals and availability of substitutes can limit efficiency in the sector. For example, many people may opt to invest in micro-finance, which offers discounts and low-interest rates. Competition is also experienced in the industry since Saudi Arabia has many banks that offer similar finance and investment services. Consequently, clients have different substitutes, which limits the profitability of the industry. However, companies with a strong brand name, such as Alinma, have attracted many customers in many areas.

Implications for Strategy

One of the implications of the strategy is that it can lead to increased competition. In this case, organizations can identify their weaknesses and develop approaches to improve their performance. For instance, firms can focus on marketing plans such as using social media marketing to increase their competitive advantage. Industry analysis is also essential since it helps corporations gain insights about competitors and seize other opportunities to enhance productivity. Industry exploration has been used as a form of market assessment to help organizations focus demand. In this case, the strategy can help companies predict the need for different industry services, leading to an increased number of new entrants. The power exerted by the buyer is a significant factor that can be determined using the industry analysis approach. Managers focus on the customers’ feedback to determine whether the services are appealing or can lead to clients seeking other substitutes. Therefore, the strategy is vital as it can help businesses develop plans to increase their output and expand the market share.

Strategies that Rival Companies can adopt to Reduce Competitive Pressure and Improve Industry Profitability

Although competition in business is inevitable, some ways can be developed to limit competitive pressure. One of the strategies involves targeting new customers, which can increase the demand for particular services. Competition is mainly high when the supply exceeds the demand. Thus, identifying new customers can be essential since the industry’s need for different services will be increased. Another approach rival companies can exercise is the signaling tactic, which involves communication to influence a competitor’s decision (Grant, 2019). For instance, businesses can use the approach to ensure that reasonable charges and exercised to limit competition. Developing a marketing plan is another essential aspect that can help rival corporations reduce the industry’s competitive pressure. Marketing helps companies attract more clients and increase the demand for the products and services. For instance, advertising is one of the marketing approaches that companies use to attract more consumers. Therefore, the organizations can use such strategies to improve industry profitability and limit competitive stress.

Recommended Strategy for the Company to Improve its Competitiveness and Earnings

The strategy I can recommend Alnima Bank to exercise to enhance its production is marketing. The company can market its services in various regions to ensure that many people know its services. Marketing can involve using the media platforms, where commercials can be used to advertise the organization. Many people are also using social media platforms to market their products (Tafesse & Wien, 2018). Thus, I would recommend that the corporation use this approach to advertise its services and encourage individuals to join the organization. Marketing may also entail analyzing customer feedback to determine what the consumers want and how to meet their demands. Typically, customer satisfaction is one of the ways that organizations increase their earnings. Additionally, consumers are attracted by companies that focus not only on improving their profits but also on meeting customer demands. Consequently, interacting with consumers during the marketing and learning about their needs can help the organization design ways to meet their expectations and increase competitiveness.

Alinma’s Key Success Factors (KSFs)

Alinma has various KSFs that can be analyzed as they can determine its productivity. One of the organization’s KSFs is its finances, whereby the company has different assets that enable it to provide various investment services to its customers. The business is also in one of the industries requiring huge funds since some of its services involve offering loans. Thus, having finances as one of the KSFs has enabled Alinma to meet customer demands and retain its competitiveness. Staff is another KSF of Alinma since the company has focused on ensuring that it acquires skilled employees. The workers have been encouraged to focus on excellent communication skills to interact with customers and inform them about the company’s services. Training is also exercised in the organization to ensure that employees gain customer service skills. Marketing is another KSF of Alinma, where the organization has focused on improving customer relations. Responsiveness is also encouraged in marketing to help the company learn what the customers feel about its services. Therefore, marketing as a KSF has enabled the company to attract clients from different regions.

Focusing on who the customers are and what they need is another fundamental approach that can improve a business’s performance. One can analyze Alinma’s customers to determine what they want and how to meet their needs. The analysis shows that the organization has investors as its main customers. Workers in different organizations are also some customers since they use the company for their banking services. Additionally, some organizations pay their customers through Alinma bank. Other companies are also customers since they conduct businesses to business transactions with Alinma bank. The demands of the customers mainly involve acquiring better investment and financial services. For instance, some of the clients are people who borrow loans from the bank and prefer fair interest rates. Another issue that customers want from the organization involves easy access to banking services. Consequently, the organization has implemented modern technology to enable clients to access their accounts through mobile apps (Mimoun, 2019). Therefore, focusing on the company’s customers and their needs can help the organization develop more competitive strategies.

Alinma faces competition from different banks in the country. Nonetheless, the organization has ensured that it survives rivalry through marketing its services, focusing on customer demands, and encouraging innovation (Mimoun, 2019). Marketing has been exercised by the bank where it has advertised its services on different radio and TV channels. The organization has also used journals and magazines to promote its services. Focusing on customer demand has enabled the company to develop ways of meeting their needs. For instance, the company has introduced discounts in various services such as loans, which has attracted many clients and helped the company survive the competition. Novelty has been of great significance in the organization since it has helped the company attract many customers. For example, the use of mobile apps to access funds from the bank has attracted many customers.

The KSFs of organizations can change over time, whereby customer demands mainly influence them. Therefore, the KSFs of Alinma bank have changed over time due to changes in customer demands. The increased number of banks has also led to clients changing their needs since they have many substitutes. Innovation is another aspect that can impact the KSFs of an organization. In this case, inventions have changed the KSFs of Alinma since many customers have shifted their focus on organizations that encourage creativity and focus on modern technology. The economy is another factor that can influence the performance of a business. Thus, the changes in economic developments have altered the KSFs of Alimna since customer needs shift based on the country’s economic trends.

Conclusion

Industry analysis is an essential aspect that can help organizations design ways of improving their performance. Companies can use the survey to determine customer demands and develop strategies to meet consumer needs. Competition is also analyzed using the industry analysis approach and can help businesses focus on remaining competitive. For instance, Alinma bank can use the analysis to design systems to become more competitive. Porter’s five forces is also an essential tool in business since it allows organizations to examine different aspects that impact their productivity. For instance, focusing on threats such as new entrants and competitors helps an organization design new ways to remain competitive. Marketing is also encouraged in Porter’s five forces since it is one of the practices that organizations can use to attract new customers. In essence, industry analysis is vital for organizations as it enables them to increase their productivity.

References

Grant, R.M. (2019). Contemporary strategy analysis. 10th ed. John Wiley & Sons Ltd.

Mimoun, M. B. (2019). Islamic banking and real performances in a dual banking system.International Journal of Islamic and Middle Eastern Finance and Management, 12(3), 426-447. Web.

Tafesse, W., & Wien, A. (2018). Implementing social media marketing strategically: An empirical assessment. Journal of Marketing Management, 34(9-10), 732-749. Web.