SWOT analysis

SWOT analysis is indispensable to the company’s planning and strategy forming system. This analysis is meant to assist the executives in choosing the most crucial issues facing the organization.

Strengths

The company’s distribution is one of its strongest points, and in the Kingdom of Saudi Arabia, it is handled by its fleet of chilled depots and delivery vans that supply food retailers with Almarai products. In addition, free Almarai branded refrigerators were given to bakalas – small local grocery stores. The fridges were to be used exclusively for selling the company’s products, and the shopkeepers covered the electricity costs. This strategy gave Almarai an essential outlet and proved so successful that competitors adopted it as well. Such a distribution system is necessary for the company’s best-selling product since fresh milk only has a shelf life of about a week and needs to be chilled.

Another one of Almarai’s strengths is its focus on quality and strong branding associated with it. The company put much effort behind its brand message, “Quality You Can Trust.” To stay true to it, Almarai even refuses to source milk from local farmers and only produces it at its facilities under strict control. This allows for impressively low bacteria levels that could not have been achieved with independent suppliers.

Weaknesses

High operation costs have not been a concern for Saudi companies since electricity was subsidized, and foreign labor was cheap. This changed with the shift in government policy, the establishment of a value-added tax, and increased costs associated with foreign labor. Before these changes, Almarai’s relatively high overhead costs and inefficient logistics were not a critical issue when it was still growing rapidly. In the crowded modern market, however, every extra percent makes a vital difference.

Furthermore, one of Almarai’s greatest strengths, proficiency in fresh milk production, is arguably also a weakness, as the native Saudis tend to prefer long shelf life alternatives like ultra-high temperature milk, or UHT, which the company only produces when they have an excess of fresh milk. This inclination appears to be rooted deeply in the people’s upbringing and is not easily affected.

Finally, IDJ, Almarai’s joined venture with PepsiCo, despite all its ambitions to cover the Middle East, Africa, and Southeast Asia has remained just in Jordan and Egypt, after 10 years of losses. Teeba, the Jordan part of this operation, has been facing harsh conditions in the mainly supermarket-focused segment, where its less flexible structure does not allow it to compete with local companies for prices.

Opportunities

The company has plenty of aspects it could improve, one of those is logistics. The way it uses separate vans for perishable and non-perishable products leads to some retailers being visited by up to three Almarai vehicles in a day: one with dairy, one with bakery, and one with poultry. Lately, Almarai has started to introduce more optimal delivery routes as well as new combined vans that could carry chilled and ambient temperature products simultaneously. While these optimizations did help improve efficiency, in the end, the company is still using a fleet of diesel trucks that burn large amounts of fuel and are costly to maintain. To alleviate those issues, it could employ electric vehicles, which, despite being more expensive upfront, tend to cost less in the long run.

Another opportunity for Almarai lies within its turnaround segments: poultry and baby formula. Now, the poultry business has become profitable after a total investment of over $1 billion, but the other one is still struggling. The infant nutrition market is simply too crowded with strong competitors like Danone, Nestlé, and Abbott. Despite all the efforts, Almarai’s baby formula just does not sell well, and the company could save money by selling that division.

The relatively successful Egyptian part of IDJ, Beyti, has a practice that could be adopted in other divisions – the El Kasseeb program. Essentially, this program allows entrepreneurs to finance the purchase of a chilled van on the condition that they deliver Beyti products exclusively. This enables Beyti to develop its logistics without investing as many funds into a fleet of its own, an excellent strategy for expanding into new markets, which is what Almarai is trying to do.

Threats

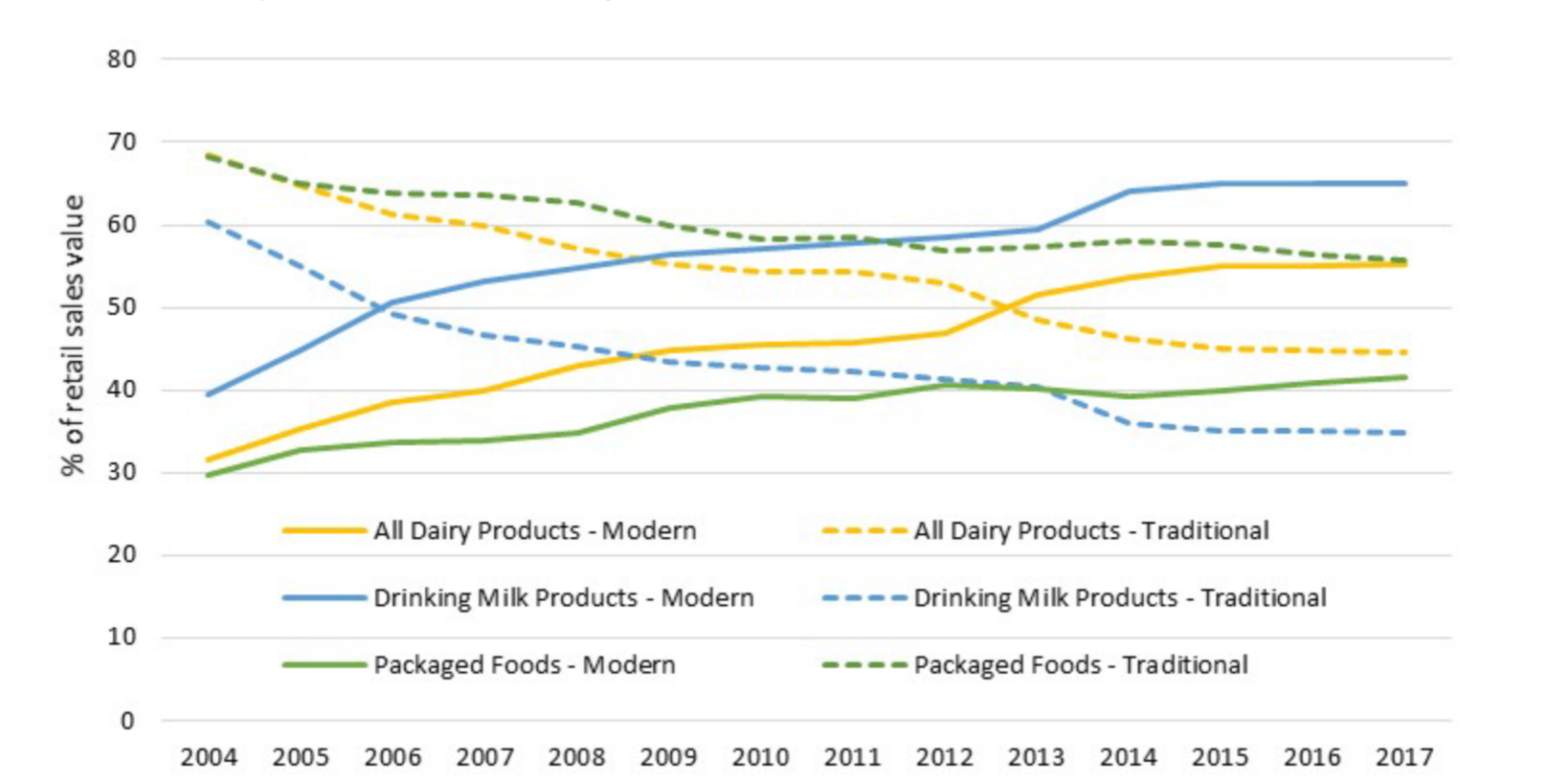

Perhaps the most pressing threat for Almarai is the changes in Saudi Arabia’s economy, which both increase the costs associated with running a large-scale business and decrease the buying power of consumers. As shown in exhibit 1, the sales of dairy products in general and drinking milk products specifically through traditional outlets have been declining steadily in the last decade, while modern outlet sales have been growing.

This is also apparent from the neglected state of some bakalas, contrasting with the well-maintained modern supermarkets that provide a cleaner and more upscale shopping experience, and at the same time, appeal to less affluent shoppers with coupons and discounts. Moreover, as estimated by an Almarai manager, some 3000 bakalas closed in 2017, and another 3000 were expected to close in 2018, with an anticipated sales drop of 5%. The company could focus more on supermarket sales; however, this would come with its own set of problems, such as having to do regular promotions, which is not easy to achieve with the increasing costs.

Another significant issue is the competition, which increased dramatically, when Almarai’s two closest rivals, Nadec and Al Safi Danone, announced their merger in March of 2018, with Nada Dairy possibly seeking to join the merged entity as well. The newly merged company will be able to grow quicker and improve its quality to be at Almarai’s level. Almarai needs to prepare to match the competitors’ prices when their products become closer in terms of value.

Market segmentation

Target Demographic selection and Market segmentation are done using geographic approaches, demographic approaches, and behavioral approaches.

Geographic segmentation

Almarai operates in Saudi Arabia, the United Arab Emirates, Oman, Kuwait, Egypt, Qatar, Bahrain, and Jordan, and its market segmentation caters to the specific features of these countries. In the more economically developed countries, it produces its milk and invests in high-end processing equipment as well as extensive logistics to provide the best quality product without compromises. In less developed countries that do not have a reliable infrastructure and electricity, Almarai focuses on more flexible strategies such as purchasing a local company and sourcing raw materials from farmers. Their products also reflect this policy, as the company tends to lean towards less logistically complicated options like ultra-high temperature milk or powder milk, which do not require refrigeration.

Demographic segmentation

In the Kingdom of Saudi Arabia, the major demographic groups relevant to the dairy sector are the native Saudis and the foreign residents. The majority of locals tend to choose the more utility-oriented UHT milk, which Almarai makes as a means of dealing with unexpected spikes in raw milk production. At the same time, expatriates have a strong preference for the taste and nutritional qualities of fresh milk – the company’s core product. It is important to note that with the decreasing number of foreign works in the country, the company’s consumer base is also shrinking, and in the future, it might need to put more emphasis on UHT milk to maintain its market share.

The Saudi demographic is also divided according to their income and outlet of choice. The more price-sensitive customers tend to shop at modern supermarkets since they find their coupons and frequent promotions appealing. Higher-income households are attracted by the convenience of traditional bakalas. Overall, though, the income variance does not have as strong of an effect on the market segmentation in Saudi Arabia, as does upbringing and origin. Almarai’s target demographic in this country is the consumers who are willing to pay more for a higher quality product and an established brand name.

In countries like Jordan and Egypt, where the general financial status of consumers is much less fortunate, income has a direct effect on the choice between UHT and the more expensive fresh milk. Relatively high-income consumers who have access to reliable refrigeration purchase fresh milk, while the majority of the population buys UHT products, both groups shop in modern retail outlets. Contrary to its domestic market, in these countries, Almarai targets the more modest buyer, and significantly alters its production schemes and logistics to reduce costs; the El Kasseeb program mentioned above is a brilliant example of this.

Behavioral segmentation

As far as behavior is concerned, there is one difference between dairy buyers. Bakala customers often use the store’s credit system, where they can take the goods now and pay later, which makes traditional sales more stable through the month. Those who prefer modern outlets tend to buy more right after receiving their salaries, so the sales are more changeable in this segment, the supply numbers need to reflect that.

Exhibits