Aggregate Demand and Aggregate Supply

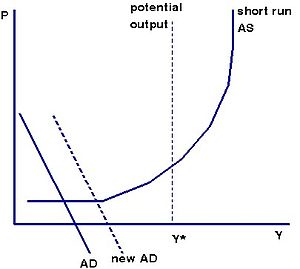

Paul Krugman emphasizes that the economic growth of the years 2000 – 2007 was not real. He explains his argument by stating that most economists confuse the concepts of aggregate demand and aggregate supply, while the growth of the economic parameters was stipulated by the proper adjustment of the economic system: experienced and motivated workers, sufficient capital stock, proper technological basis, etc. However, that was impossible to make it last forever, as most production capacities were debt-financed. Since debtors are not able to finance it the way they did, and the capacities can not decrease, hence, anybody else should finance it. Therefore, there is a strong need for the proper regulation of aggregate demand. (Krugman, 2011)

The concept of the aggregate demand and aggregate supply, it should be stated that the aggregate demand is generally stipulated by the price level, and supply rates. Since part of the supply (and, as a consequence, part of the demand) is debt-financed, the supply rate increases. This causes the cyclical growth of the production rates and creates the illusion of immense growth. Since growth is real, the rates of this growth are essentially overestimated. Therefore, the aggregate demand is lower than the supply rate. This is featured with greater losses and increased debt-financing as a consequence. Therefore, the debt crisis was inevitable.

The concepts and processes explained by Krugman are mainly associated with the requirements of the general demand and supply theory, however, by the basic microeconomic concepts; the explanation lacks potential output analysis. Since the output is known from the historic perspective, Krugman’s analysis lacks proper identification of the supply-demand correlation 2000 – 2007

Consumption Function

The consumption function theory is used to explain consumer spending, as well as for the calculation of the total consumption in the economy. The purchase of Skype by Microsoft may be regarded as one of the clearest representations of the consumption function. Since the function is linear, the key derivatives are the consumption rate and income of the consumers. The income level of Microsoft is immense, and the consumption rate is equal to the price paid for Skype. There is no need to consider the reasonability of this deal, while the consumption function concept may be explained using this case as a clear example.

One of the outcomes of the consumption function concept claims that income = consumption + savings. Therefore, the purchase of Skype has increased the income of Microsoft, as this has increased its assets. The consumption function concept also involves the opportunity of saving; however, this is not applicable for the deal regarded. Microsoft pursued the aim of being the first, and savings can not be regarded as a primary aim for the company. Hence, as it is stated by Schumpeter (2011):

The target company was heading for a stock market flotation until Microsoft suddenly lobbed in an unsolicited offer for it. The amount Microsoft ultimately coughed up for Skype was generous enough to convince the firm’s investors, which include Silver Lake Partners, a private-equity fund, and Andreessen Horowitz, a venture-capital firm, to jettison the planned public offering in favor of Microsoft’s all-cash deal.

In the light of this statement, the consumption rate of Microsoft may be assessed from the perspective of the absolute income described by Keynes.

Money Supply and Demand

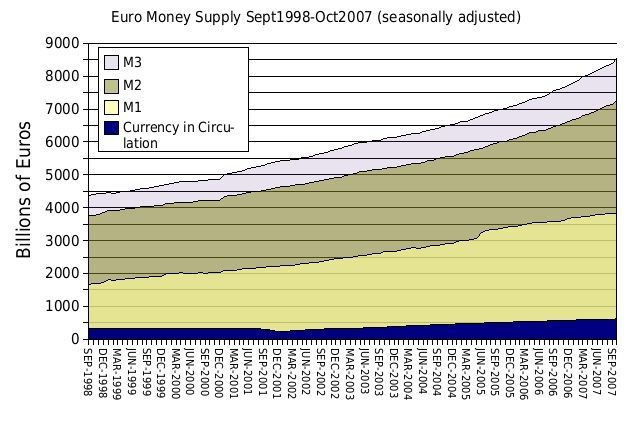

The matter of money supply and demand is observed in the problem of Greece’s possibly leaving the Eurozone. It is stated that if Greece leaves, the national debt will be restructured, and the money supply and demand levels will change. From the theoretic perspective of money supply and demand, the quantity of money in any historical period defines the price levels on the market. Therefore, it should be emphasized that Greece has an opportunity to gain better economic control over the money amounts, however, the restructuring of the national debt will decrease the flexibility of this control. (Charlemagne, 2011)

The money levels available for the EU economy are as follows:

- M1 – circulating currency and overnight deposits

- M2 – up to 2 years maturity deposits + M1

- M3 – repurchase agreements, shares and units, debts + M2.

This is helpful for the analysis of the economic money demand and supply that are based on the overall European money demand and supply levels. As for the matter of leaving the Eurozone, it is regarded as nonsense, and it will be useless unless the market upheaval, and the opportunity for improving the overall cash flow on the Greek market. In the light of this statement, it should be emphasized that the actual importance of the potential upheaval is explained by the necessary growth of the money supply. On the one hand, the increased supply may cause increased inflation rates, on the other hand, this will help increase the overall cash flow, and the necessary serving rate of the national debt for better control of the economic system.

Works Cited

Charlemagne, Karol. Bailing Out the Bail-Out. The Economist. 2011.

Krugman, Paul. The Conscience of a Liberal. The New York Times. The Opinion Pages. 2011.

Schumpeter, Michael. Microsoft and Skype. Why Buy Sype?. The Economist. 2011.