Abstract

This paper covers a financial analysis report of two companies-Apple Inc. and Samsung Electronics. The primary objective of the analysis was to provide more insights into the financial performance of the two companies considering that they compete with one another. As such, the report covers income statement, balance sheet, cash flow, statement of owners’ equity, and fifteen financial ratios for each company. The financial ratios are divided according to five financial diagnostic categories, which include liquidity of short term assets, long-term debt-paying ability, profitability, asset utilization, and market measures. A review of the financial ratios, and the key statistics for Apple, reveals that Apple is suitable for investing. This is based on the fact that the company has shown improved performance in terms of effective use of assets, invested capital, and shareholders’ equity to generate income for the company. With a high ROE, ROA, RO1 of 46.25%, 21.92%, and 11.50% respectively, it is an indication that Apple is good for investment as well as for employment.

Introduction

Overview of Research

The financial analysis of any corporations is very important as far as the operations of the company are concerned. In addition, such information can be used not only by the company itself but also by other people such as prospective employees and investors. For example, investors use financial details of various companies to ascertain the number of returns that they are likely to get should they invest their money in the said company (Kavitha, 2012). In case the financial information and possible returns are highly positive, investors can be willing to work with such a company. On the other hand, in the case the financial information shows a deteriorating trend, most likely the investors are discouraged to invest. Similarly, prospective employees also look at the stability of a company in terms of its ability to support its employees’ financial needs and demands. In most cases, individuals searching for employment would prefer a company with high returns as they attribute this to the fact that the company would be in a position to sustain them in terms of taking care of their salary and other benefits.

This paper provides a financial analysis of Apple Inc., to establish whether or not its financial information is attracting such that an investor would be willing to put their financial capital in Apple as a shareholder, as well as whether or not anyone can invest their human and intellectual capital in the firm as an employee.

Objectives

The primary objective of this research is to carry out a financial analysis of Apple Company. However, there are other specific objectives such as:

- To gather substantial information about Apple Inc.

- To determine the suitability of Apple company for investment as well as for employment.

- Make appropriate recommendations regarding investing in Apple Inc.

To achieve the above objectives, the research focuses on examining the financial ratios of Apple Inc. over a period of 5 years. This analysis will be used to interpret the position of Apple as an investment destination, as well as an employer.

An Overview of the Corporations

In order to ensure that all the important aspects of a company’s competitive nature are exhaustively covered, it is advisable to carry out the financial analysis of a selected company alongside a number of its top competitors. In the case of this research, the selected publicly held company to analyze is Apple Inc., while the benchmark firm is Samsung Electronics.

Background Information on Apple Inc.

Apple International Corporation headquarters are in Cupertino, United States of America. His current CEO is Timothy Donald Cook. The company has more than 60,000 direct employees operating in the United States alone. In addition, the company has created more than 620,000 indirect jobs such as those individuals supporting the company’s iOS ecosystem. Apple Inc. is a global country operating in a number of countries such as Turkey, Brazil, Sweden, Netherlands, Hong Kong, Spain, France, Germany, Switzerland, China, Australia, Italy, Canada, the United Kingdom, Japan, and the United States. However, Apple Store is in more than 20 countries.

Apple Inc. is known for its manufacture and sale of portable digital music players, personal computers, and mobile communication and media devices. In addition, the company sells third-party digital content and applications, networking solutions, related peripherals, services, and software.

The majority of Apple’s products and services are Apple TV, iPods, Mac, iPads, iPhones, software applications such as OS X and iOS operating systems, services, and support offerings on various accessories. On the other hand, Apple has involved in the sale as well as the delivery of digital materials and a variety of applications. This is made possible through the use of the company’s apps stores, which include the Mac App Store, iBooks Store, App Store, as well as the iTunes Store. Apple is a global player with operations in various parts of the world. Basically, its main products are availed to the target customer in a number of ways including online and offline stores, as well as through third-party engagements. Furthermore, Apple International Corporation sells numerous products that are compatible with many of the software and products within the industry such as iPhones, and iPads.

The primary customers of Apple Inc. include the education sector, various enterprises (small and medium), governments of various countries, as well as the general customers. While the major distribution channels used by Apple are the online and retail stores, the company also distributes its goods through either approach that is aimed to directly or indirectly reach the end-user (Arya & Mittendorf, 2013). For example, Apple’s sales returns from the direct channels were more than 28% of its total sales in 2013, while about 70% of the sales were from the indirect channels of distribution. The company embraces technology and information, research and development, training, and personnel development and such features have been highly significant in its success. Apple faces stiff competition from other companies in its industry. To beat such competition, Apple ought to adopt effective business and organizational strategies. Such strategies can be of much importance given the fact that rapid advances in technology alongside the launch of new products characterize the company’s areas of operation. Such a situation emanates from the fact that there is a continuous growth in the global ICT industry.

Apple Company faces stiff competition from a number of companies, which have specialized in price competition. For this reason, Apple needs to come up with effective business strategies to help it remain in the market since the lack of such approaches would imply negative implications on its operating results and financial condition. Apple is able to remain relevant in the market and outdo its competitors through the adjustment of competitive aspects such as the reliability of its products, design, and innovation, as well as taking consideration of customers’ needs in terms of third-party software.

Benchmark Firm: Samsung

The selected benchmark firm to use in making a comparison against Apple is Samsung as it is typically the largest competitor of Apple. Samsung Electronics Co., Ltd has its headquarters in Suwon, South Korea. Kwon Oh-Hyun is the current CEO of Samsung Electronics. The company has more than 275,000 employees and operates in more than 80 countries. Samsung Electronics is a significant player as far as the global manufacture and sale of telecommunication devices are concerned (Morningstar, 2017). For example, in 2012, the company was listed as one of the largest companies producing mobile phones in the world alongside other large companies such as Nokia (NASDAQ, 2017). In addition, customers in various parts of the world have actively praise Samsung’s smartphone technology. Continuous improvement and advancement in technology remain the number one factor that ensures that Samsung remains relevant in the market. In addition, its technology and innovation have been a selling point as well as a competitive edge for Apple (Amit & Zott, 2012). Over the years, Samsung and Apple have been involved in constant fights, competition, and rivalry regarding the dominance of the telecommunication industry.

Financial Analysis

In this section, the focus is on the financial information of both Apple and Samsung in an attempt to compare their financial performance as well as competitiveness. This is achieved through a review of the two company’s financial statements including the income statement, balance sheet, cash flow statement, and the statement of owners’ equity for a number of years.

The latest financial statements

Financial statements of any company include the company’s cash flow statement, its balance sheet, and income statement over a given fiscal year. The following is a brief overview of Apple’s and Samsung’s financial statements-income statement, balance sheet, cash flow statement, and statement of owners’ equity over a period of 5 years, from 2012 to 2016.

Apple Inc.: Income Statement

The table below is a comprehensive summary of Apple’s income statement between 2012 and 2016.

Table 1: Apple’s income statement, 2012-2016

Apple Inc.: Balance sheet

The table below shows the balance sheet of Apple Inc., 2012-2016

Table 2: The balance sheet of Apple Inc

Apple Inc.: Cash flow statement

The table below shows the cash flow statement of Apple Inc., 2012-2016

Table 3: The cash flow statement of Apple Inc

Apple Inc.: The statement of owners’ equity

The table below shows the statement of owners’ equity for Apple Inc., 2012-2016

Table 4: The statement of owners’ equity for Apple Inc

Samsung Electronics: Income Statement

The table below is a comprehensive summary of Samsung’s income statement between 2012 and 2016.

Table 2: Samsung’s income statement, 2012-2016

Samsung Electronics: balance sheet

The table below shows the balance sheet for Samsung Electronics

Table 5: The balance sheet for Samsung Electronics

Samsung: Cash Flow

The table below shows the cash flow for Samsung Electronics

Table 6: The cash flow for Samsung Electronics

Samsung Electronics: Owners’ Equity

The table below shows the owners’ equity for Samsung Electronics

Table 7: Owners’ equity for Samsung Electronics

Summary of each financial statement

This section provides an overview of the financial statements-income statement, cash flow, balance sheet, and owners’ equity for both Apple Inc. and Samsung Electronics. The aim of this summary is to provide an understanding of the major details of the statements.

Income statement

Apple: The total revenues in 2012 were $157 billion, while the cost of revenue was $88 billion, leaving a gross profit margin of $69 billion. During the same year, the company had total operating expenses of $13 billion, while the operating income was $56 billion before deducting any taxes. After taking out interest and taxes, the net income was $42 billion.

The total revenue increased between 2012 and 2015, before decreasing in 2016, and so was the cost of goods sold. However, the gross profit margin decreased between 2012 and 2013, from $69 billion to 64 billion, and increased between 2013 and 2015, from $64 billion to $94 billion, before decreasing again in 2016, to $84 billion. Subsequently, the net income decreased between 2012 and 2013, from $42 billion to $37 billion, and increased between 2013 and 2015, from $37 billion to $53 billion, before decreasing again in 2016, to $46 billion (NASDAQ, 2017).

Samsung: The total revenues in 2012 were $201 billion, while the cost of revenue was $126 billion, leaving a gross profit margin of $74 billion. During the same year, the company had total operating expenses of $45 billion, while the operating income was $29 billion before deducting any taxes (Morningstar, 2017). After taking out interest and taxes, the net income was $23 billion.

The total revenue increased between 2012 and 2013, and decreased between 2013 and 2015, and so was the cost of goods sold. However, the gross profit margin increased between 2012 and 2013, from $74 billion to $90 billion, and decreased between 2013 and 2015, from $90 billion to $77 billion, before increasing again in 2016, to $78 billion. On the other hand, the net income increased between 2012 and 2013, from $23 billion to $29 billion, and decreased between 2013 and 2015, from $29 billion to $18 billion.

Cash flow

Apple: The net income for 2012, 2013, 2014, 2015 and 2016, was $42 billion, $37 billion, $40 billion, $53 billion, and $46 billion respectively. After considering the accounts payable, depreciation accounts receivable, and working capital, the net cash provided by operating activities for 2012, 2013, 2014, 2015 and 2016, was $51 billion, $54 billion, $60 billion, $81 billion, and $66 billion, respectively (NASDAQ, 2017). The total cash used for investment in 2012 was $48 billion, implying that the total cash used for financing activities was $2 billion. The net cash used for investing activities decreased from 2012 to 2014from $48 billion to $23 billion and increased in 2015.

On the other hand, the net cash provided for financing activities increased from $2 billion in 2012 to $38 billion in 2014 and decreased to $18 billion in 2015 before increasing to $20 billion in 2016. Considering the debt issued, debt repaid, common stock issued, the dividend paid, repurchase of common stock, and other financing activities, the net change in cash for 2012, 2013, 2014, 2015 and 2016, was $1 billion, $4 billion, $0 billion, $7 billion, and $1billion, respectively (NASDAQ, 2017). After adding to the cash at the beginning of the period, the amount of cash at the end of 2012, 2013, 2014, 2015 and 2016, was $11 billion, $14 billion, $ 14 billion, $21 billion, and $20 billion, respectively. Therefore, after deducting capital expenditure from the operating cash flow, the amount of free cash flow for 2012, 2013, 2014, 2015 and 2016, was $41 billion, $45 billion, $ 50 billion, $70 billion, and $52 billion, respectively.

Samsung: The net income increased between 2012 and 2013, from $23 billion to $29 billion, and decreased between 2013 and 2015, from $29 billion to $18 billion. Talking into consideration the accounts payable, depreciation, accounts receivable, and working capital, the net cash provided by operating activities for 2012, 2013, 2014, 2015 and 2016, was $38 billion, $47 billion, $37 billion, $40 billion, and $49 billion, respectively. The total cash used for investment in 2012 was $31 billion, implying that the total cash used for financing activities was $1 billion (Morningstar, 2017). The net cash used for investing activities increased between 2012 and 2013, from $ 31billion to $45 billion, and decreased between 2013 and 2015, from $45 billion to $27 billion.

Consequently, the net cash provided for financing activities increased from $2 billion in 2012 to $4 billion in 2013 and decreased between 2013 and 2014 from $4 billion to $3 billion before rising again in 2015 (Morningstar, 2017). Considering the debt issued, debt repaid, common stock issued, the dividend paid, repurchase of common stock, and other financing activities, the net change in cash for 2012, 2013, 2014, 2015 and 2016, was $4 billion, $3 billion, $0.6 billion, $6 billion, and $2 billion, respectively. After adding to the cash at the beginning of the period, the amount of cash at the end of 2012, 2013, 2014, 2015 and 2016, was $18 billion, $16 billion, $ 17 billion, $22 billion, and $25 billion, respectively. Therefore, after deducting the capital expenditure from the operating cash flow, the amount of free cash flow for 2012, 2013, 2014, 2015 and 2016, was $14 billion, $22 billion, $ 13 billion, $ 12 billion, and $27 billion, respectively.

Balance sheet

Apple: in 2012, the total cash for the company was $29 billion, which was attributable to short-term investments and cash and cash equivalents amounting to $18 billion and $11 billion, respectively. The total cash for the company increased between 2012 and 2013 from $29 to $41 and decreased in the following year from $41 billion to $25 billion (NASDAQ, 2017). However, the company experienced an increase in the total cash between 2013 and 2016 from $25 billion to $67 billion following an increase in both the short-term investments and, cash and cash equivalents.

In 2012, 2013, 2014, 2015, and 2016, Apple had total current assets amounting to $58 billion, $73 billion, $ 69 billion, $ 89 billion, and $107 billion, respectively. In addition, the company’s value of net property, plant, and equipment was $15 billion, $17 billion, $ 21 billion, $ 22 billion, and $27 billion, respectively.

On the other hand, the total non-current assets for Apple over the years increased between 2012 and 2016, from $118 billion to $215 billion. This increase was attributable to the subsequent increase in the company’s equity and other investments over the years. As such, the company’s total assets grew between 2012 and 2016, from $176 billion in 2012 to $322 billion in 2016. In spite of this, Apple experienced an increase in its liabilities whereby, the total current liabilities were $39 billion, $44 billion, $63 billion, $81 billion, and $79 billion in 2012, 2013, 2014, 2015, and 2016, while the total non-current liabilities were $19, $40, $57, $91, and $114, respectively. In total, Apple’s total liabilities for in 2012, 2013, 2014, 2015, and 2016 were $58, $83, $120, $171, and $193, respectively (NASDAQ , 2017).

Samsung: in 2012, the total cash for the company was $36 billion, which was attributable to short-term investments and cash and cash equivalents amounting to $19 billion and $17 billion, respectively. The total cash for the company increased between 2011 and 2015 from $27 to $71billion due to an increase in both the company’s short-term investments and, cash and cash equivalents.

In 2011, 2012, 2013, 2014, and 2015, Samsung had total current assets amounting to $72 billion, $87 billion, $ 110 billion, $ 115 billion, and $125 billion, respectively. In addition, the company’s cost of net property, plant, and equipment were $62 billion, $68 billion, $ 75 billion, $ 81 billion, and $86 billion, respectively (Morningstar, 2017).

Over the years, the total non-current assets for Samsung increased between 2011 and 2015, from $84 billion to $117 billion. This increase was attributed to the continued increase in the company’s deferred income taxes, intangible assets, and other long-term assets. As such, the company’s total assets grew between 2011 and 2015, from $156 billion to $242 billion. It is evident from the company’s balance sheet that Samsung’s current liabilities increased between 2011 and 2015, from $44 billion to $52 billion. On the other hand, the total non-current liabilities increased from $14 in 2011 to $18 billion in 2013. Therefore, Samsung’s total liabilities for 2011, 2012, 2013, 2014, and 2015 were $58 billion, $64 billion, $70 billion, $68 billion, and $69 billion, respectively.

Owners’ Equity

Apple: In 2012 and 2013, Apple did not have any common stock, but in 2014, 2015, and 2016, the common stock was $23 billion, $27 billion, and $31 billion, respectively. Evidently, there was an increase in the amount of common stock between 2014 and 2016. Secondly, the paid-in capital for the company was $16 billion and $20 billion in 2012 and 2013, and zero for the other years. Thirdly, the retained earnings for Apple were high in 2013 and 2012, amounting to $104 billion and $101 billion while for 2014, 2015, and 2016, the retained earnings were $87billion, $92 billion, and $96 billion respectively. The company had accumulated other comprehensive income of $1 billion in 2014 and 2016. As such, the total shareholders’ equity for 2012, 2013, 2014, 2015 and 2016, was $118 billion, $124 billion, $112 billion, $119 billion, and $128 billion, respectively (NASDAQ, 2017). Taking into consideration, the company’s total liabilities, the total liabilities and stockholders’ equity in 2012, 2013, 2014, 2015 and 2016, was $176 billion, $207 billion, $232 billion, $290 billion, and $322 billion, respectively.

Samsung: the preferred stock for Samsung remained constant at $119 billion from 2011 to 2015, while common was zero in 2011, and constant at $778 billion in 2012, 2013, 2014, and 2015. In addition, the additional paid-in capital for Samsung over the five years was $ 4 billion. However, the retained earnings increased between 2011 and 2015, from $98 billion, $120 billion, $149 billion, $170 billion, and 185 billion, respectively. Taking into consideration the accumulated other income, the treasury stock, Samsung’s stockholders’ equity increased significantly between 2011 and 2015, wherein 2012, 2013, 2014, 2015 and 2016, the stockholders’ equity was $97 billion, $117 billion, $144 billion, $163 billion, and $172 billion, respectively (Morningstar, 2017).

Ration Calculation

Financial ratios play a significant role when it comes to projecting the performance of any given company. Often, investors and employees use such ratios to make investment and employment decisions. In the case of this study, the financial ratios will help to ascertain which of the two companies is worth investing, as well as working for between Apple and Samsung. The table below shows a summary of several financial ratios. The focus of the analysis is on five financial diagnostic categories including the liquidity of short term assets, long-term debt-paying ability, profitability, asset utilization, and market measures.

Table 8: Showing ratio and financial performance data of Apple Inc. and Samsung Electronics

According to the analysis of the financial ratios, such as the return on assets, it is evident that Apple is in a better position to use its assets effectively for the purpose of generating more income as compared to the case of Samsung. Secondly, its inventory is high despite the fact that it decreases significantly. On the other hand, examining the debt to equity ratio, it is evident that Apple has a much low debt than in the case of Samsung with respect to the invested capital. As such, Apple can be considered a better company for investment.

Key Statistics

There are various key statistics that can be used in the evaluable of a company’s stability in terms of its share price. Some of these elements include diluted earnings per share, beta, and market value among others. This section covers a discussion of some of the key statistics of Apple that can be used to evaluate whether or not it is a good buy or sell.

Diluted EPS

The diluted Earnings Per Share often referred to as the Diluted EPS refers to a performance metric that companies use for the purpose of determining the extent of a company’s earnings per share in aspects of quality. However, the diluted EPS is used for such purposes in the event that any other convertible security has been considered. In most cases, especially where the given company’s potential outstanding shares are zero, the diluted EPS is expected to be lower in terms of value in comparison to the simple earning per share. The importance of EPS is that it assesses the financial health of any company. Specifically, the diluted EPS is important in that it shows the financial position of a company in its worst-case scenario.

In the case of Apple, the company’s diluted earnings per share for October, November, and December 2016, was $3.6. On the other hand, a review of the company’s TTM reveals that its basic EPS in 2016 was $8.41 (NASDAQ, 2017). After exempting the non-recurrent items for October, November, and December 2016, the earnings per share for Apple was $3.36. However, when the non-recurring items are exempted when considering the TTM, the company registered earnings per share of $8.37.

Taking into consideration the past year, it is evident that there was a significant negative growth (-11.20%) in the average earnings per share of Apple, while the growth rate was 13.50%, a year. Since 2012, the company has experienced an average earnings per share growth rate of 40.20% for each year (NASDAQ, 2017). However, when the focus is on 13 years, it is evident that the highest percentage reached for the average earnings per share growth rate over a period of 3 years was 192.10% while -56% was recorded as the lowest.

Market Cap

Market cap refers to the total value for a given company when evaluated in terms of its market as well as the ability to be bought. It is expressed as a product of the total outstanding shares and the price of the shares. Considering the trading period that ended 2016, the share price of Apple was $115.82, while during the same period, the number of outstanding shares was 5,258 million implying that the market cap for Apple by the end of trading period in 2016 was $608,961 million (NASDAQ, 2017).

According to the trend, there was an increase in the company’s market cap from June 2016, which was recorded as $515,587, to December, $603,254 million. In addition, considering the past years, it is evident that there as a significant increase in the market cap of Apple between September 2014 and September 2015, from $591,016 to $615,336 (NASDAQ, 2017). In spite of this, the company registered a decline in its market cap between September 2015 and September 2016.

Beta

Beta is a metric used in finance to measure the volatility of a given company’s portfolio with respect to the company’s entire market. As such, it is useful in ascertaining the responsiveness of a company to market swings. If the beta of any given company is 1, the implication is that the security price of the concerned company aligns with the market conditions. In a case where the beta value exceeds 1, it is an indication of a more volatile security’s price when compared with the state of the market. The current statistics show that the beta of Apple is 1.36. This implies that the price of Apple’s security is highly volatile (NASDAQ, 2017). In comparison to the Beta industry, it is evident that Apple’s beta is significantly higher.

Return on Capital

A company’s return on capital is used to establish the ability of a company’s operations to generate cash flow with respect to the total amount of money invested. During the trading period that ended December 2016, the return on capital for Apple was 44.96%. Taking into consideration the current position of the company, it is evident that the weighted average cost of capital for Apple is 11.50% (NASDAQ, 2017). Overly, the company uses less investment to generate high returns. The implication is that Apple is experiencing an increasing value.

Return on Assets

Return on assets is a metric that is used to assess how well a company’s assets are being used to generate income. With regards to the trading period that ended in December 2016, the annualized net income for Apple as $71,564 million, while the average assets for the same period were $326,414 million. The implication is that the return on assets for Apple with respect to the annualized net income was 21.92%. A review of the past 13 years indicates that 28.54% was the highest return on investment that Apple registered while 14.52% was the lowest (NASDAQ, 2017).

Return on Equity

The return on equity describes the ability of a company to use its shareholders’ equity to raise income. As such, ROE is expressed as a fraction of the net income and shareholders’ equity. Considering the trading period that ends in December 2016, the annualized net income of Apple was $71,564 million, while its shareholders’ equity for the same trading period was $130,320. As such, the return on equity for this period was 54.91%. Apple has had 28.51% as the lowest ROE, and 46.25% as the highest over the past 13 years.

Considering the return on equity, the return on assets, and the return on invested capital, it is evident that Apple has been experiencing significant growth. First, its assets and shareholders’ equity are effectively used for the purpose of generating income for the company. Secondly, the total amount of invested capital is also used appropriately and that explains the positive and high return on capital ratio. Investors use such metrics to when making investment decisions and hence, in the case of Apple, it can be considered to be an investment company (Nicolás Marín Ximénez & Sanz, 2014). This is attributable to the fact that shareholders are assured of their dividends, while the company is assured that its liabilities will be paid.

Forecasting Apple’s stock price

Stock price forecast plays a significant role as far as determining the state of any corporation’s stock, whether good or bad (Hassan, Nath, & Kirley, 2007). In the case of Apple, carrying out such analysis will be of importance is determining is its stock is a good buy or sell. The following table shows the actual and forecasted price for Apple since 2008 using the 3-monthly moving average approach.

Table 9: The actual and forecasted price for Apple since 2008 using the 3-monthly moving average approach

According to the table above, it is evident that the stock price of Apple has changed over the years subject to various factors such as dividend policy, changes in laws and regulations, bond issues, and lawsuits results among other factors. However, a review of such changes in the stock price shows that the company has moments of high and low prices. For example, the stock price of Apple in 2008 was high though it reduced significantly throughout the year. In addition, according to the price forecast, Apple experienced a significant drop in prices between 2008 and mid-2009. This could be attributed to the 2007-2009 financial crisis that affected the world. However, around the middle of the month of June in 2009, the stock price started rising again. This rise in the stock price after 2009 was as a result of the recovery of corporations from the financial crisis of the previous years.

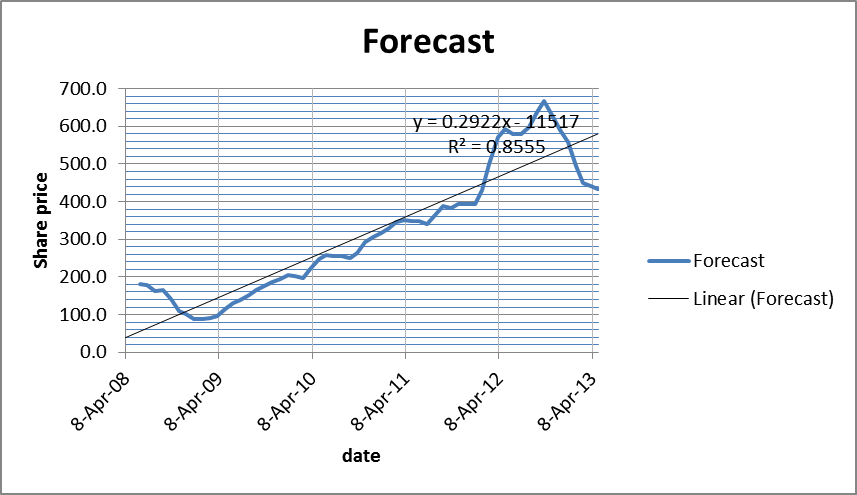

With respect to the above data, the figure below is a graph of the price forecast.

According to the above graph, it is evident the price of apple’s shares increased significantly to reach its peak between April 2012 and 2013, and then dropped. In this case, the forecast price is for 8th April 2013, it can be retrieved directly from the graph with reference to the trend line. As such, the forecast stock price is between $431.

According to the results of the forecast, it can be considered to be reasonable since the forecasted price lies within the range of prices for April 1st and 1st May 2013. For this reason, there is no need for any amendment in terms of analysis.

Apple’s other information pertinent to the corporation that could affect its future performance and stock price

A number of factors such as corporate profits, economic conditions, investor sentiment, and new products can affect the future performance and stock price of any company. In most cases, investors would be interested in companies whose revenues and profits are increasing both quarterly and yearly, but have a high potential for continuous increase and growth into the future. The increase in Apple’s profitability margins implies that there is a possible increase in the company’s overall value. Such a condition implies that the stock price is likely to rise. However, in the event that the company fails to surpass its expectations in terms of profits, the chances are high that its stock price will adversely be affected.

The stock price of Apple, as well as its future performance, is affected by any internal corporate developments. This is applicable in a case where the company wishes to launch a given product or project. Similarly, other activities such as expansion into new markets or even activities that are aimed to increase the company’s market share can have significant effects on the stock price of Apple.

The dividend policy; it is a significant financial decision, which entails a company’s requirement to pay its shareholders a certain percentage of their investment as returns. As such, lenders, managers, and investors feel the significance of dividend policy. Different companies have their own approach to payment of dividends. For example, Apple resumed its dividend policy in 2012. The share price of Apple significantly increased since 2012, with concerns that such an increase was attributable to the change in the company’s share policy. However, it is important to note that companies use dividends for the purpose of adjusting their capital structure with respect to investment decisions, and hence, they have no impact on the addition of value to any company. In spite of this, the change in Apple’s dividend policy and the rise in its share price is a reflection of the market fundamentals that were considered unstainable. As such, change in dividend policy could have adverse impacts on the company’s share price and its future performance whereby shareholders are convinced that such changes reflect the sustainability of market fundamentals. The implication is that a poor dividend policy would lead to a negative share price and a subsequent drop in the company’s performance.

Capital structure; the capital structure of any company has a significant impact on the stock price of the concerned company. In the case of Apple, the company’s future performance and stock prices are depended on its capital structure. The capital structure decisions revolve around the best financing choice between long-term debt financing and equity financing (Kavitha, 2012). As such, the approach that Apple decides to use can have varied impacts on its share prices.

Litigation; Lawsuits have a significant impact on the stock prices of any given company. In spite of this, Kavitha (2012) noted that it is quite hard to predict the impact that a given lawsuit would have on the prices of a company’s stocks. This is attributable to the fact that the impact of any lawsuit on stock price can only be determined after the lawsuit is finalized. In addition, the impact of any lawsuit is determined by a few factors including the general operations of the company, the timing, and the type of lawsuit.

The loss of a company’s lawsuit is not a necessary indication that the company’s stock price would fall. In most cases, the impact of such loss is determined by the amount of money the company pays, as well as the public attention given on the lawsuit. In the event that the public has an interest in a given lawsuit, the chances are high that affected the company’s stock price might fall due to negative media buzz. However, in the event that a company wins a lawsuit, the probability of its stock price rising is high. Most importantly, the stock price would face a significant rise where there is much public interest in the concerned lawsuit. Apple has been involved in a couple of lawsuits in the past over patent infringement cases and related issues (Kim & Song, 2013). For example, in 2012, Apple was involved in a patent infringement case in which it won the case against Samsung (Cusumano, 2013). Following this lawsuit win, Apple experienced a rise in its stock price. For this reason, lawsuits have a significant impact on the stock prices and performance of any company. In the event that the company wins a lawsuit, the stock prices go up but fall in a case where they lose the lawsuit.

Regulation; the operations of Apple Inc. are affected by various regulations. For this reason, the activities of the company are subject to worldwide regulations and laws. As such, changes in laws and regulations in the countries where Apple operates can lead to adverse effects on the company’s stock prices and future performance. This is attributable to the fact that some changes can lead to an increase in the aggregate as well as the individual costs of the company. Some of the common areas of operations that are affected by changes in laws and regulations include quality of services, promotions, e-commerce, billing, real estate, and consumer protection, digital content, advertising, areas of labor, safety, health, environmental, anti-competition, data privacy, cash repatriation restrictions, foreign exchange controls, anti-corruption, export and import requirements, tax, intellectual ownership, and copyright infringement, and mobile communications among others. For example, changes laws and regulations governing communications and media devices are expected more often, which would focus on restricting activities around production, manufacturing, distributing, as well as the usage of devices. In addition, there are certain rules and regulations that require Apple to get certified, as well as regulated to certain standards as far as the communication and mobile devices are concerned.

In most of the cases, the company might find it expensive and onerous to comply with the laws and regulations of its operating countries. In addition, there are cases where the laws and regulations are not consistent when examined from the view of one jurisdiction to the other and hence, increases the compliance cost. For this reason, an expensive requirement to comply with such laws and regulations has adverse impacts on the stock price as well as the general performance of the company. This is attributable to the fact that the increase in the cost of compliance with laws and regulations leads to a significant increase in the operational cost.

Bond issue and ratings; the announcement of any new bond tends to significantly impact the stock prices of any company’s stock. This is often attributable to pressure on price, redistribution of wealth, as well as information-release hypotheses. All these elements have varied impacts and on the share price, and hence, significantly lead to different types of reactions on the share price.

Future of Apple

With respect to the current financial position of Apple, its stock can be considered a good buy. In addition, Apple has a positive future. This can be inferred from the company’s current key statistics. For example, a review of the company’s market cap shows that Apple is in a stable position since the market value has been significantly increasing over the past 13 years. In spite of this, there was a significant drop in the company’s market value between September 2015 and September 2016.

Secondly, the company’s beta is high. Considering the fact that its beta value is currently 1.36, it can be considered to be highly volatile based on the following equation; (less volatile) 11(highly volatile). This implies that Apple’s security price is much volatile when compared to market conditions.

However, for the company to remain relevant in the market there is a need for the adoption of effective business and organizational strategies. In addition, the company should set up effective measures aimed at making its operations and activities competitive. One of the significant approaches that the company should take is to reduce the number of lawsuits that it engages in a year. This is based on the fact that such lawsuits have adverse impacts on the company’s stock price. Similarly, there is a need for Apple to ensure that it takes notice of the necessary laws and regulations that it ought to comply with to avoid unnecessary lockdown and fines that might increase its cost of operation and significantly reduce is performance and stock price.

References

Amit, R., & Zott, C. (2012). Creating value through business model innovation. MIT Sloan Management Review, 53(3), 41.

Arya, A., & Mittendorf, B. (2013). The changing face of distribution channels: Partial forward integration and strategic investments. Production and Operations Management, 22(5), 1077-1088.

Cusumano, M. A. (2013). The Apple-Samsung lawsuits. Communications of the ACM, 56(1), 28-31.

Hassan, M. R., Nath, B., & Kirley, M. (2007). A fusion model of HMM, ANN and GA for stock market forecasting. Expert Systems with Applications, 33(1), 171-180.

Kavitha, M. (2012). Impact of capital structure on the stock price performance. Chennai International Journal of Fuzzy Mathematics and Systems. 2(4), 391-400.

Kim, H., & Song, J. (2013). Social network analysis of patent infringement lawsuits. Technological Forecasting and Social Change, 80(5), 944-955.

Morningstar (2017). Income Statement for Samsung Electronics Co Ltd (SSNLF). Financials.morningstar.com. Web.

NASDAQ (2017). AAPL Income Statement. NASDAQ.com. Web.

Nicolás Marín Ximénez, J., & J. Sanz, L. (2014). Financial decision-making in a high- growth company: The case of Apple incorporated. Management Decision, 52(9), 1591-1610.