Introduction

Lufthansa is a leading airline in the global aviation industry (Lufthansa 2010). Its headquarters is in Frankfurt German. The company was founded in 1926 as a result of a merger between two airline companies that were initially competitors of each other(Lufthansa 2010). Therefore the company has been in operation for the last 84 years (Lufthansa 2010).

The founding companies are Deutsche Aero Llyod and Junkes Luftverketr. Lufthansa Airline is owned by the Deutsche Lufthansa AG which is the parent company(Lufthansa 2010). The group operates five business segments namely, passenger airline business, logistics, MRO, catering and IT services (Lufthansa 2010).

The group’s total assets as at 11-03-2009 were worth 26.4 billion Euros (Lufthansa 2010). The group’s total revenue in the last financial year was 22.3 billion (Lufthansa 2010). The group employed 118,000 employees in the same period (Lufthansa 2010). The group is committed to offer products and services of high quality, maintain financial stability and innovation (Lufthansa 2010).

Notable events in the group’s calendar include the incorporation of Swiss Airline in 2005 as an autonomous airline within the group (Lufthansa 2010). Between 2006 and 2008 the group expanded its operations by acquiring 20 Boeing 747-85 and a new A380 maintenance hanger (Lufthansa 2010). In July 2009 the group purchased 45% of Brussels Airline and completed its acquisition of Australian Airline in September of the same year (Lufthansa 2010). Lufthansa is a low cost network airline.

Main Analysis

Operational Characteristics

Initially the Airline served the domestic market which involved flights within the German state and the neighboring European countries. At the time of the company’s inception technology in aviation industry was limited. Thus it was a great challenge to provide long haul flights. Advancement in technology has made it possible to build new aircrafts with more space and better equipment.

This has led to the introduction of long haul services and more flights per destination (Morrell 2008, vol. 24, pp. 61-67). Consequently, the Airline’s route network has grown to 197 destinations as at June 2010(Lufthansa 2010). The group has recently added three new routes in its network. The new routes include Bogota, Pointe Noire and Luxembourg (Lufthansa 2010). The new routes have been introduced as part of the group’s expansion strategy.

They will help the company to increase its long haul flights to Africa and South America with the aim of increasing revenues. The introduction of the new routes is attributed to the rapid increase in demand for flights especially in emerging economies (Daraban &Fournier 2008, vol. 24, pp. 15-24). The emerging economies are continuing to record positive growth. This has led to growth in the aviation industry in terms of high demand for domestic and international flights (Franke & John 2010, vol.17, pp. 19-26).

The group has always recorded a steady increase in traffic over the last five years. The increase in demand for the company’s flights can be explained by its expansion strategy. In 2001 the company reorganized its operations by purchasing 15 new A380 mega-liners in response to the increasing demand for its flights (Lufthansa 2010). Between 2002 and 2005, the company focused on partnering with other airlines in order to meet the demand for long haul flights (Lufthansa 2010).

Most customers in the aviation industry usually connect to different destinations. Thus it is a challenge to find a single flight that can connect such passengers to their destinations (Morrell 2008, vol. 24, pp. 61-67). This has led to the formation of alliances among airlines. Between 2006 and 2008 the company continued to witness an increase in traffic and ordered 20 new Boeing 747-85 to meet the rising demand (Lufthansa 2010).

However, in 2008 there was a significant reduction in traffic due to the impact of the global financial crisis. The crisis adversely affected the aviation industry in terms of reduction in passengers and rising costs of fuel. The traffic volume has begun to rise as the economies recover from recession (Franke & John 2010, vol.17, pp. 19-26).

The rapid rise in the group’s traffic level is attributed to its high quality of services and global presence. The company focuses on the acquisition of modern aircrafts that are more comfortable and safe (Lufthansa 2010). New aircrafts are efficient in fuel consumption and thus the company is able to minimize costs as it charges low prices (Graham 2009, vol. 17, pp. 306-316). This enables it to attract and maintain more customers.

The new aircrafts have additional features such as internet connection through broadband technology (Lufthansa 2010). The group is a member of the Star Alliance (Lufthansa 2010). This enables its customers to connect conveniently to any part of the world. Besides, the company has formed partnerships with regional airlines with the aim of serving customers in every part of the world.

The competitors of the firm have not been able to realize the same level of traffic. Most of them have not been able to withstand the effects of economic down turn in the industry. Thus most of them have either collapsed or have been acquired by other major Airlines (Forsyth 2010 vol. 17, pp. 204-255). Some airlines have had to drop some of their destinations in order to reduce costs and remain profitable.

Financial Performance

The major factors that determine the financial performance of firms in the aviation industry include the cost of fuel, performance of the global economy and the efficiency of individual firms (Trethway 2004, vol.10, pp. 3-14). This means that the success of firms in this industry depends on their ability to respond effectively to the effects of these factors (McGurk 2009 vol.51, pp.635-52).

Lufthansa has been able to respond effectively to the impact of these factors through sound management strategies. Consequently, the group’s financial performance has steadily improved over the years. In the third quarter of the current financial period, the company recorded a profit of 783 million Euros (Lufthansa 2010).

This represents an increase in profit by 565 million Euros (Lufthansa 2010). The operating income attributed to the passenger airline business for the period is 218 million Euros (Lufthansa 2010). The group’s logistics business recorded an operating income of 230 million (Lufthansa 2010). The MRO segment realized 211 million Euros in operating income (Lufthansa 2010). The IT and catering segments recorded 12 million Euros and 50 million Euros respectively (Lufthansa 2010).

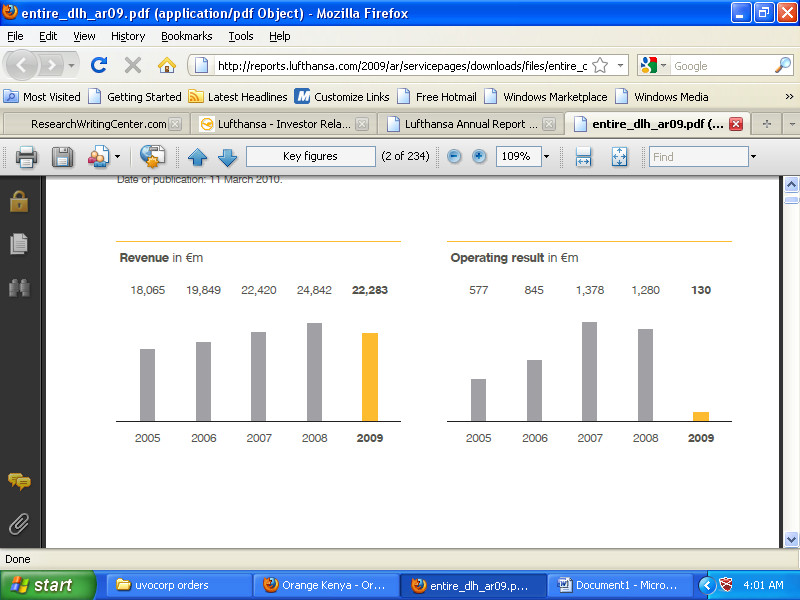

Figure 1 shows the variance of the company’s profits in the last five years. In 2005 the profit was 577 million Euros (Lufthansa 2010). The figure rose to 845 million in 2006 (Lufthansa 2010). In 2007 the company realized a profit of 1.378 billion Euros (Lufthansa 2010). The impressive growth is attributed to three factors.

First, the period between 2005 and 2007 was characterized by increase in demand for flights (Lufthansa 2010). Besides, the global economy was recording significant growth which raised demand in the aviation industry (Trethway 2004, vol.10, pp. 3-14).

Second, the company had embarked on cost reduction measures by improving efficiency across all its segments (Lufthansa 2010). Finally, the company focused on accelerating demand for its products through innovation and exploring new markets. The positive results from these factors led to the high performance. In 2008 the income dropped to 1.280 billion Euros (Lufthansa 2010). In 2009 the group realized the lowest income of 130 million Euros (Lufthansa 2010).

The reduction in profit is attributed to the impact of the 2008/ 2009 financial crisis. The recession adversely affected the aviation industry by lowering demand for flights (Franke & John 2010, vol.17, pp. 19-26). Despite the economic downturn, the company was able to realize the little profit. This means that it has a stable financial base that is backed by sound management principles.

During the recession, most airlines dropped some of their routes in order to minimize costs (Harvey 2004, vol.10, pp. 287-307). Most airlines had to layoff some of their employees in order to remain in business. Other airlines collapsed while some were bought by major companies such as Lufthansa.

The group’s total revenue has increased by 24.9% to 20.2 billion in the current financial year (Lufthansa 2010). The traffic revenue rose by 36.6% to 16.4 billion (Lufthansa 2010). Figure 2 shows the variation in the company’s revenue over the last five years. The revenue increased steadily between 2005 and 2007.

This is attributed to increased demand for flights and cost reduction measures. In 2008 and 2009 the revenue dropped due the effect of the recession. The group’s unit costs have always fluctuated over the years. In the current financial year the operating costs have risen by 47.7% due to increases in fuel prices (Lufthansa 2010). The fuel used by aircrafts forms a greater part of costs in the aviation industry. Thus any increase in the fuel prices adversely affects the industry.

Airlines in the Asian economies like the Emirates have realized similar financial success in the last five years (Feiler & Goodoritch 2009, vol.2, pp. 55-64). However, they were also adversely affected by the last recession. The British airlines on the other hand were severely affected by the recession.

For example, British Midland Airline had to be sold due to its financial instability. British Airways had to layoff most of its workers especially in overseas economies in order to reduce costs. Thus the British airlines have not been able to realize the same level of financial success as Lufthansa.

Competitive Situation

The main competitor of the airline at the domestic level is Air Berlin Plc. However, Lufthansa controls a greater market share in the domestic market. The main competitors of the airline at the global level include the Emirates Airline, Virgin Atlantic and British Airways. The aviation industry mainly serves the global economy.

Thus competition at the global level has a direct impact on the performance of major airlines (Nicolau 2010, vol.16, pp. 254-260). At the moment the industry is characterized by intense competition due to the presence of many firms. The pressure on prices is on the rise since companies are trying to offer their products at the lowest possible prices in the market (Daraban &Fournier 2008, vol. 24, pp. 15-24). Consequently, firms have had to rethink their marketing strategies in order to remain competitive.

Lufthansa has focused on price reduction in order to remain competitive in the industry (Lufthansa 2010). This has been achieved through cost reduction measures that allow the company to charge lower prices.

The company also offers discounts to its customers through promotional activities and programs such as frequent flyer. The other strategy used by Lufthansa is high quality of services (Lufthansa 2010). The company focuses on purchasing modern aircrafts that are more safe and comfortable. The customers in the industry are highly concerned with their safety and thus they will only use an airline if their safety is guaranteed (Hazeldine 2010, vol. 17, pp. 40-43).

The company’s competitiveness has also been boosted by its membership in the Star Alliance. The alliance helps the company to increase its market share by connecting the customers of the member airlines to their destinations. The company also enjoys the use of the assets of the alliance such as passengers’ launches (Duvan 2005, vol.11, pp. 448-454). The company’s customers are also able to get travel information and booking services at the Star Alliance offices. These translate to customer loyalty and a greater market share.

Conclusion

Lufthansa is a leading global airline that is owned by Deutsche Lufthansa AG (Lufthansa 2010). The airline serves a total of 197 destinations in 85 countries (Lufthansa 2010). The rapid increase in the demand for the company’s flights has led to the introduction of new routes in the company’s network.

Lufthansa has been able to achieve financial success though sound management principles which include cost reduction, innovation and high quality of services (Lufthansa 2010). In the current financial year the business has realized an income of 783 million Euros (Lufthansa 2010).

The group’s success factors include excellent team performance, effective cost reduction, stable financial foundation and membership in a strong airline alliance (Lufthansa 2010). The performance of the company in future depends on the dynamics in the global economy, the competition in the industry and the ability to implement the effective management principles.

Illustrations

Figure 1 and Figure 2

Figure 1 shows the variance in the group’s revenue in the last five years. Figure 2 shows the variance in the group’s operating income in the last five years. The rise in revenue and operating income is attributed to increase in demand and cost reduction measures. The decline in revenue and operating income is attributed to the effect of the last economic down turn.

Bibliography

Daraban, B & Fournier, G 2008, ‘Incumbent responses to low-cost airline entry and exit: a special autoregressive panel data analyses’, Research in Transport economics, vol. 24, no. 1, pp. 15-24

Duvan, D 2005, ‘Public/ stakeholder perception of airline alliances: the New Zealand experience’, Journal of Airline Transport Management, vol. 11, no. 6, pp. 448-454.

Feiler, G & Goodoritch, T 2009, ‘Decline and growth, privatization in Middle East airline industry’, Journal of Transport Geography, vol. 2, no. 1, pp. 55-64.

Forsyth, P 2010, ‘Environment and financial sustainability of air transport: are they incompatible?’, Journal of Air Transport Management, vol. 17, no.8, pp. 204-255.

Franke, M & John, F 2010, ‘What comes next after recession? airline industry scenarios and potential end games’, Journal of Air Transport Management, vol. 17, no.1, pp. 19-26.

Graham, M 2009, ‘Different model in different space or liberalization optimization? comparative strategies among low-cost carriers’, Journal of Transport Geography, vol. 17, no. 4, pp. 306-316.

Harvey, G 2004, ‘Cleared for take-off? Management labor partnership in the European civil aviation industry’, Journal of Industrial Relations, vol. 10, no.3, pp. 287-307.

Hazeldine, T 2010, ‘Legacy carriers fight back: pricing and product differentiation in modern airline marketing’, Journal of Air Transport Management, vol. 17. No. 1 40-43.

Lufthansa 2010, Reports, Web.

McGurk, J 2009, ‘Contrasting management and employment relations strategies in European airlines’, Journal of Industrial Relations, vol. 51, no.2, pp. 635-652.

Morrell, P 2008, ‘Can long-haul low-cost airlines be successful?’, Research in Transport economics, vol. 24, no. 1, pp. 61-67.

Nicolau, J 2010, ‘Testing prospect theory in airline demand’, Journal of Air Transport Management, vol. 16, no.4, pp. 254-260.

Trethway, M 2004, ‘Distortions of airline revenues: why the network airline business model is broken’, Journal of Transport Management, vol. 10, no. 1, pp. 3-14.