Abstract

This paper will focus on the analysis of Macy’s. It will provide the primary information regarding the area of the company’s activities including assessment of its major products and services, competitors, market share, elasticity, and some other aspects. Special attention will be paid to the role of Macy’s in the international market and its specificity. Moreover, the paper is an attempt to formulate the long-term prospects of the company based on past financial performance and determines the potential risks it can face in the next five to ten years. Finally, this report will introduce some recommendations for the further development of the chosen business.

Introduction

Founded in 1858, Macy’s is one of America’s premier omnichannel retailers operating in 45 states of the USA, Guam, Puerto Rico, and Dubai. Its name is associated with Bloomingdale’s and Bluemercury that are the company’s branches. I believe that it should be studied because it has a long history of financial success. What is also interesting about the company is that it has chosen to go global primarily through launching websites and worldwide deliveries rather than physical presence, except for Dubai, Guam, and Puerto Rico.

The objective of the research is to assess the performance of Macy’s and its branches through analyzing their primary products and services and the role they play on the national as well as the international market and to formulate the prospect of the business’ development for the next five to ten years. The paper will provide an investigation of the firm’s activities and present its market share as well as demonstrate the author’s recommendations for Macy’s to develop in the long run, that is why I think it is significant and important.

The research will be conducted as an analysis of the information regarding the company’s activities and the industry as the whole so that there is a possibility to assess the role it plays in the market and the influence it has. The organization of the paper is as follows: it is divided into sections and subsections. There are three primary sections of the paper excluding the introduction and conclusions. They present the critical review of the company and its performance, the analysis of the industry and the company’s closest competitors, and the long-term prospects for Macy’s including the financial risks it might face in the next five to ten years. In addition to it, the research will include charts and tables representing the key facts about the chosen business and industry that will make the information easier to acquire.

A critical review of Macy’s

Research Questions

The purpose of the research is to assess the performance of Macy’s by addressing numerous questions such as:

- What are the company’s primary products and services? Does it have a monopoly in a market?

- What kind of market does the company operate in?

- Is the demand for the company’s products elastic?

- What are the company’s closest competitors and what are the substitutes for the company’s product?

- How can the company make its profit growth and its performance improve?

- How does the company train its labor force?

- What are the financial prospects for the company and what are some risks it might face in the next five to ten years?

Product and Services Overview

Macy’s is a nationwide retailer of ready-to-use products. The company’s initial specialization was selling ready-to-wear clothes but with the merge with Bloomingdale’s in 1949 and acquisition with Bluemercury in 2015, the range of its products widened. As for today, the sphere of business performance is merchandising in clothes, footwear, furniture, bedding, home accessories, jewelry, and beauty products. Moreover, Macy’s offers some exclusive brands that can be bought only in the department stores of the company.

Except for that, it started offering spa services after Bluemercury has joined the business and worldwide delivery of products once the company went global and launched retailing websites (Macy’s Inc., 2015). The company is not a manufacturer of products; it specializes in sales only. However, it has some kind of monopoly in the market, as there is a range of brands that are sold exclusively at Macy’s, and the firm is free to determine the prices for these products.

Location and Size overview

Macy’s primary location in the United States as it has stores located in 45 states. In addition to that, it opened department stores in Guam, Puerto Rico, and Dubai. Hiring about 167,000 employees (Macy’s Inc., 2015) and operating at the scales mentioned above, it can be said that the company is big. Moreover, it has online stores – macys.com, bloomingdales.com, and bluemercury.com offering the same range of products that are sold in shops.

Bearing in mind the store location and operation of the websites granting the possibility of worldwide delivery of goods, the conclusion about the company is that it is still multi-national because it is physically present in several countries. What is significant about the firm’s strategy is that Macy’s does not have ambitions to the further physical global expansion, except for the plans to open stores in Honolulu and Abu Dhabi. These plans show that the organization’s objective is becoming a local leader in merchandising. It can be justified by the fact that it is more financially beneficial to invest in developing websites and global delivery systems than open stores all over the world.

Macy’s Specificity

There are some specific features of the chosen company. First of all, it was opened in 1858 as a one-of-a-kind store. As of today, there are almost 900 stores located all over the United States of America and in some countries abroad. That said, the business is financially successful. The previous statement can be also proved when looking at the data of Macy’s financial performance – net sales and net incomes continue to grow (Macy’s Inc., 2014a; Macy’s Inc., 2014b). In addition to it, the company is ranked 105 on the Fortune 500 List and appears in Global 500 List (ranked 434) and the World’s Most Admired Company List (Time Inc., 2016). Macy’s has been on the Fortune 500 List for 21 years for now. Together with that, it is listed on the New York Stock Exchange marked asM’.

Moreover, it has brought many novelties to the world of retailing. First, Macy’s was the first company to promote a woman to take up an executive post. Second, it introduced the one-price-for-all strategy that became a revolution in merchandising, as the company launched the practice of announcing the price for products in newspapers, so every customer could buy it at one price. Finally, it presented such an invention as tea bags, colored bath towels, etc. (Macy’s Inc., 2015).

Visibility in the UAE

Macy’s is visible in the United Arab Emirates thanks to Bloomingdale’s department store located in Dubai Mall, Dubai. In addition to it, the company has the plan to open another store in Abu Dhabi in 2018 (Macy’s Inc., 2015). Except for that, its websites operate in the UAE as well as in the rest of the world.

Industry analysis

Kind of Industry Macy’s Belongs to

Macy’s belongs to general merchandisers industry, retailing sector (Time Inc., 2016). Bearing in mind the company’s size, it can be said that it belongs to the monopolistic competition market. The motivation for choosing this type of market is that it offers customers the products of different brands. In fact, it means that Macy’s offers goods almost identical to others that can be substituted that are differentiated on the basis of the manufacturer (Monopolistic competition, 2013). Even if we speak about the brands that are exclusively sold at Macy’s it still means that the business belongs to monopolistic competition because the customers are free to choose any other product with which they can substitute that offered by our chosen company.

Macy’s offers its customers a great variety of popular brands including Michael Kors, Tommy Hilfiger, Calvin Klein, Esteé Lauder, Sean John, Hotel Collection and others. Moreover, it has what the company calls private brands such as Belgique, Alfani, Ideology, First Impressions, Epic Thread, Giani Bernini, Club Room, etc. These brands can be sold exclusively at Macy’s that makes the company monopolistic in its sector of industry because if the customers want to buy the products of the mentioned brands, they can only buy them at Macy’s and at prices determined by Macy’s.

Market Competitiveness

Macy’s is a highly competitive company at national as well as international scales. Its share in the global department store market was 6.4% as for 2014. It can be said that this spectacular result was reached thanks to the company’s localization strategy (Macy’s Inc., 2015). Choosing to become a local leader and open a great number of stores in the United States, Macy’s made it difficult for other companies to compete with it. Nevertheless, there are some firms that are nearly as successful as Macy’s, so they can be called its closest competitors.

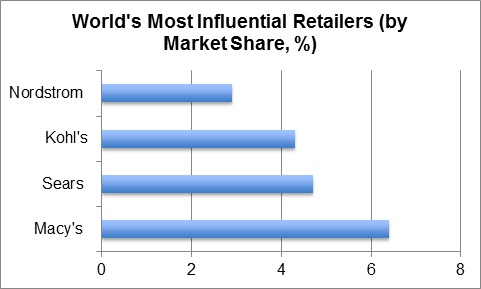

They include Sears Holdings Corp., Kohl’s Corporation, Nordstrom, Inc. that trail Macy’s in the global market (Bailey, 2015). The respective information demonstrating their market share and how they relate to the positions of Macy’s can be seen in the chart below. Bearing in mind that Macy’s as well sells furniture and home accessories, there can be another close competitor mentioned – Walmart. However, if we speak about the whole range of products offered by the company, then Sears, Kohl’s, and Nordstrom are just right.

Price Elasticity of Demand and Income Elasticity of Demand

Price elasticity of demand for the products sold by Macy’s is elastic. It means that if the company raises the prices for the goods it sales, it will affect the sales. It can be explained by the fact that Macy’s sells the goods that can be easily substituted by those offered by other retailers. So, if the company chooses to sell the products at higher prices, there is the probability that the customers will choose to go to another store.it is true for any brand it offers whether it be private or general because no matter what is written on the label, the product can be easily substituted. As of the substitutes, they can be found nearly everywhere because ready-to-wear clothes, jewelry, furnishings, and beauty products can be bought everywhere or even made at home.

Speaking of the income elasticity of demand, it is also elastic. The explanation is that the quantity of sold good has a direct impact on the incomes of the company. It means that, for example, in the case of crisis events in the economy or some unexpected environmental issues, the firms inevitably suffer losses as the quantity of the sold products drops.

It should be said, however, that the demand for the goods offered by the company continues to grow. There are several reasons that can explain this trend. First of all, Macy’s is the company that has both luxury and ordinary brands. It means that it can satisfy the customers with various tastes and financial capabilities. Second, the company offers some brands that can be bought exclusively at Macy’s. So, if the buyers are interested in that particular brand, they have no other option rather than go and get it at the nearest Macy’s department store or order online. Finally, its system of worldwide delivery is what also makes the company attractive to the customers from abroad who have got the possibility to get the desired goods easily.

Long-term prospects

Company’s Current Performance

Nowadays, Macy’s is a financially successful company that is rather influential in the international market of department stores. It was among the businesses that managed to grow starting from 2009 when the global economy was recovering from the financial crisis. What should also be said is that Macy’s development was positive for the last five years, as the company demonstrated growth in net sales and net income from $25 millions in 2010 to $28 millions in 2014. What can be noted is that the rates of growth are not high. However, they are stable. It means that the financial strategy is effective and has positive outcomes. For detailed information, see Table 1 provided below. Notwithstanding the overall success, there was a drop in the number of stores from 841 in 2012 to 823 in 2014 (Macy’s Inc., 2014a) that demonstrates that the company had some financial issues and was forced to cut the quantity of stores in operation.

Table 1. Net sales and net income of Macy’s, 2010-2014, dollars in millions. Macy’s Inc., 2014b.

In addition to the increase in net sales and net income, Macy’s has also witnessed growth in profit ratios, earnings per share, and total return. For additional information is shown in Table 2 provided below. This financial data demonstrates that the company’s rate of development is sustainable, especially looking at annualized 10-year rates that include the data for the period of financial crisis and recovery from it. Moreover, the investors will be interested in putting money in the company’s share as they have proved to be profitable and the business is in general stable.

Table 2. Macy’s Financial Performance, %. Time Inc., 2016.

Company’s Prospects

Looking at the data of the company’s financial performance, it is possible to make an attempt to determine the prospects of the development of Macy’s for the next five to ten years. What, first of all, should be said is that the company managed to show positive results in the period during and after the financial crisis. That is why my forecast for Macy’s is positive, as I believe that there are no significant threats to its development. Bearing in mind that it has its private brands, they can become the source of sustainability for the company’s development.

Moreover, if Macy’s continues to develop the worldwide system of deliveries, it might become another lever for growth. What cannot be ignored is the fact that Macy’s has a branch specializing in luxury goods and beauty products that will definitely always be sold. That said, if the company does not fall under the impact of some catastrophic events in the financial world, its prospects are bright and promising.

Possible Risks Macy’s Can Face

Nevertheless Macy’s is the history of long financial success, it can face some risks in the further development, as the company depends on its customers. For example, another collapse in the global economy or some environment issues can become the threats for the Macy’s performance. Even though the company has demonstrated possible results during the previous crisis, two subsequent crises can be too much. The risk that might have the most devastating outcomes, I think, is the risk of being outperformed by the competitors mentioned above because they are too close. It can be done if they introduce their own private brands that will be more appealing to the customer. Another potential risk is the emergence of a new retailer giant bearing in mind that there are no significant barriers to entering the industry. However, even in this case, the company might be safe thanks to its reputation and private brands.

Conclusion

This paper provided the analysis on Macy’s, one of the world’s most influential department stores if assessed by market share. The primary attention was paid to studying the company’s major products, location, and the market it belongs to. In addition to that, the focus was made on price and income elasticity highlighting that they are both elastic. It was shown that the company is successful in its financial performance because it was growing for the last five years and that there are no significant risks it can face in the nearest future except for the emergence of a new merchandising giant, being outperformed by the closest competitors, some significant economic or environmental collapses.

I believe that the key to Macy’s success is its strategy for expansion – localization together with going global exclusively through launching websites and building up the worldwide delivery system. However, there are still some areas where the company could improve. For example, it could increase the speed of deliveries to its foreign countries or open some more stores located in the most developed countries of Europe and Asia. That said, my recommendation is to not stop on UAE and go further because the company has a luxury branch, Bloomingdale’s, that would for sure be popular in rich countries.

Nevertheless, the proposed study has some limitations. It is enough to understand what the Macy’s is because it offers surface analysis of its activities. However, given more time there would be a possibility to make it more comprehensive with more focus on the use of financial data.

References

Bailey, S. (2015).Macy’s: What does the largest department store look like? Web.

Macy’s Inc. (2014a). Financial highlights. Cincinnati, OH: Macy’s Inc.

Macy’s Inc. (2014b). Five year performance. Cincinnati, OH: Macy’s Inc.

Macy’s Inc. (2015). 2015 Fact book: Aligned with the customer, prepared for growth. Cincinnati, OH: Macy’s Inc.

Monopolistic competition. (2013). In G. Kurian, The AMA Dictionary of business and management (Vol. 2). New York, NY: AMACOM, Publishing Division of the American Management Association.

Time Inc. (2016). Fortune 500: Macy’s. Web.