Introduction

Argentina’s severe financial crisis in December 2001 gave rise to the largest sovereign debt default in history. The financial crisis stemmed from many factors, but predominantly due to overvalued currency. The move was made by the currency board. The crisis was also attributed to inapt fiscal measures undertaken by the government.

According to Knoop, “…the policies attempted sent the country spiraling from a one-year recession into a four-year depression” (p. 216). At the peak of the crisis, Argentina’s debt amounted to more than 50 percent of GDP. The peso was also devalued to nearly 4 per dollar in January 2002.

The objective of this paper is to critically review the financial crisis that emerged under the currency board system. To this end, the causes of the crisis and its effects on Argentina’s economy will be analyzed. In addition, the paper will discuss the aftermath of the economic meltdown and examine whether the crisis could be averted at the time or not.

Argentina’s Economic Crisis

Argentina’s Economy: Background

In the period preceding the 1930s, Argentina enjoyed a rapid economic growth. The unprecedented expansion in the country’s markets and economy at large was attributed to the rise in agricultural exports. The exemplary performance on the international trade front and promising growth attracted foreign investment into Argentina.

Soon, the country became one of the world’s richest economies (Daseking 33). GDP grew at a rate of 2.5 percent per annum from 1870 to 1913. It was a considerable rate for the period. Argentina’s economy was greatly affected by the disruption in the world’s financial market during the World War I. It was forced to abandon the gold standard in 1929.

However, in spite of the aforementioned rapid expansion, the country’s economic success was short-lived. Other nations started to discriminate against the country’s products. The pattern was seen in the 1930s. The new development saw revenues from trade reduce drastically as a result of a decrease in foreign trade.

Argentina formulated a number of policies to address the issue. One of them was the introduction of “import substitution” legislations. It became a largely self-sufficient economy. Between 1964 and 1974, the country experienced 11 successive years of positive GDP growth (Baer and Fleischer 414). However, it emerged that these strict measures (of import substitution) were not enough to sustain economic growth. The economy could not survive on local trade alone. Eventually, the rate of growth slowed down.

The political instability in Argentina, coupled with poor economic policies, resulted in high inflation in the 1970s. By 1975, the country recorded a 3-digit inflation rate and real GDP per capita declined. Amidst the political unrest, fiscal deficit had risen to 10 percent of the country’s gross domestic product by 1983. Soon, the inflation rate reached 4,934 percent in 1989.

The Convertibility Law

President Menem came into office in 1989. His administration introduced a raft of measures to check the deteriorating economic situation. His free-market reforms allowed for the privatization of public enterprises. He also supported deregulation and liberalization of the goods and financial markets.

He appointed Domingo Cavallo as minister of economy and implemented major monetary reforms in April 1991. The new currency, peso, replaced the austral. It was fixed to the dollar at 1:1 parity under the Convertibility Law. The move was locally known as “convertibility” (Dvoskin and Feldman 148). Convertibility was a currency-board-like system. However, as discussed later in this paper, it did not behave like an orthodox currency board.

The system required Central Bank to provide full backing for the monetary base with dollar reserves. The situation implied that central bank was strictly limited to act as a lender of last resort. The system restricted the financing of public sector’s budget deficits. Under convertibility, the central bank could sterilize inflows and outflows of foreign currency.

The case was different under orthodox currency board (Salvatore, Dean and Willett 387). Finally, under the new law, domestic transactions were conducted using the dollar. Argentina, in a sense, formed a “bimonetary” system. Domestic financial transactions, especially with regards to deposits and loans, were carried out using the dollar (Saxton par. 4). With time, the dollar dominated financial transactions, which intensified the cost of devaluation.

Initially, the currency board worked remarkably well. It ended the rampant hyperinflation and promoted healthy economic growth. The rate of inflation plummeted from 1,344 percent to 4 percent between 1990 and 1994. Real GDP per capita grew at a rate of 3.4 percent per annum in 1991 and 1992, before slowing down and stabilizing at 4 percent in 1993 and 1994 (Saxton par. 4).

As a result, Argentina attracted foreign investments that helped modernize her utilities. The public sector was growing at a considerably high rate. Transportation also improved. Modern railways and roads were constructed, further encouraging investors to come into the county. The banking sector was also modernized (Saxton par. 4).

Factors Leading to the Crisis

As already indicated, pegging the peso to the dollar was beneficial to the economy as it combated the high inflation rates. However, the system was prone to a number of internal problems. It was also vulnerable to external shocks.

The system predisposed the country to a currency crisis. Internal factors that led to the crisis constituted a number of unfavorable economic policies by the government. Teunissen and Akkerman claim that under convertibility, “the peso came to be radically overvalued, which gradually threatened the whole system” (p. 29).

The country’s economy was heading in the right direction following the introduction of the convertibility system. However, the problem of unemployment arose. At the time, the country’s population was growing at a very high rate. It is a fact that the economy was growing at a considerably fast rate during this period. However, the growth was not strong enough to meet the employment needs of Argentinean citizens (Daseking 605). The government had formulated rigid labor laws that discouraged private investors from hiring new employees.

High taxes imposed on formal employment also discouraged people from seeking jobs as a result of the resulting low returns. As a result of the high taxes imposed on the workers, many started seeking jobs in underground economies that were more flexible at the time. The underground economy was, however, not beneficial to Argentina’s government. It was difficult to monitor and tax workers in this sector. A lot of government revenue was lost in terms of uncollected taxes.

President Menem’s economic reforms were implemented as a matter of emergency decree. They were unlike the normal and slow legislations made by the congress. The hasty manner in which decisions were made further hurt the country’s economy. The government took little or no time to deliberate on the implications that the reforms would have on the country’s economy.

Menem’s style of leadership attracted a lot of opposition from other members of Peronist party. Teunissen and Akkerman claim that some of the reforms that were greatly opposed “included the privatization of key government owned corporations” (p. 23). The privatization process lacked transparency. It was seen to promote some element of monopoly aimed at benefiting some of the officials in the government.

Menem and other key government officials were later to be investigated for corruption. As a result of rampant corruption, the country’s economy was doomed. Despite the allegations leveled against the government, some form of efficiency was observed in the privatization of the then publicly owned Telephone Company. The process of installing new phone lines was fast and took only a few days.

A number of external factors also contributed to the overvaluation of peso. The appreciation of the dollar, which was prompted by the dot-com boom in the mid-1990s, pulled the peso along with it. Mexico’s decision to devalue her currency in December 1994 (following the tequila crisis) made investors lose faith in Argentina (Saxton par. 4).

They expressed fear that the country could also devalue. In the event that the government took such a decision, the investors believed they would incur huge losses. The situation discouraged potential foreign investors from channeling their money into the country.

However, the fears by the investors were misplaced. The convertibility currency system adopted by Argentina was very different from that of Mexico. Argentina experienced a sharp increase in interest rates in 1995 (Saxton par. 8). At this point, investors feared that the government would devalue their currency. Business owners also feared that with increased interest rates on borrowing, the government would default on its debts.

In the same year, the country suffered a sharp recession, which was attributed to capital flight by investors. The government reacted to the situation by securing a financial package from both local private investors and international financial institutions, particularly the International Monetary Fund (IMF). The move helped to restore investor’s confidence. The government strengthened the economy further by taking over poorly run banks that were under the control of the provincial administrations.

Growth in the country’s economy returned to normal in the years 1996 and 1997. However, the change was short-lived. The Asian crisis in 1997 and Russian currency crisis in 1998 disrupted the capital flow into emerging markets and Argentina began to show signs of recession.

The Asian disaster made foreign investors to desist from investing in developing countries. Most of these investors were from the developed countries. Recession is a global problem that can easily spread from one country to another. The reason is that the economies of different countries are dependent on each other (Schopf and Zimmer 34). As a result, a crisis in the economy of a trade partner may spread to other countries that are tied to it economically.

As a result of this inter-dependence, investors are cautious when investing their resources in a given country. Many international business operators conduct a market study prior to investing in a new country. The survey is meant to ensure that they do not incur losses after channeling their money into the new frontier (Eichengreen 76).

Based on the developing Asian and Russian crises, multinationals regarded investing in Argentina as an unwise move. The reason is that the Argentinean economy shared some characteristics with that of the other two countries.

Secondly, the Brazilian currency crisis from August to October 1998, in which the government floated the Brazilian real to address the crisis, further exacerbated peso’s position. The value of real dropped from 1.21 to 2.18 to the U.S. dollar. With peso pegged to the appreciating U.S. dollar, there was no way to make up for the competitive depreciations (Saxton par. 6).

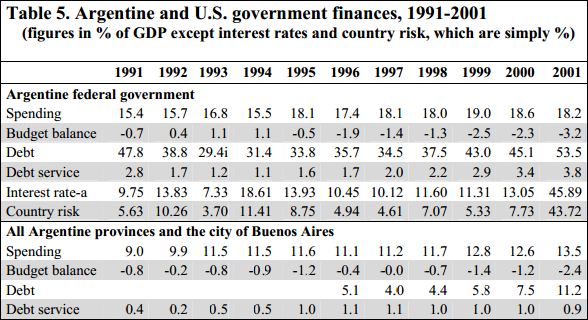

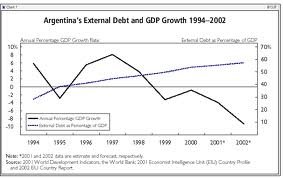

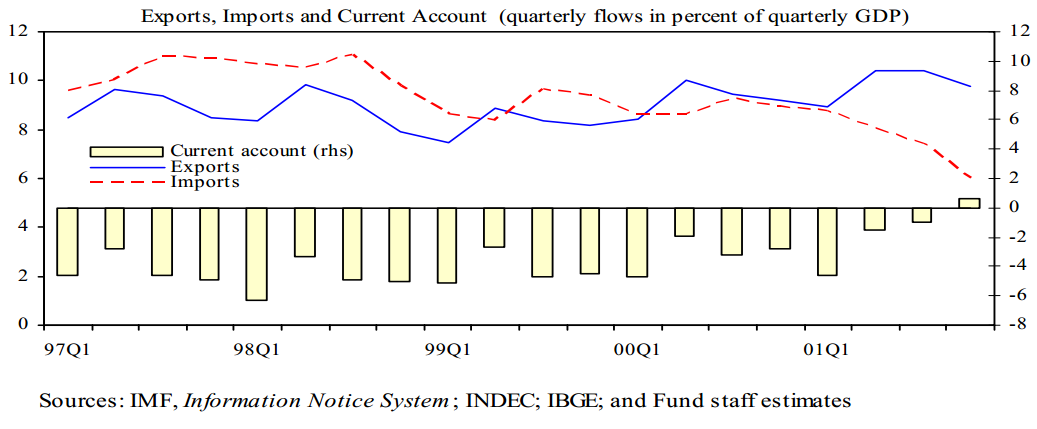

Consequently, as Brazil’s largest trading partner, Argentina’s exports lost their competitive edge in the world market. With the value of exports having fallen, Argentina’s current account deficits increased. The budget deficits as percentage of GDP rose from 1.3 percent in 1998 to 2.5 percent in 1999 and growth fell 7 percent between 1998 and1999 (figure 1).

Furthermore, Argentina’s large budget deficits due to the expanded public sector drove up the interest rate and caused substantial appreciation in peso. The ratio of public debt to GDP rose from 29 percent to 43 percent between 1993 and 1998 (Knoop 217).

The overvalued peso relative to other countries in Latin America caused a substantial increase in its budget deficits. Consequently, Argentina began to incur more debt, much of which was denominated in U.S dollars. The growth of debt was also partially attributed to low private saving rates and substantial budget deficits of the central and provincial government.

With its debt to GDP ratio surging to more than 40 percent, the interest rates for payment also rose, further increasing the deficits and the growth of debt (Saxton par. 8). The stagnant growth and overvalued currency made the debt hard to service. It was therefore not surprising for investors to expect a currency crisis in Argentina and a possible devaluation of peso. Capital account plunged from $15 billion in 1999 to $8.6 billion in 2000, reflecting lack of investors’ confidence in the government and fear of devaluation.

Argentina’s considerable budget deficits coupled with its increasing foreign debt required a substantial devaluation or deflation in order for the balance of payment to return to equilibrium. The government opted to force deflation to cut costs.

The fall in prices of commodities increased the burden of debt and as both price of goods and services and growth declined, government revenues shrunk (Eichengreen 207). To increase its revenue, the government resorted to cuts on spending by setting high tax rates. Unfitting fiscal measures undertaken by the government, as discussed below, further exacerbated the situation and proved to be counterproductive.

On December 1999, President Carlos Menem was succeeded by Fernando De La Rúa. Concerning that large budget deficits would lead to disastrous debt accumulation, the latter’s government promptly introduced three tax increment packages effective January 2000, April 2001, and August 2001.

The first of the three increases took effect in January 2000. The move by the government was termed by many analysts as uncalled for. Joseph Stiglitz asserted that “any economist would have predicted that contractionary policies would incite slowdown and that budget targets would not be met” (Saxton par. 5).

The tax increase was uncalled for since the country had already high tax rates. Saxton claims that the “personal income tax reached 35 percent; value-added tax was 21 percent; and the social security and medical care taxes are 31.9 percent in 2000” (par. 9). The taxing policy was counterproductive as high tax burden prompted tax evasion and dampened growth in the private sector. Altogether, tax revenue fell considerably and the economy continued to shrink in 2000 although at a slower rate.

Despite the worsening of the deficits and growth rate, De la Rua’s government refused to devalue the peso because of the economic and political risks involved. The decision to devalue the peso and abandon convertibility would damage confidence and trigger massive capital flight and bank run, as investors and depositors raced to avoid losses (Saxton par. 11).

In an attempt to turn the situation round, the government increased tax rates again and proposed spending cuts. The move triggered public protests in March 2001 and marked the start of the crisis.

The Crisis

Following the public protests, President De la Rua appointed Domingo Cavallo, the original architect of the Convertibility Law, as minister of economy again in 2001. On April 17, the minister introduced a radical fiscal policy. Under the new arrangement, the local currency was pegged to the euro and the dollar on a 50:50 ratio. The move by Domingo Cavallo was in an attempt to boost the economy’s competitiveness. The government, however, did not stop at that.

On June 15, Cavallo introduced new economic policies that saw the introduction of preferential export exchange rates – a dual exchange rate. The move was considered by many investors as a step towards devaluation and possible default. Furthermore, President De la Rua replaced the president of the central Bank Pedro Pou, who was regarded by the investors as the strict “hard money” official (Saxton 14).

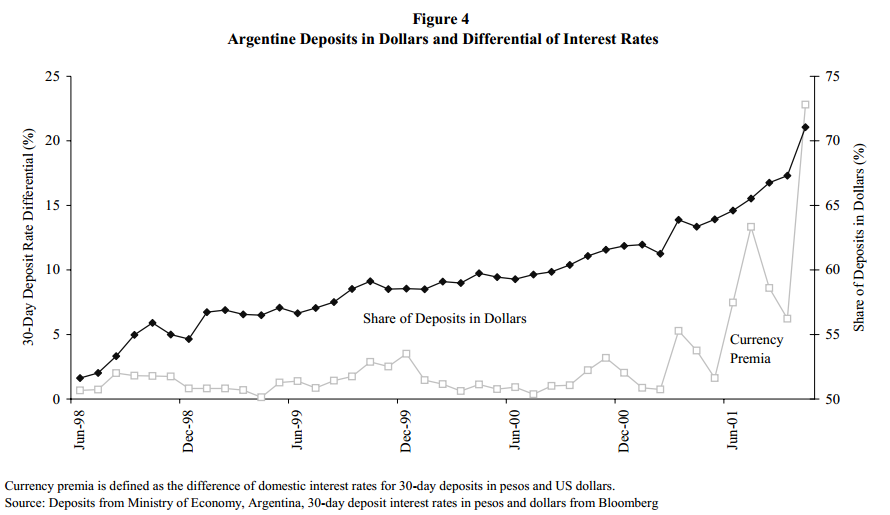

The growing uncertainty was reflected in the forward rates of the peso, and interest rates in peso skyrocketed to 40-60%. Interest rates on ten-year U.S dollar denominated bonds leaped to 35 percent in November 2001.Deposits in peso fell as bank deposit owners shifted to dollar deposits and some moved their money to offshore banks (Eichengreen 208).The rise in the share of the dollar deposits in 2001 is shown in figure.

By June 2001, the country had already entered into a debt trap (Dvoskin and Feldman 162). Confidence in government borrowing dropped considerably. Amidst the intensifying risk of default, international bond rating agencies downgraded the Argentina government’s credit ratings in July 2001. The country’s premium for borrowing increased from 3 percent to 13 percent in April 2001.

The increase was blamed on the fact that lenders were uncertain about the country’s ability to pay the debts. The increase in premiums further hurt Argentina’s economy. The country’s loan burden rose by about 16 percent on July 2001 (Daseking 78). By August of that year, the loan burden had exceeded twenty percent. The government lost the ability to pay its debts. Many investors were concerned that the government was likely to default on loans (Macedo, Cohen and Reisen p. 56).

Reacting to the Crisis

On November 2001, the crisis entered its final phases. During the month of November, the government implemented debt swaps. The swaps were aimed at reducing debt repayments with the promise of higher payments later. Local financial institutions were further burdened with government debts.

The worrying debt burden in the country was viewed to be caused by poor monetary policies by the government (Hanke and Schuler 25). For instance, the country had borrowed twice from the IMF that year. The first debt was approved in the month of January and the other on September.

However, September’s loan by the government was the highest amount that the IMF had ever approved for any country at the time. The loan amounted to 22 billion US dollars. The IMF’s decision was unpopular among many world economists. They were of the opinion that the country should have put in place sound policies to stimulate economic growth rather than increasing on borrowing. The country was only plugging deeper into the dept trap that they had entered years ago.

Argentina’s Economic Crisis: The End?

A number of government policies transferred the economic problems facing the country to the private sector. IMF approved loan to the Argentina further confirmed the investors’ worries that the government would not be in a position to honor its debts. Many private investors feared that the administration would move to freeze their deposits as it had done in 1982 and 1989 (Dvoskin and Feldman 162).

During these two periods (1982 and 1989), the government had taken drastic measures to generate income. For example, it froze all bank savings in a move to fund public spending. Consequently, on 30th November, 2001, there was a massive withdrawal of bank deposits. The fact that the new government had continued to adopt the currency board system brought fears that the peso would devalue. As expected, the finance minister reacted to the capital flight harshly.

He declared a freeze of bank deposits the following day. The aim was to prevent further withdrawals. Investors were unable to finance their operations (Daseking 33). As a result, many businesses had no option but to close down operations. The confidence that investors had in government was weakened further. Businesses came to a halt and investors were unwilling to venture into the market. As a result, the rate of economic growth continued to slow down.

The problems faced by Argentina were made worse by the new rules introduced by the IMF. The organization informed that it was going to cancel the loan that had been earlier approved for the country. The decision by the IMF was based on the fact that the country was not achieving the targets that had been set in the loan agreement.

With the IMF’s move, the country would not be in a position to secure any more foreign loans. Soon, the situation got out of hand. The country’s population started engaging in deadly riots in protest of De la Rúa’s poor governance. On 20th December, 2001, the president and his finance minister resigned from office.

After three days in office, the country’s interim president, Adolfo Rodríguez, declared a default on government loans. The default amounted to 50 billion pesos. However, it was limited only to government creditors in the private sector (Jochen 21). The move by the government was viewed by many as an act of defiance (Jochen 20).

The creditworthiness of the country was put to question. As if this was not enough, Rodríguez instituted a series of unfavorable economic reforms. One of them was the introduction of a new currency. However, the president lacked the capacity to implement these reforms since he left office a week later following widespread demonstrations in the whole country.

Eduardo Duhalde became the country’s new president in the first day of 2002 (1st January 2002). The country had had three presidents in a span of less than two weeks. On his part, he introduced a number of policies in an attempt to improve the country’s economic condition. He began by devaluing the local currency. All bank loans and deposits were then converted into pesos. The process came to be popularly referred to as ‘pesofication’ (Dvoskin and Feldman 162).

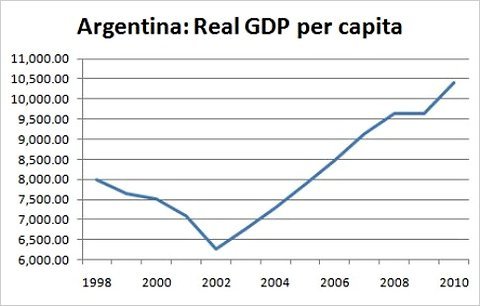

In spite of these efforts, the economic situation continued to deteriorate. In 2002, the country recorded a 12 percent decline in economic growth (Dvoskin and Feldman 162). In addition, levels of unemployment increased. Export volumes fell by 4.5 percent in the same year. The crisis appeared like a permanent narrative in the country’s economic history. Eduardo Duhalde leadership also marked the end of Argentina’s convertibility monetary system.

Conclusion

Under normal circumstances, it takes some time for a country to recover from a depression. However, the declining economic growth in Argentina was worrying. The economy was shrinking at a very fast pace. Poverty became widespread and quality of life deteriorated. Today, over 40 percent of the country’s population lives on less than a dollar a day. The situation was attributed to heavy borrowing and a huge recurrent budget (Jochen 23).

Today, the Argentinean government spends most of its income to service debts and pay wages. The heavy fines imposed on investors for offloading employees also discourages the hiring of more workers. As a result, the private sector lacks the capacity to resize its workforce at will (Dvoskin and Feldman 162).

The government has a history of failing to pay its debts and engaging in forceful confiscation of deposits. The scenario discourages private investors, who fear losing their money (Daseking 24). To avert future crises, the government should engage in lobbying to boost investors’ confidence. The local economy will improve at a gradual rate. However, with the right policies in place, the situation is bound to improve with time.

Works Cited

Baer, Werner, and David Fleischer. The Economies of Argentina and Brazil: A Comparative Perspective, Cheltenham UK: Edward Elgar, 2011. Print.

Macedo, Jorge, Daniel Cohen, and Helmut Reisen. Don’t Fix, don’t Float: The Exchange Rate in Emerging Markets, Transition Economies, and Developing Countries, Paris: Development Centre of the Organization for Economic Co-operation and Development, 2001. Print.

Daseking, Christina. Lessons from the Crisis in Argentina, Washington, D.C.: International Monetary Fund, 2004. Print.

Dvoskin, Ariel and German Feldman. “The Exchange Rate and Inflation in Argentina: A Classical Critique of Orthodox and Heterodox Policy Prescriptions.” Forum for Social Economics 39.2 (2010): 145-169. Print.

Eichengreen, Barry. Globalizing Capital, California: Princeton University Press, 1996. Print.

Hanke, Steve, and Kurt Schuler 2002, What Went wrong in Argentina?. Web.

Knoop, Todd. Recessions and Depressions: Understanding Business Cycles, Westport, CT: Praeger, 2004. Print.

Salvatore, Dominick, James Dean, and Thomas Willett. “A Dollarization/Free-Banking Blueprint for Argentina.” The Dollarization Debate. 1st ed. Eds. Dominick Salvatore, James Dean and Thomas Willett. Oxford: Oxford UP, 2003. 387-98. Print.

Saxton, Jim 2003, Argentina’s Economic Crisis: Causes and Cures. PDF file. Web.

Schopf, Mark, and Daniel Zimmer. Sovereign Debt Default and Financial Crisis in Argentina 2001, London: GRIN Verlag, 2013. Print.

Teunissen, Joost, and Age Akkerman. The Crisis That Was Not Prevented: Lessons for Argentina, the IMF, and Globalisation, The Hague: FONDAD, 2003. Print.

Jochen, Andritzky. Sovereign Default Risk Valuation Implications of Debt Crises and Bond Restructurings, Berlin, Heidelberg: Springer Berlin Heidelberg, 2006. Print