Introduction

Return on assets is widely used as a measure of company performance. The main reason why many companies prefer its use is because it is very attractive to the investors. This is because the ratio focuses on the returns to the shareholders. However, ROE should not be used blindly because it comes with scores of limitations. If not used cautiously, its can lead to focus on less important issues at the expense of the business fundamentals. In a bid to maintain a strong ROE, companies may tend to maintain artificial financial strategies, and fail to reveal weakening performance in the business (European Central Bank, 2010).

Main Body

ROA comprehensively incorporates the assets that are used to generate income for the business. With this ratio, a company can be able to establish whether its assets are in a position to generate sufficient return, as opposed to revealing of healthy returns on sales. The asset incentive industries, such as the real estate, should have a lot of income compared to those which do not need a lot of assets, such as the hospitality industry companies. Indeed, even a very little margin for the hospitality industry can generate a very strong return on assets. Perhaps, this is the reason why the hospitality industries have substantially better ROA compared to the real estate industry.

In this study, I will start by analyzing the ROA of 14 companies from Oman and Saudi Arabia, 4 of which belongs to hospitality industry and 8 of which belongs to real estate industry. Then, I will carry out a trend analysis on the net margin performance for the 14 companies, with the aim of highlighting their performance trend. On a separate section, I will analyze the ROA and ROE of the two industries, and finally analyze the applicability and limitations of using ROA and ROE as a performance metric.

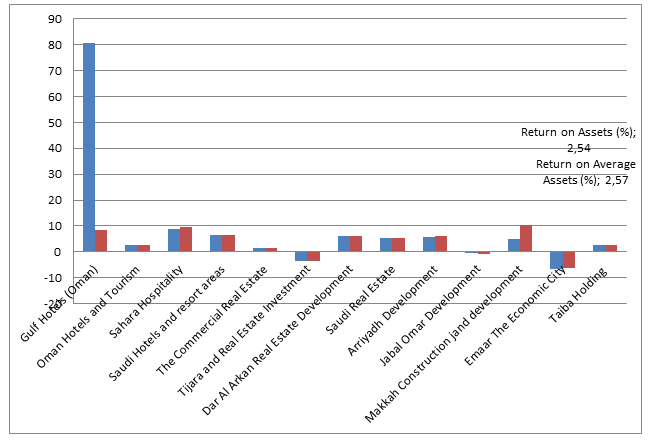

Figure 1 above shows the Return on Assets and the Return on average assets of all the 14 companies, 4 from hospitality industry and 8 from real estate industry. In a different section of the paper, use of ROA as a performance metric is recommended, therefore, analysis of this ratio for individual companies for the current year (2010) is deemed important. Evidently, the relationship between Return on Assets and Return on average Assets is virtually directly proportional, therefore, the use of Return on average Assets is squarely for clarity purpose – otherwise ROA is given more weight in this model. The ROA for hospitality industries is viewed to be healthier relative to that the real estate industry. Indeed, real estate companies such as Emaar the Econimic Tijara and Real Estate have registered a negative figure – this model will illustrate why we should not rush to conclude that these companies are performing poorly because of this reason alone (Manzler, 2004).

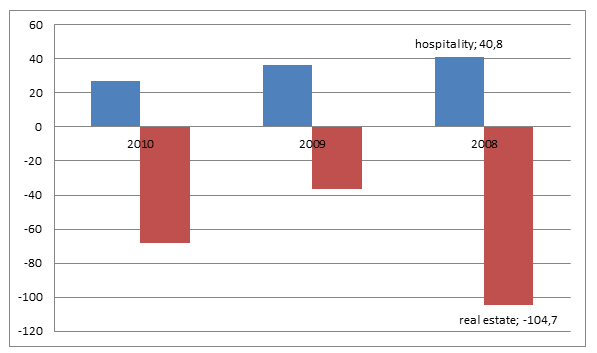

As illustrated in figure 2 above, the hospitality industry has registered positive net margins; however, the trend seems to be on the decline. On the other hand, the real estate industry registered the worst performance during 2008, perhaps due to global financial crisis.

This trend tended to recover during 2009, but again worsened in the current year (2010). Ideally, this model recommends that, besides analysis of net margin for the current year, analysis of the trend for the past few years is critical in showing the true performance of a certain company. Although we may tend to conclude that the hospitality industry is performing well because its Net margin is positive as compared to that of the real estate, this conclusion may be countered by this trend because it is clear that the performance is declining year after the other. Later in the analysis, we shall be able to establish whether there is any relationship between the net margin, and the industries’ ROA and ROE (Moyer, 1977).

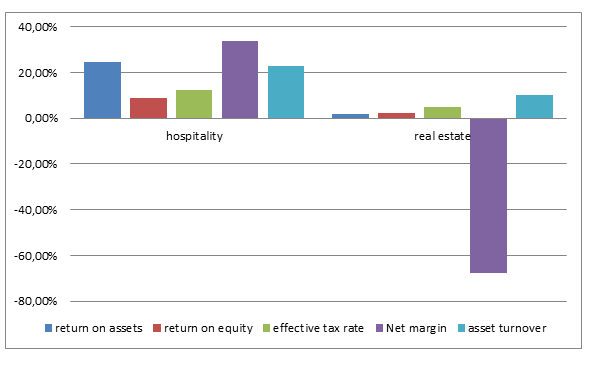

The efficiency of the company’s assets in generating profits is indicated by the Returns on Assets (ROA). Essentially, this ratio shows the ability of the management in using the company’s assets efficiently to generate profits. This ratio varies substantially in the two industries (Real estate and hospitality industries). Evidently, the ROA for the hospitality industry is better than that of the real estate industry. The ROA for the hospitality industry is 24.53%, while that of the real estate industry is 1.70% – this is a very wide gap. This is a clear indication that the hospitality industry is earning more money on its assets than the real estate industry. The ROA for the real estate is very low at 1.70%, which could be an indication that majority of the management in this industry are inefficient in using company assets (Dert & Leegwater, 2011).

Return on equity (ROE) of the two industries is directly proportional to ROA. This ratio reflects how the earnings were generated from equity. ROE is a very important ratio as it reflects the bond between management, profitability and financial leverage. Increasing efficiency, improving assets efficiency and profitability, together with proper financial leverage is the best strategy to drive a company towards an improvement in its ROE. These relationships, indeed, show why ROA varies directly with ROE (European Central Bank, 2010).

Conclusion and recommendations

Although we could be tempted to think that the performance of real estate industry is poorer than that of the hospitality industry, it is normally recommendable for the analysis to be conducted with the previous years. This is because ROE for different industries tend to differ substantially, depending on the structure of their capital. For example, the real estate industry has low return on equity because it is capital intensive, while the hospitality industry’s ROE is high because it require less capital to be invested. Actually, before starting to generate revenue, the real estate industry requires building of large and expensive infrastructure.

It is, therefore, not prudent to conclude that the hospitality industry, which has higher ROE ratio is better than the real estate which has lower ROE ratio. Even though the hospitality industry exhibits high Return on Equity ratio because it requires less capital for investment, this industry is exposed to intense competition because it does not require a lot of capital to start (Warga, 1992).

When a company performance deteriorates too much, excessive debt leverage becomes a considerable trouble for the firm, as it was experienced during 2008 economic crisis. However, considering that effect of reduction in ROE on stock performance is immediate, observing ROE decline without action is painful. On the other hand, the drawbacks are less abrupt and less proven; therefore, the avoidance of immediate impact is justifiable (Qasim, 2011).

The use of ROA to measure the performance of the business encourages the management to focus on the assets required to maintain the operations of the business. Ideally, no single measure of performance is perfect, since varied methods are suitable depending on the situation under consideration. However, on many front, over-reliance on ROE is tricky. A better vision on the fundamentals of a business can be achieved through ROA. In situations of economic pressure mounting economic pressure, the management should consider the type of assets that the company is best placed to manage, and outsources the rest, and at the same time focus on utilizing the strengths of the company (Abor & Bokpin, 2010).

Although the operational profitability could be wearing out, stock buybacks and growing debt leverage financed through accumulated cash be sued to maintain a healthy ROE. To attract the investors, a potential incentive which is characterized by artificial low interest rate and increased competitive pressures has been applied by many companies (Subramaniam, Devi, & Marimuthu, 2011). In view of these issues, ROA, which is less attractive to the investors and the executive, could be viewed as a better metric of the performance of companies. This metric is best placed in evaluating the long-term profitability trends for the above-mentioned industries.

References

Abor, J., & Bokpin, G.A. (2010). Investment opportunities, corporate finance, and dividend payout policy: Evidence from emerging markets. Studies in Economics and Finance, 27(3), 180-194.

Dert, C.L., & Leegwater, G. (2011). Decision Making and Solvency-based Dynamic Asset Allocation at the ABN AMRO Pension Fund. Journal of Investment Consulting, 12 (2), 35-41.

European Central Bank. (2010). Beyond ROE- how to measure bank performance. Web.

Manzler, D. (2004). Liquidity, liquidity risk and the closed-end fund discount. New York: University of Cincinnation.

Moyer, R. C (1977). Forecasting Financial Failure: A Re-Examination. Financial Management, 6(1), 11-16.

Qasim, S. (2011). Impacts of liquidity ratios on profitability: Case of oil and gas companies of Pakistan. Interdisciplinary Journal of Research in Business, 1(7), 95-98.

Subramaniam, R., Devi, S., & Marimuthu, M. (2011). Investment opportunity set and dividend policy in Malaysia. African Journal of Business Management, 5(24), 10128-10143.

Warga, A. (1992). Bond returns, liquidity, and missing data. Journal of Financial and Quantitative Analysis, 27, 605–617.