Industry Analysis

One of the most important industries in Australia is the coal mining that is contributing a major part in employment generation, electricity production, and partially large export earnings in the entire economy. However, a better focus on the Australian coal industry can be formulized through the following discussion-

It is said that coal industry is the integral part of Australian economy. Thus, this task is essentially hi- tech and sophisticated which is incorporated with continuous technological improvements, professional health care and safety and environmental concern that are most effective to recognize the country as world’s most loyal and qualified cooking and thermal coal producer for the global market.

As Australian European settlement has contributed greatly for some important ports, most of the coal industries are situated particularly in NSW and Queensland that are motivated by a tight service and equipment. The country is also expert in standard design, transportation and loading, technological advancement, training, managing project and finally operational construction of mines.

Regarding the possible resources of the coal industry for the year 2006, following chart would make a clear sense-

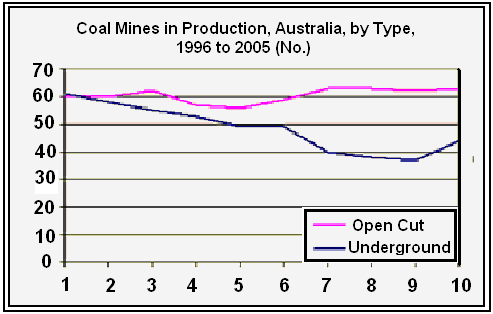

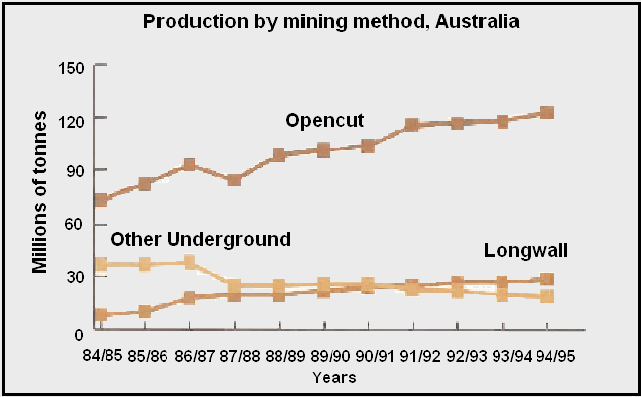

According to the statistics of 2006, 118 mines were engaged in the production of black coal, in which New South Wales had 62, Queensland had 49, South Australia had 1, Western Australia had 3 and Tasmania had 3 mines. While the year 1997 represented 60 open- cut and 58 underground mines, those are significantly reduced by the year 2004 and again raised dramatically of 74 of open- cut mines at the same year. This can be seen as-

The nation’s coal industry generates a variety of coal having the transparency of tailoring goods according to the customer preferences. Though being a natural object, many companies are eligible in specific mining, modifying parameters or blending procedures.

There exist wide amenities in coal terminals, handling equipments, testing laboratories, and explosion. The major coal mining companies in Australia are AMCI Holding Australia PVT Ltd., Anglo Coal Australia, Bloomfield Collieries, BHP Billiton, Enhance Place, Felix Resources etc.

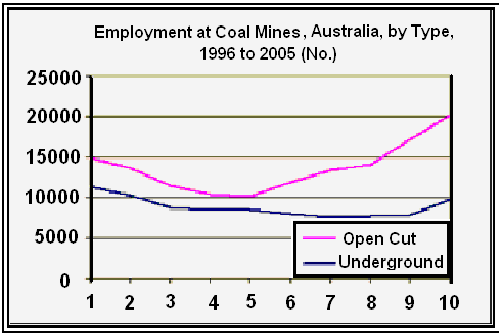

Both underground and open- cut mines offered the employment opportunity at the top level of 32559 at June 2006 while 30365 people got this chance at December of the same year. So, average employment results in 31517 for that year.

Employment opportunities were 7500 in 2002 and started to develop with approximately 10000 employees by the year 2006. Such opportunity in open- cut mines arrived in 2000 at about 10000 that has doubled in 2005 and remained constant at nearly 20500 in the last of 2006.

In Australian black coal industry, specially, Queensland and New South Wales proposed about 96% of the total job opportunity. This could be presented in graph as-

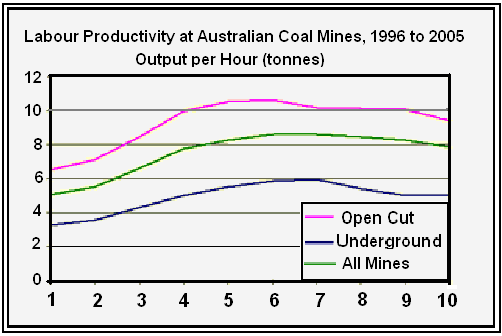

In case of production, the efficiency and productivity of mine’s labors have increased over the previous decades and gained a zenith between 2001 and 2002 but fallen lightly after that period. The following graph can show that-

If the output is measured regarding the zest each coal employee at each hour, the open- cut mines will show almost double productivity rather than the underground ones although both are efficient in case of increased productivity over the previous periods like the following data-

- Underground mines (3.5 to 4.6 tones).

- Open- cut mines (7.1 to 8.5 tones).

- All mines (5.5 to 7.1 tones).

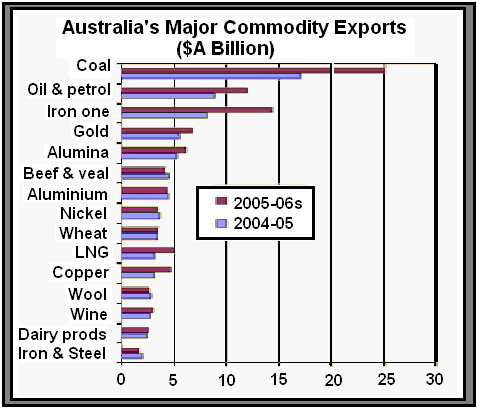

As we know that Australia’s largest export of commodities comes from this criteria, the export of black coal were amounted about $A22.5 billion by the year 2006 and 2007 that was a reduction of almost 8% that has been recorded as $A24.5 billion for the year 2005 and 2006 as shown below-

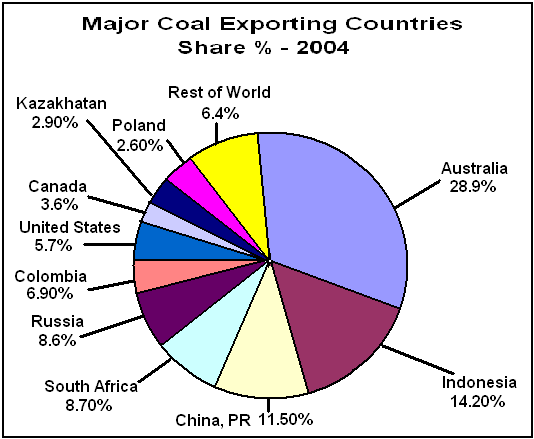

The year 2004- 05 had experienced a total global hard coal business of 766 million tones that was consisted of thermal or steaming coal of 566Mt and coking or metallurgical coal of 200Mt. The country is also capable to manage its top position as exporter of coal of 233Mt or 30% of the entire globe by the year 2005- 06 as below-

In addition, the supplies market of Australia is above 35 nations of the world. Among them, larger market includes Japan with 44% as well as other Asian countries that constitute more than 80% of the total export earnings of the country. It also exports to Europe and South America at a significant level of 12% and 5% respectively.

Company Analysis

Among many of the larger coal mining companies, Macarthur Coal Company is one that has been contributing greatly for the entire production and export of coal for the country. It is a public limited company listed on the stock exchange of Australia in July 2001. It is a Queensland- based company as it mining properties is located at Bowen Basin in Queensland as well as the location of company headquarters in Brisbane. Other important features of the company are discussed below-

- The company’s core product is PCI coal, which means low volatile pulverized injection coal for the generation of steel. It is also a major supplier of PCI coal (less volatile) to the Asian, European, and American steel mills. The export of the company has amounted about 44% of the total PCI coals those are mostly exported from the country. Coppabella and Moorvale mines are the firm’s most important properties that generate more than 47% of PCI low volatile coal sold in abroad by Australia.

- Additionally, the company holds a major optimism of tenement holding offering a pipeline of project for improving the mines. Those tenements are existed in joint ventures, which are unincorporated for gaining strategic advantages, and the relevant venture partners include CITIC Resources Australia Pty LTD, JFE Shoji Trade Co., NS Trading Co, etc.

- The company generally performs its operational activities in East Pit of Coppabella Mine where the contractors are involved in that mine’s Johnson and South pits as well as at Moorvale.

- It has 158 direct employees and 400 contractors. The entire production of both mines is situated under the company’s management of operation with a joint venture and it gets 73.3% of the raw coal, which are got from that major mines. Metallurgical and thermal coals are Macarthur’s two major products while the company is based on four major pillars those are related to leadership, employees, environmental culture and working procedure to introducing its operations as well as the group dynamics for the upward turn if the company.

- The core business strategy involves safe culture, reduction of cost focus, offering growth through selection of scopes, transition to owner operator, reducing environmental impact.

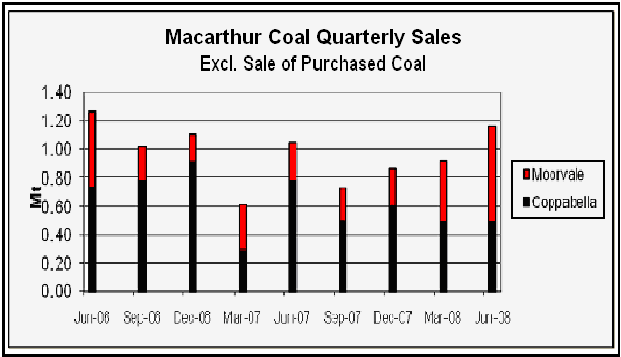

- From the financial context, it has represented that in 2007 the company earned a NPAT (Net profit after tax) of $66.5 million that is less than 2006 and annual sales of $362.8 million. Regarding sales, the company earned a share of $3794.6 tons in 2007 and $4932.7 tons in 2006 while the negative variance is 23.1%. Production results an increase from 2006 to 2007 in 11.6%. The total assets accounted of $612648 and the liabilities of $197838, ROE of 16.5%, ROI of 13.3%, and ROA of 10.9%. The company’s sales information for the following period can be shown as-

- In case of social issues, the company maintains six major principles including ethical promise, support, and respect of employees, environmental support according to the possibility, strong community relationship, and finally effective relationship with stakeholders.

- The major risks involve inadequate capacity of port, volatility of coal price, delay of capacity of rail, variation in market, disability, and raise of coal reserve, problem in management, volatility in foreign exchange rate etc. To mange so, a number of measures can be taken, such as- arthritically delegation, regular exposure, short- run investment, hedging of foreign currency, environment, trade in share, employment etc.

- Macarthur coal posses strong emphasize on health and safety issue for the employees, for this, it has adopted a HSEC plan from commitment and policy to evaluation and improvement that is recently being applied at Moorvale mine.

- It also tries to maintain a sustainable development program by the sponsorship and donation policies, children supporting programs, educational initiatives, charity services etc. for which it expands $303674 in 2007.

- Regarding growth opportunities, the company calculates its new resource as an output of 1.5 years exploration program including the last JORC Inferred Resource.

Along with the above features, Macarthur coal has faced a number of challenges during the previous periods. Such as-

- Increase in infrastructural challenges offered the greatest challenge to the company. Ion the Goonyella coal chain has affected by rail and port congestion that contributed to reduce sales for the year 2007. Reduced coal price was also liable to for the reduction of sales and profit.

- The company’s mine sites have affected by heavy rainfall.

- Rising cost compression and production purpose also seem to offer major challenges.

- The impact of exploration affairs for wet weather calendared from January-February and May- June.

- Increasing cost of resources caused for maintaining the operational cost.

- Shortage of supply held for scarce infrastructural and flooding event.

- Forecasting error.

- Other mining costs involving fuel and labor in Coppabella mine.

- Lack of success in the maintenance program of pumping system placed by the water management plant at that mine.

- Hedging of foreign exchange rates caused regarding Australian dollar with United States dollar.

- Increase in removal costs of overburden because of doubling the strip ratio.

- Increased amount of demurrage expenses may cause infrastructural issues at the system of port, rail etc.

Complication

After the entire discussion, we have come to know that Australia is the world’s one of the largest coal exporter and it gained this position because of some competitive advantages. However, several factors may affect the productivity of the industry that can be termed as operational challenges. Such as-

- Innovated technology,

- The source of resource,

- Rate of exchange,

- Taxes and tariffs,

- Royalties,

- Cost of transportation,

- Export ports proximity,

- Productivity of mines

These functions can be shown as following-

These types of complications may created by the government, environment, laws or other rules and regulation on which the company owner or operator would have smaller control. Thus, productivity of the coal industries is also characterized by complications because of huge difference in geographical situation between several mines and area of production. Additionally, a breakdown of the FOB (free on board) pricing of coal industry happens for three traditional types of mines. For example, a 20% increase in productivity may decrease only 2.5% of f. o. b costs. This indicates that if the industry strongly seeks the option to increase productivity as smoothly as possible, it should also keep the monopoly service supplier on pressure like road, rail, and ports and should maintain other costs as low as possible.

Then, the country is affected by higher transport and energy costs because of the major competitive policy that has been remade from exclusive access of mega infrastructure like- railway lines, privatization of government owned businesses through mutual co- operation and the placement of local electricity market.

An observation of the past trend in Australian coal industry demonstrates a number of developments and technological upstream to meet the rising challenge of productivity. It also include utilization of long wall operations, positive improvement of high wall mining, automation of mining, involvement of mass plant for the exploitation of economies of scale, use of cast blasting and bulk handling, use of modern mine sites, use of highly effective contract mining etc.

In the context of technological factors, downward dripping coal adaptation seems to be vital but by the passes of time high wall mining comes into focus by the involvement of Moura mine that is useful in less cost relative to conventional opencut and increase the productivity of employees for three or four times. The following chart would make a clear sense of that-

Complication and challenge of Macarthur coal

- Like the entire coal industry of Australia, Macarthur coal can also visualize versatile and vast productivity of its two major mines with their duet contribution of 73.3% annually. Records show that productivity results in negative variation on actual- quarter basis between June 2008 and June 2007 by 23.9% in case of overburden removed, ROM coal extracted results in 45.3% negativity for the same criteria, and finally, sealable coal production results in 4.1% negativity respectively.

- Here, Coppabella mine has been highly experienced with overall industrial cost compression, specifically by labor, fuel and explosives while because of production of 0.39 Mt of sealable coal, operational activities are influenced which is merely 34% less than 0.59 Mt of past year. Such impact of production has also a major impact on depletion of overburden. At the same time, productivity of this mine can be strongly by wet weather.

- On the other hand, Moorvale mine has been experienced by under production levels in ROM coal production while sealable coal production resulted in 42% higher output in the preparation of stockpiled thermal coal.

- To become aware from the reduction of congestion, the company may need to work smoothly with other producers of coal to be agreed with for designing and early works of projects for ensuring the project expedition. Substantial level of waterfall on the main sites is also harmful for the reliability of water supply and increases the complications of production and operation. Recycling of water can also be lost by evaporation.

- Distortion causes the possibility of hampering productivity that is effective in reduced sales because of coal sales prices, demurrage expense at port and rail.

- Additional challenge comes from the company’s formation as joint venture for the mines to meet the greenhouse challenge along with the partnership work with government for the improvement of energy efficiency and the reduction of greenhouse gas absorption.

- Requirements of using Marion 8200 electric dragline at the Coppabella mine and the use of combo- body trucks for CO2 emissions that incurs additional effort of the company.

- Challenge also lies in the thoughts of research and development for the fresh coal technology as well as the growth of sustainable production along with the governmental effort that requires a concern of national and international climate change in project completion.

- The delivery of rail was less than the forecasted capability that reduced sales in 2007 along with the recommendation of role of central co- ordination, QRN, commencement of supply chain to improve productivity etc.

At last, it can be said that like the Australian coal industry, Macarthur coal is also confronted with many challenges especially surrounding production, which can be affected, by several major complications like- sustainable development, community relationship and obviously a major concern of global warming.

Bibliography

Australian Coal Association (2008), Australian Black Coal Exports: The Australian Coal industry. Web.

Hitt, M. A., Ireland, R. D., Hoskisson, R. E. (2001), Strategic Management, 4th Edition, South-Western Thomson Learning, Singapore, ISBN: 0-324-041891-2.

Hollows N. & McAleese I. (2008), Financial Results Year Ended. Web.

Holt, H. H., (2002), Entrepreneurship New Venture Creation, 6th Edition, Prentice- Hall of India Private Limited, New Delhi, ISBN: 81-203-1281-3.

Macarthur Coal (2007), Annual Report 2007 Working together to build our future. Web.

Macarthur Coal (2008). Quarterly Report. Web.

Macarthur Coal (2008), Quarterly Report. Web.

Thompson, A. et al (2007), Strategic Management, 13th edition, India: Tata McGraw- Hill Publishing Company limited.