Executive Summary

During the seventy-year period when Azerbaijan was a part of the Soviet Union, the country’s economy was the most developed in the Caucasus region; its growth was associated with the expansion in the sphere of oil and gas exports while non-export spheres such as real estate and banking also showed tremendous growth. Therefore, foreign businesses are interested in entering the market due to the appealing growth of the gas and oil sector in a region that can bridge the East with the West.

With benefits come challenges; this report identified four categories of risk factors a business should take into account when dealing with the gas and oil industry of Azerbaijan. Such risk factors include economic vulnerabilities, corruption, instability of gas projects, as well as links between oil and governance. Among the four risk factors, corruption in the natural resources industry, land and tax administration, as well as the judicial system is regarded as the most concerning since it has an impact on the increase of costs for companies that will be forced to bribe governmental officials to secure their business.

When entering the gas and oil sector of Azerbaijan, the CEO of the company should determine whether the risk factors outweigh the positive aspects of the industry. While the growth of the industry has slowed down in the recent years, there is financial backing from SOFAZ that has been effective in countering inflation and positively affecting other aspects of the local economy through withholding a significant share of the total revenues from the country’s income.

Introduction: Brief Country Description

Azerbaijan (Republic of Azerbaijan) is a country situated between Southeastern Europe and Southwest Asia; it re-acquired the status of an independent state from the Soviet Union in 1991. Starting from 1994, foreign investors have been interested in the economy of Azerbaijan due to the vast potential of the gas and oil sector. Many businesses around the globe seem to be the most interested in the Caspian region as a whole because they see a tremendous benefit the region can bring.

Despite the fact that Azerbaijan was affected by the global financial crisis, currently, a renewal of interest among international investors can be seen. To this day, Azerbaijan is working on developing a cohesive market infrastructure, especially in the tax, legal, and banking spheres as they link to the international business community (PWC 2016). However, businesses entering the country are presented with a unique challenge due to the complications in assessing real risks and making decisions based on reality instead of perceptions.

According to the report conducted by the State Statistical Committee of the Republic of Azerbaijan (2016), 34.5% of the overall country GDP belongs to the oil-gas sector. At the beginning of 2016, there was a 5.1% increase in the value added produced in the non-oil sector, raising its GDP share to 65.5% (PWC 2016). Despite this, Azerbaijan is still dealing with a range of challenges for its future. Among these challenges, the issues of monopoly, corruption, and the ineffectiveness of the state governance are the most prominent (PWC 2016). Furthermore, despite the rises in the GDP shares of the non-oil sector, the economy of Azerbaijan largely depends on the exports of oil and gas; this, in turn, has an effect on the national currency devaluation, which occurs when oil prices decrease.

The Oil and Gas Industry

To this day, oil and gas form the economic ‘lifeblood’ of Azerbaijan’s economic prosperity. With the extensively developed oilfield of Azeri-Chirag-Guneshli (ACG), the country owns a key platform of oil production, pumping up to 856 thousand barrels. The majority of the exports are conducted through the following sources:

- Baku-Supsa Pipeline (Western Route Export Pipeline): a 513-mile-long oil pipeline that starts with the Sangachal terminal and ends with the Supsa terminal on the coast of the Black Sea in Georgia. The pipeline is run by British Petroleum (BP).

- Baku-Novorossiysk Pipeline (Northern Route Export Pipeline): an 830-mile-long oil pipeline starting in the Sangachal terminal and ending at the Novorossiysk terminal situated near the coast of the Black Sea in Russia. It is run by the State Oil Company of Azerbaijan Republic (SOCAR) in Azerbaijan and by Transneft in Russia.

- Baku-Tbilisi-Ceyhan Pipeline: a 1,099 mile-long oil pipeline that runs from the Azeri-Chirag-Guneshli oil field located in the Caspian Sea to the Mediterranean Sea (PWC 2016). THE ownership of BTC is shared by British Petroleum (30.1%), AzBTC (25%), Chevron (8.9%), Statoil (8.71%), Turkiye Petrolleri AO (6.53%), ENI (5%), and total (5%) (PWC 2016).

Nevertheless, oil production levels in Azerbaijan have been decreasing since 2010. As mentioned in the report conducted by the State Statistical Committee of the Republic of Azerbaijan (2016), in 2015, the country produced 2% less compared with 2014. Therefore, the government is currently trying to boost the efforts of gas production by opening the Southern Gas Corridor to Europe, although, there is little chance that it could compensate for the oil sector’s revenues.

SOCAR and SOFAZ

The State Oil Company of Azerbaijan Republic (SOCAR) plays the key role in the market of oil and gas in Azerbaijan. The company is dealing with the exploration of gas and oil fields, oil and gas production, processing, and transportation, marketing petrochemical products and petroleum in both international and domestic markets. Moreover, SOCAR is the main supplier of natural gas to the public and the industry of the country. Over the years, SOCAR was successful in establishing trading companies in countries such as the United Arab Emirates, Switzerland, and Singapore (PWC 2016).

State Oil Fund of the Republic of Azerbaijan (SOFAZ) is an extra-budgetary fund that was designed in 2000 to maintain the macroeconomic stability of the oil and gas sector as well as promote the investment in the non-oil sphere of the country’s economy. Moreover, SOFAZ was established in order to enhance the practices of transparency in the management of oil revenues. At present, the revenue profits acquired from the establishment of the offshore oil fields go to SOFAZ. Compared to 2001 ($0.5 billion), the assets of SOFAZ in 2016 stood at as high as $34.246 billion (PWC 2016).

Risks Factors

Because the region is rich with natural resources, the company decided to put a focus on oil and gas exploration as the primary set of operations upon entering Azerbaijan. The process of oil and gas exploration in a foreign country will require a business to become familiar with the system of governance with regards to the oil sector, assess the economic vulnerabilities that might make the business unprofitable, determine whether bribery and corruptions present a challenge for the industry, as well as find out about the most recent events that took place in the country with regards to new projects or regulations within the industry.

Risk Factor I: Oil and Governance

It has been found that an overwhelming number of countries where the sector of energy dominates the economy have experienced some major issues with regards to governance, democracy, and corruption (Freedom House 2015). Norway is the only exception, which points to the truth of the finding. Therefore, it remains to be known whether Azerbaijan will emulate the Norwegian model with regards to improving governance in the period after the completion of the Baku-Tbilisi-Ceyhan Pipeline as well as the export of the “major oil” to Western countries (Cornell 2011).

As the completion of the Baku-Tbilisi-Ceyhan can be considered still fairly recent, there are two different ways to determine its possible impact on the development of Azerbaijan. The proponents of the optimistic point of view usually claim that the fairly close location of Azerbaijan to Europe along with the connection to the European economy with the help of the pipeline will increase the chances of the country’s full economic integration into the European system of values, causing the improvement in the systems of governance, practices of transparency, human rights, as well as democracy in general.

The Council of Europe has been pressuring Azerbaijan on not only improving the systems of governance but also to make a reform in the electoral law, the change of authority to municipalities, as well as the development of a strong civil society, as mentioned by Cornell (2011).

Nevertheless, none of the changes and improvements had any connection to the gas and oil projects in the country. In fact, the proponents of the pessimistic outlook argued that the oil and gas projects seem to limit the development of democracy in Azerbaijan. Following the majority of the governmental and presidential elections starting from 2003, the opposition often accused multinational oil companies and foreign governments of ignoring the fraudulent acts during elects and supporting the regime of authoritarianism for the sake of stability in the region.

Therefore, foreign investors are interested in maintaining security in Azerbaijan to ensure the success of their continuous oil and gas projects. Consequently, this requires energy companies to cooperate with the regime because of the fear of losing business ties with the government.

Risk Factor II: Economic Vulnerabilities

The economic situation in the country can say a lot about a company’s potential for entering the new market. The current situation in Azerbaijan presents many potential investors in the oil and gas industry with a tremendous challenge. With the natural resources in the sector of hydrocarbons being the focus of the economy, Azerbaijan is very dependent on the production of mineral products (Euler Hermes 2016).

This, in turn, makes the economy extremely vulnerable to any external instabilities and fluctuations. For example, the decline in the global oil prices in the middle of 2014 and currency depreciation in competitor countries have caused such a shock to Azerbaijan’s economy that they had an impact on budget revenues, payment balance, the manat (currency), as well as the foreign exchange reserves.

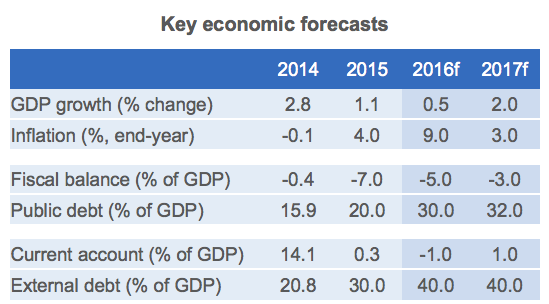

Real growth in the country’s GDP decreased from +5.8% in 2013 to +1.1% in 2015, with the fiscal deficit surging to approximately -7% in 2015 compared to -0.4% in 2014 as well as ten years of surpluses prior to that (Euler Hermes 2016). Furthermore, foreign exchange reserves of the Central Bank of Azerbaijan declined from $16.7 billion in 2014 to $5.6 billion in 2016 (Euler Hermes 2016) because of the interventions targeted at defending the exchange rate along with the flight if capital. In order to deal with the fast downfall in the foreign exchange reserves, the Central Bank devaluated the manat at the beginning of 2015 and then at the end of the year when it also made a shift from a peg to a floating regime of the exchange rate (Euler Hermes 2016).

On the other hand, the forecast conducted by Euler Hermes (2016), shows a change in the key economic indicators in 2017 compared with previous years, which presents potential investors with an opportunity for entering the oil and gas industry that is buffered substantially by the SOFAZ. The table below (Figure 1) shows these forecasts in comparison with previous years:

When assessing the economic vulnerabilities of Azerbaijan, it is crucial to mention that the country can withstand some downturn thanks to the significant reserves held by SOFAZ. Combined with the foreign exchange reserves of the CBA, SOFAZ can be effective in covering more than two years’ worth of imports.

While the government of Azerbaijan implemented some measures to respond to the weakening of the currency along with the overall economic slowdown, it is expected that any cuts can influence the emergence of layoffs in the energy and public sectors, especially with the first having seen a large cut in jobs in British Petroleum and SOCAR. The job cuts have led to protests, which had some political pressure on the government to become more active in the efforts to overcome the economic decline and strengthen the economic sector that in recent years did not show as much success as previously.

While the forecasts of Euler Hermes showed a possible decline in inflation and the growth of GDP in 2017, the leaders of the opposition parties in Azerbaijan called the year 2017 “the beginning of the political and economic crisis” (Radio Azadliq 2017) because of the events that occurred in 2016. With many people losing work in the oil and gas sector as well as the growth in inflation and prices in comparison with salaries or pensions, the economy of the country shrunk by 47% in 2016 (Radio Azadliq 2017), which points to the existence of a serious economic problem in Azerbaijan.

Furthermore, the government has difficulties with addressing the socio-economic challenges, and, according to the opposition parties, does not make much of an effort. Over the course of 2016, the government was busy with not making changes; it imitated changes, which did not make any difference in addressing the problems the country experienced.

Risk Factor III: Corruption

As already stated in the Risk Factor I section, Azerbaijan is one of those countries where the oil and gas industry plays an important role in dictating how the government addresses the problem of corruption. Corruption presents a tremendous risk to the businesses planning to enter or already operating in Azerbaijan. Political corruption contributes to the increase of business costs, which challenges many foreign companies.

Moreover, patronage is especially prevalent in the oil and gas industry that contributes to the largest share of the country’s revenue. Lack of effort in the judiciary sphere as well as the inadequate enforcement of regulatory bodies makes it possible for governments to commit fraudulent acts. While there is a comprehensive anti-corruption framework, the government does not incorporate it in an effective manner. For instance, the law of Azerbaijan prohibits gifts; however, the majority of either local or foreign businesses will be likely to be met with facilitation payments as well as other types of informal payments. To understand the broad scale of corruption, this section was divided into the following sub-topics:

Natural Resources

The sector of oil and gas in Azerbaijan has been subjected to accusations of the lack of transparency as is to this day considered the largest source of corruption in the entire country (GAN 2016). The revenue and the increase in GDP depend tremendously on the extractive industries, with gas and oil making the largest bulk of the country’s revenue. Therefore, such a distribution of gas and oil revenues incentivized the governments’ patronage and bribes for officials, which made possible by the lack of transparency practices established by the Extractive Industries Transparency Initiative.

In the spring of 2015, the Transparency Initiative downgraded the status of the country to ‘candidate’ due to the lack of the efforts on the part of the government to include the civil society in ensuring transparency in the gas and oil industry. Furthermore, the negotiations for becoming a member of the World Trade Organization were also postponed by the government of Azerbaijan in order to protect the interests of local oligarchs as well as their businesses (GAN 2016).

In one of the most notorious cases of high-profile corruption, it was revealed that the Managing Director of Unaoil Group, Reza Raein, allegedly played a role of a middleman for transferring bribes between the Azerbaijani officials and the US company Kellogg Brown & Root in order to secure contracts between them (GAN 2016). Documents that leaked to the press showed that Raein managed to obtain confidential information from the officials working at SOCAR and the deputy speaker of the parliament with regards to the project in the Caspian gas field to obtain the benefit for the clients of Unaoil (GAN 2016).

Reportedly, Raeni managed to make up to $4.5 million from his ‘middleman’ dealings. Moreover, the gas and oil industry in cooperation with the government is notorious for imprisoning the representatives of the press. For example, in the fall of 2015, a journalist Khadija Ismayilova who was reporting on the corruption in the government was imprisoned for her work. Although, her colleagues continued the investigation to reveal that the presidential family used the yachts owned by SOCAR for leisurely purposes (one yacht costs up to $12 million a year to operate) (GAN 2016).

Judicial System

In the context of the gas and oil industry of Azerbaijan, businesses risk encountering corruption in cases when dealing with the judiciary system, which presents another challenge for companies planning to enter the country (GAN 2016). Unfortunately, the operation of the courts is highly inefficient when it comes to settling disputes as well as challenging the regulations set up by the government; this means that if a company encounters restrictive actions on the part of the government, it is highly likely that the judiciary system will make a decision against that company and in favor of the government.

It is commonly accepted that the judiciary process in Azerbaijan is generally unreliable, and disputes around investments can appear in cases when the interests of foreign investors go against with the local players favored by the system (GAN 2016). For example, in 2015, a former judge who served at the Baku Grave Crimes Court was sentenced to seven years in prison for being involved in the bribery scheme (GAN 2016). Moreover, the country’s citizens regard the judiciary system as extremely corrupt and unfair.

Land and Tax Administration

Since the company is planning to proceed with oil and gas exploration in Azerbaijan, the topic of land administration is high on the agenda. Dealing with local authorities with regards to how land is managed is a challenge for any country; however, with corruption and the lack of transparency being long-standing problems in the country, foreign investors also risk encountering corruption in cases when dealing with Azerbaijanian land authorities.

The system of property registration is riddled with a variety of bureaucratic requirements and has been reportedly influenced by extreme governmental corruption and lack of efficiency. The notion of bribery is quite common when it comes to the land sales, management, and registration procedures; furthermore, the majority of companies usually give out gifts to the governmental officials when obtaining permits for construction (although such gifts are prohibited by the law).

In many instances, the government of Azerbaijan is ineffective in establishing and protecting efficient property rights that could prevent the officials from taking bribes. Corruption in the higher ranks has led to the violations of Azerbaijan’s laws of expropriation in favor of oligarchs and governmental officials, to whom the expropriation of spaces for retail or private homes for personal purposes has become a norm (GAN 2016).

Similarly, Azerbaijan can “boast” of the practices of politically motivated infringements on the rights of property; this is a tremendous challenge for foreign companies, especially for those coming from the West, where such practices are strictly monitored and then punished by the law. With regards to land administration, the construction sector in Azerbaijan is also struggling with corruption: the ruling elite of the country (not excluding the presidential family) controls the sphere completely (GAN 2016).

For a business entering an industry in a foreign country, it is important to remember that tax administration in Azerbaijan is one of the most corruption-prone sectors in the country; this presents the majority of businesses with tremendous risks. Irregular payments and bribes to the officials are used by the government for the purpose of intimidation and pressurization of private companies. Overall, any business operated by either locals or foreigners in Azerbaijan can be subjected to extreme practices of bribery, which can potentially impact the overall costs or cause some tensions with governmental officials in cases when businesses refuse to present “gifts” or bribe the higher authorities to secure their operations.

Risk Factor IV: Gas Projects

According to the report conducted by the Financial Times (2017), the recent withdrawal of Azerbaijan from the Extractive Industry Transparency Initiative poses some questions about the financing of the Southern Gas Corridor pipeline ($46 billion). British Petroleum is the project’s shareholder, to which the World Bank loaned $400 million and the European Bank for Reconstruction and Development is currently “in the talks” of providing the funding for the project (Foy 2017).

Will all three bodies being members of the Transparency Initiative, the decision of the government to withdraw will force the financial supporters to make a choice between efforts for promoting good governance and transparency and a commercial venture (Foy 2017).

It is important to note that Azerbaijan’s withdrawal from the Initiative was associated with the country’s failure to address the present concerns with regards to the freedoms of a civil society. On the other hand, the executive director of SOFRA described the country suspension as unfair while stating there was no direct connection between Azerbaijan’s membership in the Initiative and the loans from the European Bank, as mentioned in the Financial Times report (Foy 2017).

Azerbaijan has been under the rule of one family for the most of the fifty past fifty years. While President Aliyev pitched the country as an ally of the Western world for withstanding the influence of Russia in the Caspian region, he was heavily accused of the violations of the human rights as well as the suppression of the opposition that has spoken against the government’s inability to address the rising crisis.

Conclusions and Limitations

While the report was successful in identifying four categories of risk factors that can have a negative impact on the business entering the gas and oil industry in Azerbaijan, it could not assess the magnitude of such an impact because the company did not have any experience inside the country yet. Furthermore, the report was limited to predominantly addressing the most relevant aspects of the gas and oil industry in the region without taking into consideration some minor risks such as bribery in the law enforcement or the governments’ lack of efforts to protect citizens’ human rights; although these risk factors may seem irrelevant to the topic at hand, over time they can have either a direct or indirect impact on the operations of the business.

The report shed light on those problems that the government of Azerbaijan has been failing to address, so there is a possibility that the current issues would continue to exasperate over time since the country is preparing to enter an economic crisis. It is crucial to note that the political situation and the global prices of gas and oil remain the two most important determinants of either stable or unstable economy for Azerbaijan, so any further decisions about entering the gas and oil industry and proceeding with oil and gas exploration in the region should be based on these factors. Overall, there is a tremendous potential in exploring Azerbaijan for new sources of gas and oil; thus, the heads of the company should explore the presented risk factors in great detail in order to make an informed decision.

Suggestions for the CEO

Unfortunately, cases of bribery present a tremendous challenge for businesses entering the oil and gas industry of Azerbaijan because of the need to make “deals” with the government to ensure the security of their contracts. Businesses that choose to enter the industry should first of all act in accordance with the international standards for transparency and report any suggestions of bribery coming from governmental officials. Due to the recent pressures with regards to Azerbaijan leaving EITI, the government could be interested in showing loyalty to the Western investors and be more transparent in its operations in the gas and oil industry.

When it comes to the economic vulnerabilities that can limit new businesses from entering the country, it is crucial for investors to take into consideration the fact that in 2017 Azerbaijan is preparing to enter a deep crisis because for the first time in many years the budget has decreased by three times, and the economic conditions have become unwelcoming to both small and medium businesses. While there is nothing that can be done with regards to reducing the risks associated with economic vulnerabilities on the large scale, a company may choose to conduct a slower integration into the industry so see whether it is possible to attain a profit rather than ‘diving in’ completely and then suffering the negative effects of the identified risk factors.

Reflective Essay

Group projects have proven to be effective tools for developing an array of skills that will be helpful in the future career in the professional world. The positive group experiences, in my opinion, were very beneficial for contributing to the learning of each member individually and the group as a whole. Among one of the most useful skills that I acquired during learning, collaboration with regards to tackling complex problems and resolving arising issues can be classified as the most useful for anyone’s future career.

Because the assignment called for the delegation of roles and responsibilities, holding each other accountable, and sharing diverse opinions and perspectives, collaboration was the strategy that helped the group stay focused on the assignment while taking different views on it into account. Once the project was first assigned, there was a certain level of skepticism within the group as to how everyone could make equal contributions since the scope of the assignment can be considered quite vast.

However, collaboration in the form of discussions and brainstorming sessions allowed each member to voice his or her opinion about the structure of the project as well as how it should be divided within the team to achieve the best result possible. With regards to the evolution of the learning, because each group member had a specific and narrow aspect of the topic assigned to him or her, there was a possibility to go into the subject with greater detail.

For example, my part of the assignment included the identification of risks for a business when entering the industry in a foreign country, so I had to assess the economic and political conditions to come up with the list of the most feasible risk factors that may have a direct or indirect impact on the company’s success. The in-depth exploration of Azerbaijan’s current economic state and the conditions of the gas and oil industry gave profound knowledge about how a country with a different set of values and a different history is currently operating its most successful sphere of export.

Apart from the effective collaboration within the team, the overall group dynamics can also be characterized as beneficial for learning because no one put a set of boundaries on what should and should not be done with regards to the exploration of new concepts. Because the topic was vast, the group got together to assign different components of the assignment to each member but stressed the importance of individuality when completing the task.

In my opinion, this strategy has proven to be very efficient despite the fact that some components of the task could overlap; even if they overlapped, they were presented from different perspectives and viewpoints, which contributed to the development of the all-encompassing project that took the specifics of the assignment into account. Because no one in the group wanted to be responsible for assigning the topics to others, the team concluded that chance should make the final decision: we wrote the topics on small pieces of paper and put them in a box. Then, each team member randomly chose a piece of paper from the box; in my opinion, this was the fairest way to assign the topics.

The process of report preparation and writing was a personal choice of each team member because usually an individual personally knows better what may work for him or her and what may not. The guidelines for everyone included clear writing and structure and the coverage of the topic in great detail to complete the most well-rounded project possible. I would like to point out that team members asked each other for advice and shared their progress with the group; in my opinion, this was highly inspiring and motivation – when one was stuck on something, others gave out tips and suggestions as to how to proceed. Such a positive group environment enabled everyone to complete the project quicker and with more enthusiasm.

Of course, the group encountered some challenges along the way that in the end made the project stronger and more informative. There were many discussions with regards to how to structure the writing of each team member in a way that will show that the assignment was done in a group. Because everyone had different styles and different perspectives of writing, the combination of preliminary drafts into one project showed some incoherence and the lack of structure.

To resolve this problem, the group decided that each team member would divide their paper into sections with headings and subheadings for better navigation as well as better dissemination of information. In cases when themes overlapped, it was possible to take out small sections from different papers and combine them into one large section of a group project. Another challenge was associated with time coordination, especially concerning the sharing of the drafts. Because everyone had different schedules and worked on the assignment at different times of the day, there were some difficulties in getting together via Skype to discuss the project’s progress. However, after some discussing, the team decided to set up an online group to which everyone could submit questions and share files at any time of the day.

Overall, the experience of working on a group project was very beneficial for enhancing learning and developing good communication and collaboration skills that will become useful in the future career. Working in a team helped each individual present some new ways of solving the problems and offer unique perspectives on the assignment. Group collaboration was also beneficial for our instructor because there were less final products to grade along with the option to transfer some responsibilities to groups with regards to assigning topics.

Reference List

Cornell, S 2011, Azerbaijan since independence, ME Sharpe, New York.

Euler Hermes 2016, Country report: Azerbaijan. Web.

Foy, H 2017, Azerbaijan risks gas pipeline loans by quitting transparency monitor. Web.

Freedom House 2015, Nations in transit. Web.

GAN 2016, Azerbaijan corruption report. Web.

Key economic forecasts. 2016. Web.

PWC 2016, Doing business and investing in Azerbaijan. Web.

Radio Azadliq 2017, 2017: The beginning of the political and economic crisis in Azerbaijan. Web.

The State Statistical Committee of the Republic of Azerbaijan 2016, Macro-economic indicators (2016). Web.